European Parliament Supports Croatia's Accession to Eurozone

ZAGREB, 5 July 2022 - The European Parliament supported Croatia's accession to the euro area by a vast majority of votes on Tuesday.

With 539 votes in favour from 632 MEPs in attendance, the European Parliament adopted the report on the introduction of the euro as legal tender in Croatia as of 1 January 2023, saying that Croatia met all the criteria for accession to the euro area.

Forty-eight MEPs abstained form the vote and 45 voted against, mostly those from right-wing political groups who criticised Croatia's euro-area membership bid during discussion at a plenary session of Parliament on Monday.

Before an EU member state joins the euro area, the European Parliament gives its opinion on the recommendation from the European Commission. The last step is the adoption of the proposal at a meeting of the Economic and Financial Affairs Council on 12 July. The European Council has already endorsed Croatia's euro area entry.

By adopting the euro, Croatia will join the Eurosystem, which comprises the European Central Bank and the central banks of the euro-area member states. The Croatian National Bank governor will sit on the Governing Council of the European Central Bank.

The Croatian finance minister will participate in Eurogroup meetings and the prime minister will attend euro-area summits. Croatia will also automatically become a member of the banking union, a bank supervision and resolution system.

The report by European Parliament rapporteur Siegfried Muresan of the European People's Party (EPP), which was adopted on Tuesday, says that "Croatia fulfils all the criteria for adopting the euro as a result of ambitious, determined, credible and sustainable efforts by the Croatian government and the Croatian people."

The report notes that Croatia’s accession to the euro area is the first significant EU integration process after Brexit and that it should enhance the positive image of the European Union in the Western Balkans region.

"Notwithstanding the difficult socio-economic situation generated by the health crisis and the most recent increase in energy prices, Croatia's adoption of the euro and the fulfilment of the necessary criteria represent a strong political signal of the viability and attractiveness of the single currency of the Union," the report says.

Adoption of the euro will strengthen Croatia's economy and benefit its people and companies, as it will make the country's economy more resilient, attract more foreign investment, increase the confidence of international investors and cut down currency exchanges, that will have a relevant effect in the country's vital tourism sector, the European Parliament predicts.

The Croatian government was called upon to ensure that the introduction of the euro does not lead to artificial price increases.

"Croatia joining the euro area represents a strong political signal of the viability and attractiveness of the single currency of the Union. Twenty years after the introduction of the first banknotes, the euro is a symbol of European strength and unity. Thanks to its great commitment in its efforts to meet the conditions for adopting the euro, Croatia is now ready to join the euro area on 1st January 2023, less than a decade after joining the EU. The euro area as a whole will then welcome its twentieth member," the European Parliament said in an explanation of its favourable assessment of Croatia's readiness to adopt the euro.

For more, check out our politics section.

Belonging to Euro Area Boosts Croatia's Resilience to Crises, says PM

ZAGREB, 24 June 2022 - Support for Croatia's eurozone membership bid is an excellent sign for its highly euroized economy and will also boost its resilience to crises, Prime Minister Andrej Plenković said on Friday ahead of the start of the second day of the EU summit meeting.

One of the topics on the agenda of the two-day summit meeting is Croatia's entry into the euro area, and the leaders of the EU members states will support Croatia's accession, which is the penultimate step in the decision-making on receiving an aspirant in the euro area.

The last step is the adoption of three legislative proposals concerning Croatia's introduction of the euro, which will be made by the Council for Economy and Finance (EU Ecofin Council) on 12 July.

Thus, Croatia's changeover to the euro can start on 1 January 2023.

Today's summit meeting is very important for Croatia, which will become the 20th member of the euro area. This is a strategic goal of my cabinet, said Plenković while arriving at the summit meeting.

7 in 10 tourists in Croatia come from the euro area

Commenting on the highly euroized economy in Croatia, Plenković noted that 50-60% of loans and savings are tied to the euro, and 70% of travellers visiting Croatia are from the euro area, while two-thirds of the exchange is with the euro area.

The membership of the euro area will make Croatia better prepared to respond to crises such as energy and food crises or inflationary pressure, he said adding that the membership of the EU facilitated Croatia's efforts to address the COVID-19 pandemic.

For more, check out our politics section.

