Croatian Prime Minister Condemns Kramatorsk Train Station Shelling

AGREB, 8 April (2022) - Prime Minister Andrej Plenković on Friday condemned the shelling of the railway station in Kramatorsk, eastern Ukraine, earlier in the day when dozens of civilians were killed and over 100 were wounded.

Thousands of people - most of them women and children and the elderly - were at the railway station in Kramatorsk when it was hit by rockets, the city's mayor Oleksander Honcharenko was quoted by foreign media as saying.

The station, located in eastern Ukraine, was being used to evacuate civilians from the eastern Donbas region.

PM Plenković said the shelling of the train station was one more piece of evidence of Russia's brutal aggression against Ukraine.

Things getting back to normal, but caution is still advised

With almost all the COVID restrictions being lifted, life is getting back to normal, but caution is still required, said the premier at the start of his cabinet's meeting.

The Croatian COVID-19 crisis management team has established that conditions have been met for the relaxation of COVID protocols, Plenković said referring to the team's decision to lift all anti-epidemic rules as of Saturday, while the mask mandate will stay in place for hospitals and nursing homes.

For more, check out our politics section.

Croatian Government to Send HRK 1.5m Worth of Emergency Aid to Ukraine

ZAGREB, 8 April (2022) - As a sign of solidarity, Croatia will send slightly over HRK 1.5 million (€200,000) worth of emergency aid to Ukraine at Ukraine's request, the government decided on Friday.

The aid comes from the available reserves and funds of the Economy and Sustainable Development Ministry, that is, the Commodity Reserves Directorate, the Culture and Media Ministry, and the Ministry of the Interior, that is, the Civil Protection Directorate.

In light of constant danger to the moveable and immoveable cultural heritage of the city of Lviv, Ukrainian museum workers have asked for help in the form of equipment to protect and evacuate the heritage, and help has also been requested in the form of medical equipment (first aid kits).

For more, check out our politics section.

Economy Minister Believes 2022 Will Be Year of Further Growth

ZAGREB, 1 April (2022) - Economy and Sustainable Development Minister Tomislav Ćorić said on Friday he believed the year 2022 would see a further growth of the national economy.

"I believe that the Croatian economy will show in 2022, just as it did in 2021, the kind of resilience that opened the door to convergence towards the EU average," Ćorić said at a meeting of exporters, organised by Lider business weekly.

Recalling Croatia's growth rate of more than 10% in 2021, the minister said that this year could be like that as well. "That is our goal and I believe that with good exporters, we can make it happen," he said.

Croatian exporters share the fate of all European exporters who are in any way connected with the Russian Federation, while the situation is somewhat easier for exporters with diversified portfolios, whose business is not predominantly oriented to Russia, he said.

Croatia does not have too many companies that are exposed to the Russian market, he said, adding that the current situation could be overcome by companies expanding their market to other European countries, while the government would help by facilitating competition, primarily by enabling greater energy efficiency and lower production costs.

Ćorić announced a HRK 1.9 billion tender to be published by the end of Q2 referring to energy efficiency, which should help the manufacturing industry increase its capacity.

Some of the exporters have liquidity problems due to a decline in business in the Russian Federation, he said, noting that the Croatian Bank for Reconstruction and Development (HBOR) would step in.

DIV Group: Situation requires rapid response

Answering questions from the press, a member of the DIV Group Management Board, Darko Pappo, said that DIV was very much affected by the current situation because two major projects were financed by a Russian-owned bank, with EU sanctions against Russia having prevented the completion of the projects and their refinancing.

"We are talking about two loans amounting to €90 million, with our share totalling around €60 million. That is a huge amount of money and this has made us suspend production," he said, adding that he expected the government to make decisions fast to help the shipbuilding group overcome the situation.

He added that there were end-buyers for both projects, contracts on long-term lease and a repayment schedule, and that, even though state aid is not necessary, the situation requires a prompt government reaction.

The government should support DIV's proposal for the loans to be refinanced with HBOR funding under commercial terms, and one of the loans should be fully repaid by the end of the year while the other would be repaid over a longer period of time, he said.

"That would ensure the continuation of production and normal functioning," he said, adding that both the Brodosplit shipyard and DIV Group operate in the black and employ a large number of workers, which is why they believe the government and HBOR should step in.

