Croatian Banks Act as Cash Warehouses, And They're Earning Handsomely

May the 15th, 2023 - Croatian banks have been acting as real cash warehouses ever since the country's accession to the Eurozone back in January this year, and they're earning a pretty penny for that ''work''.

As Poslovni Dnevnik writes, it is only logical that the net interest income of Croatian banks grew because they increased their own interest on loans issued to their clients. Interest on savings however doesn't follow that trend, those figures are still barely above zero, meaning that both margins and earnings are increasing, writes Rijeka-based portal Novi list.

In addition to these usual reasons for bank profit growth, which therefore derive from "core" operations, Croatian banks have had one additional source of income since the New Year, more specifically since the Republic of Croatia officially entered the Eurozone, which wasn't there before, and the same of course concerns the European Central Bank's key rates.

More specifically, we are talking about increasingly high interest rates on deposits held by commercial banks within the central bank, and in Croatia's case this regards the Croatian National Bank. Namely, until the country entered the Eurozone, the rate for depositing liquidity surpluses with the CNB was a firm zero. With this year's entry into the Eurozone, all of the key rates of the "new monetary centre", the ECB in the German city of Frankfurt, began being applied to the domestic market as well.

It's important to explain that the ECB is constantly raising its key rates, which is why interest rates on loans are also always rising. This is what the banks are talking about when they discuss the "deposit facility rate" increasing and this also represents one of the ECB's three key rates, which specifically refers to those funds that commercial banks keep hold of with central banks.

At the time of Croatia's entry into the Eurozone back on January the 1st, 2023, this ECB rate stood at two percent. Immediately following accession, Croatian banks began to receive returns on the money they kept with the CNB.

Surplus liquidity that Croatian banks have kept in their accounts with the Croatian National Bank in the period since the beginning of the year currently amounts to around 14.4 billion euros on average.

In the aforementioned period, the European Central Bank continued the cycle of raising its interest rates that began back in July 2022, and interest rates on overnight bank deposits with the central bank rose from 2 percent at the beginning of the year to 3.25 percent in May. Accordingly, banks operating in Croatia were paid out a massive 85.6 million euros in interest in the first quarter of this year, according to the CNB.

For more, check out our dedicated news section.

Marko Rakar: About Legitimate Interest and the Biggest Banking Secret

April 30, 2023 - The King of Data is back, as Marko Rakar spearheads an initiative to help thousands affected by the Swiss Franc bank loan affair, offering hope of compensation.

Several thousand debtors with loans taken out in Swiss francs received an offer from the company Druga Foundation to their home addresses in recent days, an offer to take over their claims against the banks. The media announced that consultant Marko Rakar and economist Vuk Vuković are behind the initiative, as well as a dozen other lawyers, experts, mathematicians and bankers.

Here is Marko in his own words on the subject.

My general thinking is that you shouldn't spend too much time on sponsored articles, but a few days ago (and again today) I was called out in one such sponsored content, so it's time to look back on it. The first few paragraphs are an introduction to the story, and only then do the details about GDPR and banking secrets begin.

In creative ways, with the frequent use of quotation marks and a lot of question marks, the article stretches out the superficial understanding of law and elementary logic, and problematizes the action carried out by the Second Foundation, of which I am the director. That trading company was founded with a very simple and clear goal, which is to help an extremely large and, in my opinion, tormented social group to use their legal right to compensation for the damage caused to them by the banks when contracting and then collecting loans and leasing that were denominated in Swiss francs. A lot has been written about this entire issue in the last fifteen years, laws were passed to at least partially solve the problem, the state sued the banks (and probably lied in its answers before international bodies), and speculated in secret settlements.

However, when everything is added up and subtracted, according to the numbers known today, we know that there are around 120,000 citizens who were damaged in the process and who are entitled to compensation from the banks. Banks at the same time (totally wrongly but very persistently) repeat the untrue mantra that the conversion of CHF loans into EUR is at the same time compensation. What is true is that the Supreme Court in December 2022 made a legal understanding that injured consumers who have converted their loans are entitled to compensation on the basis of default interest; more precisely, "the consumer/user of the loan has the right to the payment of the corresponding default interest on the overpaid amounts that the bank charged to the consumer when calculating the conversion of the loan.". Ultimately, this legal understanding did not pass the court record and a new decision is expected literally days before the statute of limitations begins, so there is a real possibility that the Supreme Court's decision will be different (hopefully more comprehensive and favorable to the injured citizens).

Croatia is not the only country where a problem with loans in Swiss francs has appeared. In other countries, the courts ultimately made decisions about the total nullity of the contract (therefore it is considered that the deal did not happen at all, the effects of such a solution can be written in even bigger and longer texts), the latest example of this is Slovenia, where the nullity was recently declared. Our position here is somewhat specific, because at the time when loans were issued in CHF, we were not part of the European Union, and it seems that our Government played a not necessarily clean game on this topic by siding with the banks at a time when a dispute was raised before the EU bodies.

Land registers, GDPR and legitimate interest

Banks (through the association of banks) and a native journalist from Večernji, as expected, question our use of data, but what we have done is based on laws and regulations.

(Article 7 of the Law on Land Registry.)