FinMin: Everything Should Be Done So Euro Doesn't Trigger Price Hike

ZAGREB, 6 June 2022 - Finance Minister Zdravko Marić said on Monday that everything will be done so that the introduction of the euro as legal tender does not trigger a price hike.

"We will do absolutely everything, regardless of inflationary pressure and our efforts to relieve it, to prevent euro introduction from becoming an additional trigger (of price hikes) for individual market stakeholders," Marić said, adding that this was why the dual display of prices would start on 5 September.

Addressing the conference "Croatia in a New Economic Environment", organized by the 24sata daily, Marić recalled that the law on the introduction of the euro foresees 12 institutions that are responsible for the implementation of the law, including the Croatian Financial Services Supervisory Agency (HANFA), State Inspectorate, Croatian National Bank and the Finance Ministry.

These institutions will monitor the situation closely, and civil society organizations will join in the process as well so that any unfair conduct is reduced to a minimum, said Marić.

Marić recalled the recent European Commission Convergence Report, which said that Croatia was the only candidate country that had fulfilled all the accession criteria and was prepared to introduce the euro on 1 January 2023.

If Croatia joins the euro area on that date it will have spent the least time in the European Exchange Rate Mechanism (ERM II) of all member states, added Marić.

He said the final decision on Croatia's accession to the euro area will be adopted by the Council of Finance Ministers in Brussels on 12 July.

"If everything goes as we expect... and Croatia's entry to the euro area is formally announced for 1 January next year, the rate of conversion will be defined," he said but could not say whether the exchange rate would be the same as when Croatia entered the ERM II.

He underscored, however, that in the majority of cases it stayed the same, and if there were to be any change that will not be significant.

In July 2020, when Croatia joined the ERMII, the exchange rate was €1 = 7.53450.

Marić added that joining the Schengen area of passport-free movement was also very important for Croatia.

Croatia meets all the criteria to join the Schengen area, however, its admission depends on a number of other factors, including the political will of the member states, he said.

"Croatia has proven that it knows how to protect EU borders," he said, expressing the belief that the country would achieve the goal of Schengen area membership as well.

For more, check out our politics section.

Employers to Be No Longer Required to Garnish Wages Upon Euro Adoption

ZAGREB, 4 June 2022 - The planned changeover to the euro in 2023 obliges Croatia to amend a set of laws, including the legislation regulating the enforced collection of delinquent debts, the Jutarnji List (JL) daily reported on Saturday.

Apart from changing all the laws that cite the kuna, some other laws will have to be amended, the daily newspaper says, adding that the change would further reinforce the protection of consumers against invalid contracts.

Currently, apart from the Financial Agency (FINA), the Croatian Pension Insurance Fund (HZMO) and employers are also authorized to garnish pensions and wages respectively to withhold the earnings of an individual for the payment of his or her debt in accordance with out-of-court settlements.

The employers complain about this obligation as an additional administrative burden.

Furthermore, employers are often at a loss on how to deduct money from an employee's monetary compensation so as to withhold a part of the salary subject to the enforced collection.

Therefore, the justice ministry plans to introduce a single system for the enforced collection when it comes to the wage and pension garnishment, and that only FINA should be authorized to collect delinquent debts from the income of debtors.

For more, check out our business section.

Croatia Could Get Positive Assessment on Euro Introduction on 1 June

ZAGREB, 23 May 2022 - The European Commission plans to issue a convergence report on 1 June which could give Croatia a final assessment on its readiness to adopt the euro.

European Commission Executive Vice-President Valdis Dombrovskis on Monday confirmed that the Commission plans to release its convergence report on 1 June.

"In Croatia debt ratios have declined significantly over the years and show a strong downward trend. This sends an important signal ahead of the convergence report that we will present on 1 June. As you know, Croatia aims to adopt the euro as its currency on January 1, 2023," Dombovskis told a press conference.

In its analysis of the macroeconomic situation in Croatia, the Commission notes that the country has made progress in reducing private debt and net external liabilities. It underscores that public debt remains high but continues its downward trend towards the situation prior to the COVID-19 pandemic. The banking system remains stable and liquid and the share of bad loans is decreasing. The potential for production growth has increased and funds under the Recovery and Resilience Mechanism can help deal with other vulnerabilities, the Commission says.

The Commission publishes its convergence report every two years. According to the last report in June 2020, Croatia had fulfilled all the criteria to enter the euro area except for membership of the European Exchange Rate Mechanism (ERM II).