Pappo recalled that the recent case of Sberbank showed that a prompt reaction by the government was possible.

AD Plastik focusing on new deals

Marinko Došen, Management Board chair of plastic car parts manufacturer AD Plastik, said the revenue from the Russian market accounted for 20-25% of total revenue and that the company's two factories in Russia were currently not operating and there was no information on when they could resume operation.

AD Plastik is an export-oriented company, focusing on new deals and expanding to markets where it will be able to operate, Došen said.

As for the rise in energy costs, he said that the cost of energy products had gone up significantly for all businesses and that state aid would be welcome as it would also help them cover the cost of labour for markets that were currently inaccessible.

For more, check out our business section.

Croatian Equity Market: Impact of the Russian Invasion of Ukraine

March 18thund 2020 - An overview of the Croatian equity market and how it reacted to the Russian invasion of Ukraine.

On the 24th of February 2022, a full-scale Russian invasion of Ukraine began. The world was struck and this was also evident when looking at the capital markets which reacted very suddenly and there was a lot of volatility in the markets.

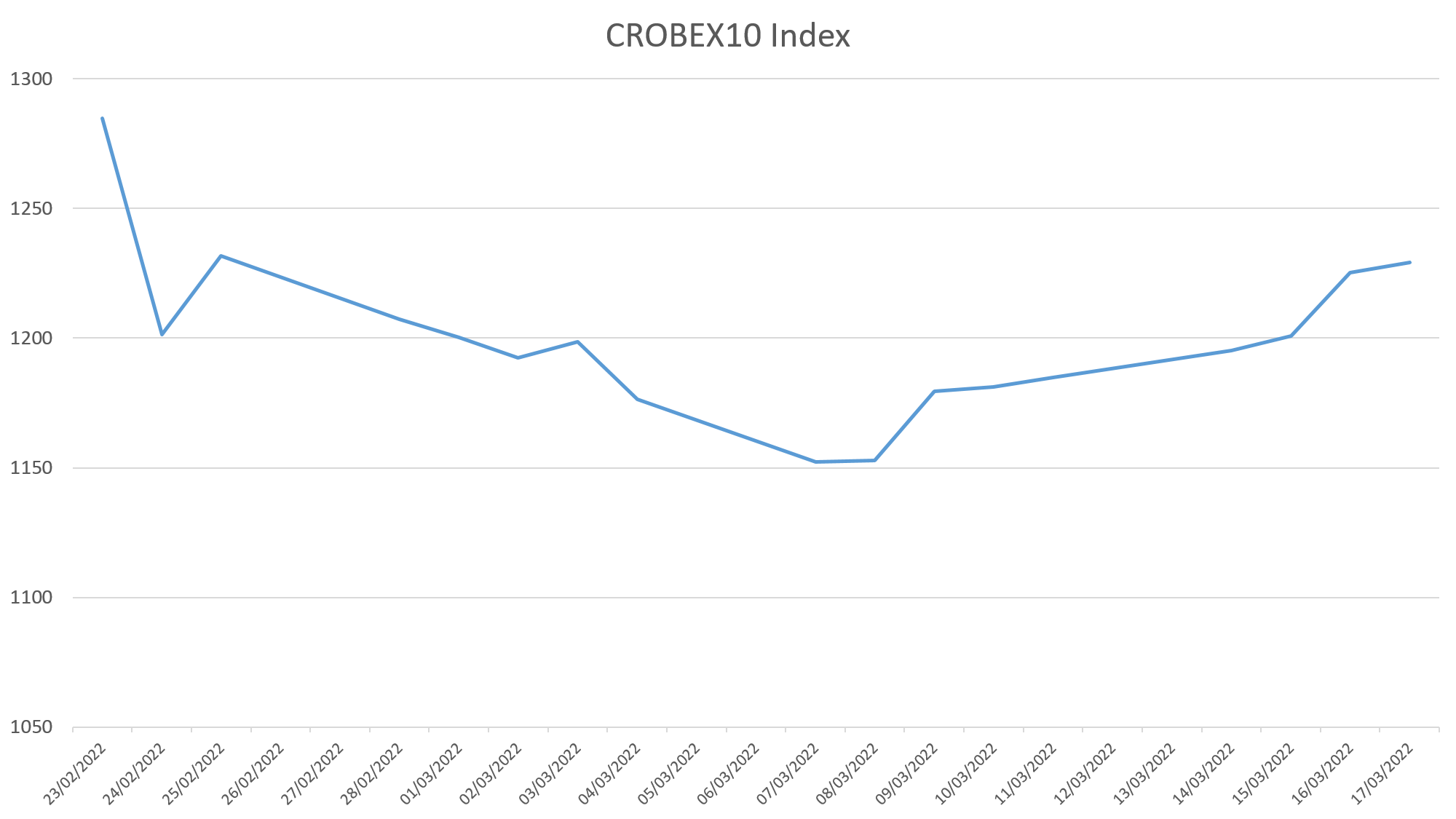

The Croatian equity market can be observed by looking at the benchmark index CROBEX10 which is made up of 10 Croatian blue-chip companies with the largest free-float, liquidity, and market capitalization. CROBEX10 fell by 6,47% on the first day of the invasion falling from 1284.56 to 1201.42. The downward trend has started even before that which is not odd since financial markets are to a large extent forward-looking. CROBEX10 reached its peak on 19th January at 1342.93 and has from there slipped down to 1152.36 on March 8th, cumulatively falling by 14,19%, and technically speaking entering into a correction phase. From March 8th to March 17th at the time of writing this article CROBEX10 has soared back up by 6,57% and it reached 1228.

