5th Day of Zagreb Digital Nomad Week and Beginning of Ambassador Program

June 26, 2021 - A look at the 5th day of Zagreb Digital Nomad Week and the first digital nomad ambassador!

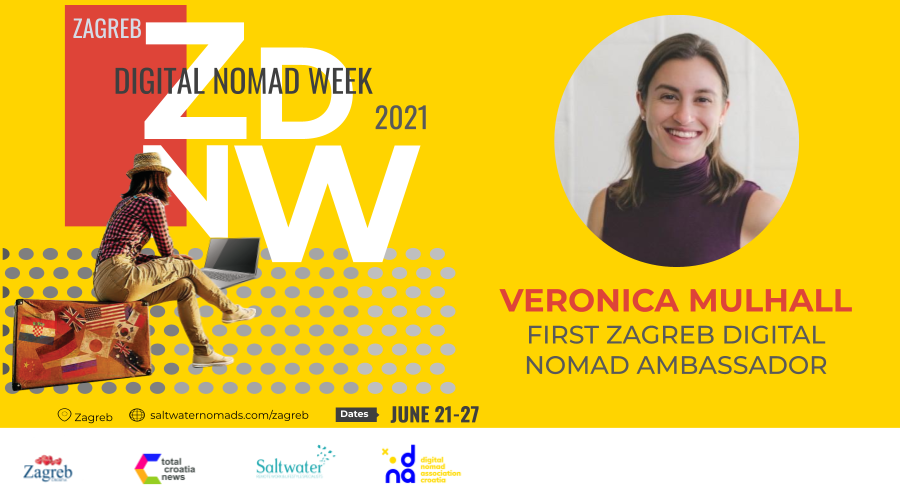

The announcement of Veronica Mulhall as the ambassador of 'Zagreb Digital Nomads' concluded the fifth day of 'Digital Nomad Week' on Friday, where the organizers Saltwater Nomads, Total Croatia News, and the Zagreb Tourist Board presented the advantages, opportunities, and possibilities of the Croatian capital for remote digital nomad work, reports Jutarnji List.

In July, Veronica Mulhall will be the first ambassador - a digital nomad who will work and live in Zagreb for a month.

"Congratulations to Veronica on this election, Zagreb welcomes her, and I think she will have a wonderful time in our city; that is, she will have great opportunities to find her new job office here. We will introduce her to everything that Zagreb has to offer digital nomads," said Petra Maršić Buljan from the Zagreb Tourist Board.

The 'Zagreb Digital Nomads' ambassador was preceded by three 'Digital Nomad Week' panels which analyzed future trends in the labor market, digital nomads as a solution to changes in the labor market, and Croatian policies in accepting and deepening global trends in teleworking.

Jose Alfonso Kusijanović

Before the panels, the participants were given a lecture by blogger and labor market researcher Albert Canigueral on the future of work.

"The future of work has three dimensions, the future of the job itself, the job and the fulfillment of business tasks or goals. Nomads are one of the solutions for the future of the workplace, and how far we have come in applying this way of working is evidenced, among other things, by the example of employers in the Swedish transport business who are committed to regulating the work of truck drivers from home," said Canigueral. He recalled the thesis of the famous sociologist Peter Drucker that the basic question of the labor market is not to find answers to the demands that arise but to ask a key question of the labor market.

After Canigueral’s presentation, the first three panels of the ‘Digital Nomad Week’ closing day entitled ‘Sustainable and Self-Renewing Destinations’ followed. In addition to moderations by Ron Tardiff, the director of the Zagreb Tourist Board Martina Bienenfeld, the director of the Dubrovnik Tourist Board Ana Hrnić, the author of numerous travelogues Anja Mutić, and the entrepreneur in tourism Daniel Lacko spoke about sustainable and self-renewing tourist destinations.

Ron Tardiff, one of the winners of the last Dubrovnik Digital Nomads in Residence competition, discussed Sustainable and Regenerative Destinations with a panel that included Martina Bienenfeld, CEO of the Zagreb Tourist Board. (Jose Alfonso Kusijanović)

Ana Hrnić pointed out that the tourist season in the pearl of Croatian tourism in Dubrovnik is currently under the strong influence of last year's consequences of the coronavirus and large restrictions in air traffic on Dubrovnik tourism, which, she warned, is an air destination. On the other hand, the Dubrovnik Tourist Board director pointed out that 2019 was a record year in terms of visiting guests for Dubrovnik tourism.

"In 2019, we took the first steps to ensure the long-term sustainability of Dubrovnik tourism, limiting the number of cruiser arrivals in the city port," said Ana Hrnić. Martina Bienenfeld reminded that the Zagreb tourist offer in 2020, in addition to COVID-19 and lockdown, also faced a devastating earthquake.

"I must emphasize that we have not given up our efforts to prove that we are still 'alive' as a tourist destination, and we have done many great projects and campaigns since the beginning of the pandemic. I want to remind you that Zagreb changed, and we do not give up with new stories, new projects, highlighting some of the projects such as Pimp my Pump, Mali Zagreb and Triptych. When it comes to the sustainability of the city's tourist offer, we try to prove that Zagreb is not only the capital of a beautiful tourist country but a great place to live and work," said Martina Bienenfeld.

Tanja Polegubić, organizer of Zagreb Digital Nomad Week, moderated a panel consisting of Petra Maršić Buljan from the Zagreb Tourist Board, Paul Bradbury from Total Croatia News, Dalibor Kovačević from Raiffeisen Bank Hrvatska, and Matthew Parsons from Skift. The theme was Future of Work Trends and Croatia's Global Standing. (Jose Alfonso Kusijanović)

Tanja Polegubić, organizer of Zagreb Digital Nomad Week, moderated a panel consisting of Petra Maršić Buljan from the Zagreb Tourist Board, Paul Bradbury from Total Croatia News, Dalibor Kovačević from Raiffeisen Bank Hrvatska, and Matthew Parsons from Skift. The theme was Future of Work Trends and Croatia's Global Standing. (Jose Alfonso Kusijanović)

The first panel was followed by a conversation between the moderator of ‘Digital Nomad Week’ Michael Freer, and Mandy Fransz, the founder of the company ‘Digital Leap’ for Digital Transformation.

"I heard about Croatia as a digital nomad destination, came here, and was convinced that Croatia provides a lot of events, but also opportunities for community development, which I consider the most important part of my job," said Mandy Fransz.

In the second panel, moderated by Tanja Polegubić from Saltwater Nomads, Petra Maršić Buljan from the Zagreb Tourist Board, Paul Bradbury, CEO of Total Croatia News, editor of the Skift portal Matthew Parsons and Dalibor Kovačević from Raiffeisenbank. This was followed by a presentation by Dean Kuchel, who introduced himself to the participants as a nomadic lifestyle ambassador.

