Croatian Equity Market: Impact of the Russian Invasion of Ukraine

March 18thund 2020 - An overview of the Croatian equity market and how it reacted to the Russian invasion of Ukraine.

On the 24th of February 2022, a full-scale Russian invasion of Ukraine began. The world was struck and this was also evident when looking at the capital markets which reacted very suddenly and there was a lot of volatility in the markets.

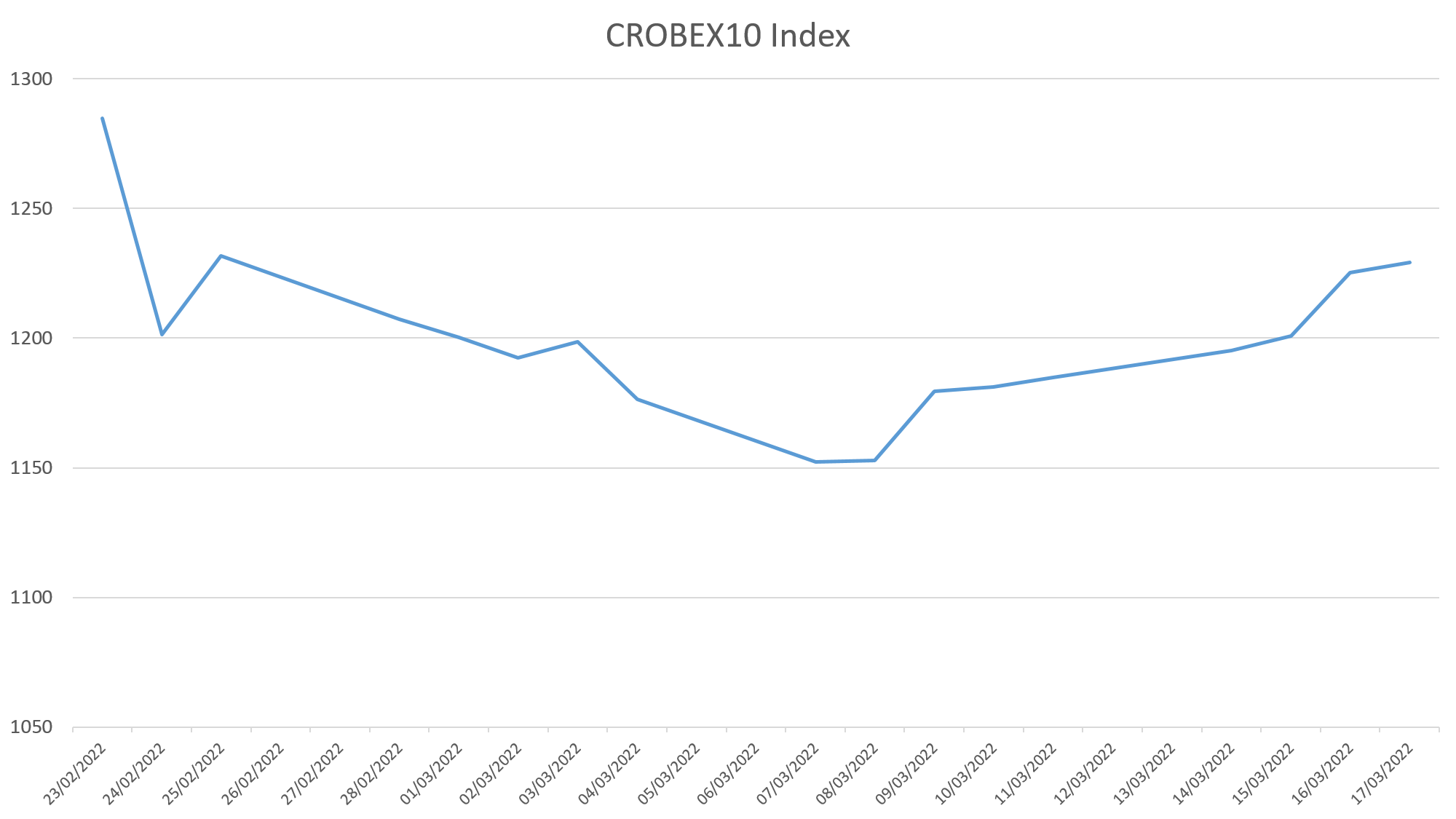

The Croatian equity market can be observed by looking at the benchmark index CROBEX10 which is made up of 10 Croatian blue-chip companies with the largest free-float, liquidity, and market capitalization. CROBEX10 fell by 6,47% on the first day of the invasion falling from 1284.56 to 1201.42. The downward trend has started even before that which is not odd since financial markets are to a large extent forward-looking. CROBEX10 reached its peak on 19th January at 1342.93 and has from there slipped down to 1152.36 on March 8th, cumulatively falling by 14,19%, and technically speaking entering into a correction phase. From March 8th to March 17th at the time of writing this article CROBEX10 has soared back up by 6,57% and it reached 1228.