To begin with, attention should be drawn to the Law on Land Registers, namely in Article 7. It clearly states that land registers are public in their entirety. This means that any person can, without stating a reason (legal interest), have unlimited access to land registers. Public availability of data from land registers, among other things, ensures legal security in real estate transactions and protects the transfer of rights to real estate from possible risks. Protection of the public availability of land registers is one of the fundamental principles of land register law. The principle of public in the material sense implies that land registers, extracts and transcripts from them enjoy public faith that their content is complete and true, while the principle of public in the formal sense means that land registers are public because their content is available to everyone. Anyone can request an inspection of the land register and all auxiliary lists and obtain extracts and transcripts from it. The right to inspect the land register is completely unlimited, neither for obtaining an inspection of the land register nor for viewing them, as well as for requesting printouts, transcripts and extracts from the land register, it is not necessary to prove or make probable the existence of a legal or any other interest (details on you can read about it in the scientific-professional paper here). Public availability of land registers is not a Croatian specificity, it is simply a European asset and in a similar way you can access land registers (almost) anywhere in the world.

Therefore, there is no doubt that our data source is not only legitimate, but also completely legal, but also in full compliance with the spirit and intent of the law.

The General Data Protection Regulation (GDPR) regulates how it is possible to collect and process personal data of citizens. The fundamental principle we are interested in here is the legal basis we use, which is called legitimate interest. We believe that the information on the right to compensation is 1001% in line with the protection of the rights of the injured party and the legitimate interest of CHF loan users, whose rights are not limited or jeopardized by this type of processing, but part of their rights are fulfilled, which, given their interest, have priority over others and possibly "other people's" rights. There is simply a legitimate interest of the Second Foundation, as a data processing manager, to try to establish or establish on the basis of public data sources contact with respondents in order to exercise their rights, protect them by providing them with information, advice - without the obligation to enter into a business relationship. On the fact that the legal basis of legitimate interest is applicable in this case, read the opinion of AZOP from December 2022.

Furthermore, Article 6 of the General Data Protection Regulation (GDPR Directive) prescribes and states which legal bases may be applied for data processing. Thus, we can also say that processing through the register of land registers is legal because:

- is necessary in order to protect the interests of natural persons, specifically, citizens damaged by banks through disputed loans in CHF,

- because it protects the public interests of the Republic of Croatia and all citizens to exercise their right to compensation, and at the same time the Republic of Croatia does not suffer damage nor will it inflict damage on its own citizens by violating their fundamental rights,

- provides information and advice to citizens in order to further inform them about their rights, given that they are not given to them by other institutions, and which does not endanger other rights of citizens or put them in a disadvantageous position, on the contrary, it enables them that if they wish to exercise rights they did not know about,

- is not prohibited by any law of the Republic of Croatia,

- processing is also enabled by the PSI directive.

Banning the processing of such data would create a disproportionate benefit for banks (at least EUR 330 million), to the detriment of citizens. Moreover, it would be a disproportionate benefit of the banks in a case that has been proven in numerous court proceedings as a violation of the banks to the detriment of a large number of citizens. And finally, the use of data is in accordance with the European PSI (Public Sector Information) directive, which encourages the reuse and creative use of data from public sources.

However, let's imagine for a moment that this processing is not allowed, then several unsustainable situations would arise:

- citizens harmed by banks through disputed loans in CHF would be denied the possibility to be offered information, advice, or a business relationship for the transfer of compensation by any natural or legal person who

observe this information through the register of land registers, - any natural or legal person who in their activity

searches the register of land registers for the needs of his business would not

may no longer use that data. This includes banks and agencies for

collection of services that use that register in their regular work business without asking the permission of each person whose data is - searched,

- citizens would be deprived of a whole range of services based on

the use of data collected through the public land registry

books, and are also based on the provision of information, services, and

business relations based on data from the register of land registers

(such as real estate companies), - insight into the potential corruption of politicians, public

of employees and banks would be difficult or completely impossible if the protection of CHF data from the register of land registers is not allowed,

there would be a conflict with the legislator's intention to provide public - data through the register of land registers, provide citizens with protection their rights (in this case, the rights of citizens injured in the Frank case to be helped in obtaining compensation in situations where they are not sufficiently informed about their rights or do not have the knowledge or skills or financial prerequisites to exercise the right to compensation).

To simplify, the Association of Banks and the native journalist of Večernji List claim that it is not allowed to inform citizens that they have the right to compensation. Imagine you drop your wallet in a mall parking lot, I noticed it, picked up the wallet and the moment I tried to open the wallet to try to find your address or phone number to notify you and return your money and wallet, the parking attendant (aka employee of a shopping center, probably at heart a PR person or a marketer) shouts over the loudspeaker that GDPR forbids me to open my wallet!

The biggest banking secret

The reason why we started the Second Foundation in the first place is the conclusion that many injured citizens do not even know that they have been injured and that they have the right to compensation from the banks that have given them credit. Although a lot was written about the issue of CHF loans (as well as leasing), due to the obvious asymmetry between the banks' PR departments and the few injured citizens who spoke about it (where the Frank Association undoubtedly played the biggest role). In the public discourse, it is common opinion that citizens are also compensated by the banks by the act of conversion and have no other right. If you read the statement of the bank association, they repeat that claim like a parrot, even though they know very, very well that it is absolutely incorrect and in conflict with judicial practice, and especially with the legal position of the Supreme Court of the Republic of Croatia from December last year. In the past few days, we have received hundreds of messages from people who realized for the first time that they are entitled to compensation.

