January 25, 2022 - This year will mark the introduction of the Euro (€) in Croatia, two years after participating in the exchange rate mechanism since 10 July 2020. This set the exchange rate at 1 euro = 7.543450 kuna, with a band of fluctuation of 15%.

From September 5 onwards, retailers throughout the country should display dual prices with both kuna and euros. This measure will extend until the end of 2023.

According to the Croatian media, reactions from the general public surrounding the adoption of the Euro is one of hesitancy. Many fearing the adoption of the Euro may bring on additional inflationary prices.

This sentiment is understandable considering the country is also facing one of the highest year-on-year inflation of 5.5% (DZS).

The same fears were also expressed when 12 countries adopted the Euro in 1999. As many as 80-90% of consumers in Austria, Finland, Portugal, Netherlands, Greece, Germany, and Spain believed that prices were higher after the adoption.

But what could have led to these beliefs in euro-related inflation?

One reason is that consumers use approximated exchange rates for ease of conversions. For example, it can be more intuitive to use a rate of 8 kuna to 1 euro compared to the real rate, distorting inflation by about 6%.

Another, perhaps more calculable concern, is due to something called the rounding effect. This occurs when prices are replaced with more attractive, higher price points that frequently end with numbers 0, 5, or 9.

But are these fears justified, especially for the consumption of everyday goods? Responses from experts have so far has been encouraging.

Leading Croatian economists and even the European Commission have repeatedly assured the introduction of the Euro will not have significant effects on aggregate price levels. Researchers have also supported these claims, showing Euro-related inflation has a larger perceived (as opposed to actual) inflation on consumer prices, particularly for cheap, frequently purchased goods.

Two common sectors that can be used as examples to determine if, and how, the rounding effect may lead to an increase in average spending for consumers are: the restaurants and cafes sector, and the food and produce sector.