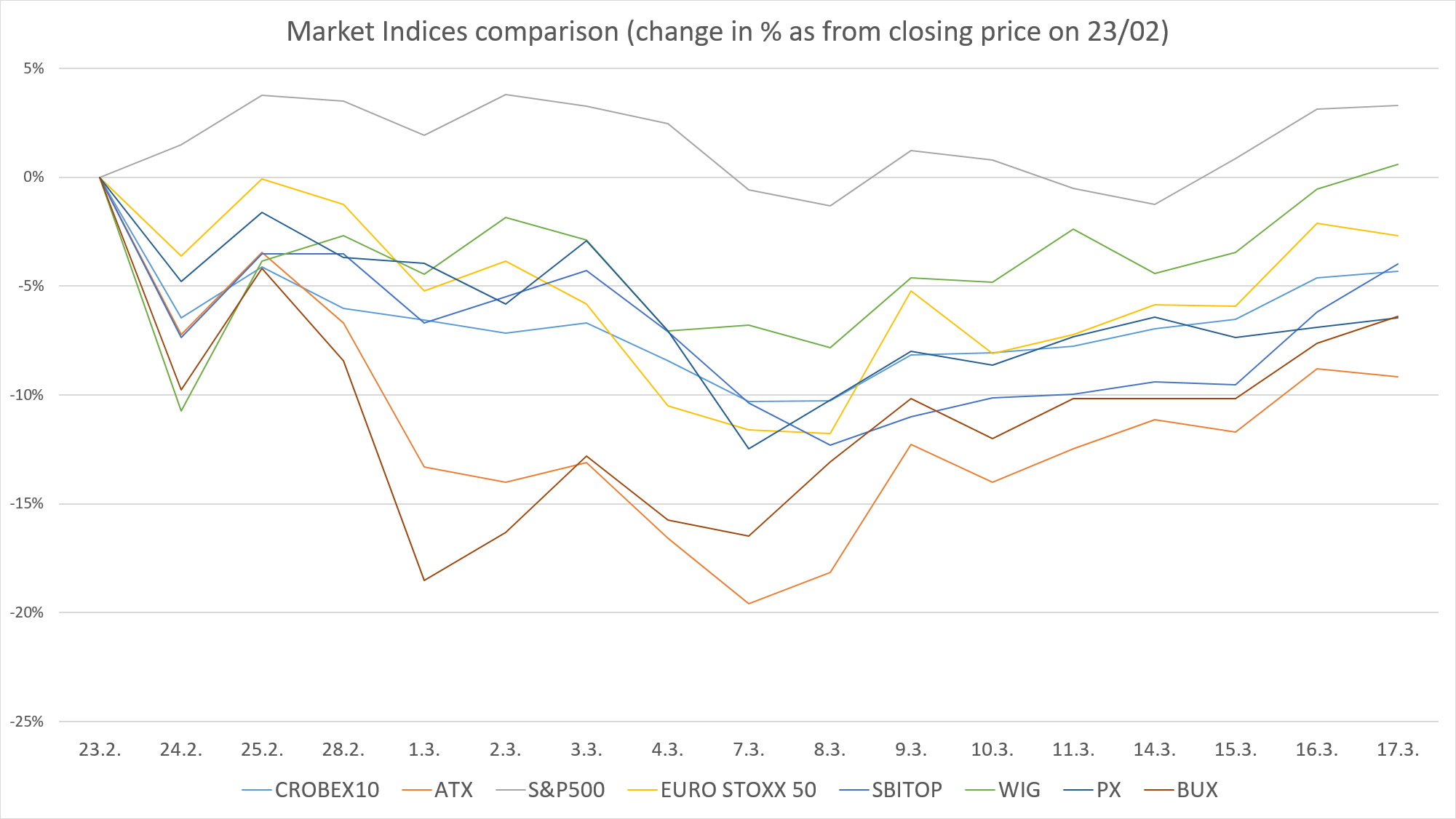

When comparing Croatian CROBEX10 with other European and American market indices we can see that some Indices experienced an even more drastic market sell-off. Most notably Polish WIG fell by 11%, Hungarian BUX fell by 10%, and Slovenian SBITOP and Austrian ATX dropped 7% on the first day of the invasion.

