Affordable Housing Project in Croatia to be Run by Erste Group

August 6, 2022 - Living costs keep climbing in Europe, including housing and rent, and Croatia is no exception. With the government policies favouring tourist rentals, there is a shortage of any, especially affordable housing in the cities. While the government sleeps on the issue, private investors are quick to recognise a niche. Erste Group prepares to run an affordable housing project.

As Poslovni writes, the absence of a housing policy in Croatia has led to the absurd situation that the residential real estate market in Zagreb and larger cities is oriented toward tourist rentals, pushing up square footage prices, and making real estate unavailable to the local population with average income.

The profession keeps warning in vain about the problem and social repercussions, but it seems that private capital has recognised a niche in what should have been dealt with by policies.

The Austrian Erste Group has launched a strategic affordable housing project that will build 15,000 apartments in the region, including Croatia, and rent them out at affordable prices. The local project is still in its infancy, and the detailed outlines of the model should be clearer by the end of the year.

“The idea of realising affordable housing is very current in the environment of growing inflation and rising real estate prices in many European countries, including Croatia. In principle, there are positive examples in other countries, such as Austria, and such a model can be a good generator of cooperation between local administrations and banks, which contributes to ensuring a kind of social stability”, says the local Erste.

In Croatia, the bank has started preparations in this segment. "At this moment it is still too early for details, and it is to be expected that the bank will be able to share information with the public within a reasonable time, most likely towards the end of the current year", they told Poslovni. Unofficially, Poslovni has learned that the project could first come to life in Rijeka and then in the capital, but there is still a need to devise models and work out cooperation with local authorities.

In doing so, the regulatory framework that paved the way for implementation in other countries will be crucial. In Austria, with a long-standing tradition of affordable housing, about one billion euros was invested in about 6,000 apartments for rent. In the Czech Republic, the bank founded a separate company for the construction of affordable apartments, while in Slovakia, where the co-investor is the government, about 200 apartments in 2022. Similar projects in Hungary and Romania are in the preparation phase.

There are several open questions to which answers will be sought in the coming months, starting with an adequate model. For example, if it will be a public-private partnership or some alternative such as reserving building rights.

The legal framework should regulate the rental market and the mutual relations (and protection) of tenants and landlords because an unregulated market regularly tells horror stories about landlords and tenants from hell, where it turns out that the key factor in renting is luck. However, it will come down to taxes to ensure that the affordable rental price remains some 10 or 20 percent lower than the market price.

According to the income tax law, it is possible to penalise selling or renting to natural persons at prices lower than market prices (on which additional taxes and contributions are calculated), so the treatment of affordable rent should be regulated because it aims to be lower than the market price by definition.

Housing is a need

The interlocutors point out that there is no possibility of VAT deduction during construction (or acquisition) if the purpose is to lease for housing, which consequently inflates the value of the investment and rent.

With the current rental prices, which the profession points out as some of the lowest in the EU, developers are not interested in building apartments for rent due to long payback periods (20-30 years), which is why it will be difficult for the initiative of affordable housing to move from a standstill without the cooperation of the state and local units (from taxes to all other benefits).

Even though he has not yet seen the details of the model, Dubravko Ranilović from the real estate agency Kastel-Zagreb points out that Croatia has a specific problem that, for example, apartments are not available for young families who are not creditworthy. “In principle, we support all initiatives. We need social programs so that housing can be available to citizens because it is a need”, he says.

The market is flooded with apartments for rent, but tourist apartments. The number of tourism listings outnumbers long-term rentals by four times, with forecasts that the gap will still widen. Ranilović sees a partial reason for this in the preferential tax treatment, which has “created a tax oasis in the taxation of tourist rentals”, so apartments have expanded into residential areas, taking away part of the space in favor of short-term rentals, and the situation is further aggravated by subsidies.

Tax policy, which steadily pushes the country towards apartment building, is part of the puzzle of the lack of a meaningful housing policy.

The government is not abandoning the housing loan subsidy program despite criticism that it freezes prices (or even pushes them up) being available only to a small group of citizens, while all others (those with weaker creditworthiness, the elderly, or simply those who do not meet the prescribed tender conditions) have to pay a higher price.

The neglected middle layer

“The corporate segment recognised that with the current dynamics of the real estate market and the rampant prices, the middle class of society with incomes for which the price of new square meters and existing square meters of apartments are not affordable has been neglected.

