RBA Analysts More Cautious in Predicting Croatian Economic Recovery

November the 5th, 2021 - RBA analysts are more cautious when it comes to predicting Croatian economic recovery or the growth of domestic GDP as the instability of the ongoing global coronavirus pandemic still remains a huge issue.

As Poslovni Dnevnik/Ana Blaskovic writes, contrary to the optimism of the central bank and the government about the dynamics of Croatian economic recovery in 2021, ranging from between 8.5 and 9 percent, Raiffeisen Bank analysts are still somewhat more cautious with the expectation that GDP growth will stop at 7 percent.

"Our estimates are significantly lower than those provided by the government because we expect a slowdown in the last quarter of the year," said RBA chief economist Zrinka Zivkovic Matijevic at the presentation of this, the latest RBA research.

The summer quarter, due to the-then good epidemiological situation and a surprisingly good tourist season that brought in 8.5 billion euros (85 percent of pre-pandemic 2019's level), could end with a double-digit growth rate.

However, on the side of the rapid deterioration of the epidemiological situation as the end of the year approaches, the withdrawal of the ''parking brake'' in terms of optimism is a reflection of the uncertainty of energy and raw material prices, as well as disruptions in supply chains. Nevertheless, real Croatian economic recovery and indeed growth throughout 2021 will remain strong, primarily driven by growth in the export of services, ie tourism and personal consumption.

Next year, domestic economic growth should pull in investment on the wings of using European Union (EU) money under the much talked about National Recovery and Resilience Plan.

"From a macroeconomic point of view, investments are a desirable generator of growth," said Zivkovic Matijevic, explaining that the benefits of a generous European Union cash injection are wider than the availability of the money itself, because its withdrawal depends on measures and reforms that will work to reduce the weaknesses of the domestic economy in the long run, and whose outlines are slowly emerging.

The news about Croatian economic recovery and the acceleration of economic dynamics has recently been overshadowed by inflation, which accelerated to 3.3 percent in Croatia back in September (as opposed to 4.1 percent in the Eurozone), which is expected to peak in the first quarter of next year.

"Inflationary pressures continued to strengthen, dominantly caused by strong growth in energy prices, thus reflecting developments in world crude oil exchanges. Since the second half of the year, energy prices have been joined by rising food prices,'' they added from RBA.

Assuming global supply chain disruptions subside, they added, the price jump should slow down in the second half of 2022, but with the caveat that uncertainty, longer supply-side disruptions and steeper transport costs could suggest that inflation could last, not only in Croatia but also in the Eurozone, which Croatia is soon set to join.

That such a scenario will not materialise is strongly assured by central banks, including Croatian ones, from which messages are coming that inflation is only a passing phenomenon.

The refreshed picture of public finances, precisely in the parliamentary debate, wasn't overly surprised by the increased inflows from VAT or the deepening of expenditures, due to which the general government deficit increased to 4.5 percent.

With the cost of the coronavirus crisis totalling a staggering 40 billion kuna so far, in the first half of next year, it is to be expected that the state will actively borrow on the capital markets in order to meet increased financing needs. These activities, together with good market conditions of high liquidity and low interest rates, will be positively marked by the process of introducing the euro, a drawn out process which is entering its final phase.

"The set goal of joining the Eurozone on January the 1st, 2023 is achievable and strong political support across the European Union is important," said Zivkovic Matijevic, believing that it is very likely that Croatia will meet the Maastricht criteria on public debt, deficit, interest rates, exchange rate and inflation.

For more, check out our business section.

Croatia With General Government Deficit in 2020, Ending 3-Year-Streak of Surplus

ZAGREB, 22 April, 2021 - The general government generated a consolidated deficit of HRK 27.5 billion, or 7.4% of GDP in 2020, with the consolidated general government debt also increasing, according to a report on which the national statistical office released on Thursday.

The deficit thus ended a three-year streak of surplus.

For comparison's sake in 2019 the government generated a consolidated government surplus of HRK 1.2 billion or 0.3% of GDP while in 2018 it amounted to HRK 863 million or 0.2% of GDP and in 2017, the surplus was HRK 2.8 billion or 0.8% of GDP.

The general government budget deficit occurred in 2020 mostly due to the repercussions of the COVID-19 pandemic for the national economy, which required the government's support measures to offset the impact.

The consolidated government debt in 2020 reached HRK 329.7 billion or 88.7% of GDP after that debt had gradually decreased for several years, the State Bureau of Statistics (DZS) said in the report.

At the end of 2019 the general government debt amounted to HRK 292.9 billion, which accounted for 72.8% of GDP. In 2018 it was HRK 286.3 billion or 74.3% of GDP and in 2017 it was HRK 285.1 billion or 77.6% of GDP.

The general government debt increased by HRK 36.8 billion in 2020 or 12.6% year on year with HRK 32.8 billion being net loans and the remainder attributed to depreciation of the kuna currency exchange rate against the euro, DZS says in the report.

