Croatian GDP Growth Among Strongest in EU at End of 2021

March the 9th, 2022 - Croatian GDP growth in the fourth quarter of last year is more than impressive, placing the country among the European Union (EU) member states with the strongest such growth of all.

As Poslovni Dnevnik writes, the Republic of Croatia is among the EU countries with the highest annual GDP growth rate in the fourth quarter of 2021, ranking behind Ireland and Malta and soaring well above the European average, new Eurostat estimates revealed this week.

The EU's seasonally adjusted gross domestic product (GDP) rose 0.4 percent in the fourth quarter of 2021 compared to the previous three months, when it increased 2.2 percent, Eurostat confirmed in its February estimate.

The Eurozone's GDP grew 0.3 percent when compared to the third quarter, when it rose 2.3 percent.

Compared to the same period a year earlier, the seasonally adjusted GDP of the EU as a bloc and the Eurozone increased by 4.8 and 4.6 percent respectively. It rose 4.1 percent in the EU and 3.9 percent in the Eurozone in the previous quarter.

Activity in both the EU and the Eurozone exceeded pre-pandemic levels from back at the end of 2019, by 0.6 and 0.2 percent, respectively, Eurostat determined on the basis of seasonally adjusted data. Throughout 2021, activity in both areas rose 5.3 percent, 0.1 percentage point stronger than Eurostat estimated back in mid-February.

Neighbouring Slovenia is at the helm...

At the annual level, all EU countries form which Eurostat obtained data recorded GDP growth in the fourth quarter of 2021, and the strongest was in neighbouring Slovenia, where it amounted to 10.5 percent.

The Slovenes are followed by Malta and Ireland with a 10 percent increase in activity, and Croatian GDP growth also places it in this group, where it grew by 9.9 percent, after a 15.3 percent jump in the period from July to September. The weakest growth among the countries with Eurostat data was recorded by Slovakia, with 1.2 percent, and Germany is close with a growth rate of a mere 1.8 percent.

Among the countries whose data were available to Eurostat, GDP in Slovenia grew the most on a quarterly basis in the fourth quarter of last year, by 5.3 percent, followed by Malta with 2.3 percent growth and Spain and Hungary, where GDP grew by two percent in both countries.

A decline in activity was recorded in Ireland, by 5.4 percent, in Austria, by 1.5 percent. The same also fell slightly in Germany, by 0.3 percent, and here in Croatia, Latvia and Romania, that fall stood at 0.1 percent. In the third quarter of last year, Croatian GDP growth stood at 1.4 percent on a quarterly basis.

Decreased employment

The number of employees in the EU and the Eurozone increased by 0.5 percent in the last three months of last year compared to the summer quarter, when it increased by 0.9 and one percent, respectively. Compared to the end of 2020, it increased by 2.1 percent in the EU and by 2.2 percent in the Eurozone. Between July and September, it rose 2.1 percent in both areas.

Recovery in Croatia...

Employment in Hungary, Denmark, Malta and Spain accelerated the most on a quarterly basis, ranging from 1.2 to 1.0 percent. Here in Croatia, the number of employees increased by 0.6 percent in the fourth quarter of last year compared to the previous quarter, when it fell by 0.1 percent. On an annual basis, the number of employees in Ireland increased by the most, by 8.4 percent.

When it comes to the growth in the number of employees at the end of last year by 3.6 percent compared to the same period back in 2020, Croatia is equal to Greece, Luxembourg and Malta. In the third quarter, the number of employees in Croatia increased by 1.7 percent on an annual basis. Only Romania saw a 9.1 percent drop in registered employee numbers.

For more, check out our lifestyle section.

Foreign Exchange Intervention: Croatian National Bank Sells €171 Million

March the 4th, 2022 - The Croatian National Bank (CNB/HNB) has sold a massive 171 million euros to various banks in a recent exchange rate intervention, the first which has taken place since back in June last year.

As Jadranka Dozan/Poslovni Dnevnik writes, on the 2nd of March, the Croatian National Bank intervened in regard to the exchange rate by selling off foreign exchange to banks in order to preserve the stability of the exchange rate, while 171 million euros were sold to banks at an average exchange rate of 7.562505, the central bank announced.

As a result of this foreign exchange intervention, which has obviously been primarily driven by increased demand for foreign exchange, about 1.3 billion kuna is being withdrawn from the system.

After the opening of that day's trading, the market exchange rate of the euro/kuna stood at 7.58, which is slightly higher than it had been. In the daily reviews of leading banks on the Croatian foreign exchange market, it could be read that on Tuesday this week, there was a slightly higher demand for euros by corporate clients for foreign currency payments, but in the past few days, a slightly higher demand was attributed primarily to the retail sector.

As briefly touched on, the Croatian National Bank last intervened in the foreign exchange market back in mid-June of last year, but then it was by buying foreign exchange from banks as a result of increasing appreciation pressures, while the last time it intervened by specifically selling off euros was in the first half of April 2021.

For more, make sure to check out our dedicated business section.