Jan de Jong (Digital Nomads Association), Nikolina Pejović (Hrvatski Telekom) and Tanja Polegubić (Saltwater Nomads). (Jose Alfonso Kusijanović)

The last panel of the fifth day featured Jan de Jong, an entrepreneur who initiated the digital nomad visa in Croatia, Kristina Grbavac from the auditing company KPMG, Branka Bajt Hrvatski Telekom, and Hermes Arriaga Sierra from Impact Hub.

Asked by panel moderator Michael Freer how he came up with the idea to initiate the introduction of digital nomad visas in our country, Jan de Jong said that at his first participation in a conference on Croatian tourism, he faced the question of how to make Croatia a year-round tourist destination. The answer to the latter question, Jan de Jong, as he said, was given in the texts of Paul Bradbury on the portal Total Croatia News.

In the third and final panel, moderated by Michael Greer, Branka Bajt from Hrvatski Telekom, Kristina Grbavac from KPMG, Jan de Jong from DNA Croatia, and Hermes Arriaga Sierra from Impact Hub discussed about DNA Croatia, Policy, and Connecting a Global Community. (Jose Alfonso Kusijanović)

"In Paul’s texts, three words shone on me, digital nomad tourism. Then I started to promote this concept in my public speeches, finding great support from the followers of my speeches, but, very soon after, almost all major media in the country," said de Jong, revealing that after they received support for the development of digital nomad tourism from the Croatian Government, i.e., the Office of the Prime Minister. We managed, de Jong, concluded that Croatia becomes one of the top ten countries in the world with a visa for digital nomads. De Jong continues to implement his idea through the DNA Croatia association.

Paul Bradbury, Total Croatia News CEO, talks to Dean Kuchel, who spoke about Community Building, and Israel's Ambassador to Croatia, Ilan Mor. (Jose Alfonso Kusijanović)

"One of the DNA Croatia association goals is to extend the visa from the current six-month residence permit for digital nomads. We also want to simplify the procedures regarding the taxation of digital nomads," announced Jan de Jong.

Meet one of Friday's keynote speakers, Albert Cañigueral, one of the Dubrovnik nomads-in-residence and recently appointed to lead the Catalan Government's Transparency and Open Data, division. Albert will be focusing on the topic of the day, the future of work.

Tourist Board Director Martina Bienenfeld on Zagreb Digital Nomad Week, Ryanair, Tourism in Pandemic

For the latest news and features on digital nomads in Croatia, check out the dedicated TCN section.

After Croatia, Montenegro Digital Nomad Visa One Step Closer to Becoming Reality

June 1, 2021 - The energy of the Croatian digital nomad visa is spreading through the region as the Montenegro digital nomad visa is in the works.

Bankar.me reports that the Ministry of Public Administration, Digital Society, and Media has sent a public invitation to organizations, associations, and individuals to get involved in the initial phase of preparing a Program for Attracting Digital Nomads and Encouraging Foreign Investments in Montenegro until 2025.

According to the invitation published on May 27, the consultations of the interested public in the initial phase of the Program will last for 28 days from the publication date of this invitation.

The invitation states, among other things, that priorities and challenges can be proposed in the consultation process when it comes to conditions for defining the status of digital nomads and incentives for foreign investments, including other important topics that this Program may cover.

As stated in the invitation, the Ministry of Public Administration, Digital Society, and Media will update all received initiatives, proposals, suggestions, and comments should be updated and, after the consultation, a report should be prepared containing an overview of the participants in the consultation and an overview of received initiatives, proposals, suggestions, and comments. It will then be published on its website http://www.mju.gov.me/ministarstvo and portal e-administration https://www.euprava.me/ and submitted to the participants in the consultation within seven days from the expiration of the aforementioned deadline of 28 days.

"The Ministry of Public Administration, Digital Society, and Media will consider and take into account all received initiatives, proposals, suggestions, and comments during the preparation of the Program for Attracting Digital Nomads and Encouraging Foreign Investments in Montenegro until 2025," the Ministry said.

This is one of the most important steps in bringing digital nomads to Montenegro, which will be among the first countries to grant a visa to this tourist group.

A digital nomad visa is a great chance for Montenegro

Several countries have already legally regulated the issue of visas for digital nomads. Estonia became the first country in the world to officially start with digital nomad visas. Shortly afterward, other countries such as Barbados, Bermuda, Georgia, Anguilla, the Cayman Islands, Dubai, and Mauritius followed in Estonia's footsteps. The initiative was first shown by Croatia from the surrounding countries, which is most similar to Montenegro with its beaches and beautiful destinations for tourists.

One of those who realized in time that Montenegro is an ideal destination for digital nomads is Milovan Novakovic, CEO, and partner of Colliers International. Novakovic and his team have taken the initiative with the Government to approve digital nomad visas as soon as possible. The team includes Dutch entrepreneur Jan de Jong, one of the most deserving of Croatia on the list of countries that approve digital nomad visas. As they say, there will be support from Estonia, which was the first country to regulate the visa legally.

Novakovic believes that Montenegro is a very suitable destination for digital nomads and has a satisfactory infrastructure, so in that sense, it would be necessary to introduce a one-year digital nomad visa and harmonize the Law on Foreigners as well as relevant bylaws, all to create a suitable legal framework that would encourage the arrival of digital nomads in Montenegro.

At the end of last year, he launched an initiative to position Montenegro as a new popular destination for digital nomads because, as he said earlier, a digital nomad visa would be a special benefit to improve tourism and extend the season to a whole year.

"Covid-19 has accelerated this industry as well, and more and more people in the world want to do their job remotely. Research predicts that by 2035, one billion people will work "remotely." If Montenegro regulates the visa program for digital nomads, a special benefit would be improving tourism and extending the season to the whole year. Digital nomads would no longer come to Montenegro for just a couple of weeks, but for a minimum of a few months or a whole year," Novakovic said.

For all, you need to know about digital nomads in Croatia, bookmark our dedicated section.

Trokut - Very First Sibenik Digital Nomad Office Opened

May the 31st, 2021 - As Croatia begins to finally recognise the importance of digital nomads being able to live in the country as they work remotely, the very first Sibenik digital nomad office has opened its doors.

As Novac writes, the very first Sibenik digital nomad office was recently officially opened in Trokut in the presence of the Mayor of Sibenik, Dr. med. Zeljko Buric, the head of the Administrative Department for Economy, Entrepreneurship and Development, Petar Misura, digital nomad Mike Pulley, the Head of the Office, Katarina Corkovic and the director of Trokut, Diana Mudrinic.

