EC Expects Croatia's Economy to Rebound by 5.3% in 2021, 4.6% in 2022

ZAGREB, 11 February, 2021 - Croatia's Gross Domestic Product is estimated to have contracted by 8.9% in 2020, while it is expected to rise at a rate of 5.3% in 2021 and 4.6% in 2022, the European Commission says in its latest Winter 2021 Economic Forecast, published on Thursday.

The economy's contraction in 2020 "is mainly attributable to the impact of the COVID-19 pandemic on service exports, particularly tourism, which suffered greatly due to the fall in demand for air travel and the imposition of travel restrictions in many countries."

Croatia's private consumption also fell, reflecting the accumulation of involuntary and precautionary savings.

Following a better-than-expected third quarter, the country's GDP is estimated to have contracted again towards the end of the year as pandemic suppression measures were reintroduced in December.

This contraction is lower than the previous projections of -9.6%, as stated by the EC in its Autumn Economic Forecast. However, the latest forecasts about the rise in 2021 are smaller in comparison to the previously projected recovery at a rate of 5.7%, while the projected growth for 2022 has been revised upward from 3.7% to 4.6%.

"Real GDP is forecast to bounce back by 5.3% in 2021, as domestic demand should rebound once pandemic containment measures are phased out and more people are vaccinated.," the EC says.

"Pent-up demand, coupled with a gradual recovery in the labour market, is expected to boost private consumption. Investment should rebound on the back of the already strong dynamics in the construction sector, supported by rebuilding efforts following the strong earthquakes in the Banija region and Zagreb.

"A gradual pick up in longer-term investment projects, is also expected. The recovery in external demand, however, is expected to be uneven. Goods exports are expected to increase strongly on the back of the improved global outlook but services exports are projected to remain subdued in both 2021 and 2022 compared to their 2019 levels.

"This is mainly because the recovery in the travel and hospitality sectors are likely to take several years. This forecast does not include any measures expected to be funded under the Recovery and Resilience Facility, posing an upside risk to the growth projections.

"HICP inflation rate dropped to 0% in 2020 on the back of a strong decline in energy prices, while core inflation remained broadly stable at around 1%. As the effect of last year’s fall in oil prices dissipates, inflation is expected to pick up slightly in 2021 but should remain subdued throughout the forecast horizon (1.2% in 2021 and 1.5% in 2022)," reads the Croatia section of the EC Winter Economic Forecast.

Croatia ranks 3rd in terms of expected rise in 2021, fourth in terms of fall in 2020

For the sake of comparison, Spain is expected to have the most robust recovery in 2021, at a rate of 5.6%, France follows (5.5%), and Croatia ranks third among the 27 EU member-states.

When it comes to the economic downturn in 2020, Spain again tops the ranking (-11%), Greece is the runner-up (-10%), and Malta ranks third (-9%), while Croatia comes as fourth with a negative growth rate of 8.9%.

Will Croatian Establishment Owners Take to Streets in Protest?

January the 26th, 2021 - Will Croatian establishment owners end up taking to the streets to protest the ongoing measures banning their work, or will they opt for a situation in which everyone opens and begins working again despite what the National Civil Protection Headquarters say?

As Poslovni Dnevnik writes, Croatian establishment owners who are banned from working have stated that they are very much ready to start working again as soon as possible, claiming that people are now running out of energy, bars are having to permanently close every single day and that as a sector they are thinking about the possibility of taking to the streets in protest or all simply re-opening in groups on the same day.

Marija Bubas, Assistant Director of the Croatian Institute of Public Health, Dino Kozlevac, Chief of Staff of the Istria County, Ivan Vestic, President of the Athletics Federation, and Drazen Biljan, a Croatian establishment owner, all said their piece recently for an HRT programme.

The topics included easing the current strict anti-epidemic measures and Croatia's now favourable epidemiological situation.

In the introductory part of the show, Bubas said that the Croatian epidemiological situation is only getting better, but it isn't what you'd call great yet. She believes that just as measures should be introduced gradually, they should also be gradually relaxed in the same manner, and she doesn't know what the first thing to be eased up will be because it is still being very carefully considered.

As for the measures, she said it's difficult to satisfy everyone, but that public health always comes first. She added that economic activities, education, and also the public health interest in not putting pressure on the healthcare system must be preserved as much as possible and that healthcare services must be provided to all those who need it, when they need it.

Asked in which segment the anti-epidemic measures will be eased first, she said it's difficult to choose. She believes that a new set of measures will be introduced, but she has stated that she doesn't know which sector will be the first to breathe a sigh of relief.

Biljan believes that all sectors in the hospitality industry should be equalised, but that ''serving coffee to go is a mere few crumbs in terms of their survival". They asked for the possibility of deliveries, but that makes up less than 3 percent of the income of such facilities, which will not help them in almost anything. He talked about the consequences of lockdown, saying that Croatian establishment owners are now on the floor and have no one to pick them up and help them at all.