The information campaign that we are carrying out is an action that the banks had to carry out independently and offer their clients compensation in accordance with court practice, or an action that the state should have carried out in such a way that, for example, FINA transfers money to the accounts of citizens at the expense of the banks, this is all that stands between the injured citizens and banks are the Franak Association and the Second Foundation (each with its own approach to the problem).

Data on how many citizens are entitled to compensation is very difficult to find (in the annual reports of banks, this data, as well as data on initiated disputes, settlements and completed disputes, are not published because "their public publication could have material effects on the banks' operations", but it is public information that about 120,000 loans were issued that were denominated in Swiss francs. About seventy thousand of them related to non-purpose loans (adaptations, cash, car loans), while the remaining fifty thousand loans related to the purchase of real estate. The other foundation contacted only these about fifty thousand who had registered CHF mortgages, and that's because they are the only loan beneficiaries that can be identified from public sources, but if you are in this second group, we also want to hear from you.

According to current judicial practice, these fifty thousand families are entitled to compensation, which, according to our estimates, is at least 330 million euros. Unfortunately, even with this compensation, our fellow citizens will not be in any profit because for many of them, the unilateral behavior of the banks in the past years caused permanent and irreparable damage and destroyed human lives. The banks are protesting because we made public the secret they have been carefully hiding these years and informed fifty thousand people that they are entitled to compensation, and that a few weeks before the statute of limitations (June 16, 2023).