As of January the 1st, 2021, Croatia has officially started offering temporary residence to digital nomads, a process that TCN has been heavily involved in, including with the recent Dubrovnik Digital-Nomads-in-Residence programme. This visa, or better to say permit for digital nomads allows them a temporary stay in Croatia for up to one year. Digital nomads are also able to apply for a second, subsequent digital nomad permit, but only six months after the expiration of the first permit they've been issued on that precise basis.

"We've been following the story that is developing in Trokut with joy and optimism. We're glad that Trokut, as the Sibenik digital nomad office, has already become recognisable as a place that brings together young entrepreneurs from across Croatia and the world. Entrepreneurs of the new generation who lead us into the future can find their opportunity here and we believe that all digital nomads who visit Sibenik once will fall in love with this city and all the advantages it provides,'' said Mayor Zeljko Buric.

Digital nomads don't have a fixed working time or location because they work as needed depending on the type of project or job they're currently working on. Some nomads work more than 12 hours a day, but their place of work often changes as they wish. The current coronavirus pandemic has resulted in an increase in the number of people now able to work remotely, making the term "digital nomads" more popular than ever before, and thankfully Croatia didn't miss the boat on this opportunity.

Petar Misura pointed out: “Based on thinking about digital nomads who most often like to work in coworking spaces, we've developed the concept of the Trokut Centre, which is adapted to them because a large part of that space is filled by them. That we've predicted well in regard to that is evidenced by the need for new office desks in the first year of operation alone. I believe that the occupancy of digital nomads here at Trokut will be more than satisfactory. "

Mike Pulley has spent more than two and a half decades in the IT industry, working with large international companies such as Apple and HP.

"As an IT entrepreneur, I feel that I'm in the right place in Sibenik at the right time. Trokut is a perfect example of this as it provides an ideal space for IT people. The staff have created a programme and environment in which you can get what you need for business and a place where you can meet people like you. In my career, I've been fortunate to live and work in numerous places around the world, including the last 22 years in London, but I've worked and lived in Central and South America and in most other European countries (apart from the UK). Given that I had the opportunity to explore different places, people and cultures, and after all these options, I chose to be here in Sibenik,'' he stated.

"As for obtaining a residence permit in Croatia and doing business, I can say that I'm extremely satisfied with my own experience. The interaction with the Ministry of the Interior was professional and efficient, I submitted the necessary documents for the application and they made a decision very quickly. I think this is another example of the fact that Sibenik is the right place for entrepreneurs,''

Diana Mudrinic pointed out that “Trokut strives to follow the current trends in the world of digital nomads and freelancers. At the beginning of this year we introduced payment in cryptocurrencies, we have tips for nomads on how to apply for their visa/permit on our website, and our goal is to help them with the whole process of coming to Sibenik, from registration to finding accommodation and places to visit. At that threshold, last week we signed a Cooperation Agreement with the Krka National Park and then we opened the first Sibenik digital nomad office in order to provide them with a complete experience and support.''

For all you need to know about digital nomads in Croatia, bookmark our dedicated section.

Krka National Park Becomes the First Nature Reserve to Provide Working Conditions for Digital Nomads

May 23, 2021 - Working conditions for digital nomads will now be offered at one of the most attractive locations in Croatia - Krka National Park.

For digital nomads who have been allowed to temporarily stay and work in Croatia with recent legislative changes, new „job locations“ are opening up at the most attractive locations of Krka National Park. The Park and Incubator for new technologies Trokut Šibenik have started business cooperation developing programs for attracting digital nomads to Šibenik-Knin County. This region encompasses some of the most beautiful parts of the Croatian coast and a part of Dalmatian Hinterland which hides an astonishing amount of natural, cultural, and historical phenomena. Many of them are situated at Krka National Park, which is now offering its infrastructure with a fast and stable Wi-Fi to digital nomads at the following Park locations: Laškovica Visitor Centre, Krka Eco Campus in Puljane, on the Stinica, across Visovac, and on Roški slap waterfall. Digital nomads will be able to freely join educational programs that the Park is organising, as well as join Friends of the Krka Club, under the same conditions as their temporary neighbours, the residents of the County.

At Šibenik’s Trokut, digital nomads have a secured workspace with their desk and chair, free access to three kitchens, showers and bathrooms, a basketball court, a free parking lot for bicycles and cars, tech support, fair use printers, and scanners, and other interesting offers. This gives digital nomads the chance to combine work and travel, fulfilling their duties and maximizing the use of their leisure time, according to the increasingly popular model of work – holliwork.

„Krka National Park is where digital nomads can find the best mixture of natural values and cultural and historical heritage. The goal of our collaboration with Trokut through the project with digital nomads is to facilitate the implementation and development of new technologies and entrepreneurship, not only in the Park or in the city of Šibenik, but throughout Šibenik-Knin Country“, said the director of Krka National Park Nella Slavica.

The city of Šibenik extended full support to the concept of holliwork and the acceptance of digital nomads, recognizing them as a niche group of world travelers. This group primarily encompasses developers, graphic designers, gamers, social media experts, blockchain developers, IoT experts, and professionals who cover many other IT areas. They need to connect with nature and a highly developed awareness of climate change, so cooperation with Krka National Park is a natural step towards strengthening Šibenik-Knin County as an ideal destination for digital nomads throughout the year.

For the latest news and features, follow the TCN dedicated digital nomads section.

New Destination for Digital Nomads in Split: SPAlato Spa

May 8, 2021 - Digital nomads in Split can now work at SPAlato Spa in the Radisson Blu Hotel, with free Wi-Fi and a relaxation zone. You may also want to book a treatment to destress your mind and body while you’re there…

The digital nomad lifestyle can sometimes be rough on my posture and my brainwaves. I live on a computer and some days it feels like I’m becoming a piece of the furniture, hunched over a keyboard with a never-ending to-do list. Recently, I had enough. I desperately needed a massage to release my tight muscles and clear my head. I decided to check out the spa at the Radisson Blu hotel near my apartment. I went there last year just before the pandemic shut things down and I enjoyed a terrific treatment with a stunning view of the Adriatic Sea.

SPAlato Spa opened in a completely renovated space on May 1, including treatment rooms, pools, a sundeck, relaxation zone, fitness center, and a yoga studio.

Cool vibe

A year ago the spa was under renovation and this time I was glad to see the new space. I went on a Sunday morning and the first thing I noticed was the cool ambiance with jazz music and a lounge vibe. I loved it immediately. It reminded me of places I used to go back home to settle in and relax with the Sunday New York Times and a pot of coffee.