This is a large segment of society, the demand is high and will remain so in the future, especially in Zagreb and university cities, and this is where Erste sees the creation of a new niche”, says Vedrana Likan of Colliers.

He detects the problem in the lack of regulation, pointing out that the domestic legal framework does not know the terms of affordable housing or, for example, housing accessible to the elderly population, and if this were regulated, the market would already recognise the opportunity.

“Affordable housing does not necessarily have to include new construction, a lot would be done if someone dealt with the existing housing stock”, believes Likan. Colliers' analysis, for example, shows that there are 7,074 apartments with an area of 410,600 square meters owned by the city of Zagreb and city companies alone, which could be used precisely for affordable and social housing.

For more, make sure to check out our dedicated business section.

Record Number of Applications Filed for Subsidised Housing Loans

ZAGREB, 26 April 2022 - The relevant APN agency has received a record 5,870 applications for subsidised housing loans and Construction, Physical Planning and State Assets Minister Ivan Paladina has announced additional funds for all the applications that will be approved.

Applications could be filed from 21 March to 22 April and in this, the seventh round, a new record number were filed. In the previous round, 4,739 were filed, a record at the time.

The government has set aside HRK 50 million for this purpose, but given the interest, Paladina said more funds would be necessary and that he discussed it with Finance Minister Zdravko Marić over the weekend.

"It was agreed that the funds will be ensured, so no one need worry as to whether there will be enough funds for all the applications that will be approved," he said in a press release.

Paladina said the subsidised house scheme would be analysed this year, taking into account the comments of real estate experts, notably regarding price hikes.

The record number of applications shows the importance of the scheme "whereby we are helping young families buy a home," he added.

The average approved subsidised loan is €78,000, the average repayment period is 22 years, and the average age of the beneficiary is 32.

The effective interest is 2.08% and the monthly instalment is HRK 3,035, including a HRK 1,020 subsidy, the ministry said.

In March, APN signed agreements on subsidised housing loans with 14 banks.

The eligibility criteria for applicants is that they are under 45 and that they are first-home buyers. Calculating the amount of subsidy depends on the location of the property covered by the scheme. Applicants in locations in underdeveloped and rural areas qualify for higher subsidisation.

In the families that use housing loan subsidies, roughly 5,000 children have been born since 2017, when the scheme was launched. Since then, more than 22,000 applications have been approved.

(€1 = HRK 7.5)

For more, make sure to check out our business section.

Zagreb Needs to Focus on Housing, Education and Protection Against Poverty

ZAGREB, 29 March 2022 - Housing, investing in education institutions and expanding services for citizens at risk of poverty and social exclusion are priorities Zagreb city authorities should focus on, it was heard at a presentation of Zagreb's social image for 2020 and 2021.

The head of the city office for social welfare, health, veterans and disabled persons, Romana Galić, said that new data points to the importance of creating a quality social policy regarding housing, which is the key to preventing social exclusion.

The social image points to the importance of expanding welfare services, particularly for children and youth as well as preventing dropping out of school.

Some of the essential measures, cited in the city's strategy to combat poverty and social exclusion for the period 2021 to 2025, refer to energy price hikes.

It is necessary to approach the most vulnerable population with preventative measures, education and energy packages to prevent them from falling into energy poverty.

Galić said the quality of life in Zagreb is of a high standard given the numerous services provided by institutions and civil society organisations however some indicators show that there is room for improvement.

She confirmed that the city plans to build public housing and her office has applied for funds for the most vulnerable to resolve housing issues.

Quake and pandemic adversely affect real estate market, employment, pay

The social image has been prepared for 20 years now and represents one of the strategic documents that are important for social planning and evaluation. It shows the situation and challenges in nine areas: population, household and family, housing, education, employment and unemployment, economic indicators, healthcare, welfare and co-financing projects and programmes.

Housing Loans Up 10.8% Y-O-Y

ZAGREB, 1 Oct 2021 - Total household loans in Croatia in August accelerated their growth on the year from 4.3% to 4.6%, with housing loans continuing to increase from 10.6% to 10.8%, according to data provided by the Croatian National Bank (HNB) on Friday.

Total lending by monetary institutions to domestic sectors (apart from the central government) in August fell by HRK 500 million or 0.2% compared to July and at the end of August they amounted to HRK 241.1 billion, the HNB reported.

The annual growth rate of total placements remained at 4.1%, the same as in July.