It was announced that children could go to sport training again and that gyms would be re-opened, Vestic said that these measures leave long-term consequences - sport clubs have been losing children for months now. After the first lockdown, it took six months for his club to have the same number of members and for the children to actually return. He believes that some sportsclubs shouldn't have been closed - especially those which take place outdoors and where children aren't in direct physical contact.

Many clubs are complaining about unequal treatment. Vestic said the measures were selective, accusing them of even involving lobbying. The head of Istria's Civil Protection Headquarters also demanded that gyms and sport clubs be opened.

Kozlevac asked for the work of gyms and sport clubs to be allowed, he is satisfied with the announcement that this will happen, but he says that they are being very careful and monitoring the epidemiological situation. He said that the number of patients in Istria County had been falling for five entire weeks and that they could now start easing the measures. They estimated, he added, that sport centres and individual sports can now be allowed. He expects the profession to find a solution and that the measure will be adopted from February the 1st, when the review is due.

Students in Istria County are still taking their classes online and this decision is also valid until the end of January. They're assessing the situation and will decide how to proceed in the coming days. They don't want to jeopardise the good epidemiological situation and believe that the measures must be gradually relaxed.

A Croatian establishment owner: We're now considering a group opening

When asked how long the Croatian establishment owners and their businesses such as cafes can last in these harsh and restrictive times, Biljan says that they're now finished and that they want to start working as soon as possible. According to official data, 1,098 Croatian cafes have been closed down since the beginning of the coronavirus pandemic. A long return of guests awaits them, he said. They are skeptical and think that it will take a long time for them to return to anywhere close to normal. All Croatian establishment owners should, Biljan said, be permitted to open their doors again at the same time, it isn't good to divide them up.

"We're not an island within Europe, we have to monitor the situation in the area," said Bubas. She added that the experiences of other countries should also be looked at.

"Sport has suffered more than you think," said Vestic. He warned of illogicalities regarding the measures in force.

Protests by Croatian establishment owners under the slogan "I will open" have been going on for days in nearby Italy, and Biljan says that here in Croatia, business owners are also very close to that because they have had enough and are now more than ready to work.

"We've fully respected the measures agreed with the Civil Protection Headquarters. I think the vast majority of restaurants are a safe place for guests. We're here to respect the measures to the maximum, in agreement with the Headquarters. We're ready to start working as soon as possible, people are running out of energy, tills are empty, bars are closing down every day and we're thinking about the possibility of going out onto the streets or organising a group opening, where we all open again on the same day,'' warned Biljan.

For the latest travel info, bookmark our main travel info article, which is updated daily.

Read the Croatian Travel Update in your language - now available in 24 languages.

10 Million Kuna Intervention Assistance Tender for Small Croatian Companies

January the 14th, 2021 - The ongoing coronavirus pandemic has seen many Croatian companies struggle to keep their heads above water, with small Croatian companies suffering previously unimaginable losses and the threat of total closure. A tender designed solely for small Croatian companies is now in the works.

As Poslovni Dnevnik/Marija Brnic writes, the Ministry of Economy is preparing an intervention aid worth 10 million kuna for small Croatian companies and craft (obrt) owners in earthquake-stricken areas for the reconstruction of machines and workshops, for which a tender will be announced in two weeks.

An important part of the wider financial package of 1.5 billion kuna, intended for capacity increase, development and digitalisation, will soon be available to all business owners there. This was announced yesterday by the Minister of Economy Tomislav Coric, who, two weeks after the earthquake hit Sisak, Petrinja and Glina, organised a conversation with representatives of the largest companies in the affected area, including Petrokemija, Sherif Group HiPP, the manufacturer of plastic bags Optiplast, the manufacturer of components for microchips, Applied Ceramics, the food chain City Kebab and the Italian ABS, which took over the plants of the former Sisak ironworks.

The meeting was also attended by the Minister of Labour, Josip Aladrovic, and Sisak-Moslavina County Prefect Ivo Zinic, as well as representatives of Hamag-Bicro, HBOR, HGK, HOK and HUP. The most attention, as stated, is being paid to small Croatian companies, and Coric announced that those business owners whose facilities were destroyed in the natural disaster at the end of 2020 will be given the opportunity to continue doing business in the temporary container settlement that is being built near Petrinja.

In addition to the already taken measures of the moratorium on business loans, Coric added that in the coming months, long-term measures will be taken to revitalise the affected area, and the possibility of introducing special tax treatment is also being actively considered.

How Has Crisis Affected Croatian Employment in Different Sectors?

December the 29th, 2020 - The coronavirus crisis has affected just about everything, causing a tremendous economic crisis, but just how has Croatian employment in various different sectors been affected by its iron grip?

As Marina Klepo/Novac writes, the impact of the ongoing crisis on young people is very serious, despite measures to preserve jobs remaining in place, the unemployment rate could still increase in the coming months, according to the European Commission (EC) in its latest quarterly report on Employment and Social Trends.