Food and Produce

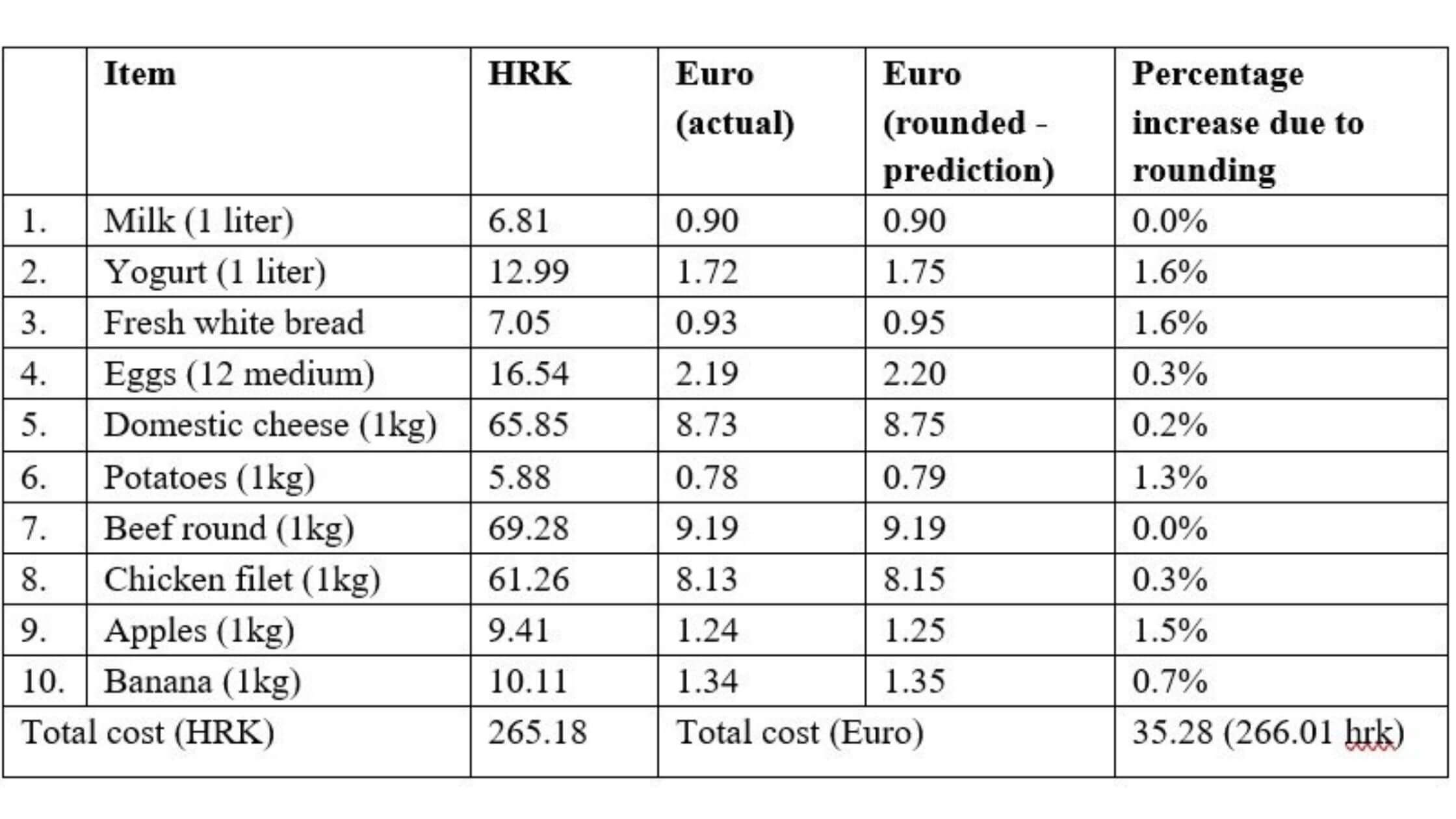

Table 1 outlines the average price of 10 common everyday household items bought on a weekly basis. Conservative estimates are made based on prices averaged from figures at Numbeo and Prices World.

These figures are based on the assumption that Euro prices are rounded to the nearest attractive price ending with 0, 5, or 9.

Table 1

When 12 countries adopted the Euro in 1999, consumer prices saw an increase of 0.12% to 0.29%. Although the increase in the rounding effect in Croatia may be slightly higher in the hypothetical scenario above, in real terms, this is almost negligible. Based on these estimates, the total cost of these weekly goods is currently 265.18 kuna. After the adoption of the Euro, the conservative estimate for the same goods is €35.29 or 266.01 kuna. A difference of 0.83 kuna or a 0.31% increase. While the euro-related inflation for everyday groceries may not burn a hole in consumers’ pockets, what about a common leisure activity, enjoying a drink or meal at a restaurant or cafe bar?

This is likely where consumers would feel more of a pinch.

