Could Croatian Minimum Wage Rise Under Pressure from Brussels?

February the 12th, 2022 - Could the Croatian minimum wage finally be forced into an increase under increasing pressure from the European Union in Brussels? Things might have to dramatically alter by June with yet another EU directive.

As Poslovni Dnevnik/Ana Blaskovic writes, a new directive on an adequate minimum wage across the European Union could come out of Brussels' ''kitchen'' by June and force the Croatian minumum wage upwards.

Although its pillar is the introduction of the institute of the minimum wage, which, unlike here in Croatia, is not yet available to all EU member states, the domestic labour market could be shaken by the additional demand it will bring, which is that the member state must actively strive to cover at least 70 to 80 percent of its workers with collective agreements.

The directive seeks to strengthen the European Union's idea of social security and it has strong political support, as could be heard recently coming from the Belgian capital.

The topic is on the table of the convocation of the European Parliament in the continuation of this mandate and is being additionally pushed by the current President of France. On the eve of the April elections, President Emmanuel Macron's trump card is an ideal opportunity to strengthen France's leadership position in the European Union after the departure of the very well known and long-standing German Chancellor Angela Merkel.

Although here in Croatia there are regular spears about the amount of the minimum wage that the Government adopts by decree (it isn't enough for workers and is always a question of competitiveness for employers), Croatia is among the 21 member states that already know and are quite well acquainted with this institute.

The exceptions are Denmark, Italy, Cyprus, Austria, Finland and Sweden. By raising the Croatian minimum wage to 3,750 kuna in 2022, Croatia has approached the goal set by the new EU directive, which is that the minimum wage must be 60 percent of the gross median and 50 percent of the average gross wage.

Therefore, the directive does not exclude the instrument of minimum wages, but provides a clearer calculation of how to calculate it and provides for a mechanism for testing the adequacy of its national level.

"We hoped that the directive would be passed during the Portuguese presidency, but some countries made a number of remarks, and Croatia doubted whether the goal of at least 70 percent of workers covered by collective agreements would be too difficult to achieve," said Kresimir Sever, the president of the Independent Croatian Trade Unions.

It's worth noting that the proposal of the European Commission is that it should be 70 percent of the workers covered by collective agreements, while the MEPs are proposing 80 percent in their amendments. "The aim is to ensure that every worker in the EU is paid for their work so that they can live with dignity, and nothing less than that. Croatia is close to the aforementioned minimum wage target, but hasn't yet reached it in gross terms. The problem in Croatia is low wages, so naturally the Croatian minimum wage is also low,'' the trade unionist added.

The trade unions themselves have a hard time estimating how many workers are actually covered by collective agreements in this country. Sever estimates that about 50 percent of employees in Croatia have a collective agreement in addition to an employment contract, but with the caveat that there is no data on "home" contracts.

In this context, it is important to note that the European Union as a whole is moving towards strengthening the role of trade unions, not only as workers' representatives, but also as bodies that collectively negotiate with employers.

It should be noted that the directive isn't binding, but it does work to further encourage member states to achieve a high percentage of coverage of their workers by collective agreements. The setting of benchmarks and modalities is still being negotiated, as are the timeframes within which each member state should achieve these goals.

Although in practice collective agreements are often perceived as clashes between employers and workers, their prevalence carries wide social consequences.

"The wide application of collective agreements is a way of coordinating wage policies that can ensure greater transparency and certainty of workers' incomes at the national or sectoral level, but also the stability of the workforce and the control of labour costs for employers, without harsh, generally universal legal interventions," said a senior research associate at the Institute for Social Research, Teo Matkovic.

He also mentioned that the legal instrument of the Croatian mininum wage has existed now for just over a decade, and it has been growing significantly for several years since. It is the opposite of collective agreements, the use of which has decreased significantly in the last 20 years or so.

"In this country, the coverage of collective agreements is modest, and the content is thin, especially outside of the public sector, so this coordination mechanism will need to be worked on if the adequacy of income in Croatia is to be relied on," explained Matkovic. He believes that a significantly larger area for collective bargaining, provided by the directive, "would strengthen the position of work across the EU, and in Croatia is likely to reduce emigration and encourage investment in skills and productivity."

For employers, the cost of labour is a calculation of competitiveness, especially emphasised in the circumstances of accelerating inflation and rising costs of raw materials. "Any increase in the Croatian minimum wage has significant consequences for employers, especially in the situation we're now witnessing when there's inflation, the rising cost of living and rising energy prices across the market.

If we take into account the consequences of the ongoing coronavirus crisis, it's clear that employers can hardly bear the new increase in costs, without these costs being accompanied by a reduction in the workload,'' they said from the Croatian Chamber of Commerce (HGK), also pointed out that they're aware of the need to increase the living standards of citizens, "but it is necessary to apply a rational approach that will not lead to new layoffs."

For more, check out our politics section.

EU: Council Agrees Position on Two Labour-Related Draft Laws

ZAGREB, 7 Dec, 2021 - The Council of the European Union on Monday agreed a common position on two draft laws - on pay transparency and on adequate minimum wages in the EU.