The coronavirus crisis has led to an “unprecedented loss of income from work”, and the effect has been particularly felt by those already disadvantaged on the labour market, such as young people, temporary workers and, in some countries, women.

Increased inequalities

The decline in income ranged from more than 10 percent in Croatia to less than two percent in Latvia and Hungary. The cause of these large differences between the countries of the European Union is the different structure of their economies, meaning that the largest decline in income was experienced by countries with a larger share in the tourism-related sector, either due to job loss, working less hours or full on unemployment.

As such, employees in food preparation and accommodation lost 20 percent of their income, in the field of culture and entertainment, 14 percent, in construction nine percent, in trade about six percent and about five percent in the transport and storage sector. The ongoing pandemic has only exacerbated previous inequalities even more and hit more vulnerable groups of employees, meaning that in some countries, the gap between lower and better paid workers has only increased.

Government measures across various member states have alleviated the problem a little bit, and the European Commission's analysis shows that some countries, such as Croatia and France, have been more effective in protecting low-paid workers from losing their income than those with middle and higher incomes. When it comes to the state of Croatian employment, however, things could still go even further south.

Nicolas Schmit, the EC's Commissioner for Employment and Social Rights, said the Commission was using all available means to provide support to member states, especially through the SURE instrument, which supports national part-time programmes. In addition, the extension of the Youth Guarantee programme will support young people "in skills development and work experience, especially in areas relevant to the green and digital transition".

The Youth Guarantee is a programme introduced back in 2014 with the aim that all those under 25 receive a quality job offer, the possibility of further education, apprenticeships and internships. On the 1st of July this year, the Commission proposed strengthening the programme to prevent rising unemployment, and the Council unanimously adopted the changes on the 30th of October. In addition to now placing greater emphasis on training in areas of the green and digital transition, the new measures include more support for disadvantaged youth, and the age limit has been raised to 29 years of age.

For the latest travel info, bookmark our main travel info article, which is updated daily.

Read the Croatian Travel Update in your language - now available in 24 languages

Vuk Vukovic's Analysis Reveals Worrisome Data on Vulnerable Croatian Companies

As Marko Repecki/Telegram writes on the 14th of December, 2020, if almost 7,000 vulnerable companies fail (according to the data from August, they're now even more endangered than they were before with this new lockdown), the Croatian state budget will lack a massive 3 billion kuna, which is equivalent to funds for as many as 130,000 pensions, according to the Voice of Entrepreneurs Association (Glas Poduzetnika). Economist and head of the Economic Council of the Voice of Entrepreneurs, Vuk Vukovic, analysed the effect of the collapse of vulnerable companies on the state budget.

The aforementioned association has been warning that micro, small and medium-sized enterprises will unfortunately be the ones to bear the brunt of the ongoing coronavirus crisis and that many of them will have to close their doors due to the lack of concrete assistance.

About 500,000 workers were affected by the measures

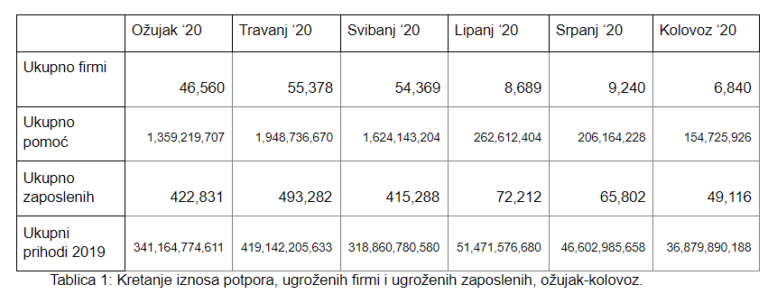

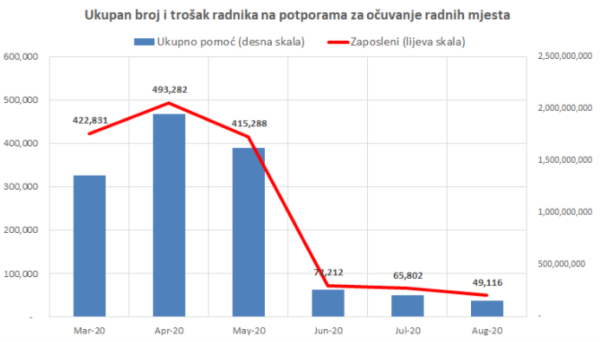

Vuk Vukovic's analysis is based on data on aid for job preservation from the Croatian Employment Service (CES), which is presented by month, and on data on the financial statements of all Croatian companies from back in pre-pandemic 2019.

Table 1 and Graph 1 indicate several interesting trends. First, during the lockdown (from March to the end of May), between 415 and 500 thousand workers were affected by the then introduced measures. This regards employees who, at least at that time, depended on state aid of 4,000 kuna because they weren't able to work (their companies were closed or they were in isolation).

