HNB Reports Increased Number of Counterfeit Banknotes in 2021

ZAGREB, 19 Feb 2022 - A total of 807 banknotes of all currencies were withdrawn from circulation in Croatia in 2021, which is 77.8% more than in 2020, and 198 of them were counterfeit kuna banknotes, which is an increase of 26.1%, the Croatian National Bank (HNB) said earlier this week.

Kuna banknote counterfeiting accounts for a quarter of fake banknotes

The kuna banknote counterfeits accounted for 24.5% of all counterfeit banknotes registered last year.

The most frequently counterfeited domestic currency denomination was the 200 kuna banknote, which accounted for 98 registered counterfeit kuna banknotes, or 49.5% of the total registered kuna banknote counterfeits.

Among the 807 counterfeit banknotes of all currencies withdrawn from circulation, counterfeit US dollar banknotes accounted for 42.9%, followed by counterfeit euro banknotes (28.3%), counterfeit Swiss franc banknotes (2.4%), and counterfeit pound sterling banknotes (1.7%).

Last year, 228 counterfeit euro banknotes were withdrawn from circulation, which is a decrease of 3.8% from 2020. 50 euro banknotes accounted for the largest number of counterfeit euro banknotes withdrawn from circulation, with a share of 38.6% in the total number of registered counterfeit euro banknotes.

8,075 counterfeit coins withdrawn from circulation in 2021

A total of 8,075 counterfeit coins were also withdrawn from circulation in 2021, including one counterfeit 5 kuna coin and 8,074 counterfeit euro coins. Compared to 2020, when 817 counterfeit euro coins were withdrawn from circulation, the number of counterfeit euro coins increased by 888.3%.

The increase in the number of counterfeit euro coins withdrawn from circulation was the result of the central bank's adjusting banknote and coin processing machines and training as part of the National Training Programme.

The HNB said that the counterfeits registered last year did not cause any significant financial damage, nor did their quantity and production quality cause any disturbances in cash operations in specialised institutions or among the general public.

For more, check out our business section.

Central Bank Warns of Continued Financial Stability Risks

ZAGREB, 16 Feb 2022 - Financial stability risks remain increased compared to the period before the crisis due to uncertainties surrounding the end of the pandemic, rising inflation, residential real estate price hikes, and geopolitical risks, the Croatian National Bank (HNB) Council concluded on Wednesday.

The economy continued to grow in the last quarter of 2021, albeit at lesser intensity than previously in the year, with industrial production increasing, while the real retail turnover and construction stayed at Q3 levels, the HNB said in a press release.

In Q4 2021, employment continued to increase while the unemployment rate dropped, making their levels better than before the pandemic. Nominal pay growth also continued to accelerate, while inflation resulted in a decrease of the real pay average.

In December, the annual inflation rate increased to 5.5% from 4.8% in November. Higher food prices contributed the most to that. Together with energy prices, they are increasingly influencing inflation.

The continuation of expansionary monetary policy continues to stimulate the fall of banks' interest rates. Keeping interest rates on the money market at zero is accompanied by a mild increase in sovereign bond yields.

At the end of last year, bank lending increased 3.9% year on year, just as it did at the end of 2020. Household lending went up from 2.1% in December 2020 to 4.5% last December, primarily as a result of a strong increase in housing loans. Corporate lending decreased from 5.6% to 2.3%.

Although a strong economic recovery enabled a gradual revocation of government aid to businesses, new waves of the pandemic continue to cause problems in global supply chains, stimulating price growth.

Hence, there is a prominent risk of long-term inflationary pressures and higher inflation than currently forecast, which could prompt a faster and stronger tightening of the monetary policies of the largest monetary markets' central banks.

Increased volatility on financial markets at the start of this year is reflected in uncertainty about inflation trends, the evolution of monetary policies and expected interest rate growth.

Residential real estate prices increasingly further from fundamentals

Last year saw a strong increase in housing loans in Croatia as well as residential real estate prices, which went up to 9% in Q3. Those prices are moving further and further from long-term trends and macroeconomic fundamentals, increasing the risk of their fall in case of economic disruptions.

Increased household borrowing is accompanied by relatively mild borrowing standards which again this year, will be supported by government subsidies. These may, at the start of the repayment period, pose a smaller burden on borrowers but when the subsidies expire, they increase repayment costs as well as vulnerability to possible shocks.