A lounge area includes a retail display for purchasing organic products used during treatments.

I scheduled a facial and a massage and I arrived early to swim and sweat in the sauna before my treatments. The spa was airy and light, which I like, and the design was minimal yet elegant. I was delighted to find several different “zones” where I could hang out, including comfy couches near the pool and an outdoor sunbathing terrace. Later I found out that the designated Relaxation Zone has Wi-Fi, is kid-free, and it’s where I can set-up and work for a day. Wait a minute, what?

Digital nomads can set up shop in the Relaxation Zone, Wi-Fi included, and alternate between work and spa amenities.

No more WFH (work from home)

The concept was mind-blowing. The SPAlato (a cute name playing up Spa with the old Italian name for Split) could replace my dining table office and allow me to take breaks from the computer in any number of spots: indoor and outdoor pools, gym, sauna, steam room, whirlpool, cold and hot plunge pools, or a yoga studio. And there’s another bonus for this spa and wellness devotee—I could tackle the enticing list of treatments.

Brand new saunas are fresh and let you build up heat before jumping in the pool.

TCM (traditional Chinese massage) with a certified Chinese therapist; Power of the Sea—a combination of marine salt scrub, aromatherapy with local essential oils, a bath, full body massage, body wrap, and finisher with local immortelle oil; and other treatments promised to restore my body and mind energies.

It seems decadent, and perhaps dangerous in regard to keeping work deadlines, but my body would be so grateful and my mind would be so happy.

The indoor pool is surrounded by glass, giving a sense of being outdoors and close to nature.

Treatments

My therapist Doris asked what kind of massage I like and I said sports or deep-tissue. Every therapist I’ve ever said that to has interpreted it differently. For all the good massages, I’ve also endured being rubbed with inexperienced, weak hands and pounded with killer claws. Not this time. Doris not only had the right touch, she knew how to apply pressure in the correct way to get my muscles flowing. Yesss!

Treatment rooms are comfortable and calming, an ideal environment to relax.

She also did my facial and explained the steps and the products used, including my particular skin type needs. Small details in both treatments made all the difference, starting with the bowl of water and eucalyptus oil she held under my nose before we began. Oh my, I inhaled deeply. I’ve had enough treatments over the years to know that every place is different and charming in its own way. That also sets a benchmark for quality and this place rates high on my list.

Thalgo and Elemis spa products are organic and made with marine ingredients for maximum effectiveness.

Mediterranean experience

I spent the rest of my time on the upper dining terrace, looking over the sea and eating a fresh salad. It couldn’t have been nicer. I can’t believe I’m contemplating my future workspace in a spa; how cool would it be to be the first digital nomad to claim a co-working seat at SPAlato.

An upstairs dining terrace offers Mediterranean food and drinks in a casual, elegant atmosphere.

Learn more about SPAlato on Radisson Blu’s website.

Learn more at TCN’s Digital Nomads channel.

Story and photographs ©2021, Cyndie Burkhardt. https://photo-diaries.com

Kristina Grbavac Talks Taxation of Digital Nomads in Croatia

April 23, 2021 - TCN meets the director of the Taxation Services Department at KPMG Croatia, Kristina Grbavac, to discuss the taxation of digital nomads in Croatia.

Croatian tax and immigration legislation were amended in 2020 to welcome digital nomads to Croatia: a digital nomad visa was introduced and income based on the acquired status of a digital nomad became tax-exempt and relieved of the tax reporting obligation in Croatia.

Even though it might look like all tax matters are covered with this exemption, there are still some open questions to be considered by digital nomads.

Kristina Grbavac, director of the Taxation Services Department at KPMG Croatia, discusses the taxation of digital nomads in Croatia.

In which country is a digital nomad a tax resident?

The question of tax residency is important because the country of tax residency has the right to tax worldwide income, while another country has the right to tax income sourced in that country only.

Therefore, digital nomads should first check and regulate their tax (non)residency status in their home country and country from which they are coming to Croatia (if different from their home country).

Based on the Croatian tax legislation, a tax resident is a physical person who has a permanent residence or habitual abode in Croatia, which amongst other includes the following:

- owning or holding a home or flat in Croatia for at least 183 days;

- permanent stay in Croatia for at least 183 days; and

- other factors like his/her family residing in Croatia, not being tax resident elsewhere, etc.

Since there are no specific provisions in the Croatian legislation on the tax residency of digital nomads, the above rules for tax residency would apply to digital nomads too.

Based on the digital nomad visa, digital nomads can stay in Croatia for a year, which is more than 183 days mentioned above; therefore, due to their stay in Croatia, they might become Croatian tax residents.

Should a digital nomad be a tax resident of a country with which Croatia has an effective Double Taxation Agreement and at the same time be a Croatian tax resident, the provisions of the relevant Double Taxation Agreement should be reviewed in order to determine the overall residency.

Therefore, there is no unique answer on the tax residency of digital nomads, but to conclude on someone’s tax residency, his/her specific personal facts should be considered.

If digital nomads would become Croatian tax residents, Croatia would have the right to tax their worldwide income.

Is other income earned by a digital nomad taxable in Croatia?

A digital nomad who only earns income based on which he/she acquired the status of a digital nomad in Croatia, will neither pay tax in Croatia nor will have tax reporting obligations in Croatia.

Furthermore, a digital nomad who would be tax non-resident in Croatia, and his/her only income source in Croatia would be income based on his/her digital nomad status, will also have no tax payment or reporting obligations in Croatia.

However, Croatian tax resident digital nomads who earn other types of income will be taxable in Croatia on these other types of income. Other types of income include all different sorts of income, and the most common examples are dividend income, capital gains, and rental income.

For example, if a Croatian tax resident digital nomad while staying and working in Croatia as a digital nomad receives dividends from shares in non-Croatian companies (e.g. US or German companies) or rental income for renting an apartment to someone else while he/she is in Croatia, that income should be reported to the Croatian tax authorities and tax paid in Croatia.

Therefore, digital nomads should carefully consider whether they earn any other types of income that could be taxable in Croatia.

Is a Croatian digital nomad subject to tax in some other country?

Even though a digital nomad's income is tax-exempt in Croatia, it does not mean digital nomads do not have to report their income to their home country or some other country in which they resided before.

Therefore, besides checking their tax status in Croatia, digital nomads should carefully check if they have any tax liabilities in the countries they lived before.

Will the work of a digital nomad in Croatia create any tax risk for his/her own company or his/her employer?

This is the question most individuals who work remotely are not aware of, and most individual travellers think that their mobility impacts their personal taxation only.

However, working abroad might create some tax obligations and risks for employers or companies owned by international travellers.