In 2019, they generated 419 billion kuna in revenue

A total of 55 thousand companies were, at one time, dependent on this type of assistance. It's worth pointing out that these companies generated a total of 419 billion kuna in revenue in 2019, which is more than the Croatian GDP from that year (which amounted to about 400 billion kuna) and represents 52 percent of the total revenue earned by all Croatian companies in 2019. Half of the Croatian economy was directly affected by the crisis caused by the COVID-19 pandemic.

"This doesn't mean that 419 billion kuna in revenue was endangered because not all revenues fell by more than 50 percent, some actually fell by much less, but in those months, many companies asked for support,'' explained Vuk Vukovic.

After the lockdown, there was a drop in the number of people provided with the aforementioned grants

Interestingly, after the lockdown, there was a sharp drop in the number of people using those government subsidies, from 415 thousand down to a significantly lower 72 thousand in June, and from 54 thousand companies to 6800 who were still seeking such support for their 49 thousand workers during the month of August. These companies, which were obviously still sailing through troubled waters three months after the lockdown and as such needed to seek 4,000 kuna in aid for their workers, account for a total of almost 37 billion kuna in revenue (9 percent of GDP).

In other words, the collapse of these companies, which haven't yet recovered from the shock of this continuing crisis, directly threatens 49 thousand jobs and 9 perent of GDP (this data refers to the period before the new, partial lockdown came into force).

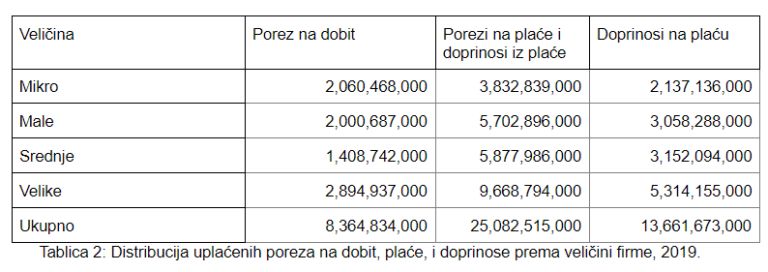

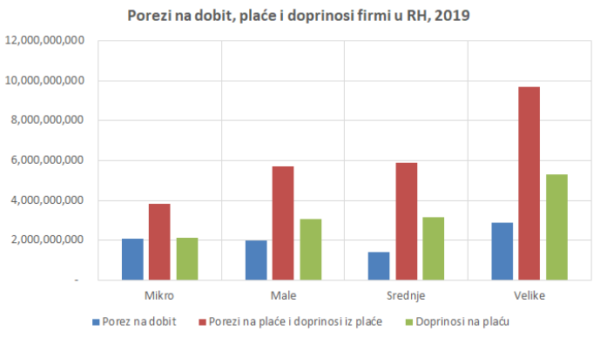

The next category is the data on paid taxes and contributions of micro, small and medium enterprises registered in Croatia. Table and Graph 2 show the distribution of income tax payments and taxes and contributions from salaries and employee salaries for all companies in Croatia for the year 2019.

They paid 29.2 billion kuna in taxes and contributions last year

Back in 2019, micro, small and medium-sized (SME) companies in Croatia paid a total of 5.5 billion kuna through profit tax and 23.7 billion kuna through taxes on salaries and contributions. This total amount, excluding VAT, of as much as 29.2 billion kuna, was enough to cover the total costs of the healthcare system in 2019, which stood at around 12.8 billion kuna, the police, court and prison costs (8.8 billion kuna), military expenditures (4.7 billion kuna) and even expenditures on sports, religion and culture (an additional 2.6 billion kuna).

Or, a different calculation of 29.2 billion kuna collected only from micro, small and medium enterprises would show that it was enough to finance the total cost of pensions of 27.4 billion kuna, or to almost cover the total cost of expenditures for public sector employees, which in 2019 amounted to 29.6 billion kuna.

A ''hole'' of 3 billion kuna has been formed through a drop in the payment of taxes and contributions alone

Micro, small and medium-sized Croatian enterprises pay the state budget an amount sufficient to finance all pensions or all salaries in the public sector or the entire healthcare system, the police, courts and prisons, the army, sports, religion and culture. If we focus solely on those Croatian companies that received aid, whose revenues at the height of the pandemic and lockdown accounted for 52.5 percent of that of the Croatian economy, such companies paid about 24 billion kuna from income tax and taxes and contributions to salaries (excluding VAT) for 2019 alone.

After the lockdown came to an end, far fewer companies were left at risk, but their potential collapse will create a hole of as much as 3 billion kuna just through the drop in taxes and contributions to the state budget. This effect of the collapse of about 7,000 of the most vulnerable companies alone means less money for the healthcare system, pensions or for public sector wages. In particular, the collapse of the 7,000 most vulnerable companies would jeopardise as many as 136,000 pensions or about 25,000 salaries in the public sector.