The Employment, Social Policy, Health and Consumer Affairs Council, which was attended by the Croatian Minister for Labour, Pension System, Family and Social Policy, Josip Aladrović, agreed the common position based on which member states will negotiate with the European Parliament the final texts of the two laws.

The proposal on pay transparency should help tackle the existing pay discrimination at work and close the gender pay gap. It aims to empower workers to enforce their right to equal pay for equal work or work of equal value between men and women through a set of binding measures on pay transparency.

Member states agreed that employers have to make sure their employees have access to the objective and gender-neutral criteria used to define their pay and career progression.

In accordance with national laws and practices, workers and their representatives have the right to request and receive information on their individual pay level and the average pay levels for workers doing the same work or work of equal value, broken down by sex. Employers also need to indicate the initial pay level or range to be paid to future workers – either in the job vacancy notice or prior to the conclusion of the employment contract.

The gender pay gap in the EU stands at around 14%, which means that women earn on average 14% less than men per hour. There are a number of inequalities underlying this pay gap. Women are overrepresented in relatively low-paying sectors such as care and education, the so-called glass ceiling leads to their underrepresentation in top positions, and in some cases women earn less than men for doing equal work or work of equal value.

The Council also agreed on a proposal for a directive on adequate minimum wages in the EU.

The aim of the directive is not to harmonise the level of minimum wages within the EU or set a uniform European minimum threshold, because the Union does not have jurisdiction over such matters. The aim is to establish minimum conditions for setting adequate minimum wages based on clear and stable criteria which would be updated in a regular and timely manner, as well as to ensure the inclusion of social partners. In most EU member states minimum wages are not adequate.

All 27 member states have minimum wages. In 21 of them, including Croatia, they are regulated by law, while in six countries (Austria, Cyprus, Denmark, Finland, Italy and Sweden) they are agreed through collective bargaining.

Countries with a high collective bargaining coverage tend to have a smaller share of low-wage workers and higher minimum wages than those with low collective bargaining coverage. That is why ministers agreed that countries should promote strengthening the capacity of social partners to engage in collective bargaining. If their collective bargaining coverage is below 70%, they should also establish an action plan to promote collective bargaining.

Croatia is far from 70%

Minister Aladrović said that Croatia is relatively far from the 70% threshold as its collective bargaining coverage is estimated at between 30% and 35%.

"Nevertheless, I am confident that we will attain this threshold of 70%. It is attainable, especially in the private sector. In Croatia, collective bargaining is mostly linked to the state and public sector and not the private sector, where at this point we have one expanded collective agreement," he said.

Aladrović said that Croatia would strengthen collective bargaining through the amended Labour Act, which is now under preparation.

"It includes a number of provisions aimed at strengthening collective bargaining, which is important to protect workers and make employment more certain. This is also important to employers so that they can make long-term plans," he said, adding that this would also have an indirect effect on increases in average and minimum wages.

"I am quite sure that we will attain the planned level of average and minimum wages before the time indicated in the government programme," Aladrović said.

For more on lifestyle, follow TCN's dedicated page.

For more about Croatia, CLICK HERE.

Minimum Wage to Be Contracted in Gross Amount as of Next Year

ZAGREB, 29 Oct 2021 - Parliament amended the Minimum Wage Act by majority vote on Friday and as of next year employers will have to contract the minimum wage with employees in the gross amount, or face a fine between HRK 60,000 and 100,000.

As of next year, the gross minimum wage will be HRK 4,687. Now it amounts to HRK 4,250.

The government decided yesterday that as of next year the net minimum wage will amount to HRK 3,750, an increase of 10.3%. For the first time, the minimum wage will exceed 50% of the average net wage.

Employers who pay below the minimum wage will also be fined, as will those who sign a contract with an employee in which they renounce the payment of the minimum wage.

Parliament rejected a conclusion by Katarina Peović of the opposition Workers Front under which the government should make sure that the minimum wage was a dignified wage. Anything else , she said, is contrary to the constitution.

Parliament also amended the Voluntary Health Insurance Act and now 120,000 insurees, mainly pensioners, will get free supplementary health insurance.

The amended law raises the income threshold from HRK 1,600 to 2,000 a month and for a single insuree from HRK 2,047 to 2,500. For that purpose HRK 16.8 million has been set aside in this year's budget and HRK 101 million for 2022 and 2023.

MPs also endorsed a corruption prevention strategy for the 2021-30 period.

Amendments to the farmland law was sent into a second reading.

A bill by Anka Mrak Tritaš of the opposition GLAS to cut the tax on feminine hygiene products did not receive majority support. However, MPs endorsed a conclusion by the ruling HDZ group tasking the government with analysing period poverty within six months and taking action to eliminate it.

For more on politics, CLICK HERE.

Opposition Amendments to Minimum Wage Bill Rejected

ZAGREB, 29 Oct 2021 - A government representative on Friday rejected all opposition amendments to the Minimum Wage Bill, of which most were put forward by MP Katarina Peović of the Workers' Front, and accepted only an amendment by Croatian Pensioners' Party MP Silvano Hrelja, who is part of the parliamentary majority.

The bill makes it possible for employers to cheat workers, enabling them to sign employment contracts setting the wage below the minimum wage yet pay the worker the minimum wage but make them work additionally for it, said Peović.