Some of these indices have managed to return near the price levels as before the war while others are still deep in the red zone. As of 17th of March, Austrian ATX is at -9%, Cezch PX and Hungarian BUX at -6% while Croatian CROBEX10 is at -4% compared to their price levels on the 23rd of February.

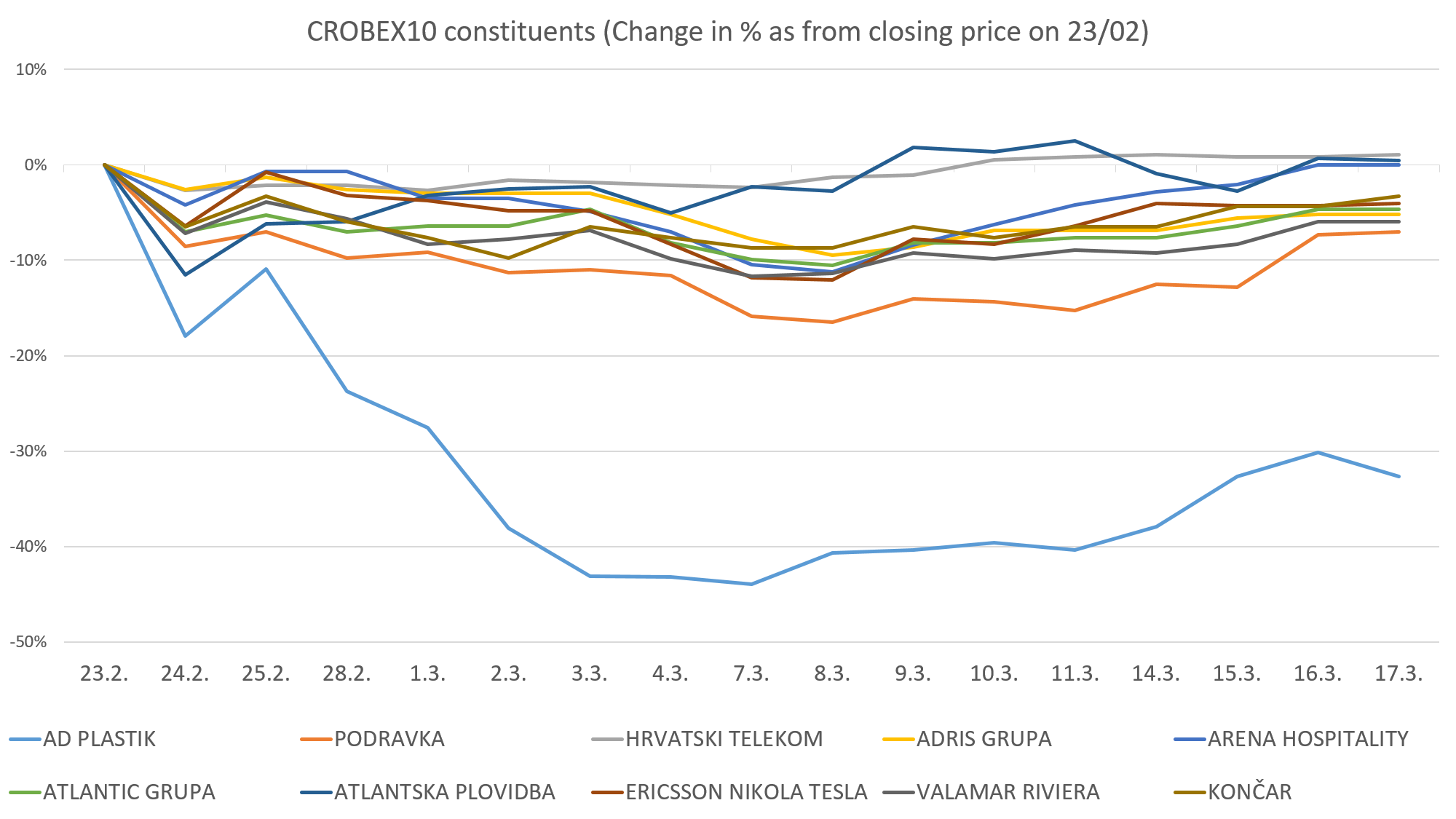

When looking at CROBEX10 and its 10 constituents we can see that on the first day of the invasion the biggest drop can be seen in Ad Plastik -18%, Atlantska Plovidba -12%, and Podravka -9%.