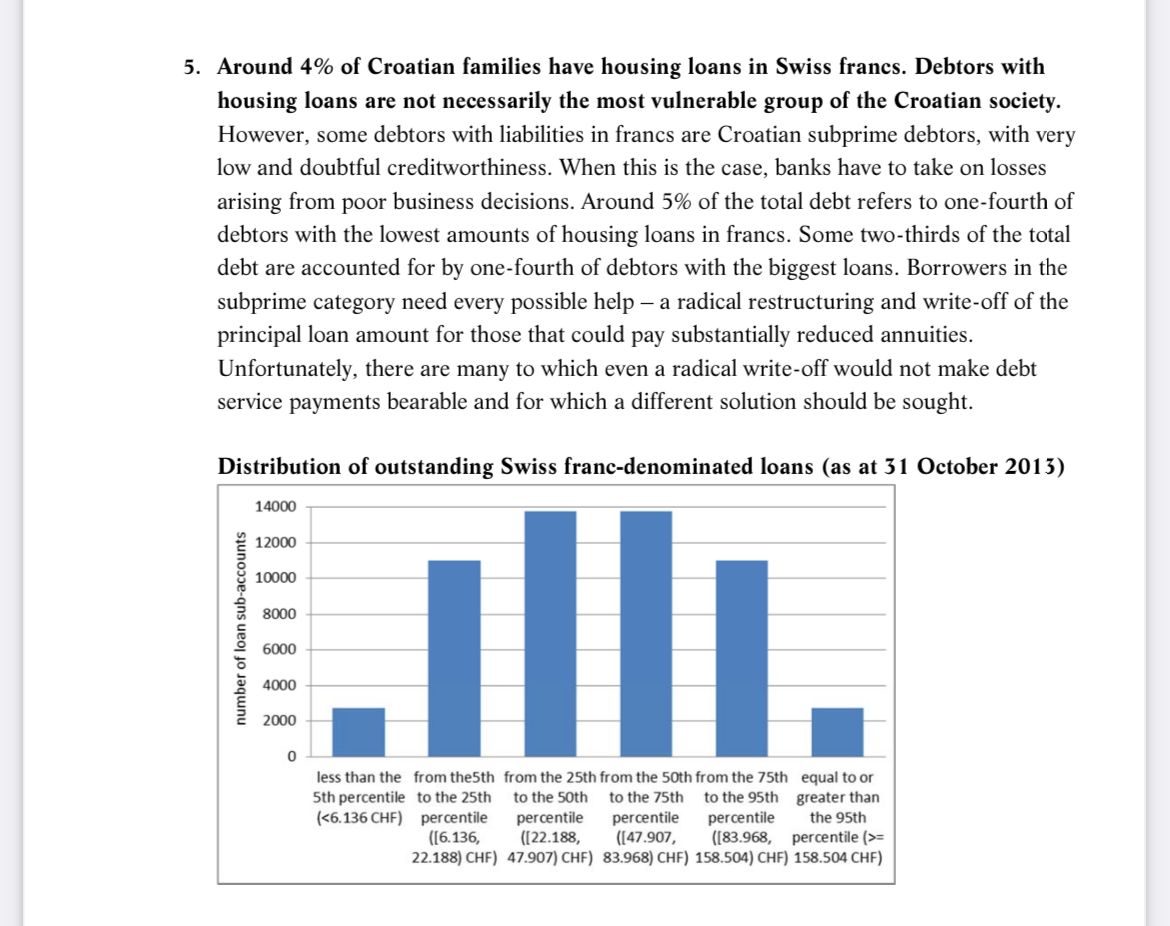

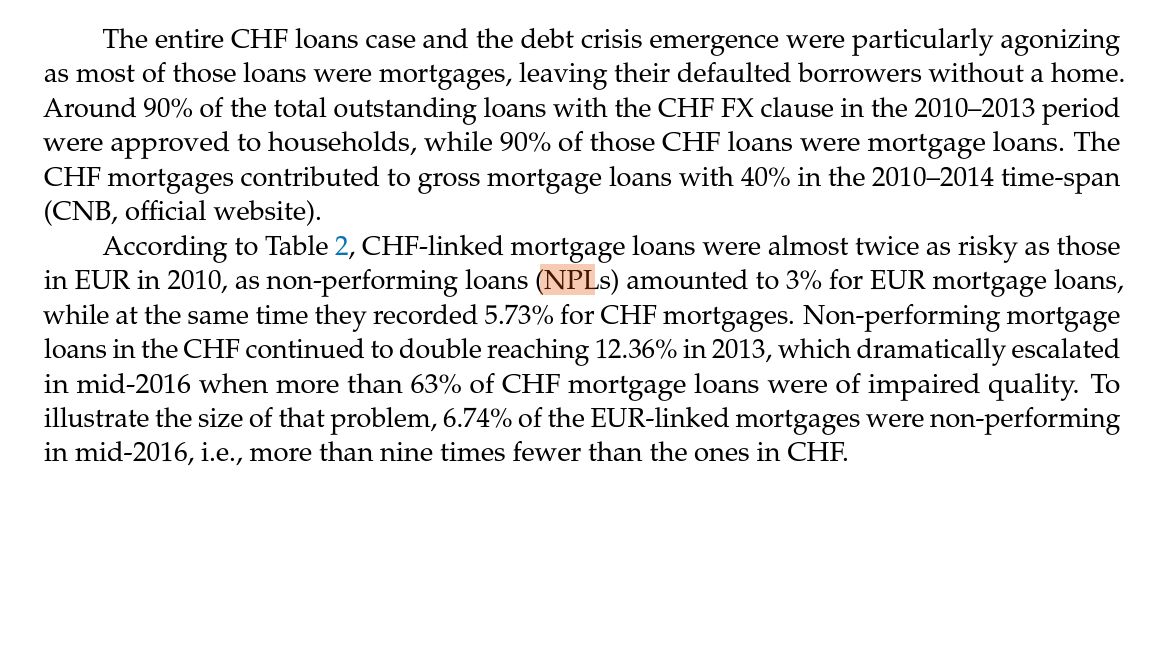

(CNB report in which users of CHF loans are called "subprime".)

In a CNB document from 2015, loan users in the Swiss are called "subprime" (remember the American movie "Big Short"), subprime loan holders are those who can reasonably be assumed to have difficulties in repaying the loan. At the moment when the Swiss central bank decided to remove the indexation with the EUR (our Kuna was indexed in the same way from the first to its last day), loan installments often doubled and became unrepayable overnight. The motivation for loans in the Swiss was the interest rates, but the devil is in the details, mortgage loans are taken out over many years and the repayment plans are arranged in such a way that at first the monthly repayment is largely due to the interest, a smaller part to the principal, and that balance would change over time. If you wanted to buy a property worth EUR 100,000, due to the accumulation of interest costs over a long period of time, with a higher interest rate on EUR loans, you could, for example, borrow for only EUR 70,000, while the same loan repayment plan, but in CHF, could provide money for the full value of the property. The bank looks at the value of the collateral (the property you are buying) and your repayment options. CHF loans were an option for you to buy the property you wanted within your repayment capacity (or you bought a bigger property for what you thought was the same money).

Until the middle of 2016, as many as 63% of loans in Swiss francs were of "impaired quality", which translated means that as many as 63% of all loan holders had problems in repayment (which the banks ingeniously tried to solve by unilaterally raising interest rates to reflect the increased risks). Delinquency was nine times higher than with EUR loans, if you need a definition of "subprime", that's it.

However, the biggest banking secret that we were all convinced of is that the Conversion Act is a big victory for the "little man", while in nature it was a maneuver by the banks to save themselves in the situation surrounding the dramatic growth of risky placements denominated in CHF.

The violent reaction of the banks is understandable and expected, they were barely saved by the law on conversion, with incredible PR efforts they managed to preserve the myth that "conversion is compensation" all these years and only a few weeks before the statute of limitations, the Second Foundation messed up their accounts, and if the bankers do something what they don't like is that someone touches their bonuses and management contract extensions that are suddenly questionable. All the warning signs were there all along, hidden in the footnotes of the banks' annual reports or the reports of the credit rating companies (read, there are interesting details in the footnotes, especially of the Austrian banks, maybe I should write about that too).

And lastly, to address two recurring details. A series of headlines incorrectly states that we "buy out claims", the Second Foundation is a company whose function is to provide injured citizens with the right to compensation - we are literally the opposite/antithesis of any "claims collection agency".