Dalmatian Dog: Croatian National Bank Issues Special Motif Kuna Coins

February the 22nd, 2022 - As Croatia's accession to the Eurozone approaches, special motif kuna in gold and silver will be issued by the Croatian National Bank (CNB/HNB) showcasing the Dalmatian, a much loved dog breed which originates from Croatia's gorgeous Dalmatian coast.

It won't be long before the Croatian national currency, the kuna, is rendered invalid and sent to the history books as the country enters the Eurozone, a move it had to promise to make in order to gain EU accession. The only countries which didn't have the make that promise and enjoyed opt-outs were Denmark and the United Kingdom.

As Poslovni Dnevnik writes, the author of the conceptual and artistic design of these special motif kuna gold and silver coins is Nikola Vudrag, and the coin which celebrates the clownish and much loved Dalmatian dog breed was made in the Croatian Mint.

The Croatian National Bank will issue a gold special motif 1000 kuna coin in a quantity of not more than 101 pieces, another gold special motif 250 kuna coin in a quantity of not more than 2,000 pieces and a silver 20 kuna coin in a quantity of not more than 500 pieces. Back in November 2021, the CNB issued two gold coins and a silver coin with the same special motif.

The sale of these gold and silver coins will be performed by the Croatian Mint, and the initial selling price is expected to be around 16,000.00 kuna without VAT for the first 1000 kuna coin, and about 3,800.00 kuna without VAT for a gold 250 kuna coin.

The initial selling price for the silver 20 kuna coin will be around 1,592.00 kuna without VAT. The final selling price of gold and silver special motif kuna coins will depend on the movement of gold and silver prices on the open market as time goes on.

Those interested can purchase these commemorative coins as of now, and more about ordering and purchasing them can be found on this website.

For more, check out Made in Croatia.

Croatian Euro Coin Design Winners Officially Announced

February 4, 2022 - Through their official social media accounts, both the Prime Minister of the Republic of Croatia and the Croatian Government shared the winning motifs for the 2 and 1 Croatian euro coin, and the 50, 20, 10, 5, 2, and 1 cent coins, all of which will enter in circulation next year.

In recent years, the conversation around Croatia's accession to the eurozone has been increasing significantly. Since joining the European Union in mid-2013, the idea of carrying out a transition from the kuna to the euro has gone from being a distant scenario to near reality. It is no secret that the Croatian government's position on such change was favorable and that, eventually, it was simply a matter of defining how and when.

Precisely, as of today, the answers to both questions are already known, as the Croatian Government, its Ministry of Finance, and the Croatian National Bank (HNB) are working on the final details. The Croatian Kuna will cease to be the official currency, and the Euro will replace it in 2023. From September 5th, prices will be displayed in both Kuna and Euros, so that both locals and foreigners get used to the idea and become familiar with the new currency. Likewise, the first two months of 2023 will serve to withdraw the Kuna from circulation. As the Governor of the HNB Boris Vujčić reported shortly ago, citizens will have the possibility of paying with kunas, but only as a way to collect those coins for their subsequent storage.

Now that the idea of the euro as the official currency in Croatia is getting closer and closer to reality, many questions have arisen from both financial authorities, companies, and even Croatian citizens themselves. The positions are diverse: from rejecting the Euro in order to defend a Croatian symbol such as the Kuna, to wondering what the economic consequences will really be. The rejection of a large sector of the population was expressed through a referendum that was recently held throughout the country. The objective of the referendum was to postpone Croatia's access to the eurozone because, it should be remembered, by being a member of the European Union, Croatia cannot bail out of using the Euro as currency, but it could keep an indefinite period of transition.

The government responded by guaranteeing that not only will the transition from one currency to another take place smoothly, but that the long-term benefits will allow Croatia to reach economic standards that allow it to equalize its status with other European Union countries. Minister Zdravko Marić revealed that the Ministry of Finance will make sure to monitor that prices are set correctly, and does not rule out the existence of sanctions for those who increase them unsustainably. For its part, the Croatian National Bank promised to effectively control the inflation rates that may be generated as a result of this currency change.

Today's session of the National Council for the Introduction of the Euro as the Official Currency in Croatia. (Photo: Goran Stanzl/PIXSELL)

Most likely, doubts will be resolved along the way, since it seems that the decision has already been made and there is no going back. Following an official Croatian government meeting earlier today, the Government of the Republic of Croatia shared the official winner designs of the Croatian Euro coin, and all the details about each design, on their social media accounts. You can watch the complete session here. Each coin was accompanied by a video and information about its designers. The Government shared the following on their Instagram account:

''At today's session of the National Council for the Introduction of the Euro as the Official Currency in Croatia, the design solutions of the Croatian side of the euro and cent coins were presented. A total of 1,299 proposals were submitted to the open competition, and the commission in charge of selecting the most successful solutions did not know who the authors were, but evaluated and ranked each proposal only on the basis of the proposed design.