Total loans, which account for the majority of total placements, fell by HRK 400 million or 0.2% on the month, with loans to the business sector contracting by HRK 700 million or 0.8% and loans to other financial institutions falling by HRK 100 million or 0.6%.

On the other hand, household loans increased by HRK 300 million or 0.2%.

Year-on-year, housing loan growth accelerated from 10.6% to 10.8%, and the growth of cash loans increased from 0.6% to 0.8%, leading to accelerated growth in household loans from 4.3% to 4.6%.

Total household deposits up by HRK 37 billion on the year

Total deposits amounted to HRK 359 billion, HRK 8.6 billion or 2.5% up from July, whereas on the year they increased by HRK 37 billion or 11.5%.

Household deposits amounted to HRK 238.3 billion, up HRK 3.3 billion or 1.1% on the month and by HRK 19 billion or 8.6% on the year, the HNB reported.

(€1 = HRK 7.491380)

For more news on business, CLICK HERE.

Croatia Housing Costs Highest in EU Compared to Wages

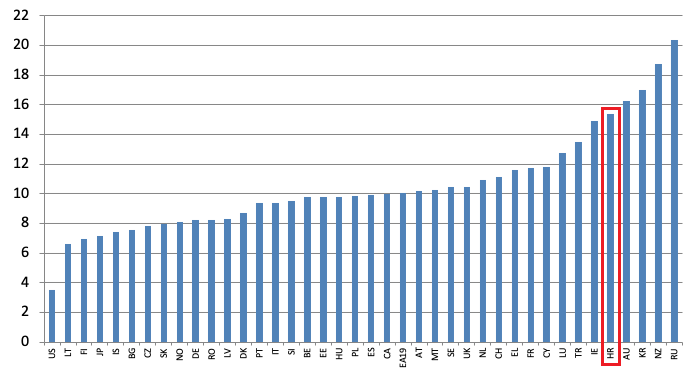

As reported by IndexHR, and according to an article published on the VoxEU portal, of all EU nations Croats (in Croatia) have to work the longest to afford an apartment.

The authors of the article are Jean-Charles Bricongne, deputy director of the Banque de France, and Allesandro Turrini, head of the European Commission's Economic and Financial Affairs Department, and both are also members of CEPR (The Center for Economic Policy Research).

CEPR is a network of more than a thousand scientists and researchers from European universities and is, among other things, also the publisher of VoxEU, an influential online platform for public policy analysis and commentary by economic experts.

Real Estate Prices in 40 Countries

Bricongne and Turrini wrote an article entitled "Estimating Real Estate Prices: Insights from Price Level Data," which looks at how much home prices in 40 countries in Europe and the world relative to wages in those countries.

In other words, the article looks at how many citizens of several countries, forty of them in all, can afford to buy an apartment with the wages they earn. There is bad news for Croatia: in terms of salaries, we have the most expensive real estate of all EU member states, while in the world real estate is more expensive only for citizens of Australia, South Korea, New Zealand and Russia.

Most Expensive Apartments in the EU

"Identifying inflated residential real estate prices has become an integral part of macroeconomic surveillance," the authors indicated at the beginning of their article, adding that a detailed database of real estate prices in all countries around the world should be created so that overvalued real estate can be more effectively analyzed.

In Croatia, real estate is most definitely overvalued, given the fact that according to 2016 data, which is based upon the survey of the two economists, the average Croatian needs to work about 15 years to afford a 100 square meter apartment. The apartment price-to-income ratio for Russians is the worst of all surveyed nations. They will need 20 annual salaries to buy the same kind of apartment. Nevertheless, in comparison to other EU member states housing is obviously the most expensive in Croatia.

Data from 2016: Present Situation Even Worse

In contrast, an average German needs just eight years of earnings to buy a 100 square foot apartment. The most favorable real estate prices are in the United States, where about three annual salaries are required to buy 100 square meters of living space.

It must also be emphasized that the authors in their research were guided by data from 2016. In the meantime, real estate prices in Croatia have exploded, while wages have not increased at roughly the same pace. That means today's ratios are even worse for Croats, who now need MORE than 15 years of earnings to buy a 100 square foot apartment.

For more information about living in Croatia, follow our lifestyle page.

Need an Apartment? Dubrovnik Remains Most Expensive

We may as well admit it, it isn't surprising.

First Apartment Building in Vukovar to Get Built Since the Homeland War

The new apartments should be completed by the end of next year