Opatija and Velika Gorica Have Highest Easter Bonuses for Croatian Retirees

March the 19th, 2022 - Two Croatian towns, one on the coast in Kvarner and one inland close to the City of Zagreb, pay out the highest Easter bonuses for Croatian retirees in the entire country.

As Poslovni Dnevnik writes, while the amounts for Easter payouts for Croatian retirees are mostly symbolic and depend on a rather low pension income threshold as a basic condition, these two Croatian cities still loosened up their purse strings in order to make Easter a little better for Croatian retirees living there, as reported by Mirovina.hr/Pension.hr.

The City of Velika Gorica will pay up to 800 kuna to Croatian retirees who are drawing a monthly pension of up to 2,000 kuna over Easter. Those who are receiving a pension of up to 1,000 kuna will also be paid an Easter bonus in the amount of 800 kuna, and Croatian returees who receive a monthly pension of 1,000.01 kuna to 2,000 kuna will be paid an Easter bonus in the amount of 400 kuna. Croatian retirees from Velika Gorica are also paid out the exact same amount for the Christmas period.

The picturesque town of Opatija close to Rijeka in Kvarner isn't lagging very far behind Velika Gorica either. It does have a slightly lower final amount, but a much higher threshold. Thus, all Croatian retirees drawing a pension of up to 4,000 kuna per month will receive an Easter bonus, and the amounts range from 500 to 700 kuna.

Croatian retirees with pensions of up to 2,000 kuna per month are entitled to an Easter bonus of 700 kuna, while those drawing a monthly pension of 2,000 to 3,000 kuna will receive 600 kuna on their bank accounts for Easter. 500 kuna is paid out to Opatija's resident pensioners who are drawing monthly pensions ranging from 3,000 to 4,000 kuna.

For more on retirement in Croatia, make sure to check out our dedicated lifestyle section.

Who Will Enjoy Right to Croatian National Pension Payments?

March the 18th, 2022 - The much talked about Croatian national pension is now a reality, but just who will be receiving this sum of money on their bank accounts each month?

As Poslovni Dnevnik writes, as the Croatian Pension Insurance Institute announced recently, the national benefit for the elderly, also known as the Croatian national pension, was set to be paid out to the beneficiaries (into their bank accounts) yesterday, more precisely on Thursday, March the 17th, according to a report from Mirovina.hr/Pension.hr.

The Croatian national pension is currently being received by 5,808 people, all of whom are over the age of 65 and who aren't receiving a pension of another kind because they haven't met the requirement of a minimum of fifteen years of service in the workforce.

If they had acquired that minimum length/time of working service, their pension would have been at least 1,072 kuna per month. However, instead the state pays them 820.8 kuna every month, provided that their total household income doesn't exceed the same amount per household member.

For example, if the husband has a pension of less than 1,641.6 kuna, the wife will receive a Croatian national pension sum on her bank account each month. If it is higher, there will be no such payments made to her.

The Croatian national pension, about which many have been talking for some time now, has a primary aim of reducing poverty in the country in old age. Women make up the most vulnerable members of the population, accounting for two-thirds of the Croatian national pension's beneficiaries.

The number of beneficiaries of the Croatian national pension, which is something multiple European countries have introduced, is only growing, but very slowly, given that the Government's projection was that this national benefit would eventually cover a far larger number of 20,000 Croatian residents.

For more, make sure to check out our dedicated lifestyle section.

Retiring in Croatia as a Non-EU National: A Cost-of-Living Comparison

26 February 2022 - In addition to its beautiful architecture and stunning landscape, a key draw for retirees looking to relocate to Croatia’s shores is a lower cost of living, especially for those coming from non-EU countries like the United Kingdom (UK) and America.

So far, we’ve discussed how to relocate to Croatia, and the cost of both public and private healthcare. Today, I present one of the more everyday aspects of the cost of living for retirees by examining the average prices of groceries.