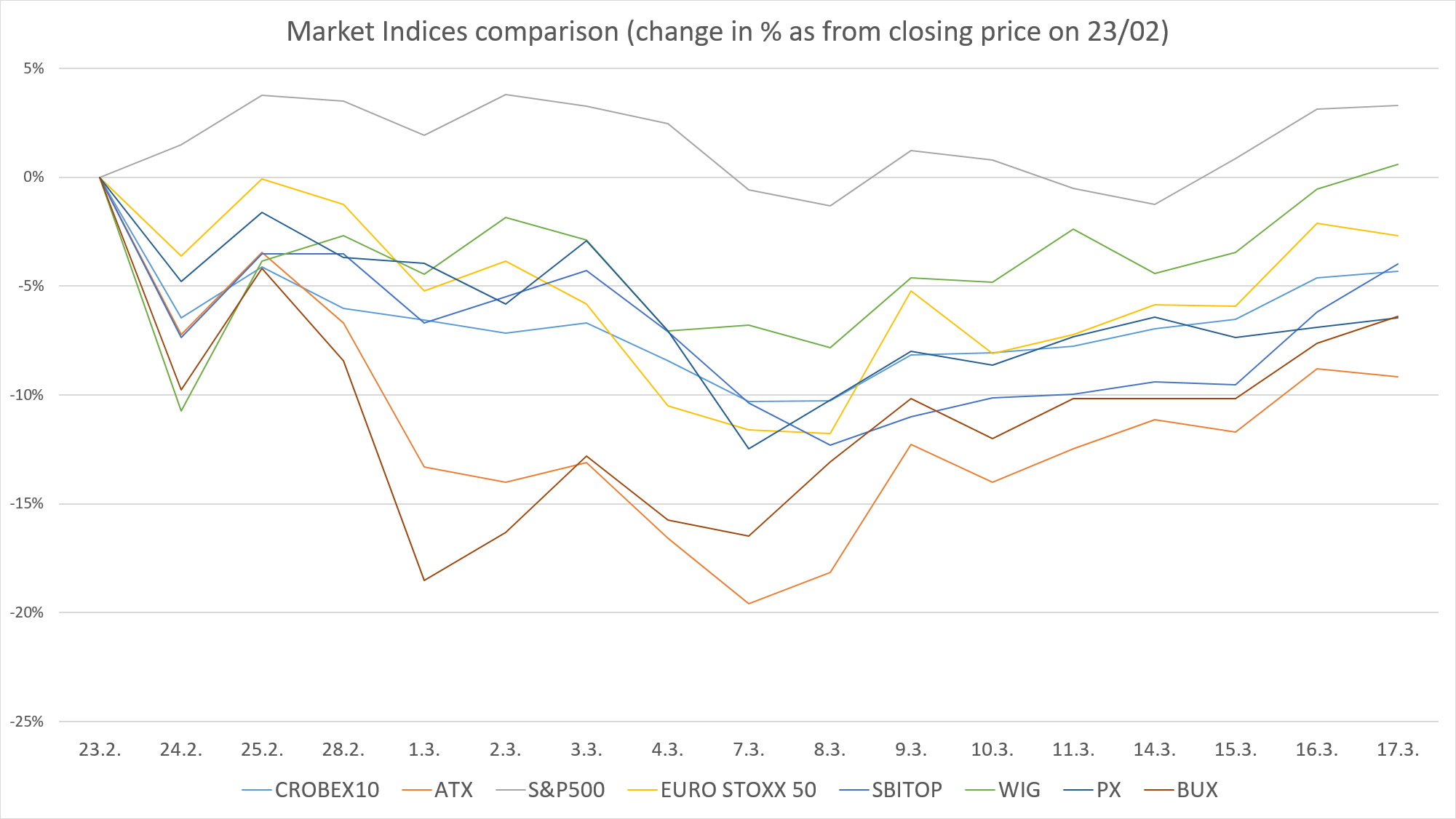

When comparing Croatian CROBEX10 with other European and American market indices we can see that some Indices experienced an even more drastic market sell-off. Most notably Polish WIG fell by 11%, Hungarian BUX fell by 10%, and Slovenian SBITOP and Austrian ATX dropped 7% on the first day of the invasion.

Some of these indices have managed to return near the price levels as before the war while others are still deep in the red zone. As of 17th of March, Austrian ATX is at -9%, Cezch PX and Hungarian BUX at -6% while Croatian CROBEX10 is at -4% compared to their price levels on the 23rd of February.