Restaurants and cafes

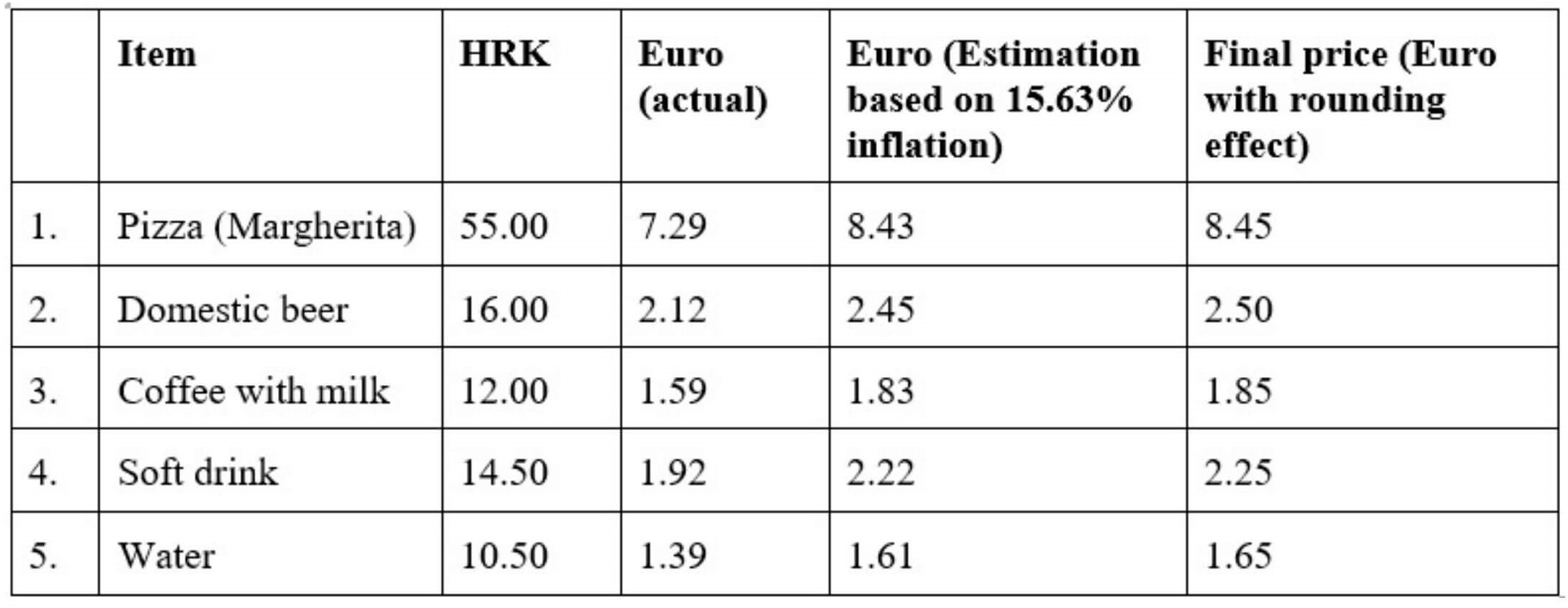

Back in January 2002, inflation for the restaurant and cafe industry in countries that adopted the Euro averaged a jump of 15.63%. In the following 3 months, these prices continued to increase at a rate of 5%. This was in contrast to countries that chose not to adopt the Euro, namely Denmark, Sweden, and the U.K. that only saw price increases of 1.01-2.18%.

Although the Euro was adopted by these countries in 1999 as outlined earlier, Euro notes and coins were only introduced 1 January 2002 which explains this trend. Until then, the old notes and coins of each country were still legal tender.

In neighboring Slovenia when the Euro was adopted in 2007, then governor of the central bank, Mitja Gaspari also shared a similar anecdote regarding the increase in coffee prices.

What might consumers expect from restaurants and cafes in Croatia? The following table uses similar predictions based on countries that previously adopted the Euro and includes a rounding effect.

Table 2

Using numbers from Numbeo and Price World, a meal at an affordable restaurant would average 59 kuna/person. With euro-related inflation, this could go up to 68.22 kuna/person.

The biggest jump is in mid-priced restaurants where an average meal increases from 220 kuna/person to 253.51 kuna/person.

There are a couple of explanations for this large increase in prices for restaurants and cafes, compared to food and produce.

The first scenario may be due to the switch acting as a motivator and coordination device for most, if not all, restaurant and cafe owners to switch to higher prices. This is also made possible through the widespread availability of menu prices online, leading to the rapid diffusion and adoption of a new Euro price point.

A secondary explanation for high inflationary prices can simply be attributed to the increase in anticipated menu costs due to the increase in marginal costs from raw ingredients. Since restaurants and cafes purchase these in bulk, costs accumulate relatively quickly and are passed down to the consumer.

Will these effects last?

The good news is for most euro-adopters in the long run, these spikes were largely temporary as people adjust to the new currency. The Croatian central bank is also giving inhabitants a longer time horizon of over a year to make this adjustment with dual prices lasting through 2023.

For more, check out our dedicated lifestyle section.