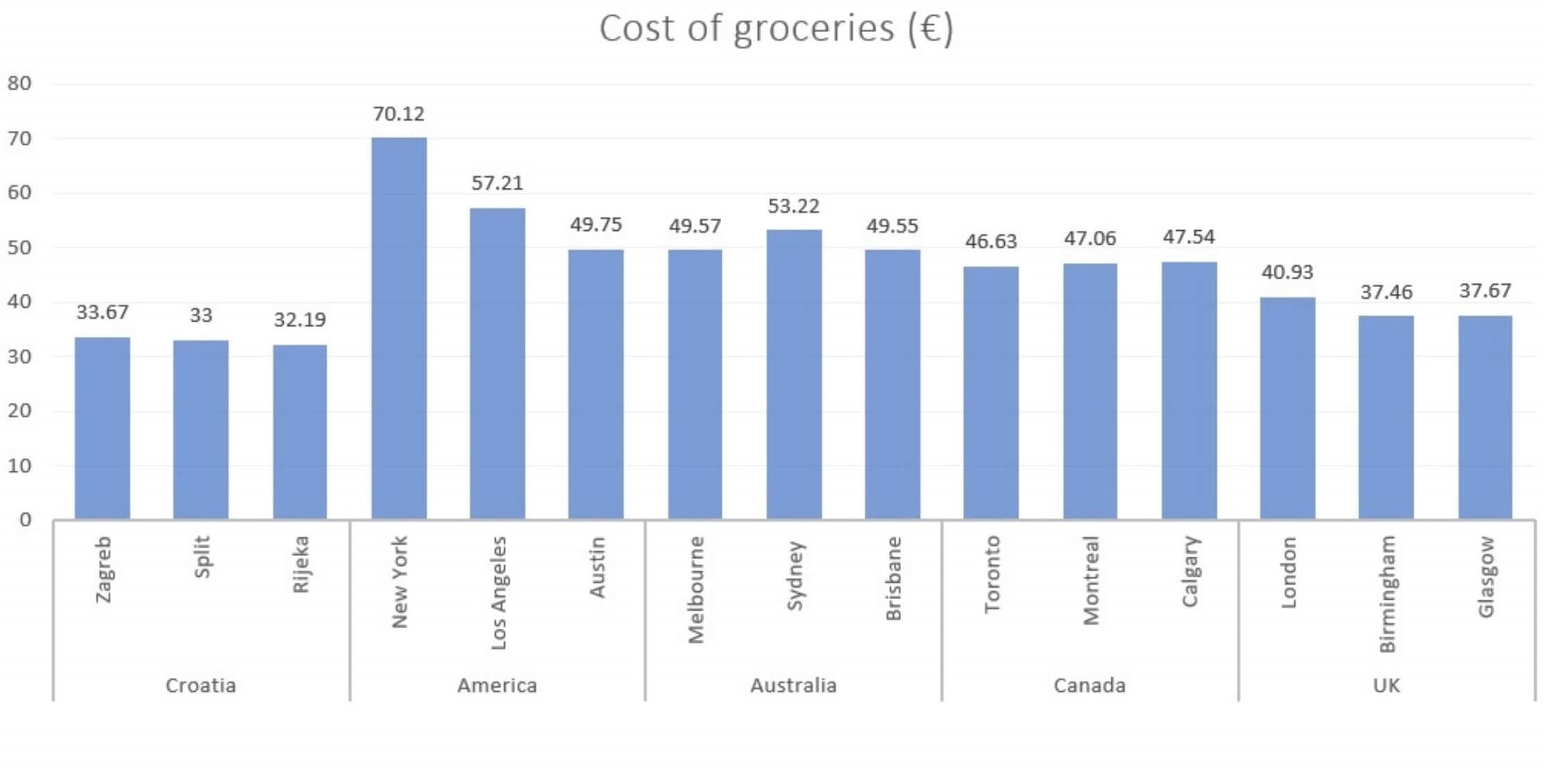

I also draw comparisons across the top 3 most populated cities in Croatia, the UK, America, Canada, Australia.

- United States: New York, LA, Austin

- Australia: Melbourne, Sydney, Brisbane

- Canada: Toronto, Montreal, Calgary

- Croatia: Zagreb, Split, Rijeka

- UK: London, Birmingham, Glasgow

According to the Croatian Bureau of Statistics (DZS), over the last 5 years, these countries represent a significant proportion of non-EU citizens that choose to live out their retirement in Croatia.

Here’s a quick overview of the results:

A couple of brief notes before we do a deeper dive into these figures.

Unlike the other 4 countries, produce you find in farmers' markets or even major supermarkets in Croatia (e.g. Konzum, Ribola) tend to be more seasonal. Generally, you will be able to find year-round items such as apples, bananas, and cucumbers, other items such as beets and watermelon tend to be stocked only when they are in season, though this trend is quickly changing with the rapid rise of tourism.

The listed items also reflect a sample of groceries that a household might purchase, they are not recommendations about how much you should spend or what you should be spending it on. Food spending varies from one household to another based on a multitude of factors like income, the type of food you buy, and other factors.

Image: Pexels.

Relative costs of grocery spend

While grocery prices in Croatia are indeed cheaper, wages in Croatia are also significantly lower than in these comparative countries on the list. The average monthly wage of a Croatian employee before taxes stands at €1,265 as of 2021, compared to €5,643 in New York.

Thus, with this sample grocery trip, a Croatian living in Zagreb spends an average of 2.67% of their income, compared to 1.24% for a New Yorker. In Calgary, the average pre-tax monthly income is €3,257 and this grocery trip cost 1.46% of that income, while in Birmingham, where average monthly wages are €2,232, these groceries make up 1.68%.

This means that the relative cost of groceries for a Croatian employee is significantly higher compared to these countries due to wage disparities.

Food trends during the pandemic

Finally, the COVID pandemic requires the acknowledgment of two key trends that impacted household grocery spending between 2020-2022, which are not accurately reflected in this sample.

The first is that food at home expenditures (e.g., grocery spending) rose during this time, while food away from home expenditures decreased due to lockdowns and mandates such as work from home. Second, global Consumer Price Indexes reflect a dramatic increase in household inflation due to supply chain disruptions, poor growing conditions, and overall economic uncertainty.

Image: Pexels.

In the years 2021-2022, the UK Office for National Statistics reports that food prices are up 4.5%. In North America, the Bureau of Labor Statistics highlights that grocery prices are up 7.4%, while Statistics Canada shows that consumers are paying 5.7% more for food. Australia appears to be bucking this trend and although the Australian Bureau of Statistics reports consumer prices have risen by 3.5%, prices for food and non-alcoholic beverages increased by a modest 1.9%.

Croatia saw a vast 9.4% increase in food and non-alcoholic beverages. However, this remains on par with other EU countries such as the Czech Republic which saw a jump of 8.8%, and Estonia with an 11% increase in food prices.

Grocery prices

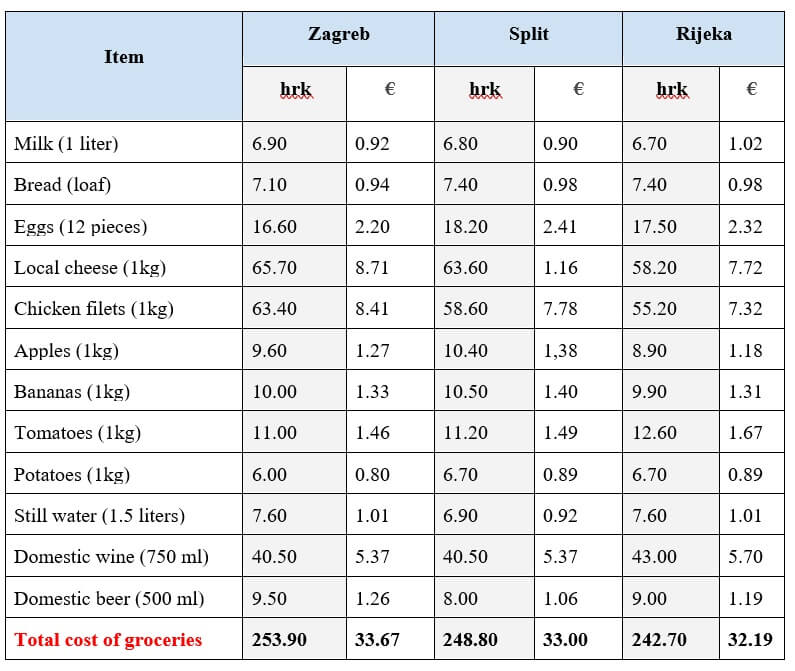

Now let’s delve into the cost of groceries starting with the 3 most populated cities in Croatia. All estimates were taken from the average prices at Numeo and Price World.