It is therefore important that overtime work, work on holidays, work in shifts and work in difficult conditions be paid for separately, she said.

The minimum pay must be defined as a decent pay, she said, noting that this was a constitutional category.

MP Sandra Benčić of the We Can! party said that the bill included "catches" that would enable employers to pay lower wages than the minimum wage of HRK 3,750 (€500), defined by the government.

MP Hrelja, whose amendment was the only one accepted by the government, had proposed erasing an article from the Minimum Wage Bill so that the minimum wage is not lower than the one determined by the bill and the planned working hours do not affect the amount of the minimum wage the worker should receive.

For more on politics, CLICK HERE.

Minimum Wage to Rise By 10.3% to €500 in 2022

ZAGREB, 28 Oct 2021 - Croatia's minimum wage for 2022 will be HRK 3,750 (€500), rising by 10.3%, and will thus be above 50% of the average net pay for the first time.

The government on Thursday adopted a regulation on the minimum wage after consultations with all social partners.

We have assessed that in the current circumstances, the minimum wage can be increased from HRK 3,400 to HRK 3,750, Prime Minister Andrej Plenković said.

He went on to say that the net minimum wage of €500 would concern 51,000 workers who now receive the minimum take-home pay.

This is for the first time that the net minimum wage will be above 50% of the average monthly wage, as it will reach 52.7% of that wage.

In August, the average monthly take-home pay was HRK 7,118 (€949), when the median wage was HRK 6,014. (€802).

The new minimum wage will be 60% of the median wage.

All of this is a great step forward, Plenković said, recalling that five years ago the minimum wage was 38% of the average wage.

Over the last five years, the minimum wage has risen by HRK 1,254, or four times more than during the terms of the previous three governments, Plenković underscored.

The gross minimum wage in 2022 will be HRK 4,687.50, Labour Ministry State Secretary Dragan Jelić said.

He informed the government that the average gross salary had risen during the first seven months of 2021 as against the corresponding period of 2020.

(€1= HRK 7.5)

For more, check out our politics section.

Opposition Says Not Against Minimum Pay Rise, But Employers Shouldn't Pay for It

ZAGREB, 28 Oct 2021 - Opposition MPs said on Thursday, ahead of a debate on changes to the Minimum Wage Act, that nobody was against the minimum wage being raised but not in such a way to make employers cover the cost.

Marin Lerotić of the Istrian Democratic Party (IDS) said his party was against employers covering the cost of a higher minimum wage, wondering when the serious discussion would begin about tax reliefs and stimulation of industries, notably export-oriented ones.

Davor Bernardić of the Social Democrats said PM Andrej Plenković's announcement of a HRK 350 increase in the minimum wage was a show, adding that people live poorly and noting that 200,000 people have left the Slavonia region.

Peđa Grbin of the Social Democratic Party (SDP) said that realistically, nobody could be against the PM's announcement but that the entire wage policy should be discussed.

Generally, wages are low, and when inflation is added to that, it is clear that not even the average wage suffices for a normal living, let alone the minimum wage, Grbin said.

Marija Selak Raspudić (Bridge) said the prime minister was "feeling generous" yet wanted somebody else to pay the bill. That is what the minimum wage bill is about, she said.

"If the prime minister really wants to be generous... he should raise the non-taxable income to HRK 5,000, as suggested by entrepreneurs," she said.

Katarina Peović of the Workers' Front said that the bill, under which the minimum wage would have to be agreed in its gross amount and employers who fail to do so would be penalized, would not bring anything good to 52,000 workers receiving the minimum wage.

The bill is unconstitutional and the amendments will only serve to improve the statistics, she said.

Hrvoje Zekanović of the Croatian Sovereignists said that employers were avoiding the government's measures, citing the example of a woman from Šibenik whose minimum wage did not increase at all after it was raised for the last two times. However, on paper her working hours were first reduced from eight to six and then to four, he said.

Employers are avoiding compliance with the government's measures by registering their workers as working six or four hours a day, so we are doing those workers a disservice instead of helping them, Zekanović said, calling the government's measures as 'cosmetic ones'.

Majda Burić of the ruling HDZ party said that the institute of minimum wage was a very sensitive one and had to be approached seriously, which, she said, the government was doing.

The gross minimum wage amounts to HRK 4,250, and the net amount is HRK 3,400, she said, adding that as of January 2022 the net amount would rise by HRK 350. Annually, that is an increase of 10.3%, the highest so far, she said.

She recalled that during the Andrej Plenković governments' terms in the past five years, the minimum wage had been raised by a gross amount of HRK 1,567 and a net amount of HRK 1,254.

During the term of the SDP-led government, it was raised by HRK 179, she said.

(€1 = HRK 7.521247)

For more, check out our politics section.

PM Says Minimum Wage to Increase by HRK 350 as of January

ZAGREB, 27 Oct 2021 - Prime Minister Andrej Plenković announced on Wednesday in the parliament that the minimum net wage would increase by HRK 350 or 10.3% as of January, from HRK 3,400 to HRK 3,750, that is to €500.

The government would pass the decision on Thursday, the prime minister said, submitting to the parliament the annual report on the work of the government.