Croatia soon met that criterion too, when it entered the ERM II on 10 July 2020.

The readiness to introduce the euro is determined according to convergence criteria, including price stability, regulated public finances, exchange rate stability, and convergence of long-term interest rates. National legislation is checked against the rules of the Economic Monetary Union (EMU).

Currently, the inflation rate is the only uncertain criterion at the moment. It must not exceed by more than 1.5 percentage points the average inflation rate of the three EU countries with the lowest annual inflation in the year preceding the assessment of the situation in the candidate country.

If Croatia gets a positive assessment, the finance ministers of the 19 euro area countries need to adopt the Commission's recommendation with a qualified majority.

The formal decision is delivered by Ecofin, comprising all EU finance ministers, after consultations with the European Parliament and following the June summit of EU leaders.

For more, check out our politics section.

Prime Minister Says Euro Area Membership Is a Plus in Crises as Serious as Current One

ZAGREB, 6 May (2022) - Prime Minister Andrej Plenković said on Friday that euro introduction would be positive for Croatia and would enable it to weather challenges better and more easily.

Opening a government session, the PM said that the National Council for euro introduction held a session on Wednesday, stressing that he expected the parliament to adopt the relevant law.

"I believe that membership in the euro area is a benefit in a crisis as serious like the current one, and that it will help us weather the future challenges better and more easily," he said.

He said the government would also formulate changes to the Government Act, announced at the start of the second term.

"We will propose, as one of the measures to step up the fight against corruption, stripping of immunity any government member for crimes of corruption that are prosecuted ex officio," he said.

He added that the government would also formulate a code of conduct for government officials.

For more, check out our politics section.

FinMin, HNB Governor Believe Inflation Criterion for Euro Area Entry to be Met

ZAGREB, 4 May 2022 - Finance Minister Zdravko Marić and Croatian National Bank (HNB) Governor Boris Vujčić on Wednesday expressed optimism regarding the fulfilment of the inflation criterion for euro area entry, with Vujčić saying that it would be unusual for Croatia to be asked to have an inflation rate below the current euro area rate.

Speaking at the 15th session of the National Council for the introduction of the euro as legal tender in Croatia, Marić recalled that a few days ago the government sent a convergence programme to Brussels and now it expected an assessment and a report to be published by the European Central Bank and the European Commission, to be followed by the checking of compliance with the Maastricht criteria, with the focus being mostly on inflation.

Marić said that the average inflation in Croatia for the first three months of 2022 was 6.3%, which, he said, was the euro area average and slightly below the EU average.

The Maastricht criteria refer to exchange rate stability, price stability, interest rate stability and two important indicators related to public finance - budget deficit and public debt.

Under the Maastricht criteria, the assessment refers to the inflation rate in the last 12 months, but not in relation to the general average but to the average of three countries with the lowest inflation rates. That means that Croatia should have an inflation rate that is a maximum 1.5 percentage points above the average inflation rate in the three EU countries with the lowest inflation, Marić said.

He added that the EC and the ECB have the right to exclude some of the countries from the calculation at their own discretion, which, he said, happened in 2014.

Marić said that without wishing to prejudge anything, he believed that European partners fully understood that the increased inflation in Croatia did not in any way differ from the situation in the EU.

"In anticipation of data on inflation in April.... we firmly believe that Croatia will meet that remaining criterion," he said.

The target date for Croatia's entry to the euro area is 1 January 2023.

Vujčić: Importance of euro area membership in times of crisis

HNB Governor Vujčić said that the reference value a country must comply with to join the euro area had so far never been lower than the average inflation in the euro area.

"If that is so, Croatia too should be able to meet the criterion because it would be a little odd to demand that it should have a lower inflation rate than the euro area which it is joining," he said.

He underlined the importance of euro area membership in times of crisis, noting that crises were easier to overcome and the consequences were significantly fewer for euro area members.

Croatia's lagging behind in terms of growth in the last decade is due to the fact that in crises its decline was much larger than in other countries, he said, noting like Marić, that euro introduction would not cause additional inflationary pressure.

Asked where after the introduction of the euro, kuna coins would be stored, Vujčić said that a solution would be found in cooperation with the Defence Ministry, to be announced after it was determined how they would be stored.

Vujčić also reported that trial euro coins with the national sides that had been approved had already been made and that after a decision on Croatia's euro entry in July, full production should be launched.