The first-ranked proposals were officially approved by European Council on January 28 this year. We also thank and congratulate the authors of the selected motifs! These are:

- Ivan Šivak - author of the conceptual design "Geographic Map of Croatia" for a 2 euro coin

Najuspješniji dizajn za motiv „Geografska karta Hrvatske" - kovanica 2 € pic.twitter.com/XSxLU3OTDI

— Vlada Republike Hrvatske (@VladaRH) February 4, 2022

The author of the 2 euro coin motif, "Geographical Map of Croatia", is Ivan Šivak, born in 1985 in Zagreb. He graduated from the Academy of Fine Arts in Zagreb in 2011 at the Department of Animated Film and New Media. Since 2011 he has been a member of the Croatian Society of Fine Artists. He lives and works in Samobor.

- Stjepan Pranjković - author of the conceptual design "Kuna" for a 1 euro coin

Najuspješniji dizajn za motiv „Kuna” - kovanica 1 € pic.twitter.com/CJwzWMcIqR

— Vlada Republike Hrvatske (@VladaRH) February 4, 2022

The author of the 1 euro coin motif, ''Kuna'', is Stjepan Pranjković, born in 1995 in Ostfildern, Germany. At the Academy of Applied Arts in Rijeka, majoring in Applied Arts, module painting, he obtained the title of Master of Applied Arts in 2020. He lives in Rijeka.

- Ivan Domagoj Račić - author of the conceptual design "Nikola Tesla" for 50, 20 and 10 cent coins

Najuspješniji dizajn za motiv „Nikola Tesla” - kovanice 50, 20 i 10 centi pic.twitter.com/sGfVnrTaCX

— Vlada Republike Hrvatske (@VladaRH) February 4, 2022

The author of the 50, 20, and 10 cent coin motif, ''Nikola Tesla, is Ivan Domagoj Račić, born in 1999 in Zagreb. Today he is a full-time third-year aeronautics student at the Faculty of Transport and Traffic Sciences in Zagreb. His interest in graphic design began in high school, when he began to study independently.

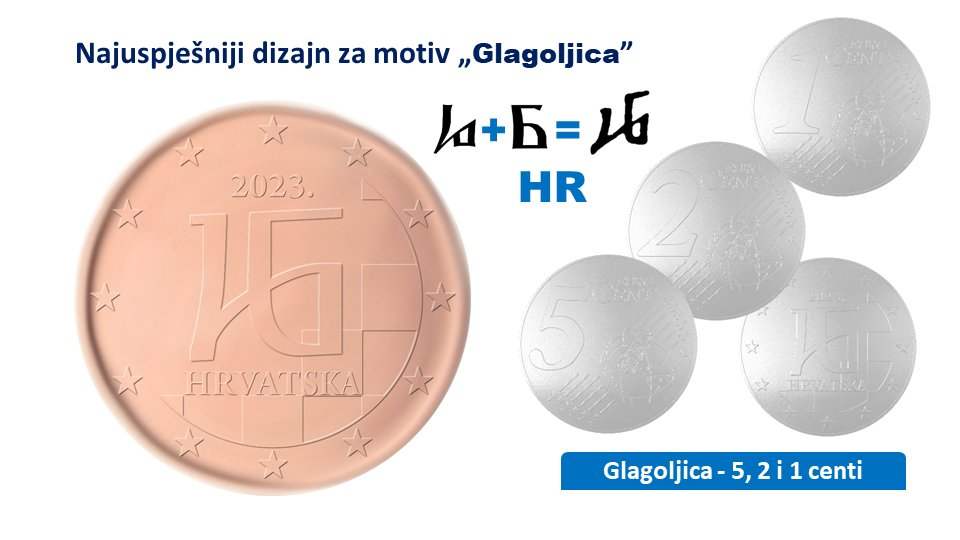

- Maja Škripelj - author of the conceptual design "Glagolitic" for coins of 5, 2 and 1 cent

Najuspješniji dizajn za motiv „Glagoljica” - kovanice 5, 2 i 1 cent pic.twitter.com/kh1IYEzSXV

— Vlada Republike Hrvatske (@VladaRH) February 4, 2022

The author of the 5, 2 and 1 cent coin motif, ''Glagolitic'', is Maja Škripelj, born in 1988 in Zagreb. She graduated from the Faculty of Architecture in Zagreb with a master's degree in engineering and architecture in February 2014. From graduation until July 2020, she worked in the architectural office, and now has her own business.

The designers behind the winning motifs for the Croatian euro coin: Ivan Šivak, Ivan Domagoj Račić, Stjepan Pranjković, and Maja Škripelj. (Photo: Goran Stanzl/PIXSELL)

After presenting the winners and their designs, the Croatian Government continued:

''In addition to the mentioned motifs, the Council of the European Union also approved another, additional motif, ie the text, which is an inscription that each country can choose and engrave on the 2 euro coin, which is the largest.

On the Croatian 2 euro coin, in addition to the Croatian chessboard, as an element of the Croatian coat of arms, and a map of the Republic of Croatia, Gundulić's verse "O LIJEPA O DRAGA O SLATKA SLOBODO" will be engraved on the rim.

As is well known, this is one of the most famous and beautiful verses from the Anthem of Freedom, which is an integral part of the pastoral "Dubravka" from the 17th century by Ivan Gundulić. The Republic of Croatia, as a symbol of Croatian statehood and independence, should also have a verse from the Anthem of Freedom, which best symbolizes the millennial aspiration for freedom of the Croatian people''.