Some ask why we don't sue for the complete nullity of the contract instead of compensation on the basis of default interest? My life practice has taught me that one should be honest and take care not to promise anything to anyone that I am not reasonably sure I can deliver, and therefore the offer of the Second Foundation is limited to what we believe we can deliver on this day. Of course, we have developed and prepared legal tactics for every foreseeable situation, including a possible nullity decision. Of course, we want to collect and maximize any compensation as quickly as possible, but that does not mean that we want to collect a large number of contracts at any cost with an unobjective or naive approach to the problem and excessive promises. Our offer is non-binding, everyone must make their own decision by consulting with people and experts they trust. If you are one of the recipients of our letter and have decided to exercise your right independently, that is absolutely OK and every euro you collect from the banks is our small victory.

Thought of the day:

An election is coming. Universal peace is declared, and the foxes have a sincere interest in prolonging the lives of the poultry.

This article originally appeared on Marko Rakar's blog, Mrak.org.

How to Croatia - Getting an OIB and Opening a Bank Account

November the 9th, 2022 - In our latest edition to our How to Croatia series, we look into how to get a personal identification number (OIB) and open a Croatian bank account as a resident.

It appears that wherever we may roam on this tiny blue dot taking trips around the sun, we end up ‘roaming’ into a taxman. Croatian taxes are the bane of society for a multitude of reasons, but I won’t get into that now. Once you’ve got your residence permit, you’ll need what’s known as an OIB to be able to work, open a bank account, and do just about anything. You can obtain an OIB without residence, too, or before you embark on the residence process.

What is an OIB?

An OIB, or personal identification number (or tax number) is a little bit like a national insurance number (you’ll know what I mean if you’re British), but you’ll end up using it so much in Croatia that you’ll likely end up remembering it. Does anyone else never look at their UK NI? Christ only knows what mine is. The funny thing is that I’ve used my OIB so often that I know it back to front. Bit sad, really. Anyway, back to the point! An OIB is very easy to get, you can simply visit your local tax office (porezna uprava) and ask for one. You’ll just need your passport or other form of government-issued ID.

You can also make the request for an OIB online by visiting porezna-uprava.hr and selecting ‘Dodjeljivanje OIBa’ (Assigning an OIB), then selecting English language as your language of choice (EN).

Getting an OIB assigned to you is so easy that if you’ve gone through the residence process first, you might think you’ve done something incredibly wrong. You haven’t. This is one of those situations in Croatia that seems too simple to be true. Cherish them, they happen at random and are kind of few and far between.

Once you have an OIB, you can open a Croatian bank account as a resident.

Opening a Croatian bank account

There are numerous banks available in Croatia, with the Croatian National Bank (Hrvatska narodna banka or HNB/CNB for short) serving as the independent regulator of commercial banks operating in the country.

The CNB was established as part of the Croatian Constitution which was passed by Parliament on the 21st of December, 1990. It issues banknotes, holds the national monetary reserves, aims to maintain stability and ensures the financial liquidity and soundness of the country’s financial system. The CNB joined the European System of Central Banks and started performing its role under the Statute of the ESCB and the ECB, following Croatia’s entry into the European Union back in July 2013.

Some of the most popular banks in Croatia are Privredna banka Zagreb (PBZ), Zagrebačka banka, Erste & Steiermärkische bank, Raiffeisenbank Austria Zagreb (RBA), and Hrvatska poštanska banka (HPB). There are of course others, such as Addiko bank and OTP, but there’s no need to list them all. Many banks are foreign owned, and those such as Erste are very popular with expats thanks to their ease of use, very good mobile app, and good customer service. There are English language options on banking apps and on their websites.

To facilitate your transactions (paying rent, paying the bills) to receive your Croatian salary and have a local bank card, and to do literally anything financially, you’ll need a Croatian bank account.

What do I need to open an account?

To open a bank account in Croatia, you’ll need an OIB. Generally speaking, you’ll need a valid passport, your residence permit (either your ID card or your registration certificate, if your card isn’t yet finished) and the bank’s application form that you can find online or get directly at the bank to open a bank account as a foreign national. Most of the staff working in banks speak a decent level of English, so you shouldn’t have any communication difficulties. The process is fairly quick.

Types of Croatian bank accounts, apps and online banking

The most typical account types are giro, current and savings account. Some banks offer automatic overdrafts once you open an account, while in others you have to apply for an overdraft once the account has been set up.

As stated, most banks offer online and mobile banking services, which comes in handy when paying the bills, for example, because you can simply scan the QR code that can be found on every payment slip and the payment information is filled in automatically, so you simply have to authorise the payment, click send and the job’s done.

Bank loans for foreigners

Applying for a bank loan is a modern reality in a society which lives increasingly on credit. Inflation and spiralling prices are likely to force more and more people to live this way. Croatia is no exception in putting things on the plastic, even though so many people still love to carry cash, and of course, some cafe bars, pubs and even restaurants like to pretend their POS machines are broken until the tourist season arrives. You can probably guess why... Despite that, many Croatian households of all classes have loans from the bank for a variety of different reasons.