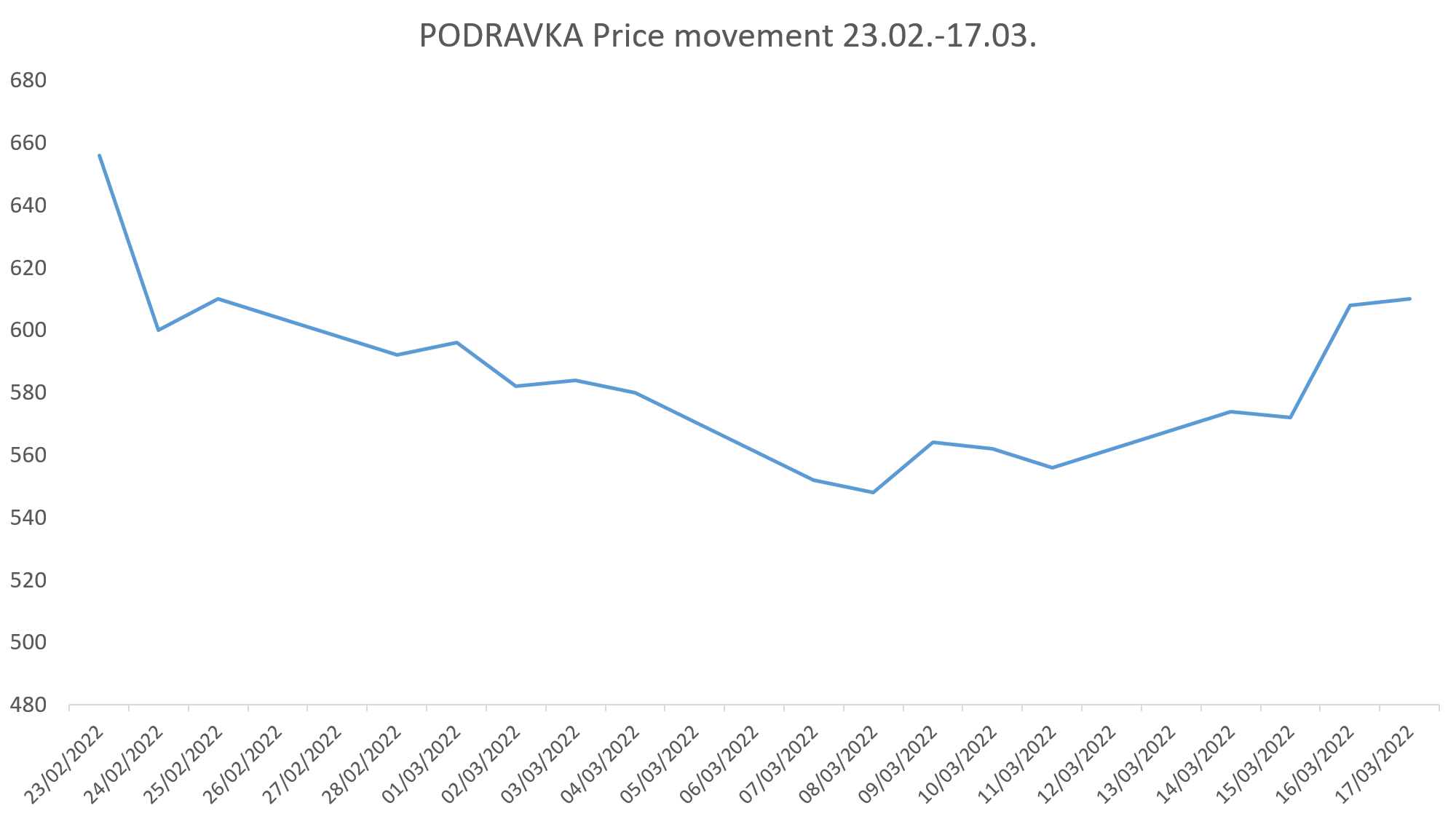

It is interesting to see how the market reacts to an unpredictable event such as this war and it is the best indicator of the extent of exposure these companies have to Russian and Ukrainian markets. As of the 17th of March, most of these companies are near the price levels before the war. Two companies that made an official statement to ZSE and which are clearly exposed to these markets are AD Plastik and Podravka which is also seen in their price level which is currently -33% and -7% respectively, compared to the price levels before the escalation.