RBA: Results better than expected

Commenting on the latest DZS report, Raiffeisenbank Bank Austria (RBA) analysts underscored that the budget gap of HRK 27.5 billion is better than had been expected.

They also attributed the noticeable deterioration in fiscal metrics to the consequences of the crisis caused by the COVID-19 pandemic which resulted in a double-digit contraction in budget revenue while at the same time generating an increase in general government spending.

The total consolidated government revenue in 2020 amounted to HRK 178.5 billion, which is a decrease of HRK 12.5 billion or 6.5% while at the same time expenditure amounted to HRK 205.9 billion, which is HRK 11.3 billion or 8.6% more y-o-y.

(€1 = HRK 7.567595)

For more about politics in Croatia, follow TCN's dedicated page.

Croatia's Foreign Debt Down In January, But Is Going To Rise In 2020

ZAGREB, May 26, 2020 - Croatia's foreign debt totaled HRK 41.1 billion in January, falling by 6.5% compared to January 2019, however RBA analysts predict a rise in the debt throughout 2020 due to the corona crisis.

Croatia's gross foreign debt of 41.1 billion at the end of January 2020 rose by 0.6% from December 2019 when it amounted HRK 40.9 billion, however, it contracted by 2.8 billion euros or by 6.5% on the year, according to the figures recently published by the Croatian National Bank (HNB).

However, considering the new circumstances in connection with the coronavirus pandemic that caused a lockdown globally as well as in the Croatian economy, RBA analysts expect the deterioration in Croatia's external vulnerability.

The analysts said that a positive streak in the current account since 2013 would be likely snapped, and the country's gross foreign debt would rise both in the real and nominal terms.

"Recovery and relaunching the economic activity, which will require high amounts of funding, will lead to a rise in the borrowing abroad by all key sectors," said the analysts of the Raiffeisenbank Austria (RBA).

The recall that the government has recently planned more borrowing both on the local and foreign markets.

As a result of growing debt and the expected sharp economic downturn, Croatia's gross foreign debt to GDP ratio is likely to increase, too.

At the end of 2019, Croatia's gross foreign debt to GDP ratio was 75.7%.

(€1 = HRK 7.579243

RBA: GDP to Drop 5% This Year

ZAGREB, March 20, 2020 - Croatia will face a steep fall in GDP this year, of almost 5% on the year, while seasonality in tourism demand and weak industry will make recovery slower in comparison with other countries, Raiffeisenbank Austria analysts have said.

The current situation and coronavirus spread will have a significant impact on the Croatian economy, especially due to its strong dependence on tourism, according to a special publication, "Covid-19", published by RBA on Friday.

It is already quite certain that there will be no preseason, and the impact of the epidemic on the peak tourist season is expected to increase. The consequence will be a fall in overnight stays and loss of tourism revenue, RBA said.

The bank's analysts reiterate that at least a fifth of overnight stays and tourism revenue in Croatia can be matched to Q2, while the main tourist season, which falls in Q3, accounts for 70% of overnight stays and revenue.

Among the sectors at risk, RBA analysts include the service sector, especially transport and all other services that depend on tourism: accommodation, food and beverage services, recreation and entertainment and travel services. They add that the manufacturing industry - chemical, paper, textile, lumber etc. - will most certainly experience a decrease in supply and demand since the main Croatian export markets are EU countries, especially Italy and Germany, so a slump in goods export is inevitable in Q2.

More economy news can be found in the Business section.

Lobbying in Croatia: Business or Corruption? RBA Case Opens Can of Worms

''Our problem is that no government has gathered enough courage to define the profession of lobbying,'' the owner of one of the largest lobbying companies in Croatia tells Viktor Vresnik from Novac (Jutarnji) when touching on the effects of the recent RBA case and lobbying in Croatia.

That is quite clearly why we don't have the legal framework to pull lobbying out of the grey zone into which it has fallen today, here in Croatia and elsewhere, and because that is the case, the owner of one of the largest lobbying companies in the country agreed to speak about the complex topic informally only.

''Lobbying in Croatia is only registered when some type of scandal breaks out, and that automatically casts a shadow over the whole profession,'' he says. There's no doubt that the advertisement by which Raiffeisenbank (RBA) sought a person to ''put pressure on the Constitutional Court and other courts in Croatia" falls into a scandalous category. RBA will probably resolve this by dismissing the "author" of the tender, but the tremendous damage to the profession has already been done and will continue to happen until this grey area is properly regulated by law.

Today, Croatia has the Law on the Prevention of Conflict of Interest, but this law, which is certainly necessary, is, at least in the opinion of the majority of the interlocutors contacted, used far too little, and it is too broad to properly regulate lobbying in Croatia as an actual profession.