I’ll be blunt, the procedure for getting a bank loan in Croatia is not simple. There are many hoops to jump through, requirements to satisfy, papers to obtain and time to kill, at least in the bank’s eyes. Unless you are armed with an extra dose or ten of patience (or you’ve been sedated), you have a particular masochistic passion for providing people with documents, copies of said documents and filling out forms with half-chewed pens stuck to tables by strings, frustration will be your main companion and your eyes will probably see more of the back of your skill than much else, you know, what with all the rolling they’ll be doing.

Many doe-eyed, would-be foreign buyers of Croatian property seek to borrow funds from the bank to help with their purchases. Despite lots of promises and stringing along, there is still no mortgage product on offer in Croatia for foreign buyers, so please, please, bear this in mind.

Opening times

Opening times for banks will be clearly displayed on their doors, their websites and their apps. Be aware that Croatia is the land of religious holidays, bank holidays, and random days where things just aren’t open. Those days can of course affect the operating hours of banks. Luckily, many things can now be resolved online and through mobile banking, thanks to virtual assistance and even instant chats.

ATMs

Just like across the vast majority of the rest of this modern, fast-paced world, ATMs can be found all over in Croatia, they have even been ‘evicted’ from the hearts of ancient towns like Dubrovnik. You’ll have no problem finding one, and the vast majority (if not all of them) have different language options you can select before withdrawing cash or checking your balance. Do keep in mind that different banks have different limits on how much cash you can withdraw in any given 24 hour period, so make sure to check what yours is.

For more on How to Croatia, from adopting pets to getting health insurance, make sure to keep up with our lifestyle section.

Croatian Banks Send Out Important Info Regarding Euro Introduction

September the 14th, 2022 - Croatian banks have sent out some important information to their customers and clients regarding Croatia's rapidly approaching accession to the Eurozone, which is set to take place on the very first day of 2023.

As Poslovni Dnevnik writes, PBZ sent its clients and customers a notice related to Croatia's upcoming introduction of the euro, in which they specify the essential elements for conversion that will be applied in the conversion of the Croatian kuna to the new single currency of the Eurozone.

"On the day of the introduction of the euro in Croatia, the bank will automatically and without charge carry out the conversion of funds held in Croatian kuna in bank accounts, deposits, loans and other financial statements of value at a fixed conversion rate of one euro = 7.53450 kuna,'' the bank stated.

''The conversion will be carried out by applying the rules for conversion and rounding in accordance with the Law on the Introduction of the Euro as the Official Currency in the Republic of Croatia. In addition to that, according to the principle of continuity of contracts and other legal instruments, the introduction of the euro will not affect the validity of existing contracts on loans, deposits and savings in kuna, etc., meaning that no new contracts need to be concluded. The goal is to carry out the process of introducing the euro and the activities resulting from it in such a way as to ensure the simplest possible treatment for everyone,'' it added.

The period of the obligation to display prices twice (in both Croatian kuna and euros) to consumers began on September the 5th, 2022 and ends twelve months after the introduction of the euro in Croatia.

Of the other Croatian banks which have sent out information on Croatian Eurozone accession to their clients, Zagrebacka banka made similar statements: "On the day of the introduction of the euro as the official currency of Croatia, monetary values expressed in kuna on custodial and brokerage accounts will be converted into euros by applying the rules for conversion and rounding defined by the Law."

Erste Bank also informed its customers about the currency change, according to a report from N1.

For more, make sure to check out our dedicated lifestyle section.

Hrvatska Postanska Banka's Organic Growth Sees it Pushed Forward on Market

July the 3st, 2022 - Hrvatska Postanska Banka has been pushed forward significantly on the market owing to its organic growth and the excellent business being done, not to mention a new acquisition.

As Poslovni Dnevnik writes, during the first six months of 2022, Hrvatska Postanska Banka achieved strong growth in terms of the wider HPB Group's assets and the acquisition of Nova Hrvatska Banka (New Croatian Bank), which is now successfully operating. All of the above has significantly strengthened its overall market position.

After a record 2021, a ten digit net profit of 1.066 billion kuna was realised at a consolidated level as a result of income due to acquisition activities and profit creation at the bank's level. A significant increase in property of 7.7 billion kuna indicates a strong step towards the entry of HPB into the top five banks per total assets on the entire Croatian market.

The main factors of the record positive results of the wider Hrvatska Postanska Banka Group in the first six months of 2022, in addition to the effects of acquisition activities, were the profits made from business even in these dire circumstances of growing inflation and the cost of adjusting business for the introduction of the euro in 2023. Hrvatska Postanska Banka successfully annulled the unfavourable effects of the drop in the price of bonds caused by the announcement of a change in monetary policy to restrain inflation and continued to implement the multitude of strategic projects of the HPB Group.

Back on March the 1st, 2022, the Hrvatska Postanska Banka took over Sberbank d.d., now called Nova Hrvatska Banka, which enabled it to stabilise its business, in that it also secured the preservation of its property and the property of its clients.

A significant increase in the Hrvatska Postanska Banka deposit and the stabilisation of Nova Hrvatska Banka's business, after them having taken it over, contributed to a much more favourable liquidity position and the strengthening of the potential to continue the realisation of a planned market share. The complementary and quality credit portfolio of Nova Hrvatska Banka has also further strengthened the stable and growing credit portfolio of HPB in almost all possible segments.