Below we show you each Croatian euro coin in detail:

The Croatian Euro coin designed by Ivan Šivak features the geographical map of Croatia and due to its size also features the verse: ''O LIJEPA O DRAGA O SLATKA SLOBODO'' engraved on the edge.

The Croatian Euro coin designed by Stjepan Pranjković features the Kuna, Croatia's symbolic animal.

The Croatian Euro coin designed by Ivan Domagoj Račić features Nikola Tesla, the world-famous inventor and engineer born in Smiljan.

The Croatian Euro coin designed by Maja Škripelj features the Glagolitic alphabet, the oldest Slavic alphabet, from Croatia. The two Glagolitic letters chosen will form the Croatian ISO: HR.

For more, check out our politics section.

Some Zagreb Hospitality Establishments Plan to Increase Coffee Prices

February the 3rd, 2022 - Could coffee become a luxury? This Croatian custom which involves sitting around a (usually really small) cup of coffee for hours on end while putting the world to rights might be affected by the introduction of the euro as Croatia's official currency next year.

As Novac/Jutarnji writes, how we can avoid price increases is a question that is becoming more and more important as the introduction of the euro approaches. In the run up to the change, mechanisms are needed to monitor prices - such as their double expression, and, ultimately, so-called blacklists. The Croatian Government is not giving up on trying to hound this further, and it claims that it intends to denounce all those who have decided to make extra money on the back of the change unjustifiably.

It's too early to guess how much a cup of coffee will end up costing due to the introduction of the euro and the rounding off of prices. Because even before that, some Zagreb hospitality establishments will, as they say, raise their prices due to the overall higher prices of energy and raw materials.

''This year, we expect an increase in all prices due to rising energy, gas and electricity costs, as well as the already announced increase in coffee prices of 150 percent, which has been announced by some Zagreb hospitality establishments. Will coffee become a luxury now? That's the question that has arisen. The introduction of the euro in Croatia will also result in a certain price increase, Franz Letica, president of the Association of Caterers of the City of Zagreb at HOK, told HRT.

Even before the introduction of the euro, hairdressing and beauty services will become significantly more expensive, but the conversion itself should not cause too much of a price increase for the end user.

''There will be no problems in terms of recalculating prices, but it will probably involve some rounding, purely because of the simpler handling of the euros,'' said Antonija Tretinjak from the Guild of Beauticians and Pedicurists at HOK.

The growth of prices of most products is already very visible in stores. The Most (Bridge) party believes that the Croatian Government must not give up publishing a black list of traders who will unjustifiably increase their prices due to the conversion.

''What we're asking for is that this measure of publishing the list of those who unjustifiably raise prices will certainly be part of this changeover of the kuna to the euro. We also want to open the question of whether this is the time for the introduction of the euro at all,'' said Nikola Grmoja from Most.

The advantages of the introduction of the euro are multiple, says the Minister of Economy and Sustainable Development Tomislav Coric, and the black list will be one of the ways to prevent any unjustified price increases.

''The idea is that those who change their prices and use the time and process of conversion for one-time profit without any reason or basis should be noticed, both by consumers and institutions. What we'll do in the coming months is for that to happen and for them to be denounced,'' warned Coric.

The best way to prevent unjustified price increases is to double-check prices and keep making a note of them in the few months before the introduction of the euro.

Weaker Kuna During Croatian Eurozone Accession Could Pose Issues

January the 30th, 2022 - A weaker Croatian national currency (kuna) during Croatian Eurozone accession could cause more issues than solve them.

As Poslovni Dnevnik/Ana Blaskovic writes, with Croatian Eurozone accession rapidly approaching, set to occur at the very beginning of 2023, one of the main issues will be the rate at which the kuna will be exchanged for the Eurozone's single currency. There isn't really much room for maneuver as the rules require targeting around a central parity of 7.5345.

For years, critics have been making negative remarks about the Croatian kuna for being too strong, arguing that it makes the currency uncompetitive when it comes to exports, and the idea of depreciation was once supported by former president Kolinda Grabar-Kitarovic.

The Croatian National Bank (CNB) once calculated that the depreciation of the kuna by ten percent would currently increase the debts felt by residents, companies and even by the state, whose contracts have a currency clause of 50 billion kuna. All of the aforementioned now comes a detailed review of the likely repercussions.

"The negative effect of kuna depreciation on the balance sheets of Croatian sectors outweighs the positive foreign trade effect of depreciation," concluded research author Ozana Nadoveza Jelic, an advisor at the Modeling Directorate, and Rafael Ravnik, an economic analyst from Macrode.

In their paper entitled "Dependent on the Euro: The Macroeconomic Effects of Exchange Rate Changes in Croatia", the duo concluded that in the medium term, net exports would benefit relatively slightly from the kuna's depreciation, but that all domestic sectors would end up paying a much higher price.

The change in the exchange rate of the kuna against the euro would be reflected through the trade channel, ie foreign trade, in which a short-term decline would occur first, followed by an increase in net exports.