In response to the continued accumulation of cyclical systemic risks, notably the rise in residential real estate prices and housing lending, the HNB has announced increasing the countercyclical capital buffer rate for Croatia from 0% to 0.5% as of 31 March 2023.

The aim is to set aside additional capital in time in order to boost the resilience of credit institutions to possible losses due to cyclical risks, the press release said.

For more, check out our business section.

Croatian National Bank: No Irregularity or Conflict of Interest in Vice Governor's Purchase of Property

ZAGREB, 16 Feb 2022 - Croatian National Bank's (HNB) Vice Governor Roman Šubić on Tuesday confirmed media reports about his purchase of a house in Zagreb below the market price, explaining that the advertisement of the sale of the property was made public and that transaction was in line with law.

He also underscored that the purchase of that villa was not in contravention of the rules on conflict of interest prevention.

Media outlets have reported that in late 2021, Šubić bought a 1,077-square-metre large villa in Zagreb's residential area of Gornji Stenjevec from a debt collection agency at the price of €230 per square metre, which was far below market price. Thus, he paid approximately €250,000, that is 1.9 million kuna, for that property, and he stated in his declaration of assets that the house's value is HRK 3.05 million.

Vice Governor Šubić coordinates and manages the Statistics Area and the Credit Institutions Resolution Office.

Following inquiries from HINA about a possible conflict of interest in this case, the central bank responded on Tuesday that Šubić is not authorised to sign HNB opinions on whether the planned sale to be conducted by a credit institution is in compliance with the existing regulations on the transactions of credit institutions. Therefore, he had not signed an opinion on the sale of the Gornji Stenjevec house, which media outlets have been reporting in recent days.

The HNB also underscores that the scope of activities within the remit of the Credit Institutions Resolution Office have nothing in common with the activities of these transactions, specifically the sales and purchases between credit institutions and debt collection agencies. The HNB explains that it means that data on individual credit obligations of consumers were not available to Vice Governor Šubić.

The HNB elaborates that February 2021 was when Šubić got the information about the sale of that debt pertaining to the property via a digital classified advertisement on real estate, and also via the public auctions conducted by a municipal court in Zagreb. This means that there was public access to the pertaining information available.

Thus, all the interested parties had an opportunity to express their interest in buying the property.

The central bank also says that the purchase and sale agreement in this case was concluded in compliance wit the existing regulations.

Therefore, the purchase of that property cannot be viewed as an illegal transaction or a conflict of interest case.

The HNB also says that the below-the-market price was a result of the failure to sell the property at the two previous public auctions.

For more on politics, follow TCN's dedicated page.

Croatian National Bank Economist Vedran Sosic Talks Interest Rate Growth

February the 16th, 2022 - Croatian National Bank economist Vedran Sosic has spoken out about interest rates and when prices in general might return to some form of normality.

As Poslovni Dnevnik writes, economist Vedran Sosic has stated that currently, inflation is expected to peak in the second quarter, after the peak of electricity and gas prices, and should calm down entirely by the end of the year. Raw material and energy prices have boosted inflation and it's normal that we're currently troubled by the price of oil, it is difficult to predict what will happen there. A slight descent is expected towards the end of the year, but all this is all still shrouded in uncertainty.

''Energy prices have quickly made their mark on prices being paid for fuel at the pumps, although we still have a limit on petrol prices, we'll see what happens with fuel costs in April - we have a package that should alleviate this spillover. Food is currently the largest contributor to inflation, with prices rising by around 8 percent, sometimes by even more. Producer food prices rose by about 4 percent, less than the case with retail. Traders say they're trying to take on part of the cost growth on margins, but according to statistics, it seems that margins haven't yet been reduced. A lot of what happened last year has already been absorbed in terms of prices, so that's something we shouldn't be seeing in the coming months,'' explained economist Vedran Sosic.

He also spoke to N1 and said that it is possible to use the growth of raw material prices to increase the price of the final product: "It's possible for that to happen. That is the greatest danger. Inflation is also a psychological phenomenon, the more we talk about it, the greater the risk that the inflationary spiral will roll, which is harder to bring back down again.''