For example and in a very simplified manner, if a digital nomad in Croatia manages his own company’s business from Croatia, his/her company might become taxable on its profits in Croatia.

Furthermore, digital nomads who work for their foreign employers from Croatia might create a taxable presence (so-called taxable permanent establishment) in Croatia for their employers. This would depend on various factors, including their job description, activities, authority to conclude contracts or negotiate their terms, etc.

A taxable permanent establishment is not a term specific for Croatia, but is common in most countries; however, awareness of international travellers on this matter is low and, therefore, many times is the question of the taxable permanent establishment not examined.

Any changes in the tax legislation expected in the future?

Significant changes to the legislation have already been made, which answered the main questions.

However, the idea behind the digital nomad's initiative was to make the move of digital nomads to Croatia easier, to remove administration obstacles and tax costs that could refrain them from moving to Croatia, and there are still many open questions related to their taxation.

Therefore, it is important to resolve the remaining matters too to allow digital nomads to move to Croatia without being concerned about their taxation.

In the light of that, further changes to the Croatian tax legislation would be expected.

For more on digital nomads in Croatia, follow the dedicated TCN section.

Marvie Living & Coworking: Split 4-star Hotel Launches Year-Round Offer for Digital Nomads

February 23, 2021 - Marvie Living & Coworking - a 4-star hotel located in Split launches an attractive year-round, long-term stay offer for digital nomads!

Marvie Hotel & Health opened its doors four years ago in one of the coziest seaside neighborhoods in the city of Split, Croatia. In recent years, the hotel has been trending among international guests due to its excellent location, comfortable rooms, the spectacular panoramic views of the nearby archipelago enjoyed from its rooftop pool, as well as the hotel’s wide array of health services provided in close collaboration with partners. Marvie has now taken a further step, becoming the first Croatian hotel to create an offer completely tailored to the needs of remote workers, widely known as digital nomads.

While embracing modern trends and following the belief that a global world that knows no boundaries can blend living, remote working, and traveling, Marvie has now launched an attractive, new offer, described by the name Marvie Living & Coworking and represented by the Long-term Stay Package.

Damira Kalajzic

An affordable long-term stay option, 28 days or longer, is now available at Marvie’s all year round, even during the summer season - and with a 50% discount. In addition, guests interested in long-term stays in Split, Croatia, now have the option of contacting Marvie Hotel & Health via a 15-minute free Zoom or Google Meets chat.

With the aim of creating a stimulating and productive living and working environment for hotel guests who are looking for long-term accommodation in Croatia, Marvie Hotel, within its Long-term Stay Package, offers Deluxe rooms with sea views, work desk, coworking space with 200 Mbps high-speed Internet, a projector and flipchart, as well as unlimited access to an indoor pool, jacuzzi, sauna, gym and relax zone.

Marvie’s coworking space, which will be complete with ergonomic chairs and new desks in March, is open to both hotel guests and all other digital nomads in town. Other hotel spaces, which include Mareo Bar, Da’Mar restaurant, the lobby, as well as the rooftop poolside, can be used as alternative working spaces, where guests can work or exchange ideas and knowledge.

“Our mission is to actively participate and contribute to the design of a brand-new tourist product, which is changing the paradigm of traveling, remote working, and living. We are thrilled to witness more and more institutions begin to recognize the potential of this trend, as well as the founding of Digital Nomad Association Croatia, whose founders we are in contact with and who have helped us create a new product”, said Diana Rubić, general manager of Marvie Hotel & Health.

Damira Kalajzic

Marvie Hotel & Health is also popular for its health services such as dermatological treatments, non-invasive methods for facial and body rejuvenation, physical medicine and rehabilitation, dental services, and more. With the aim of providing opportunities for a longer stay and affordable prices, Marvie’s has also launched two carefully created 14-day health packages - The Physiotherapy and Nutrition Package.

Digital nomads now have the opportunity to live in a sea-view 4-star hotel in Split at affordable prices and enjoy the many benefits that only Marvie Hotel & Health can offer in one place.

For more information on the prices and benefits of the Long-term Stay Package visit Marvie’s website, as well as a new blog section where you will be able to find topics related to digital nomads and Split with its surroundings - an ideal destination for working and living.

You can read more in English at the link: https://marviehotel.com/long-stay and follow Marvie's blog: https://marviehotel.com/blog

To read more about digital nomads in Croatia, follow TCN's dedicated page.

Croatia Publishes Updated Digital Nomad Visa Requirements

February the 23rd, 2021 - The Croatian Ministry of the Interior (MUP) has published an updated overview of Croatia's digital nomad visa requirements.

The much talked about Croatian digital nomad visa is finally here as Croatia finally opens its arms to the idea, and MUP have clarified some updates to the digital nomad visa requirements.

Temporary residence for digital nomads in Croatia

A digital nomad in Croatia is a third-country national who is employed or is otherwise performing work through communication technology for a company or indeed for their own company that is not registered in the Republic of Croatia. This means that the individual isn't and cannot perform work or provide services to employers headquartered/registered here in the Republic of Croatia.

Temporary residence for this purpose is granted for up to one year (in some cases for less than a year), and cannot be extended. After the expiration of the first six months of the first issued temporary residence document, a request for re-regulation of residence for a digital nomad may be submitted.

Digital nomads who have been granted temporary residence in the Republic of Croatia may be joined in the Republic of Croatia by members of their immediate family (temporary residence for the purpose of family reunification).

Let's delve deeper into MUP's recently updated Croatian digital nomad visa requirements.

The submission of an application for temporary residence as a digital nomad in Croatia

The application can be submitted in two ways, depending on whether or not the individual seeking residence as a digital nomad requires a visa to enter Croatia or not.

If a visa is needed for entry:

In this case, a request for the Croatian ''digital nomad visa'' must be submitted at the appropriate Embassy/Consulate of the Republic of Croatia abroad (a list can be found on the website of the Ministry of Foreign and European Affairs/MVEP). Prior contact with the competent embassy/consulate is advised due to possible limitations in the work being carried out as result of the spread of the novel coronavirus and by epidemiological measures relating to it.

If no visa is required for entry:

In this case, the same request must be submitted either to the appropriate embassy/consulate of the Republic of Croatia (as detailed above) or to the competent administrative police station according to the place of residence of the individual seeking this permit (a list of administrative police stations by location across the country can be found here). Please note that due to the same situation with the pandemic described above, processing times may be longer and certain functions may not be running as normal.

How to make an application and what sort of documentation you'll need

A copy of the documentation you're required to submit must be submitted in either Croatian or English.