The second effect is on the balance sheet of the sector of companies which, thanks to their open exchange rate position (where debt relief also depends on the exchange rate) are faced with an increased burden of loan repayment. Consequently, they'll reduce investment, which spills over to the rest of the economy, causing a reduction in capital accumulation in the medium and long term, and thus an effect on potential GDP.

At the same time, households will also be dealing with the burden of repayment, as well as having their financial wealth denominated in euros, and there will be a further reduction in real disposable income due to rising consumer basket prices.

The state doesn't go through quite the same effect thanks to the ability to borrow in foreign currency, but the repayment burden will grow for it as much as it will for regular citizens (as ultimately it is all the responsibility of taxpayers), and the higher debt burden will consequently raise the country’s whole risk premium.

In this vicious circle as Croatian Eurozone accession comes knocking, the next step would be the growth of all interest rates in the country, one of the factors of which is the riskiness of the state.

For more on Croatian Eurozone accession, check out our politics section.

Adopting the Euro and Everyday Prices: What Can Consumers Expect?

January 25, 2022 - This year will mark the introduction of the Euro (€) in Croatia, two years after participating in the exchange rate mechanism since 10 July 2020. This set the exchange rate at 1 euro = 7.543450 kuna, with a band of fluctuation of 15%.

From September 5 onwards, retailers throughout the country should display dual prices with both kuna and euros. This measure will extend until the end of 2023.

According to the Croatian media, reactions from the general public surrounding the adoption of the Euro is one of hesitancy. Many fearing the adoption of the Euro may bring on additional inflationary prices.

This sentiment is understandable considering the country is also facing one of the highest year-on-year inflation of 5.5% (DZS).

The same fears were also expressed when 12 countries adopted the Euro in 1999. As many as 80-90% of consumers in Austria, Finland, Portugal, Netherlands, Greece, Germany, and Spain believed that prices were higher after the adoption.

But what could have led to these beliefs in euro-related inflation?

One reason is that consumers use approximated exchange rates for ease of conversions. For example, it can be more intuitive to use a rate of 8 kuna to 1 euro compared to the real rate, distorting inflation by about 6%.

Another, perhaps more calculable concern, is due to something called the rounding effect. This occurs when prices are replaced with more attractive, higher price points that frequently end with numbers 0, 5, or 9.

But are these fears justified, especially for the consumption of everyday goods? Responses from experts have so far has been encouraging.

Leading Croatian economists and even the European Commission have repeatedly assured the introduction of the Euro will not have significant effects on aggregate price levels. Researchers have also supported these claims, showing Euro-related inflation has a larger perceived (as opposed to actual) inflation on consumer prices, particularly for cheap, frequently purchased goods.

Two common sectors that can be used as examples to determine if, and how, the rounding effect may lead to an increase in average spending for consumers are: the restaurants and cafes sector, and the food and produce sector.