Vuk Vukovic: The government needs to find a way to save these companies

''It should be borne in mind that this is an impact assessment based solely on the latest data available from the end of August. At the end of the year, after the new lockdown, even more Croatian companies are likely to find themselves in troubled waters, which means that many more jobs are potentially yet to be put at risk, and as such, tax revenues and budget contributions will also be in the same boat.

I'd like to note that these calculations don't take into account the lack of VAT revenue from companies that will potentially fail and whose staff would find themselves out of work. Thus, all of the above estimates very likely underestimate the strength of the final effects of all this. I think that the situation is very serious and that the government should find ways to prevent the collapse of so many companies as soon as possible,'' concluded Vuk Vukovic, the founder of the Economic Council of the Glas Poduzetnika Association.

For the latest travel info, bookmark our main travel info article, which is updated daily.

Read the Croatian Travel Update in your language - now available in 24 languages

As Coronavirus Crisis Rocks Economy, 5 Croatian Sectors Hardest Hit

December the 12th, 2020 - The ongoing coronavirus pandemic has shaken the Croatian economy in a way that is difficult to believe could happen in this day and age. Five Croatian sectors have been hit the hardest by the pandemic and all of the restrictions that have come with it.

As Jadranka Dozan/Poslovni Dnevnik writes, in addition to belonging to Croatian sectors whose business is more exposed to the impact of limited mobility during the continuing pandemic, the extent of damage caused by this public health crisis within the realm of entrepreneurship also lies with the size of business entities in terms of their number of employees and the levels of their income.

Such a conclusion is imposed, among other things, from the structure of paid aid for the preservation of jobs from the government back during the first wave of the pandemic, which sought to weaken the blow to the economy in as much as was possible at the time.

According to an analysis done by the Fininfo portal, of the total grants paid out by the government so far, it is estimated that in the first three months of those measures, when they included the largest number of employees, around six billion kuna was paid out, after which the grants focused on the most exposed Croatian sectors, activities and entities.

Fininfo states that as much as 87 percent of the aid was paid to micro, small and medium-sized enterprises, which, they say, indicates their significantly higher exposure to damage caused by the current pandemic when compared to more resilient, larger enterprises.

To confirm this assumption, the relative exposure of a particular size of enterprise or company was also analysed, putting in the ratio of the number of employees and operating income of companies that received support in relation to those of the same rank in terms of size that didn't receive it.

The analysis included Croatian companies that submitted their annual financial reports for 2019 (which account for 84 percent of total aid received), and the findings confirmed a significantly stronger relative exposure for micro, small and medium-sized enterprises when compared to larger companies.

A significantly higher number of employees working for micro, small and medium-sized enterprises received grants compared to those who didn't, while in large companies, the situation is the other way around, say analysts led by the director of EL Koncept, which is behind the portal.

The situation looks remarkably similar when operating revenues are taken into account as a parameter. Thus, a larger part of business revenues generated by micro, small and medium-sized enterprises received grants than those who didn't and for larger companies, the situation is the other way around yet again.

"We can conclude that the current crisis has affected more than 60 percent of micro, small and medium-sized enterprises compared to 44 percent of large ones, and if we look at the entire economy, the total exposure to the pandemic stands at about 55 percent. Relatively, the most affected by it all are small and medium-sized companies, small in terms of their number of employees, and medium-sized in terms of their income,'' the analysis states.

These findings, however, suggest that in the forthcoming period, greater problems in the payment of obligations can be expected from micro, small and medium-sized enterprises. Regarding the exposure of certain Croatian sectors, it is already very clear that the hardest hit are primarily those related to tourism, as they're based on mobility which is currently difficult.

However, Fininfo also addressed a more detailed examination of the relative exposure, given the number of workers, income and the number of entities, because, they say, this provides a better insight into the actual impact of a particular sector with the pandemic. Of the five most affected sectors, four are actually directly or indirectly related to tourism.

In addition to travel agencies and travel organisers, accommodation and catering services (the preparation and serving of food and beverages), these include wholesale and retail of motor vehicles, due to the large share of sales to car rental companies which have had very little business from tourism in 2020.

The only one of the five relatively most affected Croatian sectors not related to tourism is the category of processing of wood and wood products (with the exception of furniture). The average combined impact of the crisis on these five Croatian sectors exceeds an extremely concerning 80 percent in terms of operating income and number of employees.

In contrast to those Croatian sectors which have been the most deeply affected, back during the first wave of the pandemic, the crisis had the least impact on enterprises in computer programming and consulting, telecommunications, pharmaceuticals, waste collection, treatment and disposal, and electricity and gas supply. The average combined exposure of the least affected Croatian sectors to the crisis stands at 15 percent and is far lower than the most affected sectors or the average impact that the pandemic had on the domestic economy as a whole.

For the latest travel info, bookmark our main travel info article, which is updated daily.