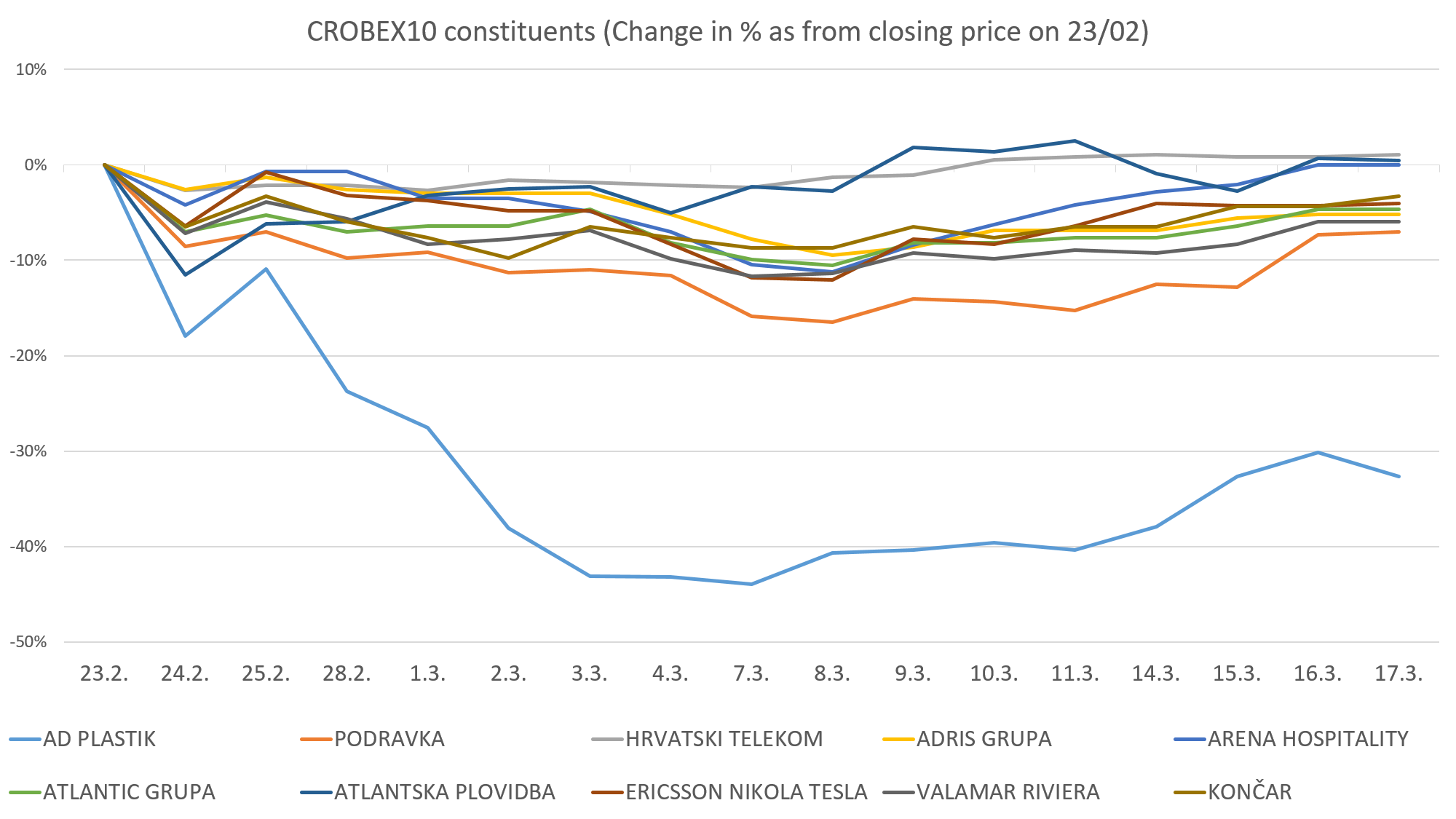

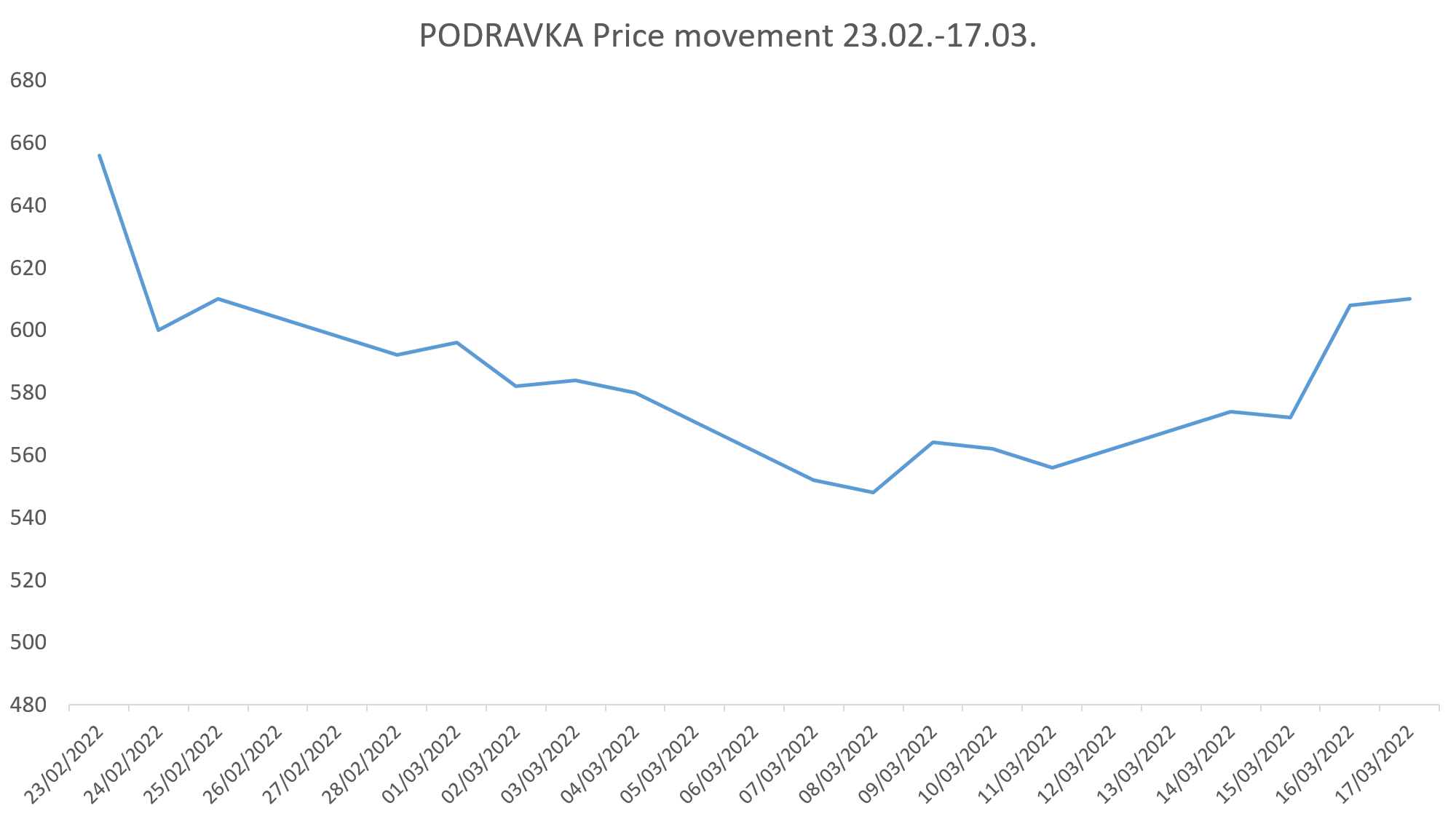

When looking at CROBEX10 and its 10 constituents we can see that on the first day of the invasion the biggest drop can be seen in Ad Plastik -18%, Atlantska Plovidba -12%, and Podravka -9%.

It is interesting to see how the market reacts to an unpredictable event such as this war and it is the best indicator of the extent of exposure these companies have to Russian and Ukrainian markets. As of the 17th of March, most of these companies are near the price levels before the war. Two companies that made an official statement to ZSE and which are clearly exposed to these markets are AD Plastik and Podravka which is also seen in their price level which is currently -33% and -7% respectively, compared to the price levels before the escalation.