Croatia

In terms of food production, the World Bank highlights that Croatia is self-sufficient in the production of wheat, corn, poultry, eggs, seafood, and wine, but a big importer of pork, beef, and surprisingly, pet food.

The first pet food manufacturing plant was only established in 2019 in Virovitica, to capture part of the €118.5 million pet food market which is now dominated by German and Italian facilities.

1€ = 7.54 hrk

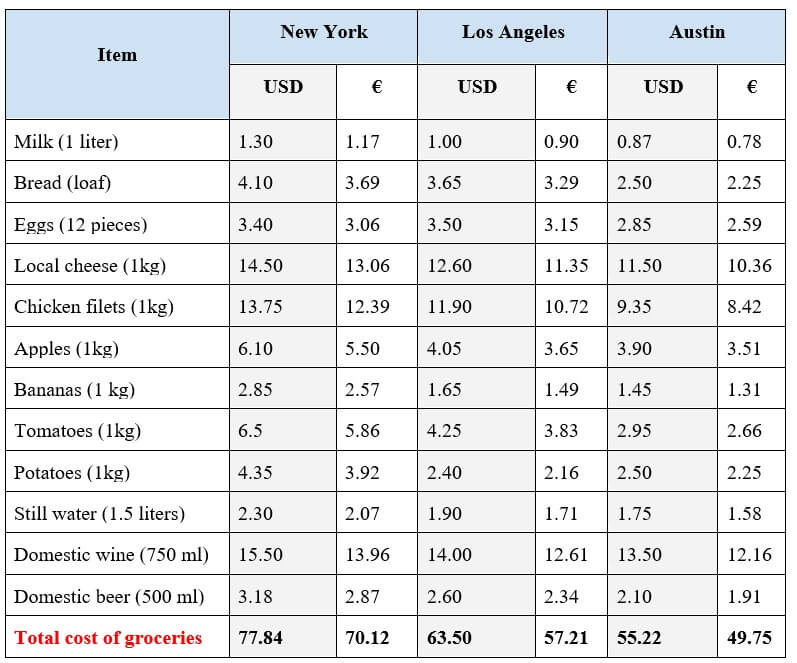

United States

Brooklyn bridge, New York. Image: Pexels.

In 2021, meat and fish prices rose most sharply with beef and veal prices increasing by 9.3%, pork by 8.6%, and fish and seafood prices by 5.4%. With these increases, Customer Expenditure Surveys by the Bureau of Labor and Statistics show that the average grocery spend per month for a household (between 1-3 people) is: $401.75/€53 in New York, $378.59/€04 in LA and $393.75/€45 for Houston

(1€ = USD$1.13)

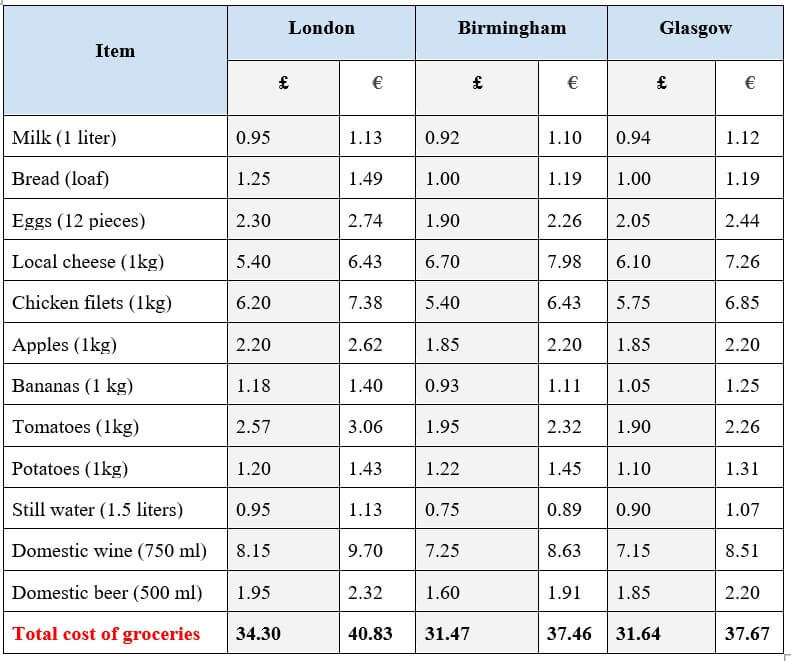

UK

London, United Kingdom. Image: Pexels.

The Office for National Statistics revealed that the average food cost for a 2 member adult UK household in 2020 was £228/month (€261) or £57 (€65.55) weekly. In the past year, prices for fresh or frozen beef have risen 13%, while poultry is now 9.0% higher. Oils and condiments such as margarine and butter are also up between 12-16% over this time.

(1€ = £0.84)

Canada

The CN Tower, Toronto. Image: Pexels.

The 2022 Canada’s Food Price Report predicts the average grocery bill for a family of 2 this year will amount to $7690.35 (€5,378) annually. This translates into $640.86 (€448.15) per month or $160 (€111.90) per week.

A significant increase in prices by 5-7% is also expected to affect dairy, vegetables, and bakery products this year.

(1€ = CAD$1.43) Australia

Australia

Sydney Opera House. Image: Pexels.

In Australia, statistics show that between 2020-2021, the CPI rose by 3.5%. Specifically, Sydney saw a 3.1% increase in consumer prices, while Brisbane and Melbourne stood at 4.3% and 2.5% respectively. Price increases were mainly driven by dairy and related products which saw a rise of 1.7%, but this was offset by a reduction in prices of fruit by 1.2% due to favorable growing conditions.

A SunCorp report revealed that the average spend per week for groceries for a single individual amounted to $135 (€86.54), or $270 (€173.08) for a couple.

(1€ = AUD$1.56) While this merely scratches the surface of how to manage your retirement income, hopefully, it has shed some light on what the cost of everyday groceries is like in Croatia compared to where you may be living right now.

While this merely scratches the surface of how to manage your retirement income, hopefully, it has shed some light on what the cost of everyday groceries is like in Croatia compared to where you may be living right now.