Read the Croatian Travel Update in your language - now available in 24 languages

Croatian Restaurants and Cafes Lose 5.6 Billion Kuna Since March 2020

December the 11th, 2020 - The ongoing coronavirus crisis has dealt a heavy blow to the economy this year, and countries like Croatia which rely very heavily on tourism and hospitality have lost out tremendously. Croatian restaurants and cafes have lost an enormous 5.6 billion kuna since back in March when the pandemic first penetrated Croatia's first lines of defence.

As Jadranka Dozan/Poslovni Dnevnik wirtes, the catering and hospitality sector has found it very difficult to accept the tightening up of the epidemiological measures which put the keys in the locks of Croatian restaurants, bars and cafes. Of course, they are not the only ones, as gym owners have also had to come to terms with the impossibility of that very same situation.

The alarming situation due to the restrictions is also being felt on the skin of the event industry. As the incidence of coronavirus infection remains high, additional restrictions by the National Civil Protection Headquarters will follow at the end of this week, primarily affecting the work of traders.

The president of the National Association of Caterers, Marin Medak, is now calculating that the work ban could be extended until the end of January 2021.

In addition to the battle over compensatory assistance measures, the owners of Croatian restaurants, bars and cafes are thus turning to the topic of facing future challenges and legal solutions for the sector in talks with government representatives. However, in the meantime, they are still trying to "negotiate" with the Headquarters to at least allow those who can and want to make coffee to do so for those remaining outside and taking it away.

The Voice of Entrepreneurs Association, on the other hand, accused the Government yesterday of making the new job preservation measures into ''just another spin''. They were disappointed by the Tax Administration's instruction regarding the reimbursement of (part) of the fixed costs as part of support for the preservation of jobs.

Authorities failed fulfill the promises they made at meetings they'd held with entrepreneurs, the aforementioned association said, stating that, according to the Tax Administration, "employers should first pay their obligations, and only then will they receive a refund from the state." In this situation, they argue, for most entrepreneurs this is mission impossible because everything they had to their names from previous years was spent during the first lockdown back in spring.

One indicator of the extent of the coronavirus crisis is the worrisome fiscalisation data, and the Ministry of Finance or the Tax Administration publishes that information weekly.

It has since been revealed that starting from March, the reported turnover of Croatian restaurants and cafes reached 8.74 billion kuna by the end of November. Compared to the same period last year, it is 39% or 5.58 billion kuna less. Of course, the decline is distributed unevenly; some within the industry have sunk far more than that, and some less than the average decline in fiscalised turnover suggests. In addition, since the beginning of the year, the decline is somewhat smaller because in the first two months of 2020, before the crisis began, Croatian restaurants and cafes recorded growth.

For accommodation services, on the other hand, data on fiscalisation indicates that their performance in the period from March to November was lower than last year by almost 57 percent or 5.7 billion kuna. Last year, it exceeded 10 billion kuna, and this year, the coronavirus crisis cut down it to 4.35 billion kuna.

The value of bills/receipts issued in the transport and storage sector fell by more than half, by almost 52 percent, down to 1.3 billion kuna when compared to last year's impressive 2.7 billion kuna. More than halved turnover in year-on-year comparisons over the past nine months was also reported by activities related to culture and sports (arts, entertainment and recreation). In this group of activities, less than 603 million kuna in turnover was fiscalised, which marks a decrease of 52 percent or 664 million kuna when compared to last year's far higher 1.26 billion kuna.

During the second wave of the pandemic, unlike during the first, hairdressers and beauty salons managed to avoid locking their doors and compared to last year, they recorded a decrease in turnover by 185 million kuna or 22 percent) Slightly stronger than hairdressers and beauty salons, the category of body care and maintenance activities was hit with a drop of 35 percent.

According to the percentage drop in fiscalised turnover, the coronavirus crisis hit the real estate business far more severely. With 109 million kuna in turnover since March, the tax data on this shows that this is a year-on-year decline of as much as 280 million kuna, or more than 70 percent. Although Croatian restaurants and cafes are the loudest when it comes to losses, this too is extremely concerning.

In contrast, Information and Communications is a segment of the business sector in which entrepreneurs haven't recorded a negative impact as a result of the ongoing coronavirus crisis. However, this group of activities also recorded a decline in fiscalised turnover, albeit in single digits. The reported 1.04 billion kuna is only about 80 million kuna or a little more than seven percent less than how things stood last year.

Approximately the same percentage decrease is indicated by the data on fiscalisation for the activities of Agriculture, Forestry and Fisheries with 1.2 billion kuna worth of invoices issued compared to around 1.3 billion kuna's worth issued in the comparable period last year.

Entrepreneurs within the Professional, Scientific and Technical Activities in the pandemic were struck with losses amounting to about 11 percent or slightly less than 290 million kuna in turnover. At the same time, a much more drastic decline was recorded in Administrative and support service activities, which reported a turnover of only 415 million kuna, whereas it stood at more than 1.7 billion kuna in 2019.

