RBA Analysts Say 2021 Growth Projection of 9% Subject to Positive Risks

ZAGREB, 2 Feb 2022 - Raiffeisenbank Austria (RBA) analysts estimate that Croatia's economy grew by 9.2% in 2021, a projection that is subject to positive risks. With regards 2022, they are sticking to their GDP growth estimate of 4.4%, according to the bank's quarterly report RBAnalize published on Wednesday.

In early November 2021, RBA analysts had expected a GDP growth rate of 7% in 2021. However, in late November official statistics showed that GDP in Q3 2021 had risen 15.8% compared to the same period in 2020, revising their initial estimate and forecasting that economy in 2021 could grow by more than 9%.

"We also expect the last quarter to bring solid economic activity growth that would be closer to the first three quarters, when the economy grew at a rate of 10.6%. In any case, real economic activity in 2021 managed to exceed the level of 2019, thus bridging the negative domestic product gap," the latest publication says.

RBA analysts expect GDP to grow by 4.4% in 2022.

"The year 2022 should see the continuation of solid growth rates, albeit markedly lower due to the effect of the base period," the analysts say.

This year's growth is expected to be spurred by investments, supported primarily by ample funding under the National Recovery and Resilience Plan, but RBA analysts warn that "disruptions to supply chains and growing costs continue to pose a certain risk, causing increased uncertainty, thus posing a risk to investment activity, notably in the private sector."

For more, check out our business section.

Croatia With General Government Deficit in 2020, Ending 3-Year-Streak of Surplus

ZAGREB, 22 April, 2021 - The general government generated a consolidated deficit of HRK 27.5 billion, or 7.4% of GDP in 2020, with the consolidated general government debt also increasing, according to a report on which the national statistical office released on Thursday.

The deficit thus ended a three-year streak of surplus.

For comparison's sake in 2019 the government generated a consolidated government surplus of HRK 1.2 billion or 0.3% of GDP while in 2018 it amounted to HRK 863 million or 0.2% of GDP and in 2017, the surplus was HRK 2.8 billion or 0.8% of GDP.

The general government budget deficit occurred in 2020 mostly due to the repercussions of the COVID-19 pandemic for the national economy, which required the government's support measures to offset the impact.

The consolidated government debt in 2020 reached HRK 329.7 billion or 88.7% of GDP after that debt had gradually decreased for several years, the State Bureau of Statistics (DZS) said in the report.

At the end of 2019 the general government debt amounted to HRK 292.9 billion, which accounted for 72.8% of GDP. In 2018 it was HRK 286.3 billion or 74.3% of GDP and in 2017 it was HRK 285.1 billion or 77.6% of GDP.

The general government debt increased by HRK 36.8 billion in 2020 or 12.6% year on year with HRK 32.8 billion being net loans and the remainder attributed to depreciation of the kuna currency exchange rate against the euro, DZS says in the report.

RBA: Results better than expected

Commenting on the latest DZS report, Raiffeisenbank Bank Austria (RBA) analysts underscored that the budget gap of HRK 27.5 billion is better than had been expected.

They also attributed the noticeable deterioration in fiscal metrics to the consequences of the crisis caused by the COVID-19 pandemic which resulted in a double-digit contraction in budget revenue while at the same time generating an increase in general government spending.

The total consolidated government revenue in 2020 amounted to HRK 178.5 billion, which is a decrease of HRK 12.5 billion or 6.5% while at the same time expenditure amounted to HRK 205.9 billion, which is HRK 11.3 billion or 8.6% more y-o-y.

(€1 = HRK 7.567595)

For more about politics in Croatia, follow TCN's dedicated page.

RBA Bank CEO Michael Müller Quits After Tender to Pressure Judiciary

As Index writes on the 22nd of January, 2020, the chairman of the board of Raiffeisen Bank (RBA) resigned after the uncovering of an affair originally announced on Index Investigations/Index Istrage. As Index found out, RBA was seeking a PR agency to put pressure on the Constitutional Court and other Croatian courts, which is illegal.

Michael Müller has now resigned as CEO of RBA, regarding the negative public perception of the invitation to the controversial PR agency tender. RBA issued a press release:

Raiffeisenbank Austria d.d.: Michael Müller resigns as CEO

Today, Michael Müller resigned as CEO of Raiffeisenbank Austria d.d. on his own request following negative media coverage regarding a briefing document for Public Relations agencies.