He underscored that the government was raising the minimum wage for the first time to more than 50% of the average net salary and to over 60% of the median net salary, which would impact 51,000 workers.

Five years ago, he recalled, the minimum salary was 38% of the average salary.

The prime minister also said that the number of employed persons was higher by 51,000 than last year and that it had reached 1.6 million employed persons, which was to date the highest number in August after the record 2008 and the second-highest since independence.

(€1 = HRK 7.5)

The unemployment rate, which stood at 13.3% five years ago, declined in August to 7.3%, he said, adding that this was the result of active employment policy measures, in which about HRK 5.5 billion had been invested over five years, encompassing 165,000 persons.

For more, check out our politics section.

Croatia's Minimum Wage Among Lowest Within EU Countries 2021

To residents of the country, the news will hardly come as much surprise: Croatia's minimum wage is among the lowest within all of the countries of the European Union.

Though 2021 has only just begun, Eurostat looked at minimum wage levels in the entire block for the month of January. Croatia's minimum wage is the 5th lowest in Europe. Only in Bulgaria, Hungary, Romania and Latvia are the set level lower than Croatia's minimum wage.

In January, the lowest minimum wage, of €332 per month, was reported in Bulgaria. In Hungary, Romania and Latvia, it was between €440 and €500 per month. Croatia's minimum wage followed at €563 per month. The Czech Republic and Estonia also had a minimum wage of below €600.

Some countries within the European Union do not have a minimum wage at all, although they are rarely regarded as being among the countries with the block's lowest living standards. They are; Denmark, Italy, Cyprus, Austria, Finland and Sweden.

21 EU member states do have a national minimum wage. It ranges from €700 in the east of the union to €1,500 in the northwest. In 10 member states - mostly in Eastern Europe - the minimum wage in January was below €700 per month. In five countries in southern Europe, the minimum wage was between €700 and slightly over €1,100. In six countries in the west and north, it was above €1,500.

The data shows that the highest minimum wage in the EU is as much as 6.6 times higher than the lowest.

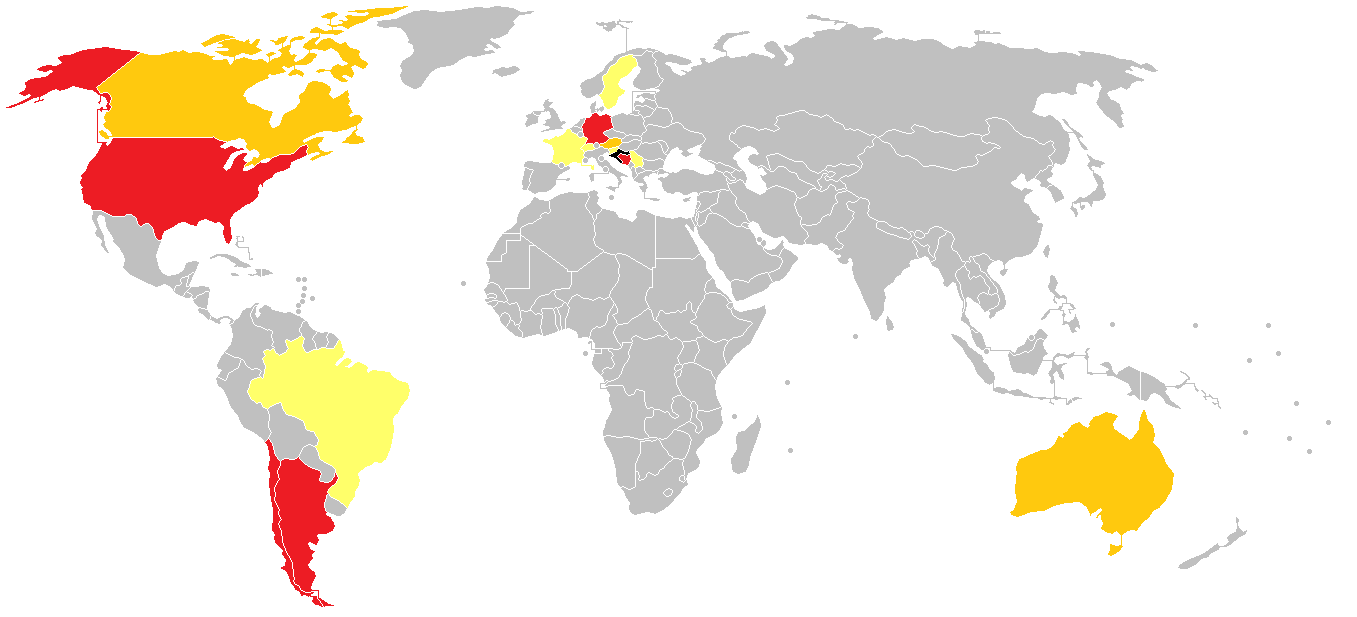

One element of the statistics which may come as a surprise to the country's residents is that the countries regarded by the EU as being 'southern Europe', all had a higher minimum wage than Croatia's minimum wage. In Greece, the lowest minimum wage in January was €758. Among southern European countries, it was followed by Portugal, Malta, Slovenia and Spain who each had a minimum wage of between €780 and slightly over €1,100. Some of south Europe's countries – specifically Greece, Portugal and Spain – were among the continent's hardest hit in the 2008 financial crisis and aftermath. That they should have recovered to the point where their minimum wage is higher than Croatia's minimum wage is notable. The Croatian diaspora around the world. Economics is not the only cause of Croatians leaving their homeland - they also move for political and sociological reasons © Davejcroyd

The Croatian diaspora around the world. Economics is not the only cause of Croatians leaving their homeland - they also move for political and sociological reasons © Davejcroyd

Among the countries in the north and west of the continent, France had the lowest minimum wage, of €1,555, followed by Germany, Belgium, the Netherlands and Ireland, where the minimum wage ranged from slightly over €1,600 to slightly over €1,724. Luxembourg had the highest minimum wage, of €2,202.