1. Fill in Form 1a and attach it to the request/application:

2. You'll need a copy of your valid travel document (the validity period of the travel document must be three months longer than the period of validity of your intended stay).

3. Proof of health insurance (travel or private health insurance which must have coverage for the territory of the Republic of Croatia).

4. Proof of your purpose for submitting the request.

This can be: (an employment contract or other document proving that your work is performed through communication technology for a foreign employer or for your own company that is not registered in the Republic of Croatia), such as a statement from your employer or from you (as proof that the business being done is through communication technology) and a contract of employment or proof of the performance of work for a foreign employer, or a copy of the registration of your own company and proof that you perform all of the stated tasks through your own company.

5. Proof of sufficient funds to cover your stay in Croatia.

This can be: a bank account statement or proof of regular income, both will be enough to be recognised and accepted as evidence. Pursuant to the Decree on the Method of Calculation and Amount of Maintenance Allowances for Third-Country Nationals in the Republic of Croatia (Official Gazette 14/21), which entered into force on the 13th of February 2021, a third-country national regulating their temporary residence in Croatia as a digital nomad must have funds in the amount of at least 2.5 average monthly net salary sums for the previous year based on officially published data from the Central Bureau of Statistics (CES), and for each additional family member, or formal or informal life partner, that amount is increased by an additional 10 percent of the average monthly net paid salaries. At the moment, the amount of funds required on a monthly basis is a minimum of 16,142.5 kuna, or if your intended period of stay in the Republic of Croatia is 12 months, it is necessary to prove that you have funds in the amount of a minimum of 193,710.00 kuna..

6. Proof that you haven't been convicted of any criminal offenses in your home country or the country in which you resided for more than a year immediately before your arrival in the Republic of Croatia. (Information on the processes for the legalisation of such documents can be found here).

7. You must state your intended Croatian address.

When submitting the application, you'll be required to state the address of your place of residence or intended stay in Croatia on the form you'll be given to complete. This is important for the purpose of determining the administrative police station that will deal with your application. If your first application is submitted and you don't yet have an address in Croatia, it's been made possible for you to state your temporary address (hostel/hotel if a reservation is booked/confirmed) as the address of your intended stay for the purpose of application processing.

What about after the delivery of MUP's notice approving your temporary residence as a digital nomad in Croatia?

If you require a visa in order to enter the country:

Once you've been informed that your temporary residence as a digital nomad has been granted, you will need to contact the embassy/consulate again to obtain an entry visa for Croatia or a biometric residence permit (please inform yourself in advance about whether or not this is a possibility at your embassy/consulate).

You can also fill in the visa application form online.

All other information on visas (application, required documentation, etc.) can be found on the website of the Ministry of Foreign and European Affairs/MVEP.

If you don't require an entry visa for Croatia:

Third-country nationals who don't need an entry visa for the Republic of Croatia don't need to take any of the aforementioned steps and may enter Croatia without a visa in accordance with the provisions of the Law on Foreigners (often referred to as the Aliens Act).

An important note: A third-country national must register their residence with the administrative police station responsible for their place/area of stay within thirty days of being granted a temporary residence permit (in this case a digital nomad permit), to ensure that their temporary residence is not revoked.

On arrival in Croatia - Residence registration and the issuance of a biometric residence permit

The registration of residence:

As a third-country national, you're obliged to register your place of stay/residence and an address within three days of entering the Republic of Croatia at the administrative police station responsible for your area of stay.

You'll need to apply using Form 8a with the attachment of a lease agreement or a statement of the property owner confirming the situation.

The issuance of a biometric residence permit:

Third-country nationals who don't need a visa to enter Croatia, as well as those who entered the Republic of Croatia on the basis of needing an entry visa, are required to obtain a residence permit which is a biometric document (it is mandatory to attach photographs and provide biometric data) immediately upon arrival at the competent administrative police station.

What are the costs?

If the application is submitted to a consulate/embassy outside of Croatia, it is paid for at the time of application:

420.00 kuna for a temporary residence permit

460.00 kuna for a visa (with the additional payment of a service fee if the visa application is submitted through the VFS visa centre)

310.00 kuna for the biometric residence permit form (check the possibility of obtaining it at the embassy/consulate)

If the application is submitted in Croatia at an administrative police station, the associated fees are paid after your stay is approved by MUP:

350.00 kuna for a temporary residence permit

70.00 kuna as an administrative fee for issuing a biometric residence permit

240.00 kuna for a biometric residence permit form

Payment of all of the admin fees if the application is submitted at a Croatian administrative police station

Admin fees for temporary stay:

Via internet banking, the payment of administrative fees for the issuance of temporary residence (350 kuna) are to be made directly to the Croatian state budget, more precisely to the IBAN of the state budget, the details of which are below:

HR1210010051863000160, model HR64, reference number: 5002-713-OIB (if you have an OIB (personal ID number/tax number), then that is entered).

For those who haven't been assigned an OIB, the reference number is: 5002-713-number of your valid travel document.

(An important note: a maximum of 10 numbers, and if the numeric label initially contains zeros (0), they are not to be entered. Do not enter letters, slashes, periods, commas, etc.).

For example, let's say the number of the travel document/identity card of a foreign citizen is AZ004586, then the reference number is: 5002-713-4586 (without any letters and zeros, and with a maximum of ten numbers).

The fees for a biometric residence permit:

Via Internet banking, the payment of a fee in the amount of 240 kuna for the preparation of a biometric residence permit will be made directly to the Croatian state budget, more precisely to the IBAN of the state budget, the details of which are below:

HR1210010051863000160, model HR65, reference number: 7005-485-OIB (enter the OIB only if you've been given one).

For those who have not been assigned an OIB, the reference number is: 7005-485-RKP-case number.

Through Internet banking, the payment of an admin fee in the amount of 70 kuna for the preparation of a biometric residence permit will be made, yet again, to the Croatian state budget, more precisely to the IBAN of the state budget, the details of which are below:

HR1210010051863000160, model HR64, reference number: 5002-713-OIB (again, you obviously only enter your OIB if you have one).

For those who do not have an OIB, the reference number is: 5002-713-number of your valid travel document.

(The same important note written above about a maximum of 10 numbers and no letters, slashes, commas etc applies here, too.)

For more on digital nomads in Croatia, as well as any more digital nomad visa requirement updates, follow TCN's dedicated section.

Health Insurance for Digital Nomads in Croatia is Now Enabled

February 20, 2021 – Digital nomads in Croatia have the right to health care, as the issue of health insurance for digital nomads in Croatia is now regulated.