“I acknowledge the strong negative sentiment towards Raiffeisenbank Austria and its management. However, the briefing in no way reflects the intention of RBA’s management. As a professional manager I decided to step down to prevent further reputational damage for the bank,” Michael Müller said.“

I accepted Michael Müller’s resignation as a sign of his responsible attitude and would like to thank him for his long-time service with Raiffeisenbank Austria and the RBI Group. Both RBI and Raiffeisenbank Austria stand for lawfulness, high ethical standards and trust,” said Andreas Gschwenter, President of Raiffeisenbank Austria’s Supervisory Board and Member of the Management Board of the bank’s parent company Raiffeisen Bank International (RBI).

Liana Keserić, a very experienced member of the management team of RBA, will act as interim CEO subject to the approval of the authorities.

The media investigation which led to Müller's resignation is translated in full below:

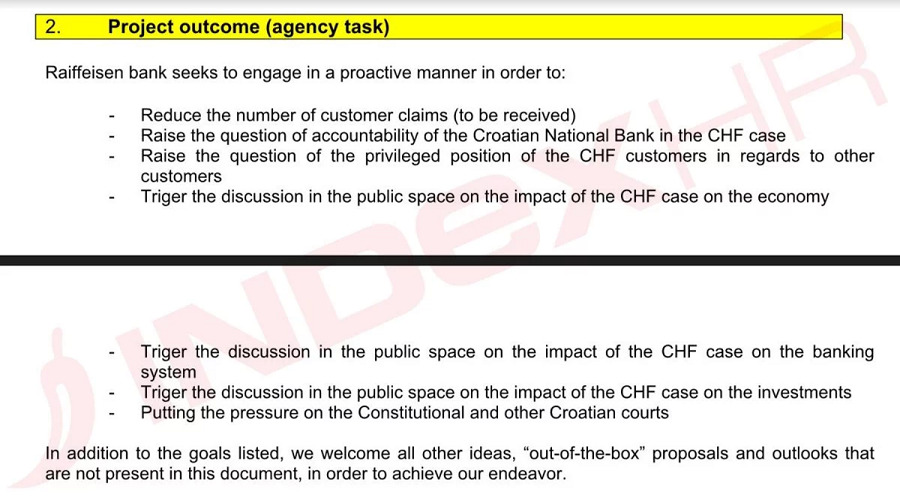

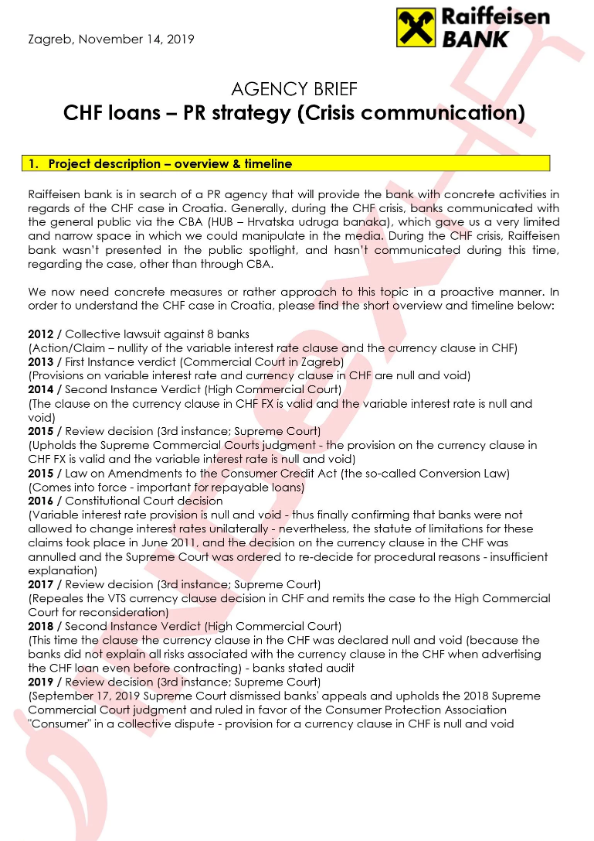

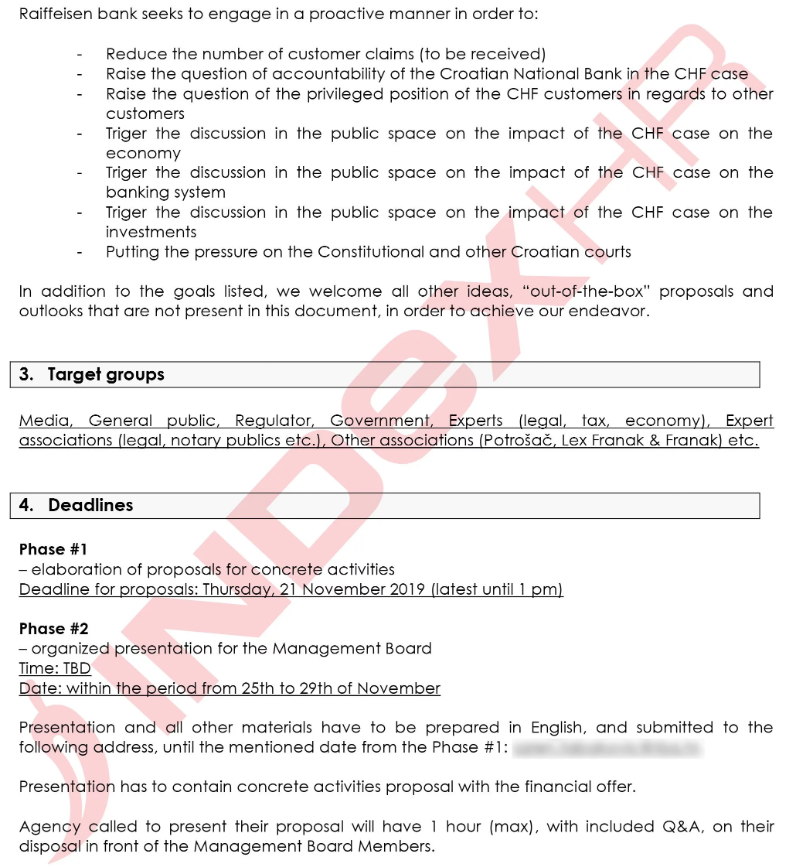

As Istrage/Ilko Cimic/Index writes on the 19th of January, 2020, for the selection of a PR agency by Raiffeisen Bank (RBA), in which the aforementioned bank sought crisis communication services over the Swiss loan case, one of the desired agency's tasks was to "exert pressure on the Constitutional and other courts in Croatia". Quite literally.

Under Croatian and international law, any pressure on the judiciary, that is, on judges, is strictly prohibited, and the European Court of Human Rights has already overturned Croatian judgments on suspicion of pressure from both the public and interested parties.

Although the letter/call, which is written in English, says to ''put pressure on the Constitutional and other Croatian courts", in its statement to Index, RBA claimed that "solely solutions containing legitimate actions" were sought.