For more, check out our lifestyle section.

Retiring in Croatia as a Non-EU National: Navigating Taxes

17 February 2022 - While retiring abroad may be a dream for some, it is not an easy decision to make especially when considering financial implications such as taxes. Depending on what country you are moving from, you may even face double taxation. Here are some useful takeaways to help you make a more informed decision before relocating to Croatia.

The information provided here is for general informational purposes only. If you require specific expertise on your current tax situation, please consult a specialized accountant or contact the Croatian Tax Administration.

Figuring out taxes can be notoriously confusing and frustrating. Image: Pexels

What is double taxation?

Briefly, double taxation is the imposition of taxes on the same income by multiple jurisdictions.

It takes on 2 forms:

- Corporate double taxation: Taxes are imposed on both profits and dividend payouts; or

- International double taxation: Taxing of the same income in the country where the income is derived, and by the country where the individual is now residing.

This article will focus more on the 2nd taxation form, international double taxation, and whether there are available relief mechanisms in place between Croatia and your country that mitigate this issue when it comes to your pension payouts.

All information presented in the following sections from the Croatian Ministry of Finance and Tax Administration.

Conditions for tax residency in Croatia

Tax residency status in Croatia is in line with the OECD model and is determined according to length of stay in the country annually. The conditions are as follows:

- If you reside in Croatia for 183 days or more out of the year, you are considered a tax resident

- If you own or lease property for a continuous period of 183 days in 1 or 2 calendar years, you are also considered a tax resident. It is not mandatory that you live on this property

- If you own more than 1 property in Croatia, the place where you spend the most time will be considered your place of residence

Tax treaties with Croatia

Double tax avoidance agreements. Image: Pexels

If you do qualify as a tax resident of Croatia, there may be Double Tax Avoidance Agreements (DTAAs) in place that outline your tax responsibilities. The Croatian Ministry of Finance outlines all countries that have standing agreements here.

These bilateral agreements do not completely exempt an individual from filing or paying taxes. Rather, they contain a series of articles that outline each country’s stand on income and capital taxes.

Specific articles, and thus tax conditions, differ depending on the agreement made between Croatia and the contracting country. Here are some examples from the agreements signed between Croatia-United Kingdom, and Croatia-Canada.

United Kingdom (UK) and Northern Ireland (NI)

Croatia and the UK and NI established a DTAA in 2016. As a retiree of either the UK or NI, Article 17(1) of the agreement specifically outlines that if you are a UK citizen but reside in Croatia, pensions and other similar remunerations (e.g. annuities) are only taxed in Croatia.

However, in the case of a lump sum payment derived from a UK pension scheme, this amount will be subject to taxes in the UK, and only in the UK.

If you’re unsure of whether the income you’re receiving is considered a pension, the agreement defines pensions as financial vehicles registered under Part 4 of the Finance Act 2004.

You are also obligated to declare foreign income to the Croatian Tax Administration even if you have already paid taxes abroad.

Canada

Croatia and Canada established a DTAA in 2000. According to Article 18, taxes on pensions and annuities may be levied by both Canada and Croatia, but with limitations. Article 18(2) states that the first CAD$12,000 or the equivalent amount in Croatian kuna is tax exempt. Taxes levied on the excess amount should not exceed 15%.

Canadian annuities paid out to a retiree residing in Croatia may also be subject to Canadian taxes, capped at 10% of the portion that is subject to taxes. This limitation does not apply to lump-sum payments arising on the surrender, cancellation, redemption or sale of an annuity.

Types of pensions that will either be taxed by Canada or Croatia include war pensions, social security and alimony.

Citizens of Canada who receive a pension but reside in Croatia are not obligated to report it to the Croatian Tax Administration. Due to international data exchange between the countries, the Croatian Tax Administration can obtain necessary information directly from the Canadian Revenue Agency.

What if Croatia has no double tax avoidance agreement (DTAAs) with my country?

In the countries where there is no DTAA with Croatia such as Australia and the United States (U.S.), on top of being taxed by your country Croatia will also levy taxes on global income which may include pensions and capital earnings.

The thresholds for Croatian income tax are:

- 20% for up to 360,000 kuna (€47,804) annually

- 30% for more than 360,000 kuna annually

So, what does this mean for those wishing to retire in Croatia? Let’s consider American citizens wanting to retire in Croatia.

Example

Although negotiations between the two countries have been going on for over 25 years, Croatia is still the only European Union nation that does not have a DTAA with the U.S.

This means that depending on where you receive your pension from, such as social security, 401(k)s, Roth accounts, private pension plans or even passive income, these distributions may be subject to tax from both the IRA as well as Croatian tax administration.

Bob. Image: Pexels

Let’s consider Bob. Bob is single, aged 65, and is thinking of retiring in Croatia. He has made steady pre-tax contributions to his 401(k) over the years and now has US$750,000. This is also Bob’s only source of pension. He decides to withdraw US$25,000 annually for his retirement in Croatia, which will be considered his retirement income.

Assuming as of 2022, he is filing taxes under “Single Filer”. The IRA will impose a 12% tax on Bob’s ‘income’ of US$25,000, which means Bob will pay a total of US$3,000 to the IRA. Meanwhile, the Croatian Tax Authorities will further impose a 20% ‘income’ tax on US$25,000, amounting to US$5,000 in taxes. This brings the total amount of taxes on Bob’s pension to US$8,000 annually and he ‘pockets’ US$17,000.

You can also use the IRS's Interactive Tax Assistant to help you determine whether some of your income may be eligible for the exclusion.

Although taxes may put a dent in your pension payout, do weigh the benefits of living in Croatia without necessarily having to make significant lifestyle changes. Or better yet, make full use of the 90-day visa free travel to do a “trial run”, and experience a slice of what retirement may look like here.

Check out the first part of the retiring in Croatia as a non-EU national series HERE.

Croatian Retirement Heaven: International Living Ranks Country Highly

February the 15th, 2022 - While retiring for Croats on a Croatian pension might not be a song and dance, Croatian retirement for foreign nationals with foreign pensions is quite the dream for many. The magazine International Living has ranked the country very highly indeed.