In addition to the record low level of the stake in unchanging loans, the activities of the diversification and increase in the quality of the bank's card products are reflected in the growth of total revenue from 7.7% fees that have mitigated the drop of net interest income of 6.0% (unconsoilidated) provided by a competent environment.

Thanks to cooperation with a strategic partner, Croatian Post (Hrvatska posta), Hrvatska Postanska Banka has continued to increase the availability of its financial services to different segments of clients even in the smallest and most remote rural locations that have a post office available.

For more, make sure to check out our dedicated business section.

Nova Hrvatska Banka/New Croatian Bank Begins Operations

April the 15th, 2022 - Nova Hrvatska Banka, or the New Croatian Bank, is set to start operations formally within the wider Hrvatska postanska banka (HPB) group following a long and extensive rehabilitation process.

As Poslovni Dnevnik writes, after a record year in which it achieved the best net profit in history in the amount of 202 million kuna, asset growth of 27.9 billion kuna and a capital adequacy ratio of 25.7 percent, Hrvatska postanska banka successfully implemented another demanding project - the rehabilitation of Sberbank d.d., more precisely the future New Croatian Bank d.d.

The Council of the Croatian National Bank (CNB/HNB) has made a decision on the successful completion of the rehabilitation procedure, which will formally start the New Croatian Bank's operations as Nova hrvatska banka d.d. within the HPB group. With this takeover, the completion of the rehabilitation process and the merger of the New Croatian Bank, HPB is ultimately strengthening its future position here on the Croatian market. The rehabilitation process itself was completed in a short time and the bank has been stabilised and is operating successfully.

Implementing this demanding process is a new step in strengthening HPB's business overall. As a new member of the HPB group, the New Croatian Bank brings with it a significant customer base, a complementary portfolio and additional strength for business growth and further expansion.

"After the record result we had last year, we believe that the synergy effects will bring new benefits to our customers, shareholders and employees," said Marko Badurina, President of the Management Board of HPB.

The Management Board of the New Croatian Bank was appointed as follows: Tadija Vrdoljak, President of the Management Board, Boris Bekavac and Ognjen Brakus, members of the Management Board.

For more on Croatian banks and financial institutions, make sure to check out our dedicated business section.

Croatian Banks Continue to Create Stricter Loan Conditions

April the 13th, 2022 - Croatian banks are placing stricter and stricter conditions on those they provide loans to as rising interest rates are anticipated by the financial system.

As Marina Klepo/Jutarnji/Novac writes, in anticipation of rising interest rates, customers of Croatian banks are already noticing heightened caution, and loan offers are somewhat less "generous", especially when it comes to cash loans. As such, some clients have been noticing quite an unusual trend - larger Croatian banks refer them to smaller ones, which have less rigorous procedures, and often lower interest rates.

The Croatian National Bank's comparative list of credit terms shows that "cash" can now be obtained in sixteen different banks, but only half of them, the smaller and medium-sized ones, actually offer fixed and variable interest rates. Today, all large Croatian banks are approving these loans exclusively at a fixed interest rate.

In an effort to protect themselves from increased repayment installments, many people over more recent years have decided to take out loans with fixed interest rates, not only for long-term housing loans, but also for non-purpose cash loans, which are now mostly being approved for a period of ten years. Over the past year and a half, judging by the Croatian National Bank's comparative list, it's fairly clear that large banks have eliminated variable interest rates that were more favourable. The reason for this could be the effort to keep the existing, very high interest rates, as they are.

In the case of kuna cash loans, the fixed interest rate effectively (with all costs) ranges from 5.5 percent, as offered by two small Croatian banks, Imex and Karlovacka banka, to as much as 7.32 percent in Zagrebacka banka and 7.49 percent in Samoborska banka. Since October last year, Croatian banks have slightly revised their fixed interest rates, some are higher, some are lower. For Zagrebacka banka, for example, their interest rate was raised from 7.16 to 7.32 percent, for RBA it was lowered from 7.42 to 6.9 percent, while a number of banks kept about the same figures.

The real boom in approving these loans occurred back in 2018 and 2019, when they increased by about 5.5 billion kuna per year. Today, the total amount of these loans, according to the Croatian National Bank for the month of February 2022, reached 53.4 billion kuna, while the amount of housing loans amounted to 68.3 billion kuna.

Who are the clients of Croatian banks who are taking out cash loans? A recent Croatian National Bank survey "Which loans do we take? A microanalysis of Croatian household debt" shows that more expensive loans are more often used by households whose income isn't sufficient to finance their current consumption. It's very likely, the study concludes, that some households use “unsecured loans” to consolidate overdrafts or credit card debts, and for most households these efforts have proved unsuccessful. In the end, they end up with even more indebtedness.

In some cases, people took out cash loans and to, at least in part, finance the purchase of properties. Since the beginning of the coronavirus pandemic, interest in cash loans has fallen sharply and banks have approved many more housing loans. According to the latest Croatian National Bank data for that same month of February, housing loans were eight percent higher than they were back in the same month last year, slightly slower than they were in January, when the growth rate was 8.4 percent, and non-purpose cash loans accelerated slightly, from 3.3 to 3.4 percent.