Why, for example, asks Novac's interlocutor, was a list of lobbyists not published anywhere in January, when Croatia took over the presidency of the EU Council, as these people had requested meetings with ministers, who reportedly occupied a significant part of the capacities of the higher quality Zagreb hotels?

Why aren't the topics they want to discuss or the companies they represent published? That is why, he says, Croatia has already been called out by the European Parliament, and the objections have also come from the European Commission itself.

The EU is not like the US, which treats lobbyists extremely strictly. Brussels is much softer and more loose, leaving most of this type of regulation to every single member state of the European Union. However, Croatia has a lack of definition here, too.

Although lobbyists' business exists in the domestic register of activities and although the Croatian lobbyists working in Brussels are duly registered in the register of "advocates" and have ID cards that allow them to enter Parliament and engage in discussions with MPs, the register, which is publicly available via the Croatian Lobbyists Association, is still considered an unofficial document, and just an internal list of members of the association.

Zeljko Ivancevic, one of the Croatian lobbyists who registered in Brussels shortly after Croatia gained independence and one of the few who didn't ask Novac not to quote him, is rather dissatisfied with the way in which the interests of Croatian lobbyists are represented by their professional association. He claims that they should have defined the profession of lobbying in Croatia properly when the time for that was right.

The current approach to lobbying in Croatia, Ivancevic believes, inevitably casts a shadow on the profession whose foundations lie in the serious preparation of expert analysis and in the collection of sound arguments that can be presented directly or indirectly to decision makers. This is by no means persuading someone to do something, or indeed not do something, purely and solely on the basis of some sort of long-standing private friendship.

Ivancevic considers the RBA case to have been a gross mistake. In the practice of the European Union and its institutions, there is no possibility of lobbying or direct communication with the court system, except for litigants.

The Society of Croatian Lobbyists attributes responsibility for the poor perception of the profession among the general public primarily to politics. Several governments have come and gone, they say, and all of them have failed to address the issues surrounding lobbying in Croatia. The draft Law on the Advocacy of Interest was submitted, but that came to nothing. Back in December 2016, however, the Ministry of Justice published its "Analysis for the regulation of the legal lobbying framework", which was intended to serve as a template for parliamentary debate, but there was no debate on it at all in the end.

The immediate reason for this analysis was the fall of Tihomir Oreskovic's government and the forced departure of Tomislav Karamarko from HDZ's leadership. As the scandal subsided, and as Drimia, a company owned by Karamarko's now ex wife, was found to have broken off its partnership with Peritus Counseling on January the 31st, 2015, just months before Anna and Tomislav Karamarko's marriage ended. The story then sank into the background. The Croatian Society of Lobbyists then stated that Josip Petrovic and his company Peritus, then called as advocates for MOL's interests in Croatia, were not on the list of registered members. Today - they are.

The proposal of the Law on Public Advocacy, which was submitted by the Croatian Lobbyists Association for discussion way back in 2013, clearly defined to Zoran Milanovic's government just who in Croatia can engage in the advocacy (lobbying) business, and how they can do so. It also defines who can't.

The advocate, under this proposal, cannot be under the age of 18, they cannot be a government official, a civil servant in a decision-maker's office or a judicial official, a former state or judicial official if less than two years have elapsed since their term expired, they must not be a former civil servant if less than one year has elapsed since the date of termination of their activities in civil service, it also can't be a person who has been convicted of a criminal offense under the jurisdiction of USKOK until their rehabilitation period is over, not can it be any person associated with someone who has the power to make political decisions.

What does it mean when it says it can't be a person associated with someone who has the power to make political decisions?

The bill on lobbying in Croatia is clear and very detailed here: ''a related person is the spouse of an official, a managerial officer or another holder of a public authority, his or her blood relatives in a direct line, an adopter or an adoptee, relatives to the second degree, a relative of to the first instance, and other persons who may reasonably be regarded as having an interest in an official, a managerial officer or another holder of a public authority by other grounds and circumstances,''

In a broader sense, lobbying is an unofficial act for someone's benefit, that is, an attempt to influence decisions by coaxing or covert pressure. It may also refer to public activities (such as demonstrations) or public business activities of various institutions (non-governmental organisations, consulting entities, various associations). In a narrow sense, lobbying can be defined as an activity that tries to persuade someone in a governing structure, usually an elected member of government, to uphold laws or rules that give a community, organisation or industry some advantage over others - it was explained.

In European regulation, the Council of Europe (not the Council of the European Union now presided over by Croatia) means lobbying means "a coordinated effort to influence policy formulations and the decision-making process with a view to obtaining a specific outcome from the government, those in power, or elected representatives."

The definition of lobbying in both the voluntary Register of lobbyists of the European Commission (Transparency Register) and of the European Parliament are also very similar.