First increase in interest rates by ECB possibly in July already

Given that the US Fed Bank has already started a cycle of increasing interest rates, reporters asked Vujčić if the ECB planned the same move, to which he said that last year already he had announced that we could expect a gradual increase in interest rates in 2022 and that the effects were already visible on the bond markets.

When it comes to the ECB, it first plans to halt the programme of quantitative easing by the third quarter of this year, after which interest rates will increase. "We don't know when that will be, however, it is possible that the first increase in interest rates by the ECB could be as early as July," Vujčić said.

He explained that a good part of what will occur with increased interest rates of central banks has already impacted the market, which anticipated it. "When something is announced, financial markets don't wait for that to occur but immediately incorporate it in the price," Vujčić said, adding that it was usual in periods of growing inflation for central banks to respond by increasing interest rates.

In mid-April, the Ministry of Finance released euro bonds on the international capital market with a total nominal value of €1.25 billion, a maturity of 2032, an annual coupon interest rate of 2.875% and a real yield of 2.975%.

If they were to be issued today, the reference interest rate would be 33 base points higher, which means they would be 0.33% more expensive, hence about €4 million will be saved on interest each year, Minister Marić underlined to illustrate the volatility of the market, due also to the war in Ukraine.

PM: Croatia's economy most euroised of all EU economies

During the meeting of the National Council, chaired by Prime Minister Andrej Plenković, the PM presented the design of the national side of the €1 coin and a final bill on euro introduction, to be sent to the parliament on Thursday for second reading.

At the meeting, reports were submitted on the progress made in implementing activities related to introducing the euro.

Plenković said that euro introduction and accession to the Schengen Area were two strategic goals for deeper integration with the EU.

He said that Croatian citizens and the economy would benefit from membership in the euro area, underscoring that Croatia's economy was the most euroised of EU economies outside the euro area.

Euro deposits account for 76% of total savings and term bank deposits, 47% of kuna loans are pegged to the euro while countries of the euro area account for 53% of commodity exports and 59% of commodity imports, he said.

Plenković recalled that last week the government said that it foresees a GDP growth of 3% this year and a budget deficit of 2.8% of GDP, to fall to 1.6% in 2023 and 1.2% in 2024. At the same time, public debt should also be reduced to 76.2% this year, 71.7% in 2023, 68.9% in 2024 and 66.9% in 2025.

"All this has to be viewed in the context of changed circumstances and growing energy prices, which impacts all processes," said Plenković, recalling last week's estimate of a 7.8% inflation rate this year.

He stressed that nine measures in four areas had been met as part of the action plan to participate in the European Exchange Rate Mechanism II (ERM II). They are related to preventing money laundering, a more favourable business environment, improved management of state-owned companies and strengthening the bankruptcy framework.

We believe that this comprehensive approach will make it possible for all key and final decisions about Croatia's accession to the euro area to be made at the EU and euro area levels in June and July, said Plenković.

For more, make sure to check out our dedicated politics section.

Croatian Euro Coin Design Winners Officially Announced

February 4, 2022 - Through their official social media accounts, both the Prime Minister of the Republic of Croatia and the Croatian Government shared the winning motifs for the 2 and 1 Croatian euro coin, and the 50, 20, 10, 5, 2, and 1 cent coins, all of which will enter in circulation next year.

In recent years, the conversation around Croatia's accession to the eurozone has been increasing significantly. Since joining the European Union in mid-2013, the idea of carrying out a transition from the kuna to the euro has gone from being a distant scenario to near reality. It is no secret that the Croatian government's position on such change was favorable and that, eventually, it was simply a matter of defining how and when.

Precisely, as of today, the answers to both questions are already known, as the Croatian Government, its Ministry of Finance, and the Croatian National Bank (HNB) are working on the final details. The Croatian Kuna will cease to be the official currency, and the Euro will replace it in 2023. From September 5th, prices will be displayed in both Kuna and Euros, so that both locals and foreigners get used to the idea and become familiar with the new currency. Likewise, the first two months of 2023 will serve to withdraw the Kuna from circulation. As the Governor of the HNB Boris Vujčić reported shortly ago, citizens will have the possibility of paying with kunas, but only as a way to collect those coins for their subsequent storage.