Food and Produce

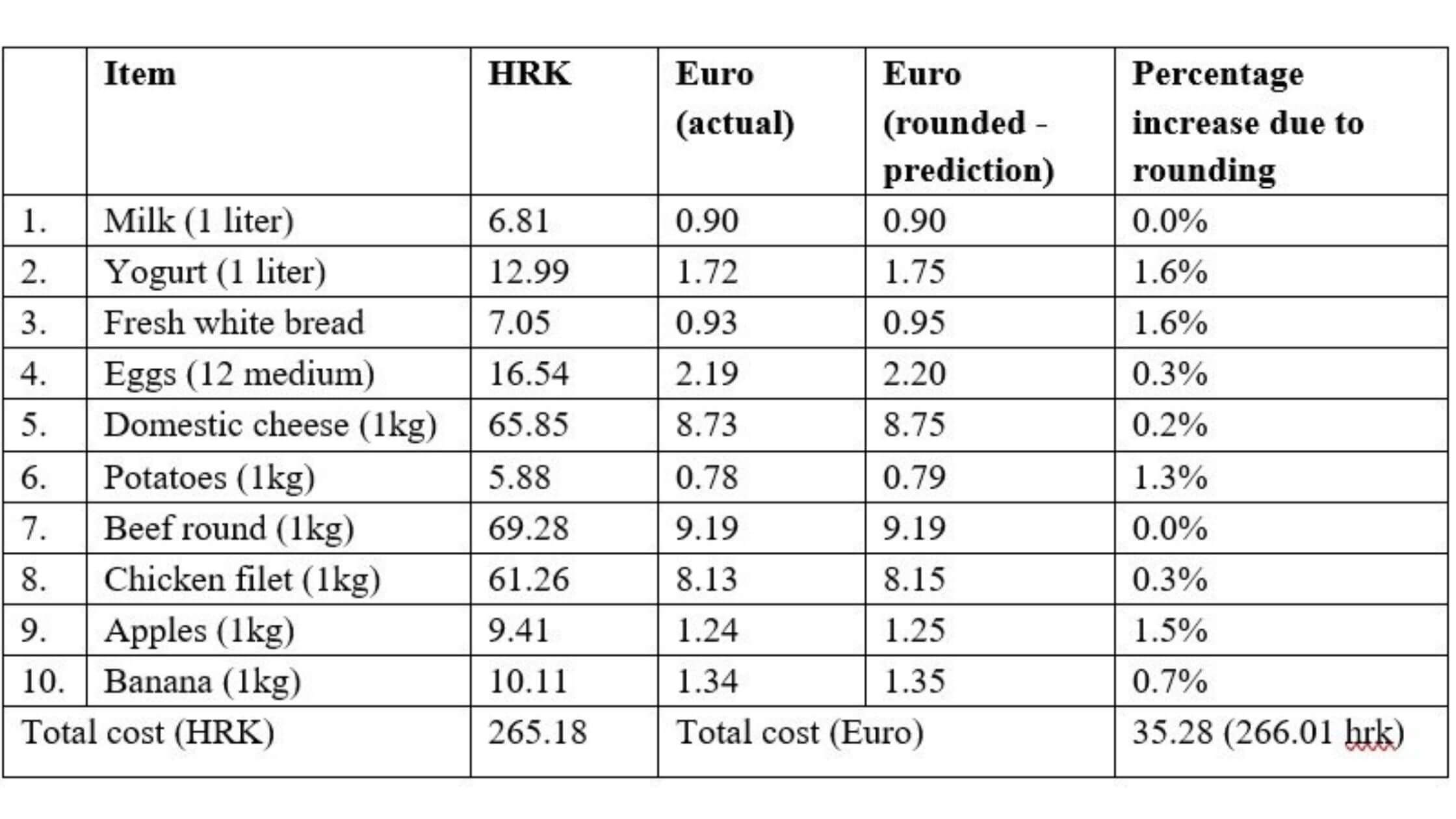

Table 1 outlines the average price of 10 common everyday household items bought on a weekly basis. Conservative estimates are made based on prices averaged from figures at Numbeo and Prices World.

These figures are based on the assumption that Euro prices are rounded to the nearest attractive price ending with 0, 5, or 9.

Table 1

When 12 countries adopted the Euro in 1999, consumer prices saw an increase of 0.12% to 0.29%. Although the increase in the rounding effect in Croatia may be slightly higher in the hypothetical scenario above, in real terms, this is almost negligible. Based on these estimates, the total cost of these weekly goods is currently 265.18 kuna. After the adoption of the Euro, the conservative estimate for the same goods is €35.29 or 266.01 kuna. A difference of 0.83 kuna or a 0.31% increase. While the euro-related inflation for everyday groceries may not burn a hole in consumers’ pockets, what about a common leisure activity, enjoying a drink or meal at a restaurant or cafe bar?

This is likely where consumers would feel more of a pinch.