AD PLASTIK

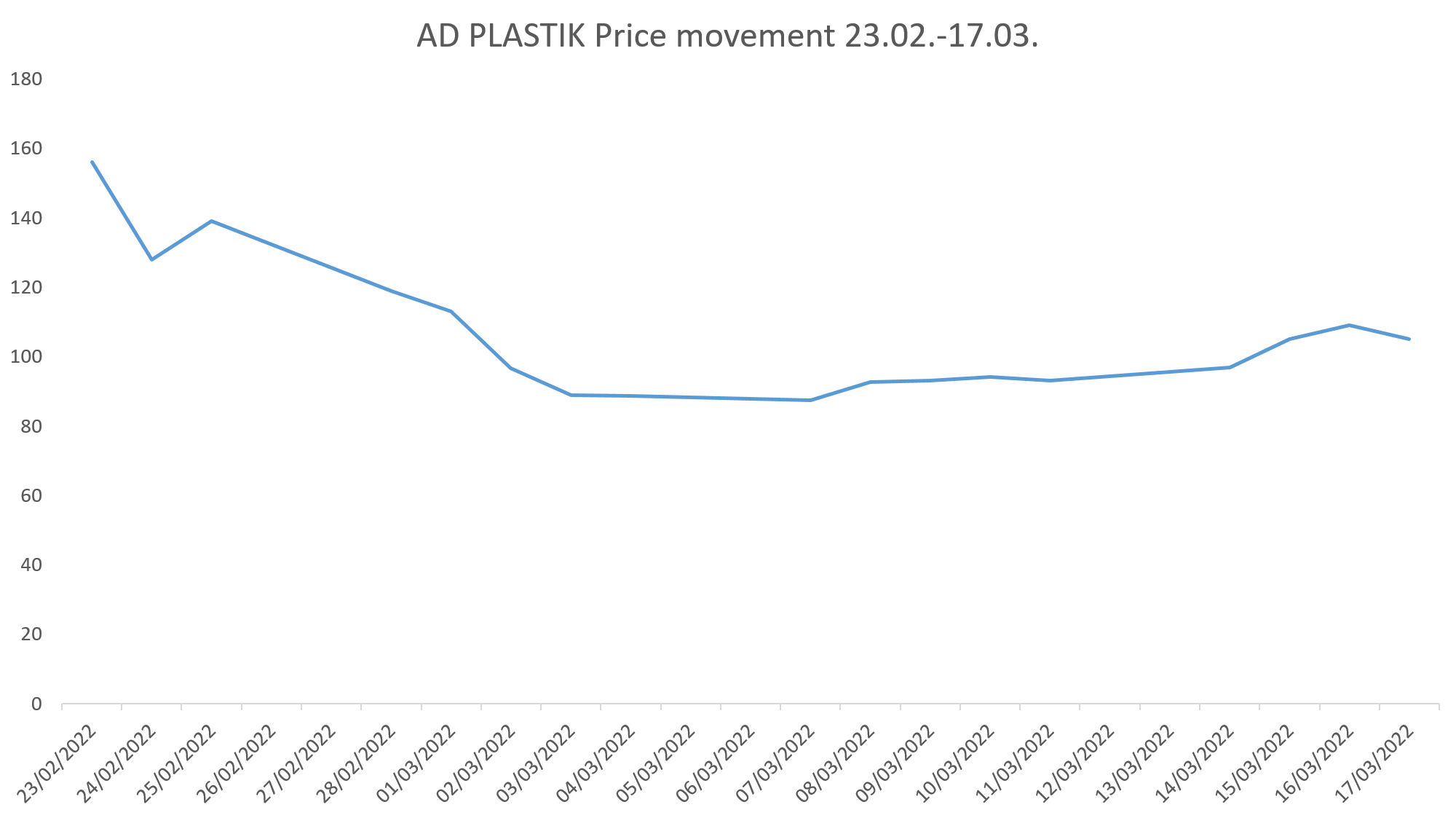

AD Plastik is a Solin-based manufacturer of automobile components. Unfortunately, AD PLASTIK is largely impacted by the Russian Ukrainian war. They have two factories in Russia which together account for around 25% of their revenue according to their statement published by ZSE. These two factories sell exclusively to the Russian market and through them, AD Plastik is exposed to the fluctuation of the Russian Rubble. The AD Plastik share price was falling from the start of the war on the 24th of February until March 7th falling by 44% and whipping out nearly 300 million HRK from their market capitalization. As of 17th March, its share price has scaled up to 105 HRK which is a 20% increase but it is still 33% lower than the share price before the start of the war.

The additional burden was the release of their 2021 financial statements on the 24th of February, which showed a drop in operating revenue by 6.8% and a drop in their EBITDA margin by 273 bps. This is most likely caused by the chip shortage and other supply chain problems in the automobile industry.

On a positive note, on March 9th, they made a public statement announcing a new contract with Stellantis Group and Motherson Group for the European market which are together worth 73,6 million Euros.

PODRAVKA