As Poslovni Dnevnik writes, faced with a sharp drop in living standards after retirement, many retirees spend time thinking of environments that offer a better life for the same amount of money. Croatia is one of the most desirable destinations for foreign retirees, and this year it was on the list of the best destinations for retirement.

Every year, the International Living magazine produces an international retirement index that promotes the best countries for living in retirement, and Croatian retirement for foreigners looks tempting. The survey involves a large number of correspondents and associates from around the world, and the calculation of the index looks not only at the cost of living, but also at many other factors that affect the quality of life.

The choice is intended primarily for Americans and other Westerners, who can often afford a better quality of life in the offered destinations than in their homeland.

In addition to the cost of living, climate, political stability, the level of healthcare offered and its cost, the development of infrastructure and the degree of environmental protection are the most important factors when it comes to scoring. Less tangible factors that have an important impact on the quality of life are also measured, such as the availability and quality of entertainment and cultural content, the attitude of local residents towards foreigners, as well as the level of general personal safety.

This year, Croatia and Croatian retirement for foreigners was included among the pensioners' paradises, and it ranked 23rd on the list of the 25 most attractive destinations. We received the most points for "ease of integration", which includes the general goodwill of the local population towards foreigners, the ability to adapt to local customs, the level of cultural content, the offer of outdoor activities and the adaptation of various content to foreign users.

Croatia is also attractive due to its low cost of living, and it also ranks well in terms of healthcare. The level of infrastructure is also highly valued, which means the availability of telecommunications services, a quality road network and efficient public transport. Croatia received the fewest points in the categories "possibility of obtaining citizenship" and "benefits for the elderly", and it is still relatively weak in terms of the quality of civil services.

Other countries with a high index also offer a combination of low costs, different benefits and nice weather. Along with Panama and Portugal, Costa Rica, Mexico, Ecuador, Colombia, France, Malta, Spain and Uruguay are among the top 10, writes tportal.

For more, check out our lifestyle section.

Retiring in Croatia as a Non-EU National: Croatian Healthcare

February 11, 2022 - When retiring in Croatia, one of the key concerns when considering a move overseas is healthcare, and trying to navigate this space can be a daunting prospect especially for those looking to spend an extended amount of time in Croatia.

We are here to answer some of the questions on healthcare in Croatia by giving a brief overview of available options, covering factors such as costs, accessibility, and quality of healthcare.

What type of healthcare is available in Croatia?

In Croatia, as either a temporary or permanent resident, you will have access to both state and private healthcare sectors.

There are three main types of state healthcare coverage in Croatia:

- Obavezno zdravstveno osiguranje – Basic public health insurance (mandatory)

- Dopunsko zdravstveno osiguranje – Supplemental health insurance from either public or private providers

- Dodatno zdravstveno osiguranje – Premium private supplemental health insurance offered by banks and private insurers

Let’s start with the basic public health insurance “obavezno” since it is mandatory for all 3rd country residents of Croatia, unless you are on a Digital Nomad Visa, where private health insurance will suffice.

State healthcare - Overview

State healthcare in Croatia is regulated by Hrvatski zavod za zdravstveno osiguranje (HZZO), otherwise known as the Croatian Health Insurance Fund (CHIF).

The breadth and scope of this coverage is extensive. Once you’re in the system, you will have access to high-quality primary (e.g. general practitioners, gynecologists, dentists), secondary (e.g. specialists), and emergency care (e.g. hospitalization). Emergency care also extends to other member states within the European Union.

A wide range of medical prescriptions and certain healthcare aids (e.g. orthopedic, dental, diabetic) are also covered by basic public health insurance.

Before moving, check with your current doctors if your prescription is available locally, or if there is an equivalent that may be under a different brand. You can also look it up in this list if it is covered by HZZO.

Image: Pexels

State healthcare - Monthly premiums

As a 3rd country national, you can expect your monthly premiums to be around 618.75 HRK (€82) per person as of 2022. This calculation is based on the minimum salary average in Croatia as determined by the Croatian Bureau of Statistics (DZS).

However, if you are receiving a foreign pension, the onus is on you to declare it to the local authorities, especially if your pension is deposited to a Croatian bank account.

Of the amount you receive in foreign pension, 16.5% will go towards monthly HZZO premiums. This contribution is capped at a minimum amount of 618.75 HRK (€82) and a maximum of 1573.60 HRK (€208.70), based on the lowest (3,750 HRK/€497.35) and highest salary averages (9,537 HRK/€1284.85) in Croatia as of 2022.

When you first sign up for HZZO, you will also have to back pay the previous 12 months of monthly premiums even if you were not living in Croatia during that time. Assuming you have no foreign pension declared, this will amount to approximately 8,043.75 HRK (12 + 1 month) (€1066.81).

State healthcare - What will you pay for a visit?

Now that you have public healthcare, when you do see a primary healthcare professional, this care is covered under “obavezno”.

For secondary and emergency care, you pay 20% of services rendered which have minimum amounts of 25 - 100 HRK (€3.30-13.26) depending on whether you received outpatient or inpatient hospitalization care.

These payments can be reduced or removed altogether with the secondary “dopunsko” coverage which calls for another post in itself. For now, just be aware that “dopunsko” coverage costs an additional 45-75 HRK (€6-10) a month per person, and is offered by private insurers as well as HZZO.

Applying for HZZO

To apply for HZZO after your visa has been approved, you will need to download and fill in all necessary forms. As a 3rd country national, the form you’re looking for is a T-2. If you face some uncertainties on how to proceed, do visit your nearest HZZO office for guidance.

Another heads-up is that the English version of the HZZO website only gives 10% of all information available on the Croatian site so it’s better if you visit the Croatian site and do a translation.

Private healthcare - Overview

What if you find yourself needing healthcare while waiting for your visa to be processed? Or if you find yourself in a situation where you need to see a specialist on short notice for a second opinion?

Unless you require urgent medical care (in this case head to the nearest hospital), your first port of call would be to seek out a poliklinika (polyclinic) which is a private clinic.

Most polyclinics house a general practitioner who will accommodate walk-ins or offer appointments likely within the same day or week. They are also able to issue and extend prescriptions for pre-existing medical conditions.

Depending on your ailment, there are also specialized polyclinics that offer a range of services (e.g. dermatologists, gynecologists, urologists). Some policlinics also offer blood work and preventative health screening (e.g. food intolerance, cancer screening).