"Interest rates will rise, but people can protect themselves now"

Commenting on interest rates on loans, CNB's main economist Vedran Sosic explained:

“Back in October last year, when it became apparent that inflation was going on, we warned people that interest rates would rise. The normalisation of monetary policy was expected, those expectations haven't really altered and so these jumps shouldn't be sudden. For the European Central Bank, the market expectation is about half a percentage point increase in interest rates. In some markets, this growth can be seen, Croatia borrowed more when it issued bonds, so the growth of interest rates is already visible.

Every loan is different - those that come with a fixed rate are protected. Those who have a variable, again, aren't the same as what's tied in with the interest rate. An increase of one to two percentage points for those who have a loan for a period of 20 years, could mean a 10 to 20 percent higher installment, that would of course be the worst case scenario - so about 400 kuna on a loan of 4,000 kuna. The suggestion to people is to look at what rates they have, maybe reprogramme things, change the bank… Let them ask personal bankers, inquire about protection, there's still time to change those loans.'' concluded economist Vedran Sosic.

For more, check out our dedicated lifestyle section.

Stjepan Pranjković Withdraws His Croatian Euro Coin Design Proposal

February 7, 2022 - After four days of controversy over an alleged case of plagiarism, Stjepan Pranjković finally decided to withdraw his Croatian euro coin design proposal.

On February 4, Total Croatia News shared the official announcement by the Government and the Croatian National Bank (CNB) regarding the four winners of the Croatian euro coin design proposal competition. In a government session that day, it was confirmed that the 2 euro coin would feature the geographical map of Croatia; the 1 euro coin would feature the kuna, the symbolic animal of Croatia; the 50, 20, and 10 cent coins would feature Nikola Tesla; and that the 5, 2 and 1 cent coins would feature the Glagolitic alphabet.

Stjepan Pranjković with Boris Vujčić, Croatian National Bank Governor. (Photo: Igor Kralj/PIXSELL)

The four winners were present at a symbolic event after the session, where each one offered more details about the creative process behind their Croatian euro coin design proposal and also received a special gift from the Croatian National Bank. It is also known that each of the winners would receive a prize of 70,000 kunas.

Public reaction was mixed. While some applauded the designs, some others criticized them. Many, for example, considered that choosing the map of Croatia was a very simple and easy idea, and others also called Nikola Tesla's coin part of political propaganda about the debate on its origins.