America approaches lobbying virtually like any other business, their law states: a lobbyist is someone who wants to influence the structures of government on behalf of a third party. In doing so, lobbyists must not bribe senators and congressmen with money or gifts, offer them privileged access to their client's services, and they may not threaten them.

By joining the European Union, Croatia joined a bloc of eighteen other countries that didn't regulate lobbying in any way, but left it to "self-regulation" within their own respective associations. The oldest European law governing, among other things, lobbying, are the German Rules of Business in the Bundestag (1951).

In addition to the statutory register of lobbyists, Slovenia has included the regulation in the Anti-Corruption Act. Montenegro and Serbia's lobbying laws, though both of these European countries are outside the EU, are also strong, and resistance to their introduction was strong because the regulation didn't suit particular interest groups accustomed to working in the shadows.

With such a poor level of definition, work in the shadows has again become a very regular way of influencing politics, as can be seen in the recent, scandalous RBA case.

Make sure to follow our dedicated politics page for more.

RBA CEO Mueller Resigns in Wake of PR Agency Affair

ZAGREB, January 23, 2020 - Michael Mueller, the president of the management board of the Raiffeisen Bank (RBA), resigned on Wednesday in the wake of the negative perception in public regarding a tender to procure the services of a PR agency, the bank has reported.

I am aware of the strong negative perception generated of Raiffeisen Bank and its management and I stress that the said document in no way reflects the intention of the bank's management. I have decided to resign in order to protect the bank's reputation, Mueller said.

The press release notes that Andreas Gschwenter is Chief Operating & Information Officer at Raiffeisen Bank International AG and Chairman of Raiffeisen Bank Zrt has accepted Mueller's resignation.

Following approval by the Croatian National Bank (HNB), Liana Keserić will be acting president of the management board at RBA, the press release notes.

Mueller's resignation comes after it was disclosed the RBA was seeking a PR agency that would exert pressure on the Croatian Constitutional Court over the case of the Swiss franc-pegged loans.

The Index news portal on Sunday reported that RBA was seeking PR agency for crisis communication regarding Swiss franc-denominated loans and that one of its tasks includes "exerting pressure on the Constitutional Court and other courts in Croatia."

RBA explained that it had advertised the tender to engage a PR agency with the aim of the bank's stance being equally represented in the case CHF-pegged loans.

"The task of the agency was solely intended as a way to make the other side of the case gain more publicity, since it has not had much of a reach so far. In all activities, including this tender, we have sought legitimate procedures as our solutions, that is, communication activities which would reach their target audience through the media," RBA said.

However, the tender came across negative reactions and the Franak association on Monday reacted sharply to the news of the tender. The SNAGA party and the Franak association on Tuesday asked the Office of the Chief State Prosecutor to investigate an attempt by Raiffeisen Bank (RBA) to hire a PR agency to put pressure on courts in a case in which bank contracts on loans pegged to the Swiss franc were nullified.

The HNB on Monday reported that it was unpleasantly surprised by that commercial lender's advertisement for a PR agency and that it would urgently conduct an inspection of RBA and take the necessary steps.

More news about banks can be found in the Business section.

RBA Bank CEO Michael Müller Quits After Tender to Pressure Judiciary

As Index writes on the 22nd of January, 2020, the chairman of the board of Raiffeisen Bank (RBA) resigned after the uncovering of an affair originally announced on Index Investigations/Index Istrage. As Index found out, RBA was seeking a PR agency to put pressure on the Constitutional Court and other Croatian courts, which is illegal.

Michael Müller has now resigned as CEO of RBA, regarding the negative public perception of the invitation to the controversial PR agency tender. RBA issued a press release:

Raiffeisenbank Austria d.d.: Michael Müller resigns as CEO

Today, Michael Müller resigned as CEO of Raiffeisenbank Austria d.d. on his own request following negative media coverage regarding a briefing document for Public Relations agencies.

“I acknowledge the strong negative sentiment towards Raiffeisenbank Austria and its management. However, the briefing in no way reflects the intention of RBA’s management. As a professional manager I decided to step down to prevent further reputational damage for the bank,” Michael Müller said.“

I accepted Michael Müller’s resignation as a sign of his responsible attitude and would like to thank him for his long-time service with Raiffeisenbank Austria and the RBI Group. Both RBI and Raiffeisenbank Austria stand for lawfulness, high ethical standards and trust,” said Andreas Gschwenter, President of Raiffeisenbank Austria’s Supervisory Board and Member of the Management Board of the bank’s parent company Raiffeisen Bank International (RBI).

Liana Keserić, a very experienced member of the management team of RBA, will act as interim CEO subject to the approval of the authorities.

The media investigation which led to Müller's resignation is translated in full below:

As Istrage/Ilko Cimic/Index writes on the 19th of January, 2020, for the selection of a PR agency by Raiffeisen Bank (RBA), in which the aforementioned bank sought crisis communication services over the Swiss loan case, one of the desired agency's tasks was to "exert pressure on the Constitutional and other courts in Croatia". Quite literally.