Croatia also offers top-notch private specialists and hospitals, which is reflected in their growing medical tourism sector. There are also private dental clinics that offer high-quality dental care at competitive rates when compared to other EU countries.

Image: Pexels

Private healthcare - What will you pay for a visit?

While costs of private healthcare vary, here is a non-exhaustive list of procedures assembled from various sources to give you an idea of what you can expect to pay out of pocket. Depending on your private healthcare policy (e.g. Cigna), you may be able to cover some of these costs but do double-check with your insurance provider.

Sample costs for general healthcare and screening:

- Basic consultation (general practitioner): 200 HRK (€27)

- Ultrasound abdominal: 250 HRK (€33)

- Mole screening: 200 HRK (€27)

- Food sensitivity tests (220 types): 2,700 HRK (€358)

- Thyroid panel tests: 450 HRK (€60)

- Breast/prostate blood panel: 2,335 HRK (€310)

- MRI-head: 2,090 HRK (€277)

- CT-Spine (3 segments): 1,030 HRK (€136)

Sample costs for surgery:

- Artificial disk replacement 113,000 HRK (€15,000)

- Knee replacement: 56,900 HRK (€7,545)

- Hip replacement: 56,730 HRK (€7,525)

- Torn achilles tendon - repair: 18,860 HRK (€2,501)

- Tennis elbow: 14,720 HRK (€1,952)

- Cataract and glaucoma (cataract surgery): 11,000 (€1,460)

The estimates above typically include pre-and post-operative consultations, but do not account for long-term rehabilitative care, or possible hotel stays if you are traveling to a specific city to undergo surgery.

Image: Pexels

Sample costs for dentistry:

- Basic consultation: 200 HRK (€26)

- Descale and polish: 480 HRK (€64)

- Root canal treatment (per root): 500 HRK (€66)

- Zirconia-based crown: 2,300 HRK (€305)

Most private healthcare providers in Croatia expect cash payment upfront. In some cases, they will accept credit or debit cards, but call or drop them a message to confirm this. If you are a resident of Croatia, some clinics will allow you to pay in installments.

(€1 = 7.54 HRK)

For more news about Croatia, click here.

Retiring in Croatia as a Non-EU National: Navigating Bureaucracy

February 4, 2022 - Croatia is touted as being one of the best places to retire, with plenty to offer including an agreeable climate, rich culture, relatively low cost of living, and affordable healthcare. But how can retirees, especially 3rd country nationals, gain the right to live long-term in Croatia?

In this article, I briefly walk you through the different types of long-term permits the Croatian government currently offers and provide deeper insights into those that are the most applicable to retirees.

All information presented here is from the Ministry of the Interior (MUP) which regulates the stay of foreigners in Croatia.

Can I get permanent status to stay long-term?

The short answer is, yes, but for anything longer than 1-year, it becomes increasingly complicated.

For now, just know that although there are 2 types of Permanent Residency Permits in Croatia that allow extended stays beyond 1-year, it is nearly impossible for a 3rd country national to obtain either on arrival if you have no Croatian roots or family.

In order to stay for more than 90 days in Croatia, you must apply for a Temporary Residence Permit.

Time to get all that paperwork in order. Image: Anete Lusina/Pexels

Types of Temporary Residency Permits

According to the MUP, there are different ways for 3rd country nationals to obtain a Temporary Residency Permit.

- Work for a Croatian registered company

- Study at a Croatian institute

- Conduct scientific research

- Humanitarian grounds

- Be a digital nomad*

- Start a business

- Be a non-remunerated volunteer*

- Other purposes (purchasing real estate)*

- Other purposes (renting real estate)*

As of writing, these (*) options do not count towards gaining permanent residency or citizenship.

For those looking to retire, let’s briefly consider options 5-9 as the most appropriate.

The Digital Nomad Visa (point 5)

Introduced in January 2021, the Digital Nomad Visa provides a relatively straightforward way for 3rd country nationals to stay in Croatia for an extended period.

If you’re retired but do some freelancing from time to time, this may just work for you.

Criteria for a Digital Nomad Visa include:

- Proof that you are a digital nomad by providing documents such as company registration, freelance contracts, invoices, and payment from clients (documents should be translated into Croatian and notarized)

- A criminal background check from your home country

- Valid health insurance for 1-year (e.g. Cigna, Safetywings, Croatia Osiguranje)

- Proof of sufficient monthly funds which are 2.5 times the average net salary of the previous year as published by the Croatian Bureau of Statistics (DZS). For each additional family member, the amount is increased by 10% of the average net salary

- When this expires, you have to leave the country for 90 days before reapplying

As of October 2021, the average gross earning per employee as published by the DZS is HRK 9,597 (€1,275), while the average net earning per employee is HRK 7,140 (€948).

This means for one retiree; you need to show that you have a monthly income of HRK 17,860 (€2,367). For each additional member, it is HRK 714 (€95) more per month.

If your monthly income is irregular, you can also prove sufficient funds by showing you have a full 12 months of income in your bank account, HRK 214,320 (€28,424) for a solo retiree and HRK 222,786 (€29,545) if you are coming with a partner.

Starting a business (point 6)

Alternatively, for some retirees, starting a local business may be an ideal way to make some passive income while enjoying all that Croatia has to offer.

3rd country retirees can gain Temporary Residency by starting a business in Croatia, but meeting the required thresholds and the additional bureaucratic requirements can be more than a full-time job in itself.

To qualify, you have to:

- Own at least 51% of a Croatian company, or incorporate one of these business forms - obrt, j.d.o.o, or d.o.o.

- Invest at least HRK 200,000 (€26,500) as starting capital which can be claimed for business expenses

- You must employ yourself, as well as 3 Croatian nationals as full-time permanent staff

- The gross salaries of all 3 of your staff have to be equal to the average gross salary of the previous year

- Your own salary must be at least 1.5 times the average gross salary

For 3 members of staff and yourself, you’d be looking at a minimum monthly human capital cost of approximately HRK 43,186 (€5,738). Not to mention you also have to deal with taxes, health insurance and other miscellaneous paperwork.