When the minimum wage is expressed in purchasing power standards (PPS), the gap between member states is somewhat narrower - the minimum wage is 'only' 2.7 higher than the lowest. Bulgaria is still at the bottom of the list with a minimum wage of 623 PPS per month, while Luxembourg tops the list with 1,668 PPS. Croatia's minimum wage in January 2021 was 805 PPS.

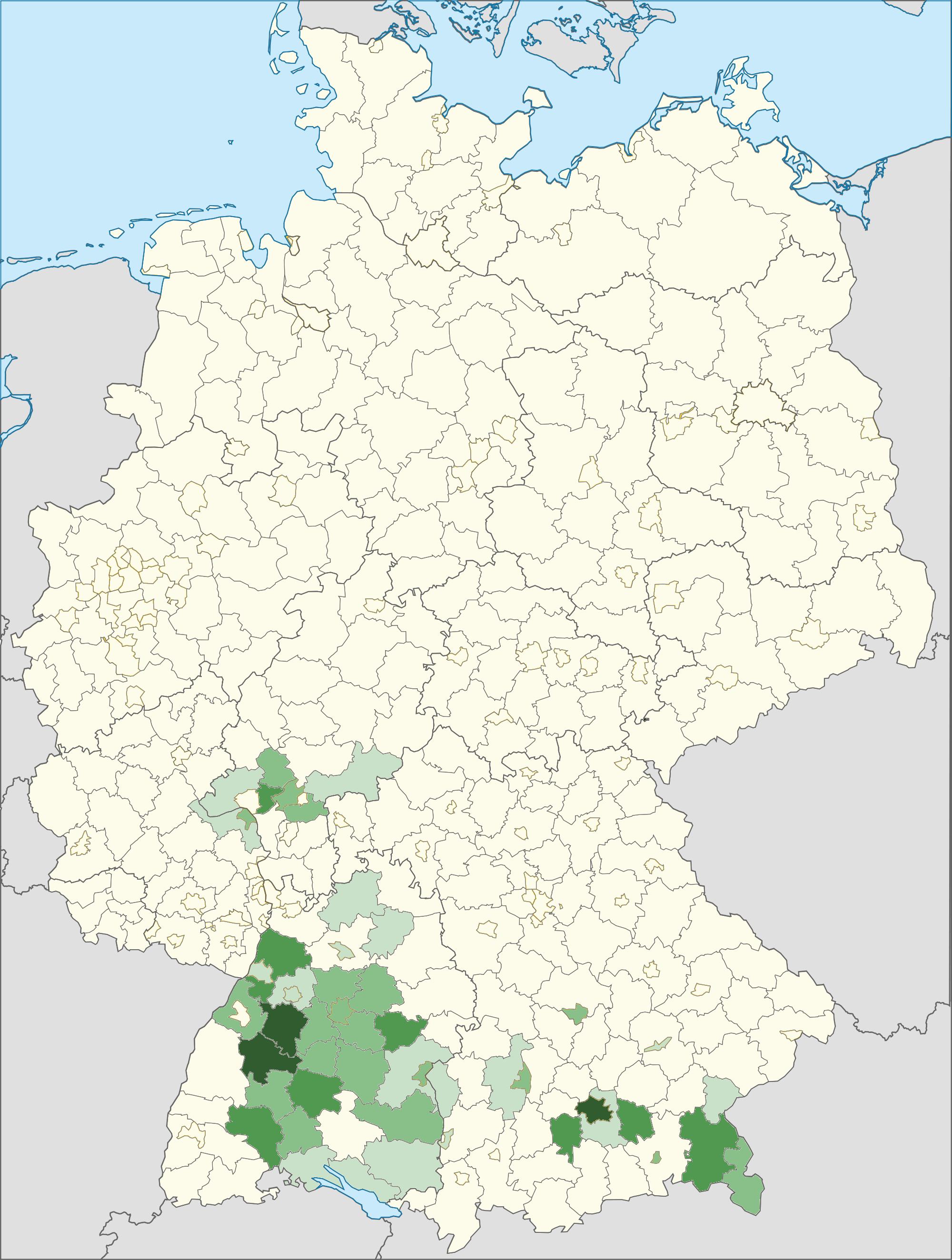

While figures on Croatia's minimum wage level within the European Union are not entirely welcome on a national level, this economic disparity is, in some way, how the European Union is set up to function – residents of EU member states may travel to and live within any EU member state where opportunities may be better and wages may be higher. Croatians have free access to the employment market within the whole of the European Union. Where Croats most live in Germany. Croatians are the sixth-highest group of residents of Germany who hold citizenship in a different country © Michael Sander

Where Croats most live in Germany. Croatians are the sixth-highest group of residents of Germany who hold citizenship in a different country © Michael Sander

Many young Croatians are happy to take advantage of this situation and travel overseas for their employment. While this is beneficial to them on an individual level, it contributes to a considerable 'brain drain' from Croatia – where the brightest and best young minds are snapped up for employment in other countries, where wages are higher. It also greatly impacts the demographics of Croatia's population.