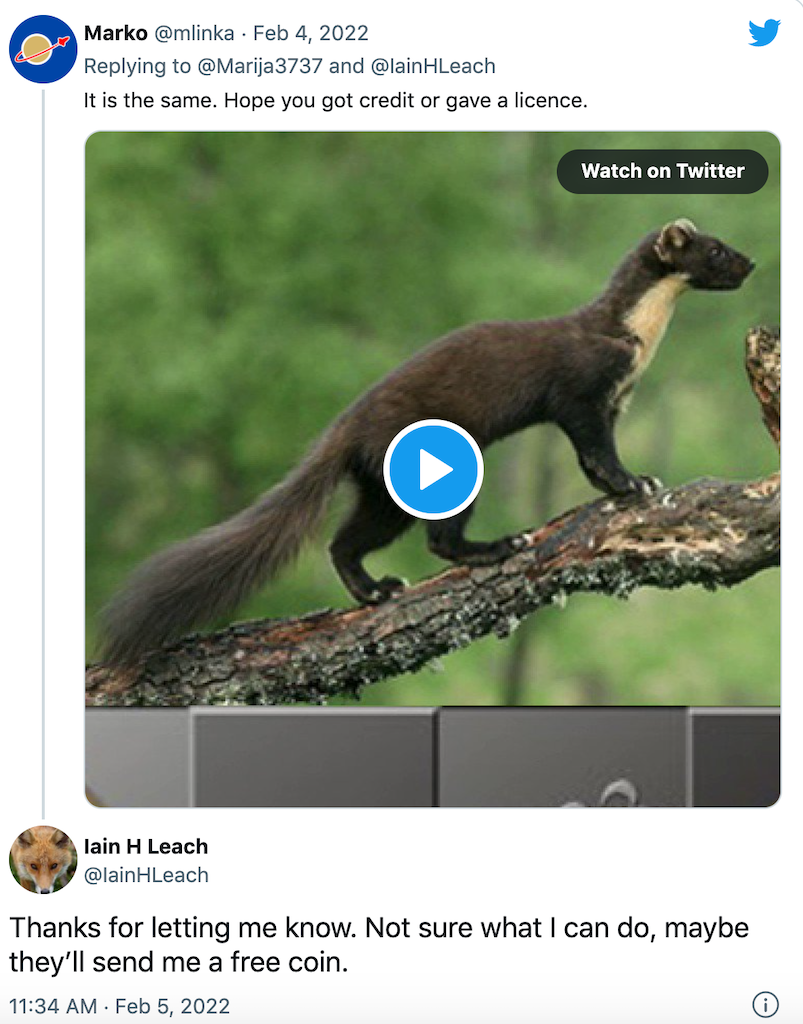

However, the biggest controversy would come the next day when suspicions began to spread on social networks about an alleged case of plagiarism. Some people found the design of the one-euro coin quite familiar, specifically because of the kuna animal layout. Thus, several users began to find little coincidence in the resemblance between the design of the coin and the image of the British wildlife photographer Iain H Leach of a pine marten, the name by which the animal is known in English.

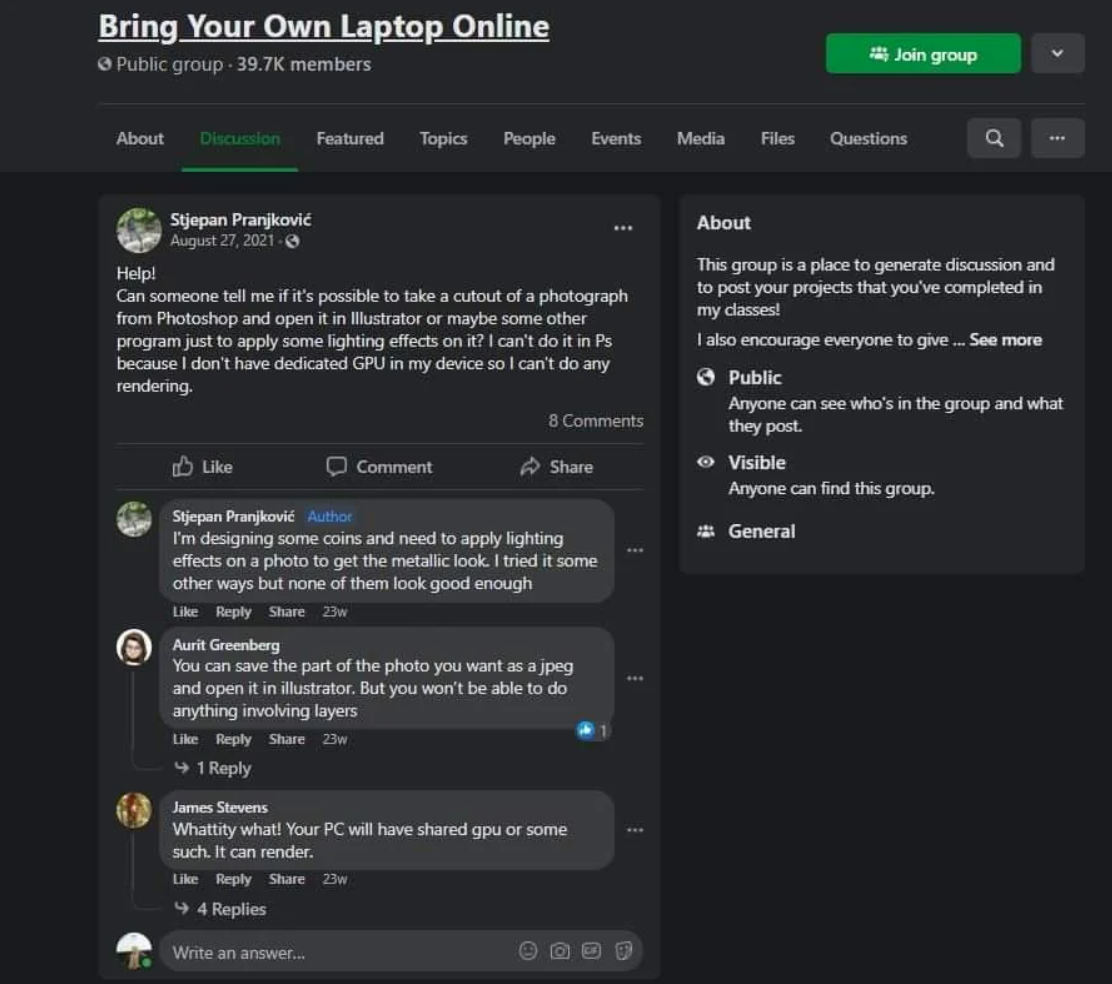

Shortly after, they managed to make contact with Leach, who in turn expressed his ignorance of what happened and, in addition, criticized that his permission was not requested to use an image that in the end would win a prize of at least 9,300 euros. Some users even shared a screenshot in a public Facebook group called Bring Your Own Laptop Online, where Pranjković would have asked for help to transform the photo into editing software, by adding special lighting effects to give it a metallic look.