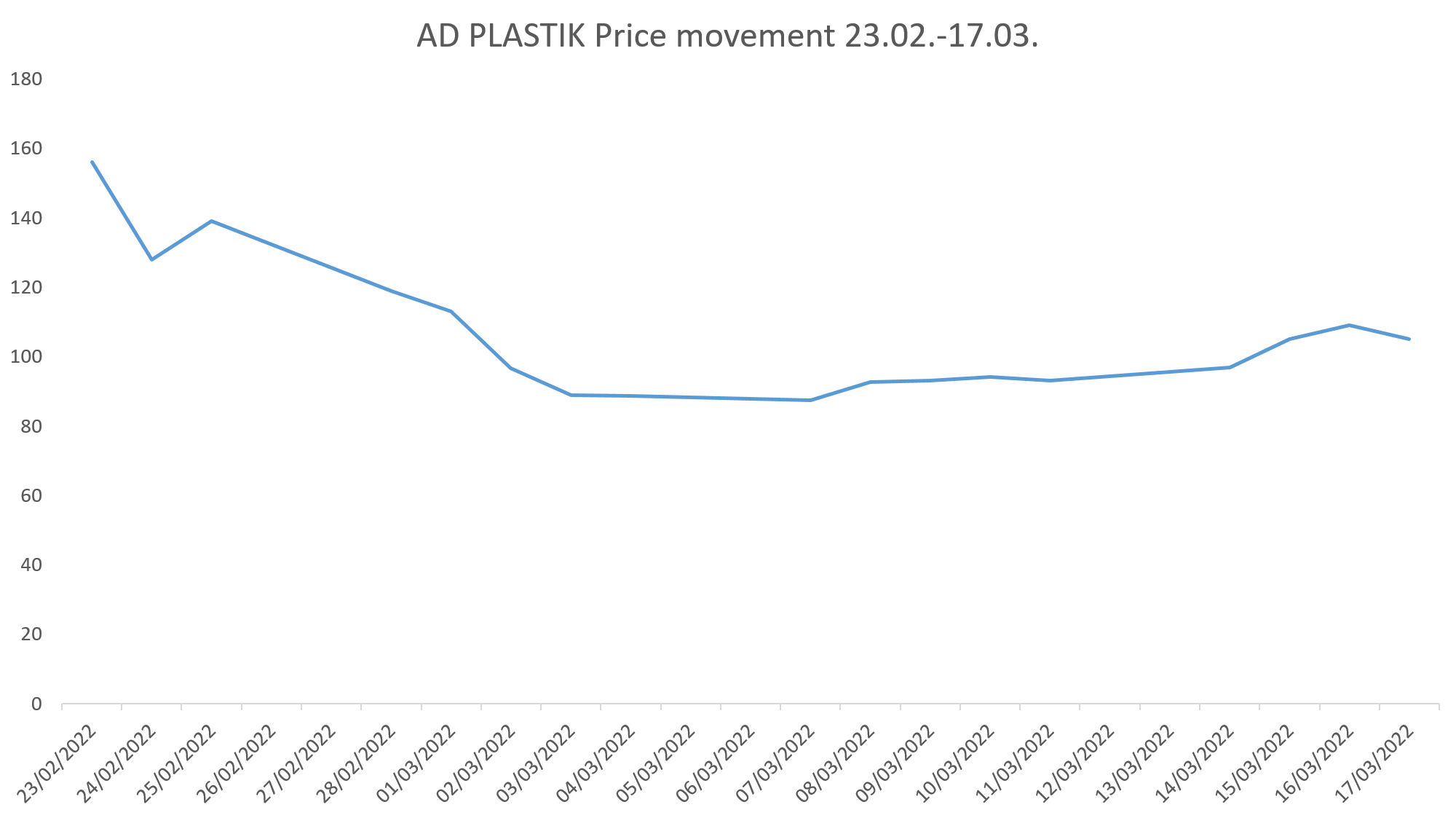

AD PLASTIK

AD Plastik is a Solin-based manufacturer of automobile components. Unfortunately, AD PLASTIK is largely impacted by the Russian Ukrainian war. They have two factories in Russia which together account for around 25% of their revenue according to their statement published by ZSE. These two factories sell exclusively to the Russian market and through them, AD Plastik is exposed to the fluctuation of the Russian Rubble. The AD Plastik share price was falling from the start of the war on the 24th of February until March 7th falling by 44% and whipping out nearly 300 million HRK from their market capitalization. As of 17th March, its share price has scaled up to 105 HRK which is a 20% increase but it is still 33% lower than the share price before the start of the war.