Under Croatian and international law, any pressure on the judiciary, that is, on judges, is strictly prohibited, and the European Court of Human Rights has already overturned Croatian judgments on suspicion of pressure from both the public and interested parties.

Although the letter/call, which is written in English, says to ''put pressure on the Constitutional and other Croatian courts", in its statement to Index, RBA claimed that "solely solutions containing legitimate actions" were sought.

Attorney Nicole Kwiatkowski, the co-author of a collective lawsuit against eight banks in the Swiss case, said it was an inadmissible practice that could have an impact on the final judgment. Goran Aleksic, a SNAGA member of parliament and an activist of the Franak Association, claims that it is an illegal attack on an independent judiciary and clear evidence that Croatian banks are not afraid of anyone.

But let's not get ahead of ourselves just yet.

How did it all begin?

Last September, an important verdict was passed by the Supreme Court, which ruled that the banks had violated the collective interests and rights of credit users contracted in Swiss francs. According to this ruling, all eight Croatian banks were found guilty of unlawful and dishonest treatment. It is a final judgment after which debtors can claim repayment of the overpaid loans in Swiss francs, but in individual court proceedings.

The banks were left to address the Constitutional Court and possibly initiate proceedings at the European level. Additionally, a judgment of the Supreme Court is now awaited, which has yet to decide whether a contract with a currency clause in Swiss francs is void.

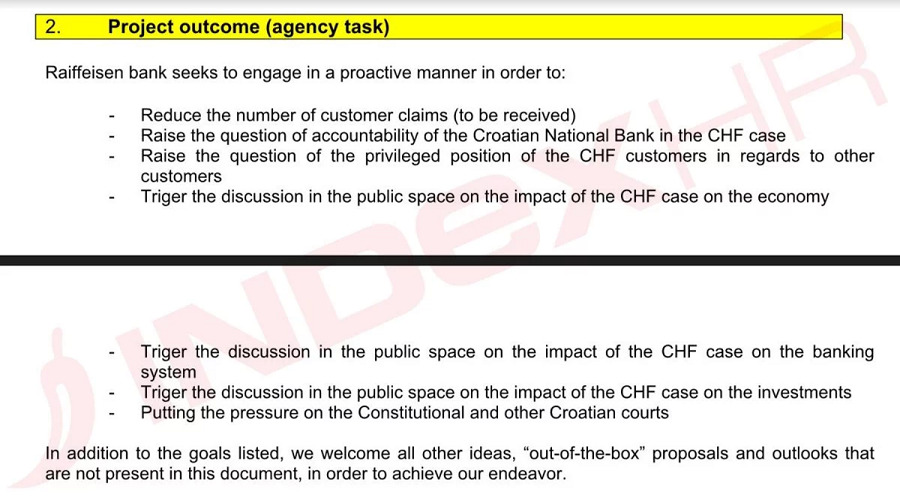

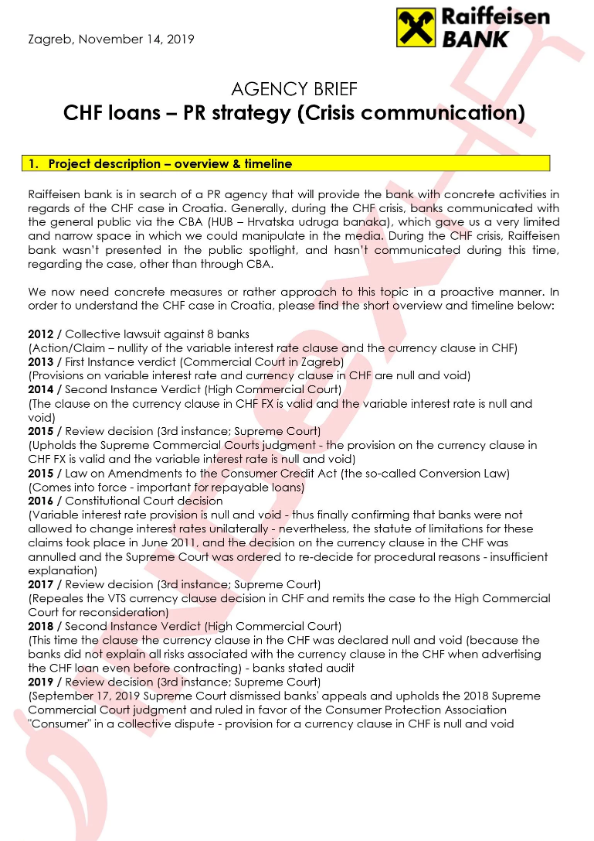

In the middle of November last year (more precisely November the 17th, 2019), RBA sent some PR agencies a tender, ie, a call for selection, a so-called pitch, in which they sought out crisis communication services. RBA's main agenda was to reduce the number of appeals, to open up the issue of the Croatian National Bank's liability in the Swiss case, to launch a debate in the public space on the impact of the Swiss case on the economy, and more.