Finally, after several days of intense criticism, Telegram.hr reports that Pranjković sent a letter to the Croatian National Bank in order to withdraw his proposal and also apologize for the unpleasant atmosphere created by the controversy.

"It was a great honor for me to participate in the process of selecting the national side of the Croatian euro coin. However, motivated by the unpleasant atmosphere created in the media and social networks, as well as the pressures I was exposed to regarding my design of the reverse of the one euro coin with a kuna motif, I decided to withdraw my design proposal for this motif and waive any rights to on the basis of participation in the competition for the motif of a one-euro coin", said Pranjković.

"I made this decision so as not to aggravate this situation or contribute to further possible uncertainties. I am sorry that there have been controversies regarding my work that could harm this important process for the Republic of Croatia. I did not intend to hurt anyone's feelings, so I apologize to everyone, especially to the Croatian National Bank, the Government and the Croatian public ", concluded Pranjković.

The CNB's Money Commission announces that it will hold an emergency session today and will comment on Pranjković's letter. By the way, after the media suspected that Pranjković used someone else's photo for his design, the CNB's Commission reported yesterday that they had launched an urgent inspection of his design.

Speculation regarding the possible alternatives has been present on social networks, with some proposing that the original photographer be credited, that another design be used that also has the kuna as a motif, and others also propose that an entirely different motif be used. However, the outcome of the Croatian euro coin design proposal is uncertain pending the CNB investigation.

For more, check out our lifestyle section.

Croatian National Bank Investigating Stolen Croatian Euro Coin Kuna Design

February 6, 2022 - The Croatian National Bank is consulting with legal experts about the potentially stolen Croatian euro coin kuna design by Stjepan Pranjković, which is oddly similar to a photograph of a kuna animal found on the Internet by British photographer Iain H Leach.

The CNB will publish its comment on Monday, writes Večernji List.

The author of the photograph, Iain H. Leach, was not asked for permission to use his photograph.

"Yes, it looks like someone took my photo without my permission and used it to design a new Croatian coin. They told me it was a competition and that design won. I also heard that the winner received a cash prize. I didn't get anything. He's a thief. He took my photo and picked up the prize. I think that those who organized it should withdraw the cash prize and name the real author of the photo on which the Croatian coin was made," Leach told 24 Sata.

"I am amazed at the interest from Croatia. A lot of good people from Croatia contacted me about this, and I didn't hear anything about it until two days ago," stated Leach for N1.

“I don’t mind the photo being used as a motif for the coin and I would be glad to see it there. However, I would like to be officially recognized as a photographer and receive a usage fee. Also, I don't think that the person who stole my photo should be rewarded with almost 10,000 euros for something that was copied," concluded the photographer for N1.

The Government told N1 that the competition to select the winning designs was led by the CNB from the beginning to the end.

"The competition for selecting the design was led from the beginning to the end by the CNB, through the Selection Committee (with external members) and the CNB's Permanent Money Commission, which otherwise decides on the design of commemorative coins. All contestants had to submit a statement guaranteeing that they are the owners of the copyright of the artistic solution that they applied for," the Government said for N1.

Recall, earlier this week, the Croatian Government presented the winning designs for the new Croatian euro coins. Various motifs were chosen - the coat of arms (šahovnica), a map of Croatia, a kuna (marten), Nikola Tesla, and the Glagolitic alphabet.

The kuna design, however, is familiar to a photograph of a kuna by a British photographer Iain H Leach. Many comments on social media pointed out the similarities between the kuna on the coin and the outline of the kuna in the photograph, primarily noticing the similar pose, the branch, but also smaller details, such as the position of the tail or the white color found on the animal's neck.

Leach also joined the discussion on Twitter.

"I hope the author of the Croatian euro coin design contacted you and paid you for the rights to the photo because the coin looks the same as your photo," one person wrote on Twitter, and he responded quickly. "Thanks for letting me know. Not sure what I can do, maybe they'll send me a free coin," Leach said. Twitter users soon began advising him to file a lawsuit.