The additional burden was the release of their 2021 financial statements on the 24th of February, which showed a drop in operating revenue by 6.8% and a drop in their EBITDA margin by 273 bps. This is most likely caused by the chip shortage and other supply chain problems in the automobile industry.

On a positive note, on March 9th, they made a public statement announcing a new contract with Stellantis Group and Motherson Group for the European market which are together worth 73,6 million Euros.

PODRAVKA

Podravka is Koprivnica based food and pharmaceutical company. According to their statement published on ZSE, the group’s exposure to Russian and Ukrainian markets account for less than 6.5% of their sales revenue. Belupo, their pharma division, had 37,1% of international sales in Russia according to their 2020 annual report. Considering that their pharma division had significantly higher EBITDA margins In 2021 with 20.5% compared to 10.6% in the food division, it Is likely that investors expect a decrease in EBITDA margins in the coming period.

On the positive side, their 2021 financial report recorded a 2.8% increase in the group’s sales revenue and a 64 bps increase In their EBITDA margin.

To conclude, the Croatian equity market has been through a few turbulent weeks and has managed to partially recover but we are still surrounded by a high level of uncertainty, with the war in Ukraine still raging, with rising inflation, and the upcoming interest rate hikes it will be a challenge for the whole world and especially for the European continent.

Disclosure: I do not own any of these shares and this article is purely for informational purposes and should not be used as the basis for any investment decisions.

SYMBOLS

EBITDA – earnings before interest taxes depreciation and amortization

WIG - Warsaw Stock Exchange General Index (WIG)

BUX -Budapest Stock Exchange Index

SBITOP – Ljubljana Stock Exchange Index

ATX - Austrian Traded Index

PX- Prague Stock Exchange Index

S&P500 - Standard and Poor's 500 Index

EURO STOXX 50 - stock index of Eurozone stocks

CROBEX- Zagreb Stock Exchange Index

Sources: zse.hr , pse.cz , RGFI , marketwatch.com , wienerborse.at, ljse.si

For more, check out our business section.

Zagreb Stock Exchange Indices Slump at End of Week

ZAGREB, 4 March (2022) - The main Zagreb Stock Exchange (ZSE) indices slumped again on Friday, after yesterday's brief recovery, thus increasing the loss on the week to about 4.5%, which is a consequence of the pressure of the Ukrainian crisis on the world stock market, as well as the domestic one.

The Crobex fell by 1.94% on Friday, to 1,946 points, its lowest level since August 2021. At the same time, the Crobex10 dropped by 1.86% to 1,176 points, its lowest level since April 2021.

All sector indices went down, and the construction index saw the biggest decline, of 2.87%.

Domestic indices thus followed the negative trends on European stock markets, which saw sharp declines, while investors follow the news on the war in Ukraine and assess the possible effects of that war on the world economy.

The Crobex indices also registered significant losses on the week for the third consecutive week. Compared with the beginning of the week, the Crobex fell by 4.69% and the Crobex10 by 4.5%.

Regular turnover amounted to HRK 14 million, or half a million less than on Thursday. Another HRK 23 million was generated by a block transaction with the HT telecom stock at HRK 184 per share.

The highest turnover, of nearly HRK 1.8 million, was generated by the stock of the Croatian Postal Bank (HPB). Its prices dropped by 2.37% to HRK 825.

Atlantska Plovidba turned over HRK 1.41 million, closing at HRK 412 per share, down 2.83%.

The stock of the Span IT company turned over HRK 1.4 million, closing at HRK 185.5, down 0.8%.

The price of the Ericsson Nikola Tesla stock also recorded a significant decline, by 3.7% to HRK 1,705 per share. It generated a turnover of HRK 1.26 million.

A total of 45 stocks traded on the ZSE today, with 10 gaining and 23 losing in price, while 12 were stable.

(€1 = HRK 7.568685)

For more, check out our business section.

ZSE Indices Plunge By 6.5%

ZAGREB, 24 Feb 2022 - The main Zagreb Stock Exchange (ZSE) indices plummeted by 6.5% on Thursday to their lowest levels since September 2021, amid a high turnover, which indicates some investors are withdrawing from the market.