At the bottom is a request to put pressure on the Constitutional Court and other courts in Croatia (Literally, and in English: Putting pressure on the Constitutional and other Croatian courts). RBA hasn't denied that it sent the call out to PR agencies.

RBA stated that they wanted a PR agency to provide them with better visibility in the media.

"In view of the current topic of the Swiss franc loans, RBA decided to call for a PR agency in order to promote the views of the bank in the public and media space,'' they say from RBA in response to an Index inquiry.

What is of particular interest is the way in which the Croatian judiciary, ie the Croatian courts, were supposed to be put under pressure, which is explicitly mentioned in the call to the PR agencies in English. Keep in mind that influencing courts or the judiciary in Croatia is completely and utterly illegal.

RBA claims that only solutions containing ''legitimate practices'' were sought.

"RBA adheres to all of the laws and regulations of the Republic of Croatia in its business operations, including the case for the tender you're referring to. Only solutions containing legitimate procedures and communication activities that would reach the public through the media were sought," RBA told Index.

Following that answer, Index asked what these legitimate procedures for pressuring the Constitutional Court and other courts in Croatia would be, and whether these legitimate procedures were established by law, given that RBA was urged to "comply with all of the laws and regulations of the Republic of Croatia". Index asked them what specific regulations or laws they were referring to in this case.

"RBA is not engaged in any of the activities that you're suggesting. The tender sought the service of developing a communication strategy and key messages," RBA responded, adding that no agency was selected for these type of activities.

Kwiatkowski claims that this is inadmissible and illegal.

Lawyer Nicole Kwiatkowski was surprised when Index asked her for comments on RBA's tender.

"Any pressure on the courts is unacceptable on any side. Such behaviour is completely inappropriate. Croatian and European case law is full of examples of the rescission of judgments and the reopening of court pressure proceedings,'' Kwiatkowski told Index, adding that there were various options for so-called lobbying in an appropriate manner, from organising public hearings and engaging the professional public, but any pressure is totally unacceptable.

"All of this surprises me. Okay, we expect heightened media coverage, literacy tributes and some action, but something like this... no. I'd like to say that this is happening at a time when we have a final judgment of the Supreme Court where users of these loans are allowed to claim compensation through individual cases, which is an extremely important point. I emphasise that any pressure is unacceptable and illegal,'' says lawyer Nicole Kwiatkowski.

Index then asked Goran Aleksic, an MP for SNAGA and an activist of the Franak Association, if he had any knowledge that the banks had been pressuring the courts.

"Banks have been doing this sophisticatedly for a very long time. They do it primarily through ''their'' journalists in ''their'' media, but also through ''their'' law professors. I will not say what kind of media this is, but I will say how it works.

Each time something with franc case was dealt with, spins would start in some media, which could be summarised in the following statements: ''What do they want, they were greedy and now they complain; they were economically illiterate; they made fun of those of us who raised euro loans; now they're acting stupid as if they don't know that currency can grow on the exchange rate; the banks are not guilty, variable interest and currency clauses are allowed,'' and the like," explains Aleksic.

"If pressure is being exerted directly on the judges, I can't really say, but I suppose that e-mails are sent to the judges with certain ''expert'' papers from some ''experts'' who agitate for banks. The last example of ''expert'' agitation is the case of Professors Petrovic and Jaksic, who publicly stand in favour of banks, claiming that debtors with converted loans have nothing more to seek because they've been indemnified, and Professor Petrovic even writes expert opinions on bank defense filings in the courts. But, I have to say that I believe in the independence of the judiciary, and I believe that a large proportion of judges will not be affected by such spins,'' says Aleksic, noting that the vast majority of first-instance judgments for converted loans are for the benefit of the consumers, and many judges correctly understood the judgment of the EU Court of Justice C-118/17.

Aleksic says that it is difficult for him to be surprised by anything when it comes to banks, even the idea of them trying to put pressure on the Constitutional Court and other Croatian courts.

"The banks no longer surprise me. The concrete formulation you mention is unmistakable - it calls for pressure on the Constitutional Court and other courts to release banks from liability and blame. This is an attack on an independent judiciary, and an illegal attack. I'm amazed that they've formulated such wording in their official document, and if it is official, the banks don't appear to be afraid of anybody. The Croatian National Bank, the Government of the Republic of Croatia and the Croatian Parliament are to blame for such actions,'' says Aleksic.