This photo can be found in the photographer's kuna gallery on his website and around the Internet. This photograph is also provided by Google if "pine marten side view" is entered in the search engine. Pine marten is the English name for the kuna.

The author of the Croatian euro coin design received HRK 70,000

The kuna motif will be on the 1 euro coin, and next to it will be the word "Croatia," and the year they introduced the euro - 2023. The author of the best design for this coin is Stjepan Pranjković, Master of Applied Arts.

Pranjković received HRK 70,000 for his winning design. His other two solutions won second place, receiving HRK 35,000. In total, he received HRK 140,000.

There are also posts on the Internet in which Pranjković asked for help in a group on Facebook on how to process a photo for a coin.

By the way, 295 design proposals were accepted for the kuna coin. The Croatian Commission for the Selection of Artistic Design Proposals selected the nine most successful proposals and submitted them to the CNB. Finally, in the second round of the tender, the CNB's Money Commission selected the three most successful design proposals.

The CNB published a document in which they explained the awarded works. Among them, they explained the motif of the kuna that will adorn the 1 euro coin, which is identical to the British photographer's image.

"The author of the award-winning work decided on a realistic depiction of the kuna animal. He very successfully graphically highlighted the figure of the kuna using a different surface texture, which contributed to the realistic depiction.

The author skillfully used the relationship between the given elements, so he uses straight and sharp chessboard lines as a frame of motifs and contrasts them with wavy lines in depicting the marten animal and the branch on which it stands. The position of the obligatory elements, which are placed along the edge of the inner part of the coin, additionally frames the motif and emphasizes its position," explains the CNB.

For more, check out our lifestyle section.

HNB: Household Deposits Increase by 9.2%, Loans by 4.5%

ZAGREB, 31 January 2022 - In 2021, household loans went up by 4.5% to HRK 141.5 billion on the year on the back of a strong rise in housing loans, while household deposits went up by 9.2% to HRK 246.1 billion, the Croatian National Bank (HNB) said on Monday.

At the end of 2021, monetary institutions' lending to domestic sectors, except the central government, totalled HRK 245.8 billion, up 3.9% on the year.

Loans totalled HRK 238.9 billion, of which HRK 141.5 billion were household loans, HRK 86 billion were corporate loans, and HRK 11.4 billion were loans to other domestic sectors.

Housing loans totalled HRK 67.8 billion, up 9.2% from the end of 2020. Non-purpose cash loans went up by 2.3% to HRK 53 billion.

Loans to non-financial companies went up by 1%, as against a 6% increase at the end of 2020. Their bonds went up by 58.7%. Corporate loans went up by 2.3%, as against a 2.3% increase at the end of 2020.

Month on month, monetary institutions' lending in December 2021 was up by HRK 2.8 billion (+1.1%). Loans went up by HRK 1.7 billion (+0.7%). Loans to non-financial companies were up by HRK 1.4 billion (+1.6) and those to other domestic sectors by HRK 400 million (+3.6%).

Household loans decreased by HRK 100 million month on month, as did non-purpose cash loans, while housing loans increased by HRK 300 million.

At the end of 2021, deposits reached HRK 365.8 billion, up by 35.5 billion on the year (+10.8%). Money on transaction accounts increased by HRK 13.6 billion (+21%).

(€1 = HRK 7.5)

For more, check out our dedicated business section.

Central Bank Governor: Citizens Hold Cash Amounting to HRK 36 Billion

ZAGREB, 17 Jan 2022- Croatian National Bank Governor Boris Vujčić said on Monday that inflation might be the most serious potential "cost" of introducing the euro, however, this year, that influence on the total inflation rate could be less than 10%, so he believes this isn't something to be overly bothered about.

Vujčić added that the rest of the inflation will be generated from entirely different sources, primarily the prices of energy. He expects that the first half of this year will see strong inflationary pressure whereas "deflating" is expected in the second half.

Vujčić said that the best prevention against prices increasing is competition, adding that state intervention is only justifiable where monopolies exist. In the months prior to and after introducing the euro, consumers have to avoid those who increase their prices and buy from those who don't, he said, believing that the best protection against price increases is showing prices in both kuna and euro.