The Crobex plunged by 6.48% to 1,983 points, which is its biggest daily fall since March 2020, while the Crobex10 plummeted by 6.47% to 1,201 points.

All sector indices fell significantly, with the construction and industry indices seeing the sharpest drop, of 10.14% and 9.01% respectively.

The Crobex indices followed the decline of world indices, which are under pressure due to Russia's attack on Ukraine.

On the other hand, oil prices rose sharply, breaking the psychological $100-a-barrel barrier on the London market for the first time in more than seven years. Traders are concerned that Russia's attack on Ukraine will disrupt the supply of world markets with oil and gas from Russia.

The rise in energy prices could further boost the already high inflation, which would negatively impact the economic recovery from the coronavirus crisis.

Today's regular turnover on the ZSE was a high HRK 33 million, or HRK 24 million more than on Wednesday.

An additional HRK 2.29 million was generated by a block transaction with the Ericsson Nikola Tesla stock at HRK 1,760 per share.

A total of 57 stocks traded on the ZSE today, with as many as 47 registering price decreases and only two recording price increases, while eight were stable.

The highest turnover, of HRK 4.7 million, was generated by the stock of the HT telecom, which closed at HRK 183 per share, down 2.66%.

The Ericsson Nikola Tesla stock turned over HRK 2.7 million, closing at HRK 1,740, down 6.45%.

The stock of the Podravka food company generated HRK 2.46 million in turnover. Its price sank by 8.54% to HRK 600 per share.

The stock of the Atlantic Group turned over HRK 2.4 million, closing at HRK 1,590, down 7%.

The price of the Valamar Riviera stock dropped by 7.16% to HRK 31.1, and it generated a turnover of over HRK 2.2 million.

The biggest loser was the stock of the AD Plastik car parts company, whose price plunged by nearly 18% to HRK 128 per share.

AD Plastik Management Board President Marinko Došen told Hina on Thursday he didn't expect sanctions against Russia to negatively affect the business of the AD Plastik Group, which has two factories in Russia, adding that those factories produced exclusively for the Russian market.

"The geopolitical situation is not affecting our business at the moment and we believe it will stay that way," said Došen.

Among the stocks whose price dropped significantly were also Jadroplov (-17.9%), Ingra (-12.99%) and Atlantska Plovidba (-11.52%).

The biggest winner was the stock of the Granolio food company, whose price soared by 42% to HRK 39.8 per share.

For more, check out our business section.

Zagreb Stock Exchange Indices End Week in Red

ZAGREB, 18 Feb 2022 - The main Zagreb Stock Exchange (ZSE) dropped for the second consecutive day on Friday, the Crobex by 0.8% to 2,121 points, and the Crobex10 by 0.99% to 1,289 points.

The indices also ended the week in the red, with the Crobex falling by 2.01% and the Crobex10 by 2.25%.

All sector indices fell today, and the transport index saw the biggest decrease, of 2.6%.

Regular turnover amounted to HRK 6.6 million, or about HRK 2.8 million less than on Thursday.

The most traded stock was Hrvatska Poštanska Banka, which turned over HRK 948,000, its price stagnating at HRK 790.

A total of 44 stocks traded today, with eight of them registering price increases, 21 recording price decreases, and 15 stagnating in price.

(€1 = HRK 7.527023)

For more, check out our business section.

Crobex Indices Down After Rising Several Days

ZAGREB, 11 Feb 2022 - The main Zagreb Stock Exchange indices dipped on Friday after several days of growth, the Crobex by 0.03% to 2,164 points and the Crobex10 by 0.05% to 1,318 points.

Regular turnover was HRK 7.9 million, about 300,000 less than on Thursday.

The most traded stock was Atlantska Plovidba shipping company, turning over HRK 1.95 million. It closed at HRK 463 per share, down 0.91%.

Another two stocks crossed the million kuna mark: Sunce Hotels, turning over HRK 1.25 million and closing at HRK 145 (+3.57%), and HT telecom, which turned over HRK 1 million, closing at HRK 187.5 (+0.54%).

Forty-three stocks traded today: 18 going up in price, ten going down, while 15 were stable.

(€1 = HRK 7.524737)

For more, check out our business section.

Zagreb Stock Exchange Main Indices Continue Positive Streak

ZAGREB, 10 Feb 2022 - The main Zagreb Stock Exchange indices went up on Thursday, the Crobex by 0.12% to 2,165 points, up for the fifth straight trading day, and the Crobex10 by 0.34% to 1,319 points, up for the third straight day.