In the 1960s, Croatia had five or more employees per retiree, supporting the country's economy while the elderly enjoyed the retirement they had long worked for. In the Croatia of today, only 1.4 employees remain in the country to help support a nation that, thanks to advances in healthcare and education, has an increasing number of old people and retirees. And, why should younger people be asked to stay, when Croatia's minimum wage lines up so poorly compared to countries which are just a few hours away by bus?

What's Changing Today? Higher Croatian Minimum Wage, Less Income Tax

January the 1st, 2020 - As Index writes, in 2021, Croatia is set to introduce the national compensation for the elderly in the amount of 800 kuna, increase the Croatian minimum wage to 3400 kuna net, reduce income tax rates down to 20 and 30 percent, and also down to 10 percent for enterprises with an income up of up to 7.5 million kuna, abolish quotas for foreign (third country) workers, and regulate the temporary stay of digital nomads.

Usually, a number of new laws come into force at the beginning of any given year, or amendments to existing ones occur, such as the new National Allowance for the Elderly Act, the new Law on Foreigners, a package of laws regulating the fifth round of tax reform - amendments to the tax laws on income, profit, VAT, the fiscalisation in cash transactions, on the financing of local self-government units, as well as new laws regulating the banking sector.

At the beginning of this year, some new bylaws came into force, such as the regulation on the amount of the Croatian minimum wage.

The Croatian minimum net wage in 2021 will rise to 3400 kuna

From the beginning of 2021, the Croatian minimum wage will be 3,400 kuna, which is 150 kuna or 4.61 percent more than it was in 2020. Namely, the government prescribed, by decree, that the Croatian minimum wage this year amounts to 4,250 kuna, which is 187.49 kuna more than last year.

The minimum hourly rate for student services - 26.56 kuna

Students who work through student services will also profit slightly from the increase in the Croatian minimum wage, to whom employers must pay a minimum of 26.56 kuna per hour from the beginning of this year, which is about 4.7 percent more than the previous 25.39 kuna in 2020.

The decision on the Croatian minimum wage for students is made every year by the Minister of Science and Education.

In February, the first payment of national compensation for the elderly will take place - 800 kuna

From this year on, Croatia will start paying the national benefit for the elderly to Croatian citizens over the age of 65 who have for whatever reason not secured an old-age pensions and are not entitled to any sort of pension, in the amount of 800 kuna.

This, popularly called the national pension, is regulated by the new Law on National Compensation for the Elderly, and the Minister of Labour, Pension System, Family and Social Policy, Josip Aladrovic, expects that around 20,000 beneficiaries will receive the new payment in the first year alone.

"The national benefit for the elderly is designed as a benefit that will cover the most vulnerable part of the population. We expect that in the first year, there will be slightly less than 20,000 who will use their right to access this benefit and the approximate cost of it to the state budget will stand at 132 million kuna in 2021,'' Aladrovic said in mid-December, when the Croatian Pension Insurance Institute (HZMO) began receiving applications for these payments.

HZMO will pay this fee through commercial banks and the first payments of this fee should start in February, with backpayments from January 2021 included.

Amendments to the Income Tax Act also define the tax treatment of this benefit - it, like other social benefits, will not be considered a sum on which income tax is paid.

Lower income tax rates

Amendments to the Income Tax Act are part of the package governing the fifth round of tax reforms. These changes have reduced income tax rates down from 24 percent to 20 percent, and from 36 percent down to 30 percent.

These lower rates should result in a higher salary for working people who, considering their salaries and thus their tax bases, must pay income tax. That increase can be anywhere from ten kuna to a thousand or two or more kuna. How much the increase is exactly depends on the amount of a person's salary, any benefits they receive for their dependent members and their place of residence and its surtax rate.

An estimate made earlier on by Finance Minister Zdravko Maric says that more than 900,000 taxpayers can expect higher incomes from the reduction of income tax rates, depending on the amount of their income. Out of a total of 2.8 million employees and pensioners, 1.9 million of them, given the amount of their income or pensions, don't pay any income tax, according to the Minister of Finance.

Amendments to the Income Tax Act reduce the rate applied from 12 percent to 10 percent applicable to the taxation of annual and final declared income and the flat-rate taxation of activities (such as renters of flats or apartments). However, the tax burden for those who fail to report their income in accordance with legal regulations is increasing, and the so-called penalty rate for asset disproportion has gone up from 54 percent to 60 percent.

This is other income based on the difference between the value of assets and the amount of assets with which it was acquired. Until now, this disparity has been taxed at a rate of 36 percent.