With regard to losing monetary sovereignty once Croatia enters the euro area, Vujčić recalled that the central bank has been maintaining a fixed exchange rate since the 1990s.

Hence, it is not using it actively as a monetary policy instrument, considering that a 10 percent depreciation of the kuna against the euro, due to the high level of ''euro-zation'' of the economy and households, the debt for all sectors in Croatia would increase by more than HRK 50 billion whereas appreciation of the kuna would disrupt the Croatian economy's competitiveness, that is exports, said Vujčić.

He revealed that fairly reliable data indicate that citizens are holding as much as HRK 36 billion in cash. He called on citizens to deposit cash in banks which would facilitate conversion once Croatia enters the euro area.

(€1 = HRK 7.5)

For more, check out our dedicated politics section.

HNB Governor Says Not Thinking of Resigning

ZAGREB, 17 Jan 2022 - Croatian National Bank (HNB) Governor Boris Vujčić said on Sunday he was not thinking of resigning and called on the financial regulator HANFA to look into the veracity of media reports of financial wrongdoing at the central bank.

"We certainly didn't do anything wrong," Vujčić told RTL television in a comment on the article by the Index news website saying that 40 HNB staff had been involved in insider trading in securities.

Vujčić urged HANFA to look into the allegations, stressing that the HNB wanted the matter clarified as soon as possible. He said that the regulator had access to all the data, both at the HNB and the Central Depositary Agency.

He said it was not the HNB staff that had caused damage to the central bank but the media fuss that was made without any evidence.

Vujčić said that he always adhered to the law in his work. In 2001, when he joined the HNB leadership, he had sold his shares in two banks to avoid a potential conflict of interest, he added.

He said that the HNB had adopted a code of ethics in 2016, which requires all staff to report to their superiors if they trade in banks' securities.

"If anyone is found to have traded in insider information from the HNB, they will immediately lose their job and that will not be the end of problems for that person. At this point we do not have any indications that something like that happened," the central bank governor said.

Vujčić said he was not thinking of resigning. He noted that in his opinion this whole affair was aimed at undermining the process of adopting the euro, adding that this attempt would not succeed.

"These unsubstantiated accusations in the public sphere and partly in the political sphere are certainly undermining the credibility of the institution," he said.

Vujčić said he would not be attending the presentation of the Euro Act on Monday. Asked how was it that he was not invited, he said the question should be addressed to the prime minister.

For more, check out our dedicated politics section.

HNB: Total Loans Reach HRK 237.6 bn

ZAGREB, 4 Jan 2022 - The volume of loans issued in Croatia totaled HRK 237.6 billion at the end of November 2021, which is an increase of 3.7% compared with November 2020, according to data from the Croatian National Bank (HNB).

Total lending by monetary institutions to domestic sectors (except the central government) was HRK 243.4 billion, an increase of HRK 700 million or 0.3% compared with October 2021 and of 4.5% compared with November 2021.

Loans accounted for the majority of lending, reaching HRK 237.6 billion in November 2021. They increased by 0.3% from October 2021 and by HRK 8.5 billion or 3.7% from November 2020.

Broken down by sector, compared with October 2021, corporate loans increased by HRK 400 million, or 0.5%, to HRK 84.8 billion, while household loans rose by HRK 200 million, or 0.2%, to HRK 141.8 billion. A slight rise, of HRK 100 million or 0.5% to HRK 11 billion, was also observed with other financial institutions.

The majority of household loans included housing loans, which increased by HRK 300 million or 0.4% month on month to HRK 67.5 billion, while general-purpose cash loans remained almost unchanged, at HRK 53.3 billion.

Compared with November 2020, corporate loans rose by HRK 600 million or 0.7%, and household loans by HRK 5.7 billion or 4.2%. Loans to other domestic sectors went up by HRK 2.2 billion or 25.1%.

On an annual level, total loans to households slowed down from 4.9% in October to 4.8% in November, reflecting the slowdown in the growth of housing loans, from 11.3% to 10.5%, due to the marked growth of subsidized loans issued in the same period of last year.

The slowdown in household lending on an annual level was partly mitigated by the stagnation of general-purpose cash loans, which decreased in the same month of the previous year, which increased their annual growth rate from 1.6% to 2.0%. On the other hand, corporate loans continued to accelerate on an annual level, from 1.8% to 2.2%, after stagnating earlier in the year.

(€1 = HRK 7.5)

For more, check out our dedicated business section.