Podravka is Koprivnica based food and pharmaceutical company. According to their statement published on ZSE, the group’s exposure to Russian and Ukrainian markets account for less than 6.5% of their sales revenue. Belupo, their pharma division, had 37,1% of international sales in Russia according to their 2020 annual report. Considering that their pharma division had significantly higher EBITDA margins In 2021 with 20.5% compared to 10.6% in the food division, it Is likely that investors expect a decrease in EBITDA margins in the coming period.

On the positive side, their 2021 financial report recorded a 2.8% increase in the group’s sales revenue and a 64 bps increase In their EBITDA margin.

To conclude, the Croatian equity market has been through a few turbulent weeks and has managed to partially recover but we are still surrounded by a high level of uncertainty, with the war in Ukraine still raging, with rising inflation, and the upcoming interest rate hikes it will be a challenge for the whole world and especially for the European continent.

Disclosure: I do not own any of these shares and this article is purely for informational purposes and should not be used as the basis for any investment decisions.

SYMBOLS

EBITDA – earnings before interest taxes depreciation and amortization

WIG - Warsaw Stock Exchange General Index (WIG)

BUX -Budapest Stock Exchange Index

SBITOP – Ljubljana Stock Exchange Index

ATX - Austrian Traded Index

PX- Prague Stock Exchange Index

S&P500 - Standard and Poor's 500 Index

EURO STOXX 50 - stock index of Eurozone stocks

CROBEX- Zagreb Stock Exchange Index

Sources: zse.hr , pse.cz , RGFI , marketwatch.com , wienerborse.at, ljse.si

For more, check out our business section.