Attorney Nicole Kwiatkowski, the co-author of a collective lawsuit against eight banks in the Swiss case, said it was an inadmissible practice that could have an impact on the final judgment. Goran Aleksic, a SNAGA member of parliament and an activist of the Franak Association, claims that it is an illegal attack on an independent judiciary and clear evidence that Croatian banks are not afraid of anyone.

But let's not get ahead of ourselves just yet.

How did it all begin?

Last September, an important verdict was passed by the Supreme Court, which ruled that the banks had violated the collective interests and rights of credit users contracted in Swiss francs. According to this ruling, all eight Croatian banks were found guilty of unlawful and dishonest treatment. It is a final judgment after which debtors can claim repayment of the overpaid loans in Swiss francs, but in individual court proceedings.

The banks were left to address the Constitutional Court and possibly initiate proceedings at the European level. Additionally, a judgment of the Supreme Court is now awaited, which has yet to decide whether a contract with a currency clause in Swiss francs is void.

In the middle of November last year (more precisely November the 17th, 2019), RBA sent some PR agencies a tender, ie, a call for selection, a so-called pitch, in which they sought out crisis communication services. RBA's main agenda was to reduce the number of appeals, to open up the issue of the Croatian National Bank's liability in the Swiss case, to launch a debate in the public space on the impact of the Swiss case on the economy, and more.

At the bottom is a request to put pressure on the Constitutional Court and other courts in Croatia (Literally, and in English: Putting pressure on the Constitutional and other Croatian courts). RBA hasn't denied that it sent the call out to PR agencies.