When it comes to housing loans, Croatian banks still offer all kinds of interest rates, and they generally range from three to four percent. Those who need a smaller amount, up to 500,000 kuna, can currently get the best loan from the Istrian Credit Bank.

For more, check out our lifestyle section.

RBA Marks Down Forecast of Croatia's 2022 GDP Growth to 4%

7 March 2022 - Raiffeisenbank Austria (RBA) analysts on Monday revised down their estimate of Croatia's economic growth in 2022 from 4.4% to 4%, underscoring uncertainty and negative risks, particularly regarding investments.

The analysts said that in light of the war in Ukraine and growing uncertainty, their forecast for the euro area economy has been marked down by 0.7 percentage points to 3.3%.

"The expected trends will have a negative, albeit a limited impact on Croatia's GDP. In the scenario that excludes the possibility of the war spreading to other countries of the EU and/or Western Balkans and implies, at least for the time being, that the tourism season will be successful, the forecast for the real annual GDP growth rate for 2002 has been revised from 4.4% to 4%," the analysts said.

The analysts however remain cautious, underscoring uncertainty and negative risks, particularly with regard to investments.

Inflation in 2022 at 4.9%

They also see a more significant risk in the spilling over of the global increase in energy and food prices, and have therefore revised up their inflation forecast.

RBA estimates that this year's inflation rate in Croatia will be 4.9% whereas previously it was forecast at 3.6%.

Data from the Croatian Bureau of Statistics (DZS) indicated an increase in inflation of 5.7% in January this year compared to January 2021, which is the highest increase since October 2008.

"We expect that this year will see stronger inflationary pressure, directly on food prices, and that the impact of price growth on producers will also affect consumers, which will negatively impact available income. In such circumstances we cannot rule out the possibility of additional fiscal support," the analysts said.

Croatian HPB Takes Over Sberbank, Clients Can Breathe Easy

March the 3rd, 2022 - Following alarming reports of Zagreb and Split residents lining up outside Sberbank branches to withdraw any cash they had in accounts there after harsh sanctions were imposed by most of the world on Russia, the Croatian HPB has taken over and clients can now breathe easy.

As Poslovni Dnevnik writes, Croatian Sberbank clients' money is safe yet again, and business conditions remain unchanged. On Wednesday, March the 2nd, at 12:00, the bank opened its branches for all of its clients and continued its regular operations as part of the HPB Group,'' the statement reads.

"We reacted in an extremely short time and enabled our fellow citizens to freely deposit their funds. At the same time, the acquisition of Sberbank strengthens the Croatian HPB's future position on the market, which is great news for our employees and shareholders alike. As of today, our new clients can continue to use all of their financial services normally, without any restrictions, and as such I'd like to congratulate everyone who did their best to resolve this situation as soon as possible,'' said HPB CEO Marko Badurina.

The Croatian National Bank (CNB/HNB) announced earlier not so long before that that the Single Resolution Committee had made a decision on Tuesday, in co-operation with the Croatian National Bank as the national resolution authority, initiating the resolution process over Sberbank d.d. Zagreb, and the new owner is now the Croatian HPB (Hrvatska postanska banka).

HPB is one of the leading banks in the Republic of Croatia, and back in 2021 it achieved the best result in 30 years of the bank's history and a record net profit of 202 million kuna.

HPB pointed out that this bank is one of the leaders in innovation and digitalisation of the sector, and for many years it has stood out as the most active in the programme of subsidised housing APN loans.

For more, make sure to check out our lifestyle section.

New Zagrebacka Banka Instant Payment Option Introduced for Clients

February the 28th, 2022 - A brand new Zagrebacka banka instant payment service has been introduced for the clients of this Croatian bank, be they business or private customers.

As Poslovni Dnevnik writes, Zagrebacka banka has introduced a new instant payment service for all its private and business users who have transaction accounts with the bank, and the new Zagrebacka banka instant payment service will be able to be used for up to a maximum of 100,000 kuna. Instant payments in Croatia can be made in the Croatian national currency (kuna), and can be carried out every day, including during weekends, over bank holidays and on public holidays.

Clients of Zagrebacka banka will thus be able to execute their transactions in almost real time, meaning in just a few seconds. Instant payments are made by online banking via a mobile application (m-zaba) and the Internet (e-zaba), through existing forms of Zagrebacka bank account, and then by checking the ''instant payment'' option.

Filling out Zagrebacka banka instant payment orders will be exactly the same as it is with standard payment orders, and the payer can immediately see if their payment has been successfully completed and sent to the correct individual.

For example, if a client needs to pay money on Friday night to a person who has a transaction account with another bank, it would have been an issue owing to bank processing times. Until now, it would have been necessary to wait until Monday to see the money appear in the desired bank account.

Now, with the introduction of this new Zagrebacka banka instant payment service, the money heading for the recipient's account will be available immediately. Payments are made through NKSInst, a national clearing system for instant payments developed by the Financial Agency (Fina) and approved by the Croatian National Bank (CNB/HNB).

For more on Croatian banks and their services, make sure to check out our dedicated lifestyle section.