Now that the idea of the euro as the official currency in Croatia is getting closer and closer to reality, many questions have arisen from both financial authorities, companies, and even Croatian citizens themselves. The positions are diverse: from rejecting the Euro in order to defend a Croatian symbol such as the Kuna, to wondering what the economic consequences will really be. The rejection of a large sector of the population was expressed through a referendum that was recently held throughout the country. The objective of the referendum was to postpone Croatia's access to the eurozone because, it should be remembered, by being a member of the European Union, Croatia cannot bail out of using the Euro as currency, but it could keep an indefinite period of transition.

The government responded by guaranteeing that not only will the transition from one currency to another take place smoothly, but that the long-term benefits will allow Croatia to reach economic standards that allow it to equalize its status with other European Union countries. Minister Zdravko Marić revealed that the Ministry of Finance will make sure to monitor that prices are set correctly, and does not rule out the existence of sanctions for those who increase them unsustainably. For its part, the Croatian National Bank promised to effectively control the inflation rates that may be generated as a result of this currency change.

Today's session of the National Council for the Introduction of the Euro as the Official Currency in Croatia. (Photo: Goran Stanzl/PIXSELL)

Most likely, doubts will be resolved along the way, since it seems that the decision has already been made and there is no going back. Following an official Croatian government meeting earlier today, the Government of the Republic of Croatia shared the official winner designs of the Croatian Euro coin, and all the details about each design, on their social media accounts. You can watch the complete session here. Each coin was accompanied by a video and information about its designers. The Government shared the following on their Instagram account:

''At today's session of the National Council for the Introduction of the Euro as the Official Currency in Croatia, the design solutions of the Croatian side of the euro and cent coins were presented. A total of 1,299 proposals were submitted to the open competition, and the commission in charge of selecting the most successful solutions did not know who the authors were, but evaluated and ranked each proposal only on the basis of the proposed design.

The first-ranked proposals were officially approved by European Council on January 28 this year. We also thank and congratulate the authors of the selected motifs! These are:

- Ivan Šivak - author of the conceptual design "Geographic Map of Croatia" for a 2 euro coin

Najuspješniji dizajn za motiv „Geografska karta Hrvatske" - kovanica 2 € pic.twitter.com/XSxLU3OTDI

— Vlada Republike Hrvatske (@VladaRH) February 4, 2022

The author of the 2 euro coin motif, "Geographical Map of Croatia", is Ivan Šivak, born in 1985 in Zagreb. He graduated from the Academy of Fine Arts in Zagreb in 2011 at the Department of Animated Film and New Media. Since 2011 he has been a member of the Croatian Society of Fine Artists. He lives and works in Samobor.

- Stjepan Pranjković - author of the conceptual design "Kuna" for a 1 euro coin

Najuspješniji dizajn za motiv „Kuna” - kovanica 1 € pic.twitter.com/CJwzWMcIqR

— Vlada Republike Hrvatske (@VladaRH) February 4, 2022

The author of the 1 euro coin motif, ''Kuna'', is Stjepan Pranjković, born in 1995 in Ostfildern, Germany. At the Academy of Applied Arts in Rijeka, majoring in Applied Arts, module painting, he obtained the title of Master of Applied Arts in 2020. He lives in Rijeka.

- Ivan Domagoj Račić - author of the conceptual design "Nikola Tesla" for 50, 20 and 10 cent coins

Najuspješniji dizajn za motiv „Nikola Tesla” - kovanice 50, 20 i 10 centi pic.twitter.com/sGfVnrTaCX

— Vlada Republike Hrvatske (@VladaRH) February 4, 2022

The author of the 50, 20, and 10 cent coin motif, ''Nikola Tesla, is Ivan Domagoj Račić, born in 1999 in Zagreb. Today he is a full-time third-year aeronautics student at the Faculty of Transport and Traffic Sciences in Zagreb. His interest in graphic design began in high school, when he began to study independently.