Regular turnover was HRK 8.2 million, a million more than on Wednesday.

The most traded stock was Atlantska Plovidba, turning over HRK 1.58 million. It closed at HRK 440 per share, down 0.68%.

Two other stocks crossed the million kuna mark. Končar turned over HRK 1.4 million, closing at HRK 945 (+0.53%), and Saponia turned over HRK 1.09 million, stable at HRK 920 per share.

Forty-one stocks traded today, ten going up, 13 down, and 18 were stable.

(€1 = HRK 7.521719)

For more, check out our business section.

ZSE Indices Go Up Amid Weak Turnover

ZAGREB, 31 January 2022 - The main Zagreb Stock Exchange (ZSE) indices went up slightly amid weak turnover, with the Crobex increasing by 0.33% to 2,132.61 points and the Crobex10 by 0.40% to 1,301.52 points.

Regular turnover was HRK 3.9 million, about HRK 700,000 less than on Friday.

No stock crossed the million kuna mark in trading.

Končar generated the highest turnover, of HRK 552,100, closing at HRK 900 per share, up 1.69%.

Thirty-six stocks traded today, with 11 gaining in price and 11 losing, while 14 were stable.

(€1 = HRK 7.528487)

For more, check out our business section.

ZSE: Crobex Indices Up

ZAGREB, 28 Jan 2022 - The main Zagreb Stock Exchange (ZSE) indices went up on Friday, the Crobex by 0.09% to 2,125 points and the Crobex10 by 0.27% to 1,296 points.

Regular turnover was HRK 4.6 million, about 1.5 million less than on Thursday.

The most traded stock and the only one to cross the million kuna mark was Atlantska Plovidba shipping company, which turned over HRK 1.14 million. It closed at HRK 387 per share, up 4.03%.

Thirty-seven stocks traded today, with 15 increasing and 12 decreasing in price, while ten were stable.

(€1 = HRK 7.526395)

For more, check out our dedicated business section.

ZSE Indices Increase

ZAGREB, 26 Jan 2022 - The main Zagreb Stock Exchange (ZSE) indices rose on Wednesday, the Crobex by 1.15% to 2,147.32 points and the Crobex10 by 1.01% to 1,306.91 points.

Regular turnover was HRK 7.4 million, or about HRK 2.8 million less than on Tuesday.

The highest turnover was generated by the Valamar Riviera stock, HRK 1.6 million. Its price went up by 2.99% to HRK 34.50 per share.

The stock of the HT telecommunications company turned over HRK 1.2 million, closing at HRK 184, up 0.27%.

The stock of the Atlantska Plovidba shipping company generated a turnover of HRK 1.19 million. Its price rose by 3.64% to HRK 370.

Forty-two stocks traded today, with 25 increasing in price and seven decreasing, while 10 were stable.

(€1 = HRK 7.525776)

For more, check out our business section.

ZSE Indices Fall Sharply

ZAGREB, 21 Jan 2022 - The main Zagreb Stock Exchange (ZSE) indices fell sharply on Friday, weakening for the second consecutive day.

The Crobex on Friday declined by 1.86% to 2,164 points, weakening for the second day in a row, and it ended the week in the red, decreasing by 0.31% on the week and ending its eight-week winning streak.

The Crobex10 fell by 1.3% to 1,323 points, but it went up by 0.23% on the week.

All sector indices slumped on Friday, with the construction index dropping the most, by 4.12%.

Regular turnover surpassed HRK 16 million, which is about HRK 3.2 million than on Thursday.

The highest turnover was generated by the stock of the HT telecommunications company, HRK 2.85 million. Its price remained the same at HRK 185 per share.

Hrvatski Telekom (HT) and Zagrebačka Banka said that on Friday they had concluded a transaction to sell 54.31% of Optima Telekom shares to Telemach Hrvatska, owned by United Group.

The stock of Valamar Riviera turned over HRK 1.96 million, closing at HRK 34.3, down 1.71%.

The Croatian Postal Bank (HPB) stock generated a turnover of HRK 1.6 million. Its price dropped by 5.45% to HRK 780, and it was the biggest loser among the more liquid stocks.

The stock of the Podravka food company also crossed the million kuna mark, turning over HRK 1.43 million, while its price remained the same at HRK 696.

Forty-six stocks were traded today, with only five gaining in price, 28 decreasing in price, and 13 remaining stables.

(€1 = HRK 7.522614)

For more, make sure to check out our dedicated business section.