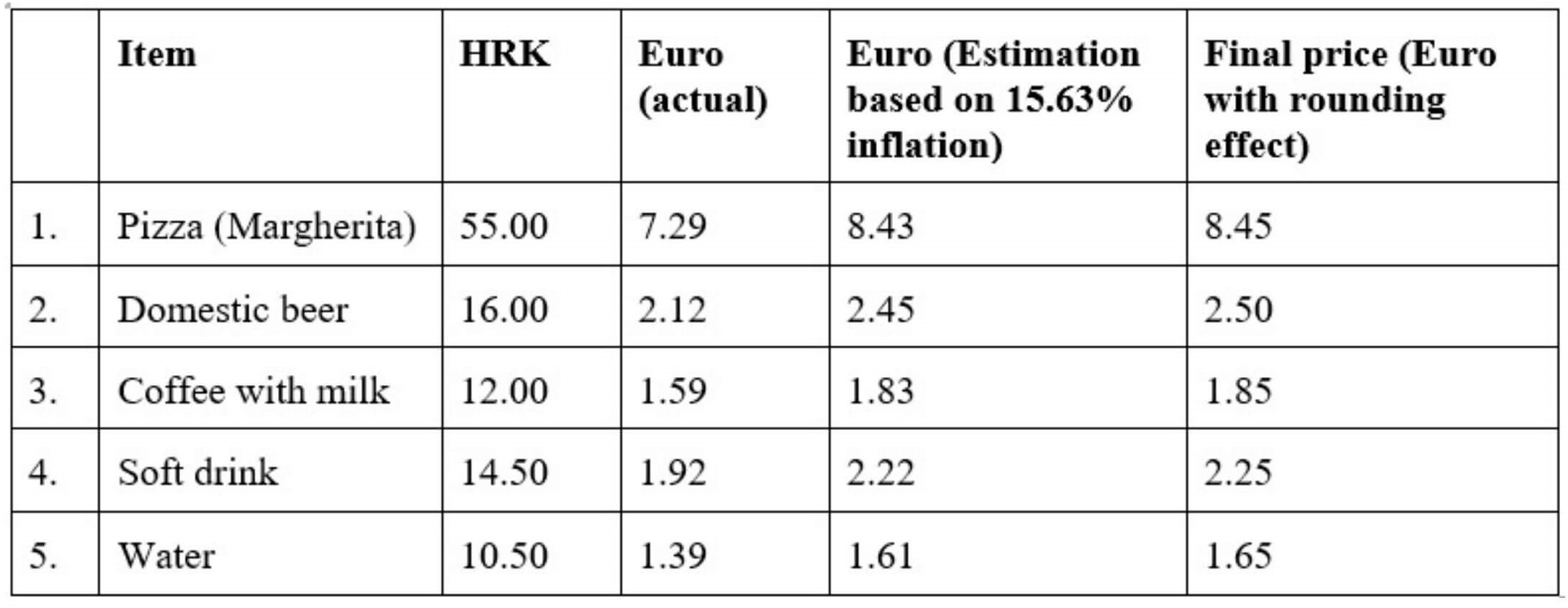

Restaurants and cafes

Back in January 2002, inflation for the restaurant and cafe industry in countries that adopted the Euro averaged a jump of 15.63%. In the following 3 months, these prices continued to increase at a rate of 5%. This was in contrast to countries that chose not to adopt the Euro, namely Denmark, Sweden, and the U.K. that only saw price increases of 1.01-2.18%.

Although the Euro was adopted by these countries in 1999 as outlined earlier, Euro notes and coins were only introduced 1 January 2002 which explains this trend. Until then, the old notes and coins of each country were still legal tender.

In neighboring Slovenia when the Euro was adopted in 2007, then governor of the central bank, Mitja Gaspari also shared a similar anecdote regarding the increase in coffee prices.

What might consumers expect from restaurants and cafes in Croatia? The following table uses similar predictions based on countries that previously adopted the Euro and includes a rounding effect.

Table 2

Using numbers from Numbeo and Price World, a meal at an affordable restaurant would average 59 kuna/person. With euro-related inflation, this could go up to 68.22 kuna/person.

The biggest jump is in mid-priced restaurants where an average meal increases from 220 kuna/person to 253.51 kuna/person.

There are a couple of explanations for this large increase in prices for restaurants and cafes, compared to food and produce.

The first scenario may be due to the switch acting as a motivator and coordination device for most, if not all, restaurant and cafe owners to switch to higher prices. This is also made possible through the widespread availability of menu prices online, leading to the rapid diffusion and adoption of a new Euro price point.

A secondary explanation for high inflationary prices can simply be attributed to the increase in anticipated menu costs due to the increase in marginal costs from raw ingredients. Since restaurants and cafes purchase these in bulk, costs accumulate relatively quickly and are passed down to the consumer.

Will these effects last?

The good news is for most euro-adopters in the long run, these spikes were largely temporary as people adjust to the new currency. The Croatian central bank is also giving inhabitants a longer time horizon of over a year to make this adjustment with dual prices lasting through 2023.

For more, check out our dedicated lifestyle section.

How Will Croatian Eurozone Accession Affect Kuna-Winning Game Shows?

January the 25th, 2022 - How will Croatian Eurozone accession, which is rapidly approaching and currently due to happen at the very beginning of next year, affect game shows in which prizes are paid out to winners in Croatian kuna?

As Poslovni Dnevnik writes, Croatian Eurozone accession will occur on January the 1st, 2023, and then the euro will replace the kuna as the official currency in this country as well. At that moment, a lot will change, but what interests quiz and game show fans is whether or not the prize money in the popular show "Who wants to be a millionaire?" will increase from one million kuna to one million euros.

Vecernji list finds out that things in that regard are still very much up in the air.

''We haven't totally ruled out the possibility of competitors fighting for a prize of one million euros, but it's more likely that this won't be the case. It will be difficult to plan seven and a half times more funds for the prize fund in the production plan than is the case now. That's a real issue, but it hasn't really been discussed yet.

The originally British "Who wants to be a millionaire?" is also aired on many commercial TV stations in other countries as well, and in those countries, the fund is covered by sponsors. Maybe part of that fund could be covered by sponsors in this country as well.

''There are different options and they are all still being discussed, and when the time comes, we'll have to decide on what our format will look like,'' said Igor Grkovic, the editor of ''Who wants to be a millionaire?" and ''The Chase''.

''We won't have any problems with "The Chase", as the amount of cash offered for the answering of the questions will simply be converted from 3,500 kuna to 500 euros. As for "Who wants to be a millionaire?", we've seen many different examples on how that's done from other countries. Slovenians play for 100,000 euros, and countries such as Slovakia, Estonia, Latvia and Lithuania cancelled their versions of the show before joining the Eurozone. I guess they didn't want it to still be being called "Who wants to be a millionaire?" when the prize isn't a million euros,'' Grkovic said.

It is interesting to compare experiences in other countries. As previously touched on, "Who wants to be a millionaire?" started in the UK back in 1998 and has been broadcast in more than a hundred countries since. Regardless of the name, in some countries, much less than a million is won. For example, in the Albanian and Kosovar versions of the show, the highest prize was 50,000 euros. A new season of the show is being broadcast in Bulgaria, where the main prize is 100 thousand levs, or 385 thousand kuna, and in Greece, as well as in neighbouring Slovenia, the top prize is 100 thousand euros.

For more on Croatian Eurozone accession, check out our lifestyle section.

Boris Vujcic Reveals All Locations for Kuna-Euro Cash Exhange

January the 22nd, 2022 - Boris Vujcic has revealed all of the locations at which the Croatian kuna can be exchanged for the euro as the country edges closer to Eurozone entry.