As HRturizam reports, on Thursday, the Government sent amendments to the Law on Compulsory Health Insurance and Health Care of Foreigners in the Republic of Croatia to the parliamentary procedure. They are harmonized with the Aliens Act to regulate the manner of exercising the right to health care for digital nomads. The amendments thus enable the realization of the health care right for digital nomads.

By the official definition, a digital nomad is a third-country national who is employed or doing business through communication technology for a company or their own company that is not registered in Croatia and does not do business or provide services to employers in Croatia and has been granted temporary residence in Croatia.

As Health Minister Vili Beroš explained, a digital nomad is not obliged to apply for compulsory health insurance. Still, they are obliged to bear the costs of using health care in a health institution, i.e., with a private practice health worker or other health care provider in Croatia.

By amending the Law on Foreigners, Croatia has introduced the concept of digital nomads who now have preferential tax treatment. Legal changes regulate the tax exemption for receipts of digital nomads – foreigners who work online from Croatia for other countries' employers.

The new Law on Foreigners for Digital Nomads prescribes a tax exemption for their income based on the status thus acquired. All this to facilitate their decision to choose Croatia as a place of residence and work.

This way of regulating their stay in Croatia assumes that digital nomads will spend their earnings here while living in our country and thus positively impact the domestic economy.

Temporary residence is granted for up to one year (possibly shorter). However, the temporary stay cannot be extended. A request for re-regulation of the digital nomad's stay may be submitted six months after the digital nomad's temporary stay expiration.

As Jan de Jong, the initiator of the introduction of visas for digital nomads, has repeatedly pointed out, when a digital nomad would spend at least 10,000 kunas a month on living in Croatia, which is more than realistic, for about 50,000 potential digital nomads (as many as there are in Bali), that would mean a revenue of about 500 million kunas a month into the Croatian economy.

At the moment, the publication of the online system for electronic submission of applications for digital nomads is still pending and will be done soon. But before that, the Ministry of the Interior announced the procedure for obtaining visas for digital nomads.

To read more about digital nomads in Croatia, follow TCN's dedicated page.

What's Changing Today? Higher Croatian Minimum Wage, Less Income Tax

January the 1st, 2020 - As Index writes, in 2021, Croatia is set to introduce the national compensation for the elderly in the amount of 800 kuna, increase the Croatian minimum wage to 3400 kuna net, reduce income tax rates down to 20 and 30 percent, and also down to 10 percent for enterprises with an income up of up to 7.5 million kuna, abolish quotas for foreign (third country) workers, and regulate the temporary stay of digital nomads.

Usually, a number of new laws come into force at the beginning of any given year, or amendments to existing ones occur, such as the new National Allowance for the Elderly Act, the new Law on Foreigners, a package of laws regulating the fifth round of tax reform - amendments to the tax laws on income, profit, VAT, the fiscalisation in cash transactions, on the financing of local self-government units, as well as new laws regulating the banking sector.

At the beginning of this year, some new bylaws came into force, such as the regulation on the amount of the Croatian minimum wage.

The Croatian minimum net wage in 2021 will rise to 3400 kuna

From the beginning of 2021, the Croatian minimum wage will be 3,400 kuna, which is 150 kuna or 4.61 percent more than it was in 2020. Namely, the government prescribed, by decree, that the Croatian minimum wage this year amounts to 4,250 kuna, which is 187.49 kuna more than last year.

The minimum hourly rate for student services - 26.56 kuna

Students who work through student services will also profit slightly from the increase in the Croatian minimum wage, to whom employers must pay a minimum of 26.56 kuna per hour from the beginning of this year, which is about 4.7 percent more than the previous 25.39 kuna in 2020.

The decision on the Croatian minimum wage for students is made every year by the Minister of Science and Education.

In February, the first payment of national compensation for the elderly will take place - 800 kuna

From this year on, Croatia will start paying the national benefit for the elderly to Croatian citizens over the age of 65 who have for whatever reason not secured an old-age pensions and are not entitled to any sort of pension, in the amount of 800 kuna.

This, popularly called the national pension, is regulated by the new Law on National Compensation for the Elderly, and the Minister of Labour, Pension System, Family and Social Policy, Josip Aladrovic, expects that around 20,000 beneficiaries will receive the new payment in the first year alone.

"The national benefit for the elderly is designed as a benefit that will cover the most vulnerable part of the population. We expect that in the first year, there will be slightly less than 20,000 who will use their right to access this benefit and the approximate cost of it to the state budget will stand at 132 million kuna in 2021,'' Aladrovic said in mid-December, when the Croatian Pension Insurance Institute (HZMO) began receiving applications for these payments.

HZMO will pay this fee through commercial banks and the first payments of this fee should start in February, with backpayments from January 2021 included.

Amendments to the Income Tax Act also define the tax treatment of this benefit - it, like other social benefits, will not be considered a sum on which income tax is paid.

Lower income tax rates

Amendments to the Income Tax Act are part of the package governing the fifth round of tax reforms. These changes have reduced income tax rates down from 24 percent to 20 percent, and from 36 percent down to 30 percent.

These lower rates should result in a higher salary for working people who, considering their salaries and thus their tax bases, must pay income tax. That increase can be anywhere from ten kuna to a thousand or two or more kuna. How much the increase is exactly depends on the amount of a person's salary, any benefits they receive for their dependent members and their place of residence and its surtax rate.

An estimate made earlier on by Finance Minister Zdravko Maric says that more than 900,000 taxpayers can expect higher incomes from the reduction of income tax rates, depending on the amount of their income. Out of a total of 2.8 million employees and pensioners, 1.9 million of them, given the amount of their income or pensions, don't pay any income tax, according to the Minister of Finance.

Amendments to the Income Tax Act reduce the rate applied from 12 percent to 10 percent applicable to the taxation of annual and final declared income and the flat-rate taxation of activities (such as renters of flats or apartments). However, the tax burden for those who fail to report their income in accordance with legal regulations is increasing, and the so-called penalty rate for asset disproportion has gone up from 54 percent to 60 percent.

This is other income based on the difference between the value of assets and the amount of assets with which it was acquired. Until now, this disparity has been taxed at a rate of 36 percent.

The novelty of the legal changes is that people who rent out their apartments, and if they certify the contract with a public notary, will no longer have to go to the Tax Administration themselves, but notaries will have the obligation to send this certified contract to the tax authorities. If, on the other hand, the contract is concluded without notarisation, people will still have to bring it to the Tax Administration themselves.

The financial effect of the changes in the income tax rate is estimated at two billion kuna, and since this tax is the income of local self-government units, the state will compensate them by taking over the equalisation fund, which is further explained below.

The state has taken over the equalisation fund

Thus, in accordance with the amendments to the Law on Financing of Local Self-Government Units, the shares of municipalities and cities in the distribution of income tax have increased from 60 to 74 percent, and that of counties has increased from 17 to 20 percent.