More detailed data shows that within the trade sector, as expected, super and hypermarkets suffered the smallest decline. The turnover of the category of non-specialised stores, mainly food, beverages and tobacco products, decreased by only 1.3 percent when compared to the comparable period last year from March onwards. A moderate 6.4 percent drop in turnover was also recorded in specialised stores, mostly in the food and beverage sector, but the turnover in the non-food trade sank significantly more.

For the latest travel info, bookmark our main travel info article, which is updated daily.

Read the Croatian Travel Update in your language - now available in 24 languages

Green Plan for Croatian Economy - Investment Focus on 3 Key Areas

November the 30th, 2020 - The Croatian economy has been dealt a very heavy blow this year as a result of the ongoing pandemic and all of the economic downturn caused by it. Despite that, the proverbial show must go on and investments must continue in order to pull ourselves out of this unprecedented situation. What are the main points of focus for the Croatian economy within the much talked about Green Plan?

As Poslovni Dnevnik/Darko Bicak writes, Vladimir Nisevic, the editor-in-chief of Poslovni Dnevnik, pointed out that Croatia's destiny, both in terms of recovering from the economic difficulties which have ensued since the coronavirus crisis took hold, and the Green Plan, is closely linked to the European Union (EU) as a whole and therefore the Green Plan and its implementation in Croatia are even more significant.

Ivo Miletic, State Secretary of the Ministry of the Economy and Sustainable Development, emphasised that the European Green Plan is a big step forward in regard to energy transformation, and as such the idea opens up a number of opportunities for the Croatian economy, and we must all adapt to it readily in order to benefit to the fullest extent possible.

"Croatia is also sensitive to the threats posed by climate change, which is why we've adhered to the provisions of the Green Plan, which doesn't leave any European Union member state behind, but instead provides everyone with an opportunity for development.

Stricter environmental standards await us, primarily in regard to the reduction of CO2 emissions, and the goals will almost certainly be higher and thus need to be adjusted. We will focus on efficient construction, decarbonised energy and clean transport.

The EU will commit a minimum of 100 billion euros in this budget perspective for precisely this purpose, and at least 30 percent of the money from the Next Generation programme, out of a total of 700 billion euros, will be directed to numerous green projects.

The situation caused by the coronavirus pandemic has also shown how vulnerable energy supply routes actually are, and it has once again highlighted the fact that decentralised renewable energy projects are necessary and strategic and will continue to be the focus of the Croatian Government,'' concluded Miletic.

For the latest travel info, bookmark our main travel info article, which is updated daily.

Read the Croatian Travel Update in your language - now available in 24 languages

Croatian GDP Drop Expected to be Significant Within EU Parameters

As Novac/Marina Klepo writes on the 23rd of November, 2020, after falling 15.1 percent in the second quarter, seven Hina analysts predict that the Croatian GDP will sink slightly less in the summer quarter, averaging 10.4 percent. Their estimates range from 9.5 to 11 percent, and if they materialise, despite a better-than-expected tourist season, Croatia will find it extremely difficult indeed to avoid one of the biggest declines among all EU countries.

According to the first Eurostat data for 21 countries, the average decline across the EU in the third quarter was 4.3 percent, and except for the United Kingdom with a deficit of 9.6 percent, the Spanish economy was most heavily affected with a decline of 8.7 percent, while in In Italy it stood at 4.7 percent.

Tourist spending

As one Hina analyst explained, with the easing of anti-epidemic measures during the summer months, most activities began to recover and the first high-frequency indicators confirmed growth in the third quarter compared to the March-June period, but a relatively high annual Croatian GDP decline is inevitable.

CBS datas show that retail trade turnover fell by 7.6 percent in the third quarter when compared to the same period last year, among other things due to significantly lower tourist spending. At the same time, industrial production fell by 1.3 percent, the value of merchandise exports in the first nine months of 2020 was 4.8 percent lower than it was during the very same period last year, and imports fell by an alarming 10.1 percent. Finally, government spending remains the only component of Croatian GDP that mitigated these utterly negative trends.

The CNB estimates that the ''real'' Croatian GDP in the first nine months of this year was 8.3 percent lower than it was back during the same period last year. Given the rapidly deteriorating epidemiological situation, expectations for the fourth quarter have also deteriorated alongside it.

Economic analysts also expect that Croatian GDP will continue to decline very sharply indeed because of, among other things. lower amounts of disposable income, lower festive spending and a further decline in exports. According to their expectations, the decline this year will stand at around 9.2 percent, similar to the EC's forecasts, which are at 9.6 percent, while the Croatian Government and the CNB believe that it will amount to 8 percent.