RBA stated that they wanted a PR agency to provide them with better visibility in the media.

"In view of the current topic of the Swiss franc loans, RBA decided to call for a PR agency in order to promote the views of the bank in the public and media space,'' they say from RBA in response to an Index inquiry.

What is of particular interest is the way in which the Croatian judiciary, ie the Croatian courts, were supposed to be put under pressure, which is explicitly mentioned in the call to the PR agencies in English. Keep in mind that influencing courts or the judiciary in Croatia is completely and utterly illegal.

RBA claims that only solutions containing ''legitimate practices'' were sought.

"RBA adheres to all of the laws and regulations of the Republic of Croatia in its business operations, including the case for the tender you're referring to. Only solutions containing legitimate procedures and communication activities that would reach the public through the media were sought," RBA told Index.

Following that answer, Index asked what these legitimate procedures for pressuring the Constitutional Court and other courts in Croatia would be, and whether these legitimate procedures were established by law, given that RBA was urged to "comply with all of the laws and regulations of the Republic of Croatia". Index asked them what specific regulations or laws they were referring to in this case.

"RBA is not engaged in any of the activities that you're suggesting. The tender sought the service of developing a communication strategy and key messages," RBA responded, adding that no agency was selected for these type of activities.

Kwiatkowski claims that this is inadmissible and illegal.

Lawyer Nicole Kwiatkowski was surprised when Index asked her for comments on RBA's tender.

"Any pressure on the courts is unacceptable on any side. Such behaviour is completely inappropriate. Croatian and European case law is full of examples of the rescission of judgments and the reopening of court pressure proceedings,'' Kwiatkowski told Index, adding that there were various options for so-called lobbying in an appropriate manner, from organising public hearings and engaging the professional public, but any pressure is totally unacceptable.

"All of this surprises me. Okay, we expect heightened media coverage, literacy tributes and some action, but something like this... no. I'd like to say that this is happening at a time when we have a final judgment of the Supreme Court where users of these loans are allowed to claim compensation through individual cases, which is an extremely important point. I emphasise that any pressure is unacceptable and illegal,'' says lawyer Nicole Kwiatkowski.

Index then asked Goran Aleksic, an MP for SNAGA and an activist of the Franak Association, if he had any knowledge that the banks had been pressuring the courts.

"Banks have been doing this sophisticatedly for a very long time. They do it primarily through ''their'' journalists in ''their'' media, but also through ''their'' law professors. I will not say what kind of media this is, but I will say how it works.

Each time something with franc case was dealt with, spins would start in some media, which could be summarised in the following statements: ''What do they want, they were greedy and now they complain; they were economically illiterate; they made fun of those of us who raised euro loans; now they're acting stupid as if they don't know that currency can grow on the exchange rate; the banks are not guilty, variable interest and currency clauses are allowed,'' and the like," explains Aleksic.

"If pressure is being exerted directly on the judges, I can't really say, but I suppose that e-mails are sent to the judges with certain ''expert'' papers from some ''experts'' who agitate for banks. The last example of ''expert'' agitation is the case of Professors Petrovic and Jaksic, who publicly stand in favour of banks, claiming that debtors with converted loans have nothing more to seek because they've been indemnified, and Professor Petrovic even writes expert opinions on bank defense filings in the courts. But, I have to say that I believe in the independence of the judiciary, and I believe that a large proportion of judges will not be affected by such spins,'' says Aleksic, noting that the vast majority of first-instance judgments for converted loans are for the benefit of the consumers, and many judges correctly understood the judgment of the EU Court of Justice C-118/17.

Aleksic says that it is difficult for him to be surprised by anything when it comes to banks, even the idea of them trying to put pressure on the Constitutional Court and other Croatian courts.

"The banks no longer surprise me. The concrete formulation you mention is unmistakable - it calls for pressure on the Constitutional Court and other courts to release banks from liability and blame. This is an attack on an independent judiciary, and an illegal attack. I'm amazed that they've formulated such wording in their official document, and if it is official, the banks don't appear to be afraid of anybody. The Croatian National Bank, the Government of the Republic of Croatia and the Croatian Parliament are to blame for such actions,'' says Aleksic.