"For now, the state is doing nothing about it, the banks are still acting as if they've not been convicted at all, they're still lying about how their business was in line with the law, and at the same time they're asking the state for damages in Washington. The banks are the holy cow for the Croatian National Bank and the Government of the Republic of Croatia. This is a national embarrassment. The courts remain the last line of defense against thieves and I believe that in the first half of 2020 all remaining legal dilemmas will be resolved in the franc case, after which I hope for the general mobilisation of all robbed citizens towards the courts with the aim of being repaid, all together the banks need to return around 25 billion kuna of stolen interest and stolen Swiss franc growth. Minister Darko Horvat announced the strengthening of consumer protection as part of the presidency of the EU Council, so we'll see if he's serious, or if it's just a cosmetic statement because of the EU Commission, which truly advocates for consumer rights,'' Aleksic concludes.

The banks were warned against unlawful pressure on judges, but by the Franak Association.

There were also accusations of pressure on judges. For example, the Croatian Banking Association accused the Franak Association of unlawful pressure on judges throughout the Republic of Croatia and the Supreme Court. Specifically, they resented the individual publication of judgments that went in their favour. The last such announcement by the Croatian Banking Association dates from April last year, following the Supreme Court ruling in favour of the Franak Association.

"The ruling of the Supreme Court of the Republic of Croatia published today speaks exclusively about the consumer's legal interest in judicial protection and the admissibility of trials. This judgment does not in any way direct the lower-level courts to decide on individual actions in connection with the lawsuits filed, and especially not in relation to converted loans under the Consumer Credit Act, as would be deduced from today's media appearances,'' they stressed from the Croatian Banking Association, making accusations of unlawful pressure on the courts because they said they were ''manipulating the media using the verdict" as a prejudice to the final outcome.

Make sure to follow our dedicated news page for more on the unfolding situation with RBA.

RBA Analyses Restoration of Croatia's Investment Credit Rating

ZAGREB, April 19, 2019 - Raiffeisenbank Austria (RBA) analysts expect Croatia to end this year with growth rates similar to those in 2018 and, in their latest analysis, they comment on the restoration of Croatia's investment credit rating.

For now, Croatia's investment rating has been restored only by Standard & Poor's, but the other two rating agencies are expected to follow suit and confirm that, after nearly a decade, Croatia is back among countries with adequate credit quality, the analysis says.

It adds that such assessments will be a consequence of solid fiscal policy indicators, lower external vulnerability, continued economic growth, and preserved political stability.

RBA analysts note that Standard & Poor's restored Croatia's investment rating shortly after the European Commission's decision that Croatia no longer had excessive imbalances.

The strategic commitment to adopting the euro as the sole means of payment certainly also impacted the decision, they say, adding that according to announcements, the government and the central bank will send a letter of intent to Brussels, expressing interest to enter the euro area.

The central part of that envelope would be a list of reform measures to which Croatia would commit in order to make the nominal meeting of economic criteria viable.

The importance of reform measures is reflected in the Commission's latest report on Croatia, which says the recommended and necessary measures for sustainable and stronger growth are implemented partly and slowly, RBA analysts say.

The poor and slow resolving of internal structural problems can explain why Croatia, despite growth, lags behind comparable member states and why there are no major improvements on competitiveness rankings, they add.

More credit rating news can be found in the Business section.

Croatia's Woes Leave it Second Only to Bulgaria in Underdevelopment

The problem of emigration in Croatia has been further underlined by weak economic indicators, after Bulgaria, Croatia is the most underdeveloped country in the EU, explains economist Zdeslav Šantić.

As Tomislav Pili/Poslovni Dnevnik writes on the 14th of April, 2019, bringing Croatian average salaries closer to the average salaries of Western Europe, and strengthening institutions, are major factors which could significantly reduce the outflow of people from Croatia to work overseas, according to a study by the Brussels think tank, Centre for Economic and Political Studies (CEPS), which was published last week.

In a piece of research entitled "Mobile Workers of the European Union: A Challenge for Public Finance?" authors Cinzia Alcidi and Daniel Gros discuss current trends in labour mobility within the European Union, and the challenges faced by the countries from which such a workforce leaves.

The research suggests that in the last ten years, the mobility of workers has increased considerably in the EU. While in 2007 only 2.5 percent of workers had left their home countries, in 2017, the share of the mobile working population of the European Union grew to 3.8 percent. Increasing the mobility of European workers is the result of two factors, states CEPS. The first is the enlargement of the EU to the east having occurred in two waves, and mobility has increased much more, especially after the accession of Romania and Bulgaria to the EU back in 2007. Apart from the east-west direction, recent years have seen more labour force mobility from the southern EU member states to the north, due to debt crisis and unemployment growth.

The latest data referenced by CEPS shows that Romania, Lithuania and Croatia have the highest share of workforce abroad, far above the European average. Nearly 20 percent of Romanian citizens earn their money in other EU member states, in Lithuania it is 14.8 percent, and in Croatia, 13.9 percent. For Croatian economists, such data doesn't really come as a surprise.