Becoming a long-term volunteer (point 7)

Maybe starting a business is not for you, perhaps consider volunteering? According to Croatian law, long-term volunteers between the ages of 18-65 are allowed to stay for 1-year.

The requirements are as follows:

- You have to register your stay and apply for a residence and work permit

- The host organization (“udraga”) has to prove they will cover costs for your stay, including food, accommodation, and other necessary expenses

- You can be given an allowance by the host organization, but you cannot be paid

- You are not allowed to work for any other company in Croatia

- The hosting organization must possess a third-party liability insurance policy

Under certain conditions, this permit can be renewed for a second year if approved by the host organization and relevant authorities.

Real estate in Dubrovnik. Image: Lucian Photography/Pexels

Other purposes: Investing in real estate (point 8)

Unlike other EU countries (e.g. Spain, Portugal, Greece), Croatia does not currently offer a similar investment scheme where investing a certain amount in real estate qualifies you to live indefinitely.

In the case of Croatia,

- There is no set amount of investment required

- You must live in the purchased residential property

- The visa is only valid for 6 months which is extended to 9 months if you include the 3-month short-term tourist visa

- Once your 9 months is up, you are not allowed to renew or extend the permit

- You must wait 6 months and leave Croatia during this time before submitting a new application again

While there is no minimum investment requirement, the criteria of having to leave and resubmit an application make it difficult for retirees to settle permanently.

Other purposes: Renting real estate (point 9)

What if you’re considering the following retirement scenario: renting out your current residence that will help fund your retirement years in Croatia where you’d also rent instead of purchasing real estate?

You most certainly can but know that this route will also only entitle you to a 1-year Temporary Residency permit.

Let’s look at the additional criteria:

- You are not allowed to work for a Croatia registered company

- You have to sign a rental contract with the landlord and prepay a full year of rent (AirBnB, Booking.com does not count)

- The contract has to be notarized before submission to the relevant authorities

- At the end of your 1-year permit, you have to leave Croatia (although through anecdotal evidence, I have heard of this being extended for another year)

- You can only reapply again 6 months after the permit expires

While rent in Croatia is relatively lower than in cities in North America, Australia, or the UK, it also comes with its own complications.

Finding a landlord who is willing to lease you an apartment year-round can be difficult as the tourist season (June - September) brings in the bulk of their income. It is not uncommon for landlords to make a full year’s rent and more, just during tourist season alone.

What would retirement in Croatia look like then?

Until the rules change, it is problematic if you intend to live out a “classic” retirement scenario.

However, now that you know what to expect, if you’re willing to take on a more dynamic approach and make Croatia a secondary home as part of your broader retirement plan, it might just be some of the best year(s) of your life.

(€1 = HRK 7.54)

For more, check out our lifestyle section.

Travel and Leisure Lists Split Among 9 Best European Cities to Retire

April 9, 2021 - The second largest city in Croatia has been highlighted not only for its tourism but also for meeting the expectations of seniors around the world. The esteemed travel portal Travel and Leisure lists Split among the 9 best European cities to retire!

The international travel web portal Travel+Leisure recently published a list of the best places in Europe where people can make their retirement plans come true. Although the cost of living is a factor to take into consideration, the list considered others such as the climate, environment, culture, sights, and the health system quality.

Photo: Romulić and Stojčić

Despite the list recognizing Croatia in general as a tempting destination for retirees, due to its decent climate in both summer and winter along its nearly 6000 kilometers of coastline, the city of Split stood out above the rest.

‘"The Roman emperor Diocletian built his palace in Split, and its remains have been designated as a UNESCO World Heritage site. Restaurants, bars, cultural and entertainment venues, and many English-speaking residents make it relatively easy to adapt," writes Travel+Leisure.

It should come as no surprise then that the Roman Emperor Diocletian decided to spend his last years in retirement in his palace, located in the heart of Split.

Photo: Romulić and Stojčić

The portal also added that to get permanent residence in Croatia, it is necessary to spend five years in the country as a temporary resident. Likewise, it considers the Croatian health system to be adequate and something positive for those traveling from abroad is the availability of English-speaking doctors. You can find what you need to know about living in Croatia here.

Those interested in fulfilling their retirement plans on the Dalmatian coast can also consider other locations near Split, such as Trogir, Omiš, Makarska, Stobreč, or Podstrana. To learn more about Split, be sure to read our dedicated Total Croatia page.

Split also stands out for its gastronomic offer, its beaches, its museums and history, and the ease of setting sail in the Adriatic either from its ferry ports or by purchasing a boat; something that all interested seniors should definitely keep in mind.

Photo: Romulić and Stojčić

The full list includes the following cities:

- Algarve, Portugal

- Bordeaux, France

- Budapest, Hungary

- Ljubljana, Slovenia

- Split, Croatia

- Alicante, España

- Valletta, Malta

- Kinsale, Ireland

- Prague, Czech Republic

Follow the latest travel updates and COVID-19 news from Croatia HERE.

For more on travel in Croatia, follow TCN's dedicated page.

Lessons from Portugal: Taking Advantage of the Retirement Lifestyle Opportunity

August 16, 2020 - With a Croatian digital nomad visa discussion taking place at the ministerial level this week, can Croatia also cash in on the retirement lifestyle opportunity?

It has been quite a year already, and we are not finished yet. And it is clear that many things will never be the same again, and that new approaches are required. This also includes tourism, which accounts for more than 20% of GDP in Croatia in a normal year. 2020 has been anything but normal.

Looking forward, and not back, there are huge opportunities for Croatia to diversify and to attract high-spending visitors without investing very much. Indeed, some simple legislation change could open the doors to new types of tourism and revenue streams which are currently being spent in other countries in Europe, but only negligible amounts.

We have been writing about the huge opportunity offered by remote workers wanting to combine their nomadic existence with great lifestyle. Nowhere does lifestyle in Europe better than Croatia, and the additional attractions of Croatia's safety, authentic experiences, great food and wine, natural beauty, affordability, accessibility, good infrastructure and English spoken, make it an ideal destination for an industry which is booming and set to expand rapidly.

The main thing stopping this from already being part of Croatia's tourism makeup is our old friend, Croatian bureaucracy, but there are signs that there might be a small shift in thinking. Following an open letter to Prime Minister Andrej Plenkovic, Split-based Dutch entrepreneur Jan de Jong has a meeting with the Minister of the Interior this week to discuss the introduction of a digital nomad visa in Croatia.