"For now, the state is doing nothing about it, the banks are still acting as if they've not been convicted at all, they're still lying about how their business was in line with the law, and at the same time they're asking the state for damages in Washington. The banks are the holy cow for the Croatian National Bank and the Government of the Republic of Croatia. This is a national embarrassment. The courts remain the last line of defense against thieves and I believe that in the first half of 2020 all remaining legal dilemmas will be resolved in the franc case, after which I hope for the general mobilisation of all robbed citizens towards the courts with the aim of being repaid, all together the banks need to return around 25 billion kuna of stolen interest and stolen Swiss franc growth. Minister Darko Horvat announced the strengthening of consumer protection as part of the presidency of the EU Council, so we'll see if he's serious, or if it's just a cosmetic statement because of the EU Commission, which truly advocates for consumer rights,'' Aleksic concludes.

The banks were warned against unlawful pressure on judges, but by the Franak Association.

There were also accusations of pressure on judges. For example, the Croatian Banking Association accused the Franak Association of unlawful pressure on judges throughout the Republic of Croatia and the Supreme Court. Specifically, they resented the individual publication of judgments that went in their favour. The last such announcement by the Croatian Banking Association dates from April last year, following the Supreme Court ruling in favour of the Franak Association.

"The ruling of the Supreme Court of the Republic of Croatia published today speaks exclusively about the consumer's legal interest in judicial protection and the admissibility of trials. This judgment does not in any way direct the lower-level courts to decide on individual actions in connection with the lawsuits filed, and especially not in relation to converted loans under the Consumer Credit Act, as would be deduced from today's media appearances,'' they stressed from the Croatian Banking Association, making accusations of unlawful pressure on the courts because they said they were ''manipulating the media using the verdict" as a prejudice to the final outcome.

Make sure to follow our dedicated news page for more on the unfolding situation with RBA.

Raiffeisenbank Seeks Potential Acquisitions in Croatia

ZAGREB, May 23, 2019 - Austria’s Raiffeisenbank (RBA) is looking to make acquisitions in Croatia as organic growth alone will not be sufficient to boost its market share in the country, the CEO of the lender’s Croatian unit told Reuters on Wednesday.

RBA is the fifth biggest lender in Croatia, controlling slightly below eight percent of a market dominated by Italian-, Austrian-, and Hungarian-owned banks, according to central bank data.

“Our basic approach is organic growth through a high quality of service. However, organic growth will not be enough to increase market share in a market with limited growth potential,” Michael Georg Mueller told Reuters in an interview.

Croatia currently has around 20, mostly smaller banks, with the five biggest players controlling 80 percent of the market.

UniCredit’s Zagrebačka Banka and Intesa Sanpaolo’s Privredna Banka Zagreb are the country’s two main lenders, followed by Austria’s Erste and Hungary’s OTP, Reuters said. “RBA is seeking possible acquisitions to boost potential for reaching a targeted level of return on capital,” Mueller said without elaborating further.

OTP is also looking at two potential targets in Croatia, including a unit of Raiffeisen, sources and local media reports said last month, having already acquired much of the south east European network of France’s Societe Generale.

A Raiffeisen spokesman at the time said the lender had no intention to sell its Croatian business.

Croatia plans to formalise its bid to join the European Exchange Mechanism (ERM-2) by mid-July, a first step to adopting the euro, which the government wants to do by 2024, Reuters said.

Mueller said Croatia’s economy would benefit from using the single currency, with the advantages outweighing the costs. “The biggest advantage is the removal of the exchange rate risk,” he said. “In addition, positive effects can be expected from lower interest rates and an increase in investments and international trade.”

Around 80 percent of deposits and 60 percent of loans in Croatia are already denominated in euros, but some opposition leaders and analysts argue that the country should follow Poland, Hungary and the Czech Republic and keep its own currency, the kuna.

In a recent poll conducted by the central bank, 52 percent of people were in favour of adopting the euro, with the 40 percent against mostly citing a fear of higher prices.

Mueller said that as prices in Croatia are already relatively high compared with the average in the euro zone, those fears were unfounded. “There is no real reason to fear euro zone entry as it shouldn’t bring a significant rise in prices,” he said.

He added that Croatia could still do more to make its economy more resilient, which in turn would make the country appear less risky to lenders and thus lower its borrowing costs. “A stronger institutional and legal environment would improve the perception of risk in Croatia, while the removal of the barriers to running business, together with the euro adoption, would draw more investment into the country,” Mueller told Reuters.

More news about banks in Croatia can be found in the Business section.