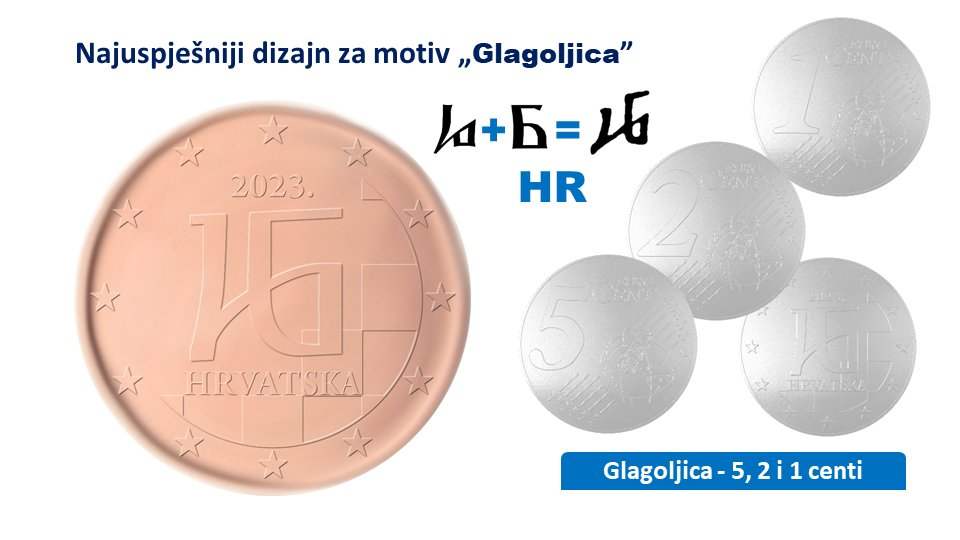

- Maja Škripelj - author of the conceptual design "Glagolitic" for coins of 5, 2 and 1 cent

Najuspješniji dizajn za motiv „Glagoljica” - kovanice 5, 2 i 1 cent pic.twitter.com/kh1IYEzSXV

— Vlada Republike Hrvatske (@VladaRH) February 4, 2022

The author of the 5, 2 and 1 cent coin motif, ''Glagolitic'', is Maja Škripelj, born in 1988 in Zagreb. She graduated from the Faculty of Architecture in Zagreb with a master's degree in engineering and architecture in February 2014. From graduation until July 2020, she worked in the architectural office, and now has her own business.

The designers behind the winning motifs for the Croatian euro coin: Ivan Šivak, Ivan Domagoj Račić, Stjepan Pranjković, and Maja Škripelj. (Photo: Goran Stanzl/PIXSELL)

After presenting the winners and their designs, the Croatian Government continued:

''In addition to the mentioned motifs, the Council of the European Union also approved another, additional motif, ie the text, which is an inscription that each country can choose and engrave on the 2 euro coin, which is the largest.

On the Croatian 2 euro coin, in addition to the Croatian chessboard, as an element of the Croatian coat of arms, and a map of the Republic of Croatia, Gundulić's verse "O LIJEPA O DRAGA O SLATKA SLOBODO" will be engraved on the rim.

As is well known, this is one of the most famous and beautiful verses from the Anthem of Freedom, which is an integral part of the pastoral "Dubravka" from the 17th century by Ivan Gundulić. The Republic of Croatia, as a symbol of Croatian statehood and independence, should also have a verse from the Anthem of Freedom, which best symbolizes the millennial aspiration for freedom of the Croatian people''.

Below we show you each Croatian euro coin in detail:

The Croatian Euro coin designed by Ivan Šivak features the geographical map of Croatia and due to its size also features the verse: ''O LIJEPA O DRAGA O SLATKA SLOBODO'' engraved on the edge.

The Croatian Euro coin designed by Stjepan Pranjković features the Kuna, Croatia's symbolic animal.

The Croatian Euro coin designed by Ivan Domagoj Račić features Nikola Tesla, the world-famous inventor and engineer born in Smiljan.

The Croatian Euro coin designed by Maja Škripelj features the Glagolitic alphabet, the oldest Slavic alphabet, from Croatia. The two Glagolitic letters chosen will form the Croatian ISO: HR.

For more, check out our politics section.

Some Zagreb Hospitality Establishments Plan to Increase Coffee Prices

February the 3rd, 2022 - Could coffee become a luxury? This Croatian custom which involves sitting around a (usually really small) cup of coffee for hours on end while putting the world to rights might be affected by the introduction of the euro as Croatia's official currency next year.

As Novac/Jutarnji writes, how we can avoid price increases is a question that is becoming more and more important as the introduction of the euro approaches. In the run up to the change, mechanisms are needed to monitor prices - such as their double expression, and, ultimately, so-called blacklists. The Croatian Government is not giving up on trying to hound this further, and it claims that it intends to denounce all those who have decided to make extra money on the back of the change unjustifiably.