The novelty of the legal changes is that people who rent out their apartments, and if they certify the contract with a public notary, will no longer have to go to the Tax Administration themselves, but notaries will have the obligation to send this certified contract to the tax authorities. If, on the other hand, the contract is concluded without notarisation, people will still have to bring it to the Tax Administration themselves.

The financial effect of the changes in the income tax rate is estimated at two billion kuna, and since this tax is the income of local self-government units, the state will compensate them by taking over the equalisation fund, which is further explained below.

The state has taken over the equalisation fund

Thus, in accordance with the amendments to the Law on Financing of Local Self-Government Units, the shares of municipalities and cities in the distribution of income tax have increased from 60 to 74 percent, and that of counties has increased from 17 to 20 percent.

However, the funds for the equalisation fund, which has so far held a share of 17 percent in the distribution of income tax, will be provided for by the state budget from this year.

Income tax - the rate for enterprises with an income up to 7.5 million will fall from 12 to 10 percent

At the beginning of the year, amendments to the Income Tax Act came into force, reducing this tax rate for enterprises with an annual income of up to 7.5 million kuna from 12 percent down to 10 percent.

In addition to that, the tax rate on dividends and profit sharing was reduced from 12 percent down to 10 percent, and the tax rate on performance fees for foreign performers (artists, entertainers, athletes, etc) was reduced from 15 percent down to 10 percent.

The amendments to this law also stimulate banks to try to agree on a partial or complete write-off of receivables with clients who end up running into financial difficulties. Namely, the tax-deductible expense of a credit institution would be the same amount of the write-off of receivables, based on credit placements, the value of which is adjusted in accordance with special regulations of the Croatian National Bank.

VAT - the threshold for payment according to the collected invoices has been raised to 15 million kuna

Amendments to the Law on VAT raised the threshold for the payment of VAT according to the collected fees - from 7.5 million kuna to 15 million kuna. It also expands on the possibility of applying the VAT calculation category to imports.

Although most of the provisions of this law will enter into force at the beginning of this year, one important provision will enter into force in the middle of the year - from the 1st of July 2021, all imports of goods into Croatia from third countries will have to have VAT paid on them.

Fiscalisation - the treasury maximum is going to be prescribed by the Minister of Finance, Zdravko Maric, in an ordinance

The package of the fifth round of tax reform also includes amendments to the Law on Fiscalisation in Cash Transactions, whose provisions no longer prescribe the cash maximum, but will instead be prescribed by the Minister of Finance, according to certain categories of Croatian taxpayers.

At the beginning of the year, the application of some provisions adopted back at the end of 2019 began, so from the 1st of January 2021, the obligation to carry out the procedure of the fiscalisation of sales via self-service devices begins, as does the obligation to display QR codes on each issued and fiscalised invoice/receipt.

Law on Foreigners - quotas for foreign workers are abolished

At the beginning of 2021, Croatia will abolish its previous quota model for the employment of foreigners from third countries and move over to a new model that should make it easier for employers to employ foreigners.

Until now, the government has made decisions on determining the annual quota of permits for the employment of foreigners, for which it has also determined the list of activities and occupations they can engage in, as well as the number of permits for those professions in one year.

However, the new Law on Foreigners, which also came into force today, introduces a new model based on the opinion of the Croatian Employment Service (CES) on the justification of the employment of third-country nationals and the issuance of residence and work permits for such individuals.

This means that employers will first ask the CES to conduct a labour market survey before applying for a residence and work permit for the employment of a foreigner. If it is determined that there are no unemployed persons already here in Croatia who meet the requirements for that position, employers will then be able to apply for a residence and work permit to the Ministry of the Interior (MUP). The procedure for issuing residence and work permits, including the implementation of the labour market survey will take a maximum of 30 days.

The law also prescribes exceptions to the implementation of the labour market survey related to deficient occupations such as carpenters, masons, waiters, butchers and in the case of seasonal work of up to 90 days in agriculture, forestry, catering and tourism sectors.

The Law on sending workers to the Republic of Croatia (posted workers)

On the first day of the new year, the Law on Sending Workers to the Republic of Croatia and Cross-Border Enforcement of Decisions on Fines enters into force. It regulates the fundamental issues related to the position of workers in accordance with and on the basis of European Union legal sources, and provides a framework for compensation for the work performed, as other conditions, of posted workers.

These include the rights and guaranteed amounts of compensation for work performed in Croatia, the rights to protection at work, working hours and holidays, protection against discrimination, the right to quality for accommodation and internal mobility costs to which a Croatian worker is entitled, as well as the judicial protection of these rights.

The temporary stay of digital nomads will be properly regulated

Croatia is also among the few countries that will regulate the temporary stay of digital nomads. The Law on Foreigners also defined the term digital nomad - a third-country national who is employed or performs business through communication technology for a company or for their own company that isn't registered in the Republic of Croatia and doesn't perform work or provide services to employers headquartered in Croatia.

Temporary residence can be granted to third-country nationals who intend to stay in Croatia or are staying for the purpose of remaining here as digital nomads - this will be regulated by the new law. These people are mainly highly qualified foreigners and IT experts.