As Poslovni Dnevnik writes, Prime Minister Andrej Plenkovic and CNB Governor Boris Vujcic addressed the public at a recent session of the Council for the Introduction of the Euro as the Official Currency, held at the National and University Library.

Plenkovic: There are many advantages for citizens

"Why is the introduction of the euro good? There are benefits for our citizens. Currency risks will disappear. The euro will bring with it a great impetus to the international exchange of goods and services,'' explained Plenkovic.

“Euro deposits account for more than 76 percent of total time and savings deposits with banks, and 50.3 percent of total bank placements are euro placements. We intend to highlight several fundamental principles of this process which are included in the bill. The first and most important thing is consumer protection, we must prevent any situations that would take advantage of the introduction of the euro to the detriment of consumers,'' added the Prime Minister.

"The intention is that in the beginning the prices will be expressed twice, both in kuna and in euros. Throughout the whole of 2023, after the introduction of the euro, prices will also remain highlighted in kuna. So, first we'll pay in kuna and see the prices in euros, and then we'll pay in euros, but we will also have the prices visible in kuna,'' he said.

After Plenkovic, CNB Governor Boris Vujcic spoke, HRT writes:

"The most important thing in the law is that it contains the principle according to which the existing contracts stating the reference to the kuna are still valid. We're removing any possibility of legal uncertainty during Croatia's changeover to the euro,'' he said.

"When it comes to the process of exchanging the kuna for the euro, consumer protection is important. Converting kuna into euros will be done by and in banks automatically and without any incurred costs,'' assured Boris Vujcic.

"As for deposits and loans, people don't need to worry, the conversion into euros will be done automatically on the day of the introduction of the euro in Croatia at a fixed conversion rate and without any cost. Agreements on all loans and deposits will continue to be valid,'' he added.

"As for interest rates, the rule is that fixed interest rates will remain fixed, and when it comes variable interest rates, if the variable parameter needs to be adjusted when introducing the euro due to rounding, this law stipulates how this adjustment will be made," Boris Vujcic said.

"The consumer must not be put in a worse position than they were in before"

"Again, the important principle is that the consumer cannot be in a worse position than they were in before. If there are any differences in the second decimal, it will be at the expense of the bank, not at the expense of people. When exchanging kuna cash, about 36 billion kuna is in circulation at the moment, it would be good to deposit as much of that money in banks as possible this year in order to logistically facilitate the conversion itself,'' noted the governor.

"Those who fail to do so will have a chance after that, for one year at Fina, in banks and at Croatian Post (Hrvatska posta) offices, and banknotes will be able to be exchanged forever at the CNB, and the same will be made possible for kuna coins for the next three years," concluded Boris Vujcic.

For more, check out our dedicated lifestyle and politics sections.

Plenkovic Talks Croatian Eurozone Entry: Cash At Home? Bank It!

January the 18th, 2022 - Plenkovic has discussed the impending Croatian Eurozone entry and told people who have kuna in cash at home or wherever else to bank it to make their lives easier when the transition happens.

As Poslovni Dnevnik writes, Plenkovic also reminded people of Croatia's entry into the EU back in July 2013 and the referendum by which the Croatian people confirmed their desire to enter the bloc.

"The Schengen zone and the Eurozone are the only two deeper integrations that Croatia needs to join at this point. The year 2022 is the year of decisions on both," said the Prime Minister.

"Back in 2017, we launched a public debate on the introduction of the euro in Croatia, and a few months later the government adopted this strategy. Why is Croatian Eurozone entry happening? Because we're already a very highly euroized economy,'' he said, noting that 70 percent of tourism revenues come from tourists from EU member states which typically have the euro as their main currencies. He also mentioned that most savings and loans in Croatia are tied to the euro, as N1 also reported.

"Both savings and loans and trade and tourism revenues are linked to the Eurozone," Plenković said. He also spoke about the law on the introduction of the euro as the official currency in Croatia. "The goal is for the adjustment to go smoothly and to enable the economy to function, for people to be informed of things in good time and for Croatian Eurozone entry to be done in a fair and proper way."

In just one year, the only means of payment in Croatia will be the euro, and the kuna will enter the history books.

"This time in one year, the only means of payment in Croatia will be the euro. It's very important to understand the speed of completion of this process, with the introduction of the euro, everything in kuna in the banks will automatically be converted into euros,'' Plenkovic said.

He also spoke about highlighting prices in both euros and kuna.

"Prices will be highlighted in kuna and euros for another year, and for the whole of 2023," he added, noting that the double price highlighting will start in September this year and will continue throughout next year.

"Everyone will be able to exchange kuna for euros in banks, at Fina and at the post office. The transition process will take another year after Croatian Eurozone entry. An additional element is that after that deadline, people will be able to bring their kuna into the CNB and exchange that money for euro banknotes,'' noted Plenkovic.

"I'd like to invite people who have kuna cash at home to come and deposit it at the bank, because the money in kuna will automatically be converted into euros," he concluded.

For more, check out our politics section.