It's too early to guess how much a cup of coffee will end up costing due to the introduction of the euro and the rounding off of prices. Because even before that, some Zagreb hospitality establishments will, as they say, raise their prices due to the overall higher prices of energy and raw materials.

''This year, we expect an increase in all prices due to rising energy, gas and electricity costs, as well as the already announced increase in coffee prices of 150 percent, which has been announced by some Zagreb hospitality establishments. Will coffee become a luxury now? That's the question that has arisen. The introduction of the euro in Croatia will also result in a certain price increase, Franz Letica, president of the Association of Caterers of the City of Zagreb at HOK, told HRT.

Even before the introduction of the euro, hairdressing and beauty services will become significantly more expensive, but the conversion itself should not cause too much of a price increase for the end user.

''There will be no problems in terms of recalculating prices, but it will probably involve some rounding, purely because of the simpler handling of the euros,'' said Antonija Tretinjak from the Guild of Beauticians and Pedicurists at HOK.

The growth of prices of most products is already very visible in stores. The Most (Bridge) party believes that the Croatian Government must not give up publishing a black list of traders who will unjustifiably increase their prices due to the conversion.

''What we're asking for is that this measure of publishing the list of those who unjustifiably raise prices will certainly be part of this changeover of the kuna to the euro. We also want to open the question of whether this is the time for the introduction of the euro at all,'' said Nikola Grmoja from Most.

The advantages of the introduction of the euro are multiple, says the Minister of Economy and Sustainable Development Tomislav Coric, and the black list will be one of the ways to prevent any unjustified price increases.

''The idea is that those who change their prices and use the time and process of conversion for one-time profit without any reason or basis should be noticed, both by consumers and institutions. What we'll do in the coming months is for that to happen and for them to be denounced,'' warned Coric.

The best way to prevent unjustified price increases is to double-check prices and keep making a note of them in the few months before the introduction of the euro.

Croatia to Display Prices Both in Kuna and Euro as of September 5

ZAGREB, 17 Jan 2022 - Prime Minister Andrej Plenković on Monday announced a dual display of prices in Croatia, both in kuna and in euro, from 5 September through the whole of 2023.

Plenković made the announcement at a press conference where he unveiled the bill proposing the adoption of the euro as legal tender in Croatia. He was accompanied by Finance Minister Zdravko Marić, Economy and Sustainable Development Minister Tomislav Ćorić, and Croatian National Bank (HNB) Governor Boris Vujčić.

The bill was put to public consultation today and the final proposal is expected to be sent to Parliament for a second reading in the second half of April.

The bill regulates the legal framework, the cash exchange, supplying all legal entities with euro, the loan and deposit conversion, and consumer protection from undue price increases.

Prices will be displayed in both kuna and euro as of 5 September to raise awareness of the euro even before its adoption, for which the target date has been set at 1 January 2023. The dual display of prices will continue throughout 2023.

Plenković said that citizens will be able to exchange kuna for euro at no cost to them at banks, the Croatian Post, and the Financial Agency (Fina) throughout next year, after which they will be able to do so at the Croatian National Bank free of charge too. He called on citizens to deposit any cash they have in banks so that the conversion can be done automatically.

The PM said that the aim is to ensure a smooth switch to the euro and the effective functioning of the economy.

He noted that this year the government would send to Parliament more than 70 proposals concerning the adoption of the euro, including the physical replacement of the national currency with the euro.

Plenković said that Croatia aspired to integrate with the European Union more deeply by joining the Schengen passport-free travel area and the euro area, and in that regard, relevant decisions would be made in the coming months.

He spoke of the steps that had been taken so far regarding the euro adoption and the reasons why Croatia wanted to join the euro area. He said that the Croatian economy is highly euroized, that 70 percent of tourism revenues come from citizens of euro-area countries, 60 percent of trade is generated with those countries, 70 percent of time savings deposits and nearly 60 percent of household and corporate loans are in euro or indexed to the euro.

Plenković said that the goal of euro area membership was included in government activities 20 years ago.

"What will be happening this year will be the culmination of the processes that have been systematically worked on in the last two decades," the prime minister said, announcing that the Council for Euro Adoption would meet before a cabinet meeting on Thursday.

For more, check out our dedicated politics section.