The rate for calculating and paying tourist board membership fees will be reduced by 12 percent

Enterprises can count on the reduction some parafiscal levies this year. As such, they will pay a 12 percent lower membership fee to the tourist board, regulated by amendments to the law on this topic.

This also enabled the Tax Administration to change the amount of the monthly membership fee advance due to a significant drop in that activity, and the calculation of the lump sum membership fee when persons providing catering and hospitality services in households or on family farms obtain a decision on approval in the current year, considering the fact that this membership fee is calculated based on the capacities from the previous year according to the data from the eVisitor system.

Amendments to the Tourist Board Membership Act are explicitly prescribed to enter into force on the 1st of January, and although this date isn't explicitly foreseen for amendments to the Forest Act, the application of these legal provisions coincides with the beginning of the year.

Namely, on the 15th of December 2020, Croatian Parliament passed amendments to the Forest Act, which were published in the Official Gazette (145/2020) on the 24th of December, and as they enter into force eight days after their publication, this coincides with the beginning of 2021. These legal changes envision the lowering of yet another parafiscal levy.

The total relief for the domestic economy from the above moves is estimated to stand at around 33 million kuna.

The new regulation on special tax on cars - Finance Minister Zdravko Maric expects their reduction in price

At the end of last year, the Croatian Government passed a new regulation on special tax on motor vehicles, and the Minister of Finance expects that this could lead to cheaper cars.

That regulation regulates the calculation of that special tax in the light of the new system for the measuring of carbon dioxide (CO2) emissions produced by new cars. At the beginning of 2021, the full application of the so-called Globally Harmonised Light Vehicle Test Procedure (WLTP) across the EU will begin, which means that new vehicles will no longer have CO2 measurement data according to the old type-approval rules, but it will be governed by new data. As such, it was necessary to adopt a new regulation, Minister Maric explained at a government session held on December 30th.

In addition to the environmental component which is implied, this special tax on motor vehicles also has a value component, and the new regulation has raised the value threshold up to which the special tax is not paid from 150 to 200 thousand kuna.

For the latest travel info, bookmark our main travel info article, which is updated daily.

Read the Croatian Travel Update in your language - now available in 24 languages

Minimum Wage in Croatia Raised to 3,000 Kuna

ZAGREB, November 30, 2018 - At the government session on Friday, Prime Minister Andrej Plenković announced an increase in the net minimum wage from 2,752 kuna to 3,000 kuna, an increase of 248 kuna or 9% compared to 2018, underscoring that this is the largest one-off increase in the minimum wage since 2008.

"We will endorse a decision that will increase the minimum wage which currently amounts to 2,752 kuna net, to 3,000 kuna net. This is an increase of 248 kuna or nine percent compared to 2018. The gross amount that today totals 3,440 kuna will be 3,750 kuna, an increase of 310 kuna," Plenković said.

This is the highest one-off increase of the minimum wage since 2008, the prime minister underscored.

Expressed in the euro, following the increase the minimum wage will amount to 404 euro net or 505 gross.

Compared to other countries in central and eastern Europe, Plenković noted that according to Eurostat figures from July, Croatia's minimum gross wage amounted to 464 euro and was even then higher than in Bulgaria (261 euro), Lithuania (400 euro), Romania (407 euro), Latvia (430 euro) and Hungary (445 euro).

After this increase, the minimum wage in Croatia will as of the New Year be higher than in the Czech Republic (469 euro), Slovakia and Poland (480 euro) and Estonia (500 euro).

Plenković noted that according to the Labour and Pension System Ministry's data, about 37,000 people are currently earning a minimum wage.

He recalled that in the first two years of this government's term, the minimum wage was increased twice by five percent, which cumulatively amounts to 10.25%, with an additional 3.3% increase after excluding overtime, Sunday and public holiday hours.

"Prior to that, it was increased during our term by 13.6% compared to 2016. That was the biggest increase until now and with this increase that will mean a total net increase of the net minimum wage during our term of 504 kuna and that is 23.9%," the prime minister underscored.

He noted that the share of the gross minimum wage in the average wage will increase significantly in 2019 to 44.85%.

Plenković underscored that this measure takes employers into account. Certain compensatory measures are foreseen because the government doesn't want the challenge of increasing labour costs to lead to negative consequences for workers or their employers.

"The minimum wage is usually paid in the textile, timber, leather and metal industries and as such in 2019 we will retain the reduced base wage to calculate contributions by 50% for those workers who were paid a minimum wage in 2018, and in 2020, those reliefs will be reduced by one half," he underscored.

In addition to fiscal breaks, the government has prepared a set of measures to preserve jobs and that means that next year we will enable the use of up to 1.5 million kuna in support and in 2020 that support will be even greater in an effort to save jobs and open new ones.

Plenković recalled that the 2.8% increase in Gross Domestic Product (GDP) meant that it had grown for the 17th consecutive quarter and that the growth was based on sound foundations, on growing exports and investments.

"We think that the GDP growth, which has continued for 17 quarters in a row is a good signal. Figures that relate to the export of goods and services are also good – with exports increasing by 5.2% and services by 2.5% while investments have grown for the 15th consecutive quarter," he said.

With regard to industrial production falling after a long period, Plenković said that the government has been thinking about consolidating production and exports.

For more on the minimum wage in Croatia, click here.