There is another opportunity which countries such as Portugal are taking full advantage of, which Croatia is not at the moment. An opportunity with much smaller numbers of visitors but with a much higher spending power.

The retirement lifestyle opportunity.

I have lost count of the number of emails I have received over the years, particularly from Americans, who have fallen in love with life in Croatia and desperately want to retire here.

But they can't under the current rules.

I knew one American couple in Split a couple of years ago who felt a particularly strong bond with Croatia and exhausted all roads to find the way to retire here. High spenders, very active in the local community, visited by friends who also fell in love with Croatia. They ended up retiring in Sri Lanka.

To be clear, we are non-EU (Americans), retirees, with no Croatian family connections, who are already married, so can’t marry a Croatian spouse. We are retired, so not necessarily eager to take jobs or start companies. We just want to enjoy living in this beautiful country, and contribute by paying our own way through taxes, insurance, housing, investments, entertainment, etc. Many of us are even willing to donate our time, knowledge and skills.

You can read more on this topic from the 2018 TCN article Why Croatia is Not (But Could Be) a Top American Retirement Destination.

The emails and Facebook messages kept on coming. Soon after we started the CROMADS Facebook page a couple of months ago, I received a message from an American retiree desperate to retire in Croatia, but accepting the impossibility of the situation and making plans instead for a new life in Portugal:

I suggested to the American Ambassador to Croatia last fall that he pass along the idea of creating a special visa category in Croatia for retired people, such as the one Portugal has (I'm not sure his mission is to get people to leave the USA...lol). I think the suggestion would be more likely to gain traction with this group as you seem to be getting things done. I love having TCN as a resource. Anyway, I understand the desire to attract young entrepreneurs in the tech industry, but take a look at what Portugal has done. They realize that "old money" spends well, and the economic reach is wider than you might first think. There are many groups in the USA that have formed around the idea of retiring to Portugal. They meet in person and online. When they move, they create a circle of friends and family who want to visit them. These are people with money to invest in real estate and lifestyle. I love Croatia, but I can only come here for 90 days and then the welcome mat is removed.

That's why I'm moving to Portugal, even though I'd rather be in Croatia. I love Croatia, especially Zadar, where I am currently residing on an extended visa due to COVID-19. I'll be going back to USA 5 July (if I can force myself on the plane) and making my plans to move to Portugal. I wish you the best of luck! I will enjoy watching your successful journey!!!

Portugal has managed to attract a sizeable number of foreign retirees, who are enjoying the relaxed lifestyle in temperate climes, and it appears that their simplified bureaucracy is helping to make the decision a little easier. Here is what you need to do to retire in Portugal as a non-EU citizen:

Under Portugal’s retirement residency law, non-EU citizens who want to retire to Portugal will need to apply for a residence permit at a Portuguese consular office in their home country before relocating to Portugal. You will typically need to show a valid passport, proof of income, proof of health insurance and submit to a criminal background check. Non-EU nationals can obtain a temporary residence permit for five years, after which they will be able to apply for permanent residence.

There have been various initiatives and ideas to attract the higher-spending older generation to Croatia, ideas which inevitably come up against the wall of bureaucracy. One of the most interesting a few years ago came from leading eye surgeon, Nikica Gabric, who drew a circle on the map of Europe 500 kilometres from the epicentre of Istria. I forget the number of millions of European retirees drawing Western pension in Gabric's circle, but it was a lot. With many just a 4-5 hour drive from Croatia, a combination of much cheaper cost of living in Croatia and more temperate winters make Croatia an ideal retirement destination for at least part of the year.

Tourism is changing, and Croatia's over-reliance on classic sun and sea tourism is not healthy. Tourism is not just about that summer holiday, but embracing lesser-explored options. By following the excellent examples of digital nomad visas set by Estonia, and attracting high-spending retirees as in Portugal, a rationalising of some aspects of Croatian bureaucracy will easily open up new possibilities and revenue streams.

What Pensioners? Number of Croatian Retired Employees Jumps 40 Percent

As Novac/Marina Klepo writes on the 9th of February, 2020, in the past year, since the Croatian Government expanded work opportunities for retirees, many Croatian retired people have taken this opportunity.

Last November, according to HZMO data, there were 11,737 pensioners who had taken up work under the measures. Whereas back at the end of 2016, for example, there were only about 2,600 retirees engaged in such work, about a year later, there were about 3,500, and at the end of 2018, there were 4,600. Who are these Croatian retired people willing to extend their time on the labour market?

Most of them are men, who make up 7,246 or 62 percent of the total employees. According to the chosen occupations, as shown by HZMO statistics for the first eleven months of 2019, this opportunity was mostly used by experts in industries and scientists, 2,282 of them.This means that almost every fifth employed pensioner is an expert in their field or a scientist.

This was followed by engineers and technicians (1,730), followed by managers, members and officials of legislative and state bodies, and directors (1,729), and in fourth place came service and commercial professions (1,383). It follows that the people who are the most interested in working during their retirement are those working in better paid positions.

However, when looking at the activities they're engaged in, the first place is shop work, employing about 2,200 Croatian retired people, the second is the manufacturing industry with 1,500 pensioners, and more than a thousand are in the construction industry. About 800 of them work in transport and warehousing, as many work in health and social care, while about 400 are engaged in the field of education. The ability to work four hours per day for pensioners in Croatia was first legalised by former Labour Minister Mirando Mrsic. At the time, the opportunity was only available to those who had reached legal retirement age.

At the beginning of last year, the possibility of employing pensioners, while still fully retaining their pension, was extended to those who had for whatever reason retired early. Thus, at the end of last year, 3,073 people who had retired early were employed, and 8,815 of them were at Croatia's normal retirement age.

An additional benefit is reserved for active duty military personnel, police officers and mine clearance workers who can choose whether to work for up to four hours a day while retaining a full pension, or to be employed full-time and receive 50 percent of their pension.

Work under this scheme for Croatian retired people also gives them the opportunity to receive a higher pension. A pensioner who is employed for four hours a day may request a new pension calculation after two years of being engaged in such work.

Make sure to follow our lifestyle page for more.