Next year, however, the government and the CNB are currently convinced that the domestic economy will grow by 5 percent, and the European Commission believes that its growth will stand at a decent 5.7 percent. The latest EBRD forecasts, on the other hand, claim that there will be slightly more modest growth in 2021, of only 3.5 percent. In addition, they point out that negative risks prevail, especially those related to the spread of the novel coronavirus, SARS-CoV-2. The EBRD has since reiterated its position that Croatia needs structural reforms in order to properly increase the competitiveness of the economy, and in addition to those already undertaken, the improvement of the quality of Croatia's typically horrendous institutions and governance is considered to be particularly important.

The business environment

In addition, as they point out in the latest Transition Report, it is necessary to improve the business environment in Croatia and remove all of the draconian and mostly entirely unnecessary red tape and administration, but also to diversify the economy properly. The current pandemic, according to the EBRD, has shown the danger of relying too much on one or two sectors, and Croatia must now think twice about lying on its tourism laurels.

For the latest travel info, bookmark our main travel info article, which is updated daily.

Read the Croatian Travel Update in your language - now available in 24 languages

Analysts Say Croatia's GDP Dropped by About 10% in Q3 2020

ZAGREB, November 22, 2020 - Despite the fact that Croatia's economy somewhat recovered from the record decline in the second quarter, thanks to activities after the lockdown, analysts estimate that in the third quarter it also fell at a double digit rate compared to the previous year.

The national statistical office (DZS) will release at the end of next week the first estimate of gross domestic product (GDP) for Q3, and seven analysts who took part in Hina's survey expect a drop in GDP of 10.4% on the year.

Their estimates of the decline range from 9.5% to 11%.

Economy in recession

That will be the second quarter in a row that the economy declines on the year, which means it has entered a recession, but the decline will be milder compared to the record 15.1% drop in the previous quarter.

The record decline in Q2 was a consequence of the coronavirus pandemic and restrictive measures aimed at curbing the spread of the virus, which paralysed economic activity from the second half of March to the end of April.

"When the measures were relaxed in June, and especially during the summer months, most activities already started to recover. First high-frequency indicators confirm that Q3 will see a growth compared with the period from March to June, but a relatively steep decline in GDP on the year is inevitable," one of the analysts said.

Personal consumption continues to decline

The decline is mainly due to weak personal consumption, which is the largest component of GDP. Data from the national statistical office show that retail trade turnover fell by 7.6% in Q3 compared to the same period last year.

"That is mainly a consequence of trends in hospitality services, which didn't manage to compensate for losses caused by the closure of the economy even during the summer months, and tourist spending was markedly lower compared to the previous year," it was said in the survey.

Even though the summer tourist season was slightly better than expected at the start of the coronavirus crisis, the decline in tourist turnover was sharp.

According to the DZS's data, there were 6.6 million tourists in commercial accommodation establishments in the first nine months of 2020, which is a drop of about 63% from the same period last year, while the number of tourist nights dropped by 54% to 39.7 million.

The decline in industrial production also had a negative effect on GDP. In the past quarter, production dropped by 1.3% on the year.

That is a consequence of weak domestic demand, as well as foreign demand, as indicated by the decline in exports since the start of the year.

According to the DZS's data, the value of exports of goods in the first nine months of 2020 totalled about HRK 80 billion, which 4.8% less compared to the same period last year, while imports dropped by 10.1%, to approximately HRK 126 billion.

"High levels of uncertainty and worsening expectations also curbed stronger investment, while government spending is the only GDP component that is mitigating the negative trends on the demand side with its growth," one of the analysts said in Hina's survey.

Second wave of corona crisis

Because of the second wave of coronavirus spreading in Croatia and Europe, analysts also expect an economic decline in Q4 compared to the previous year.

It is expected that holiday spending and tourist activity will weaken due to epidemiological measures.

In addition, a further decline in exports and imports is expected, given the new restrictive measures introduced in most European countries due to the second wave of coronavirus, as is recession in Croatia's largest trading partners, Italy and Germany.

Deep, but brief recession?

Because of all this, a record decline in economy is expected in the entire 2020.

According to Hina's survey, seven analysts on average estimate that in the entire 2020 the economy could decline by 9.2%. Their estimates of the decline range from 8% to 10%.

The estimates of the decline have slightly decreased since three months ago analysts on average expected a drop of 10.5%.

According to one analyst, some of the reasons for that include a somewhat salvaged main tourist season, the resilience of construction (more) and industry (less) to negative trends, reduced gap in trade in goods (goods exports more resilient than imports) and, finally, the government's fiscal impulse through wage subsidies and maintaining household income levels, as well as the moratorium on loan repayment.

Despite being mitigated, this year's economic downturn could be greater than during the 2009 financial crisis, when the GDP dropped by a record 7.4%.

The government itself expects a greater drop in economy than in 2009, so it estimates that the GDP will decline by 8%.

The Croatian National Bank also expects a drop of about 8%, while the European Commission estimates that Croatia's economy will decline by 9.6% this year.

While the drop in GDP in 2020 will likely be deeper than during the global financial crisis, it is expected that this recession will be shorter. Then, the recession lasted for six years, while this time the economy is expected to grow as soon as next year.