"Increasing emigration over the last few years was expected, and the experience of other new EU member states has shown that after EU accession and the labour market opening, emigration strongly increased, and in Croatia, the problem of emigration is further underlined by weak [domestic] economic indicators.

Croatia had one of the longest recessions in Europe, lasting six years in total. At the same time, even after recovery began, the growth dynamics remained insufficient in bringing Croatia closer to the EU's economic growth. Today, Croatia, after Bulgaria, is the least developed country,'' says OTP banka's economist Zdeslav Šantić.

"The accelerated outflow of the working-age population is particularly evident with the opening up of [Croatia's access to] the single European market since 2013, which was further strengthened by the deep recession in Croatia. However, with the exit from the migrant crisis, emigration from Croatia, especially among the working-age population, has not diminished but accelerated. Migration motives can be different - from differences in incomes, to employment opportunities, to structural factors,'' emphasised Zrinka Živković Matijević, an analyst from RBA.

"The very last factors - a weak institutional environment and (unfavourable) expectations of future economic prosperity (quality of education, satisfaction and trust in politics, future opportunities for generations to come) - are the most common motives for migration of citizens of a particular state who have a higher level of education. In that context, it isn't surprising that the countries which the most emigration are those with the lowest social progress index.

Regarding the convergence of wages, the fact is that at the very beginning of the transition process, Croatia had a high exchange rate, ie, a higher level of wage adjustment with the EU compared to other new members, following only Slovenia, the RBA analyst said.

"Meanwhile, the pace of wage growth and the standard of measured purchasing power parity in other countries has increased considerably since 2004, while GDP measured by the purchasing power parity in relation to the EU 28 average remains at approximately the same level (around 60 percent of the EU average), stagnant or comparatively behind,'' explained Živković Matijević.

Unfortunately, in Croatia, the problem of emigration is not a consequence of current economic trends, Šantić added, saying that the high perception of corruption and nepotism, inefficient state institutions, the huge importance the state carries in overall economic trends and the lack of transparency in the public sector further encourage young people to leave.

"When talking about the emigration of young people, it's worth mentioning that there's a lack of a housing care strategy. There's no regulated rental market yet, but young people have only the option of buying property through multi-year borrowing, and government measures are aimed solely at boosting property purchases,''

An interesting detail in the CEPS survey is the share of faculty-educated mobile workers. Although the usual theory often claims that those who find it the "easiest to leave'' are the highly educated, research shows that this is not the case, especially in the case of new EU members such as Croatia.

Make sure to follow our dedicated business and politics pages for much more.

Click here for the original article by Tomislav Pili for Poslovni Dnevnik

Croatia's Foreign Debt is Lowest in Last Eleven Years

The trend of the Republic of Croatia's foreign debt falling on an annual basis has been going on since the end of 2015, according to RBA analysts in light of their review of the recently published data of the Croatian National Bank (CNB/HNB).

As Poslovni Dnevnik writes on the 5th of February, 2019, at the end of October last year, Croatia's gross foreign debt amounted to 38.4 billion euro, which is less by as much as 4.1 percent when compared to one year before, meaning that the country's foreign debt fell to its lowest level since back in September 2008, according to a new analysis carried out by Raiffeisenbank Austria (RBA).

RBA pointed out, in addition to the fact that the falling of Croatia's foreign debt has been a trend since 2015, that the fall of this debt in October in particular is the result of a decline in the debt(s) of other financial institutions, which fell by 13.1 percent, as it also did in other similar sectors.

Thus, the gross foreign debt of other Croatian (domestic) sectors dropped to 13.5 billion euro at the end of October, or by 5.3 percent year-on-year, continuing the trend of depreciation dating from January 2016, as was stated on Tuesday.

The gross foreign debt of the state amounted to 13.7 billion euro at the end of October, which was 0.4 percent less than it was one year earlier. The growth of Croatia's gross foreign debt at an annual level was recorded only in direct investments, by 4.4 percent, to 6.3 billion euro.

"We expect the data for the last two months of 2018 to point to the continuation of similar developments, and at the end of 2018, the relative indicator of external borrowing should be below 75 percent of GDP," RBA analysts point out.

They expect that this year's debt to gross domestic product (GDP) will decline, thanks to the growth of the domestic economy and further diversification of all of Croatia's key sectors. "Further reductions in debt in the corporate sector are expected as a result of the discrepancies in the cost of financing on domestic and foreign financial markets," analysts from RBA have stated.

However, a tightening monetary policy and worsening funding conditions in regional and global financial markets could warn of a potentially negative impact.

"[This is particularly concerning] in the case of Croatia's modest progress in the implementation of structural reforms, which leads to an increase in risk perception and, consequently, the risk premium of the country itself," concluded RBA's financial analysts.

Make sure to follow our dedicated business and politics pages for more infromation on Croatia's financial situation, doing business in Croatia, and the overall business and investment climate.