However, the funds for the equalisation fund, which has so far held a share of 17 percent in the distribution of income tax, will be provided for by the state budget from this year.

Income tax - the rate for enterprises with an income up to 7.5 million will fall from 12 to 10 percent

At the beginning of the year, amendments to the Income Tax Act came into force, reducing this tax rate for enterprises with an annual income of up to 7.5 million kuna from 12 percent down to 10 percent.

In addition to that, the tax rate on dividends and profit sharing was reduced from 12 percent down to 10 percent, and the tax rate on performance fees for foreign performers (artists, entertainers, athletes, etc) was reduced from 15 percent down to 10 percent.

The amendments to this law also stimulate banks to try to agree on a partial or complete write-off of receivables with clients who end up running into financial difficulties. Namely, the tax-deductible expense of a credit institution would be the same amount of the write-off of receivables, based on credit placements, the value of which is adjusted in accordance with special regulations of the Croatian National Bank.

VAT - the threshold for payment according to the collected invoices has been raised to 15 million kuna

Amendments to the Law on VAT raised the threshold for the payment of VAT according to the collected fees - from 7.5 million kuna to 15 million kuna. It also expands on the possibility of applying the VAT calculation category to imports.

Although most of the provisions of this law will enter into force at the beginning of this year, one important provision will enter into force in the middle of the year - from the 1st of July 2021, all imports of goods into Croatia from third countries will have to have VAT paid on them.

Fiscalisation - the treasury maximum is going to be prescribed by the Minister of Finance, Zdravko Maric, in an ordinance

The package of the fifth round of tax reform also includes amendments to the Law on Fiscalisation in Cash Transactions, whose provisions no longer prescribe the cash maximum, but will instead be prescribed by the Minister of Finance, according to certain categories of Croatian taxpayers.

At the beginning of the year, the application of some provisions adopted back at the end of 2019 began, so from the 1st of January 2021, the obligation to carry out the procedure of the fiscalisation of sales via self-service devices begins, as does the obligation to display QR codes on each issued and fiscalised invoice/receipt.

Law on Foreigners - quotas for foreign workers are abolished

At the beginning of 2021, Croatia will abolish its previous quota model for the employment of foreigners from third countries and move over to a new model that should make it easier for employers to employ foreigners.

Until now, the government has made decisions on determining the annual quota of permits for the employment of foreigners, for which it has also determined the list of activities and occupations they can engage in, as well as the number of permits for those professions in one year.

However, the new Law on Foreigners, which also came into force today, introduces a new model based on the opinion of the Croatian Employment Service (CES) on the justification of the employment of third-country nationals and the issuance of residence and work permits for such individuals.

This means that employers will first ask the CES to conduct a labour market survey before applying for a residence and work permit for the employment of a foreigner. If it is determined that there are no unemployed persons already here in Croatia who meet the requirements for that position, employers will then be able to apply for a residence and work permit to the Ministry of the Interior (MUP). The procedure for issuing residence and work permits, including the implementation of the labour market survey will take a maximum of 30 days.

The law also prescribes exceptions to the implementation of the labour market survey related to deficient occupations such as carpenters, masons, waiters, butchers and in the case of seasonal work of up to 90 days in agriculture, forestry, catering and tourism sectors.

The Law on sending workers to the Republic of Croatia (posted workers)

On the first day of the new year, the Law on Sending Workers to the Republic of Croatia and Cross-Border Enforcement of Decisions on Fines enters into force. It regulates the fundamental issues related to the position of workers in accordance with and on the basis of European Union legal sources, and provides a framework for compensation for the work performed, as other conditions, of posted workers.

These include the rights and guaranteed amounts of compensation for work performed in Croatia, the rights to protection at work, working hours and holidays, protection against discrimination, the right to quality for accommodation and internal mobility costs to which a Croatian worker is entitled, as well as the judicial protection of these rights.

The temporary stay of digital nomads will be properly regulated

Croatia is also among the few countries that will regulate the temporary stay of digital nomads. The Law on Foreigners also defined the term digital nomad - a third-country national who is employed or performs business through communication technology for a company or for their own company that isn't registered in the Republic of Croatia and doesn't perform work or provide services to employers headquartered in Croatia.

Temporary residence can be granted to third-country nationals who intend to stay in Croatia or are staying for the purpose of remaining here as digital nomads - this will be regulated by the new law. These people are mainly highly qualified foreigners and IT experts.

The rate for calculating and paying tourist board membership fees will be reduced by 12 percent

Enterprises can count on the reduction some parafiscal levies this year. As such, they will pay a 12 percent lower membership fee to the tourist board, regulated by amendments to the law on this topic.

This also enabled the Tax Administration to change the amount of the monthly membership fee advance due to a significant drop in that activity, and the calculation of the lump sum membership fee when persons providing catering and hospitality services in households or on family farms obtain a decision on approval in the current year, considering the fact that this membership fee is calculated based on the capacities from the previous year according to the data from the eVisitor system.

Amendments to the Tourist Board Membership Act are explicitly prescribed to enter into force on the 1st of January, and although this date isn't explicitly foreseen for amendments to the Forest Act, the application of these legal provisions coincides with the beginning of the year.

Namely, on the 15th of December 2020, Croatian Parliament passed amendments to the Forest Act, which were published in the Official Gazette (145/2020) on the 24th of December, and as they enter into force eight days after their publication, this coincides with the beginning of 2021. These legal changes envision the lowering of yet another parafiscal levy.

The total relief for the domestic economy from the above moves is estimated to stand at around 33 million kuna.

The new regulation on special tax on cars - Finance Minister Zdravko Maric expects their reduction in price

At the end of last year, the Croatian Government passed a new regulation on special tax on motor vehicles, and the Minister of Finance expects that this could lead to cheaper cars.

That regulation regulates the calculation of that special tax in the light of the new system for the measuring of carbon dioxide (CO2) emissions produced by new cars. At the beginning of 2021, the full application of the so-called Globally Harmonised Light Vehicle Test Procedure (WLTP) across the EU will begin, which means that new vehicles will no longer have CO2 measurement data according to the old type-approval rules, but it will be governed by new data. As such, it was necessary to adopt a new regulation, Minister Maric explained at a government session held on December 30th.

In addition to the environmental component which is implied, this special tax on motor vehicles also has a value component, and the new regulation has raised the value threshold up to which the special tax is not paid from 150 to 200 thousand kuna.

For the latest travel info, bookmark our main travel info article, which is updated daily.

Read the Croatian Travel Update in your language - now available in 24 languages