Central Bank to Hold New Competition for Design of €1 Coin With Marten Motif

ZAGREB, 8 Feb 2022 - The Croatian National Bank (HNB) said on Tuesday that in the coming days its Currency Committee would invite new proposals for the design of the national side of the €1 coin with the marten as the motif.

The HNB said that late on 6 February, the Currency Committee, as the expert body of the HNB Council in charge of the competition for the designs of the national side of euro coins, received a statement from Stjepan Pranjković whereby he withdrew his design for the marten motif and waived all rights stemming from having participated in the competition.

Today, the Currency Committee accepted Pranjković's decision and, in order to eliminate any further uncertainty, suspicion or doubt concerning the selection of the design for the marten motif, decided to invite new proposals for the design.

The HNB said that during the competition all authors were required to sign statements whereby they confirmed that their designs were original intellectual creations made solely for the needs of the competition.

The new competition for the design of the back of the €1 coin with the marten motif will not bring into question the timely manufacture of Croatian euro coins, the HNB said.

The selected designs for the national side of euro and cent coins were presented last Friday, including the marten motif for the €1 coin by Pranjković, who has a master's degree in applied arts.

Shortly thereafter, however, media reported that his design was almost identical to a marten photo by Scottish photographer Iain H. Leach, which raised the question of intellectual property infringement.

In a letter to the HNB Currency Committee on 6 February, Pranjković said that, "spurred by the unpleasant atmosphere in the media and on social networks as well as the pressures" he was exposed to, he had decided to withdraw his design for the €1 coin with the marten motif as well as waive all rights stemming from having participated in the design competition.

SDP Proposes Inflation Bonus for Pensioners

ZAGREB, 8 Feb 2022 - Social Democratic Party leader Peđa Grbin on Tuesday presented a proposal designed to help alleviate the impact of growing inflation on pensioners in the form of a pension allowance bonus for allowances amounting to less than HRK 4,000, proposing also adjustment of pensions to wage and inflation growth.

"Croatian pensions are low and at a time of growing inflation they become even lower, which requires action. The government is late with responding, it first capped fuel prices for two months, which was insufficient, and now it has to cap them again at a higher amount," the SDP leader told a news conference.

Long and short-term measures for pensioners

Other countries introduced measures to alleviate the inflationary effects of euro adoption a year before adopting the euro, while in Croatia a bill on euro adoption is still under public consultation, Grbin said.

"We cannot expect its entry into force before April, and neither can we expect before that date measures that should cushion the inflationary blow to citizens," he said, proposing two measures to help pensioners.

One is a long-term measure envisaging a change of the model of adjusting pensions to wage and inflation growth, and the other is a short-term measure in the form of an inflation bonus.

SDP MP Branko Grčić said the current adjustment of pensions did not follow wage growth. Five years ago, when the incumbent government took over, the average pension accounted for around 40% of the average wage while now it accounts for less than 37%, he said.

Grčić said that if inflation growth was higher than the growth of wages, pensions should be adjusted 100% to the inflation rate, and if the wage growth was higher, pensions should be adjusted to the wage growth rate.

Average pension could drop below 30% of average wage

Had this model been used over the past five years, the average pension, which now amounts to HRK 2,645, would have been HRK 200 higher, Grčić said, warning that if the current model of pension indexation was not changed, the average pension would fall below 30% of the average wage in the next 10-15 years.

SDP MP Boris Lalovac believes that the parliament can introduce the inflation bonus already this month so that pensioners can receive it in April.

"The government has said it will give a HRK 200 bonus only to pensioners with guaranteed minimum allowances, and there are around 60,000 such pensioners. We believe that the scheme should be expanded... to cover around 850,000 pensioners whose pension allowance is below HRK 4,000, which would cost up to HRK 700 million," said Lalovac.

The SDP proposes that pensioners whose allowance is below HRK 1,500 should receive a one-off bonus in the amount of HRK 1,200, those whose pension amounts to HRK 1,500-2,000 should get a HRK 1,000 bonus, those with pensions ranging from HRK 2,000 to 3,000 should receive a HRK 600 bonus, and those with pensions ranging from HRK 3,000 to 4,000 a bonus of HRK 400.

Lalovac said that the state budget was the biggest winner at a time of inflation growth, which was why there should be no problems in securing funds for the inflation bonus for pensioners.

Everything supposed to be creative turns into corruption in Croatia

Grbin also commented on a scandal involving the falsification of the motif on the national side of the €1 coin, saying that "everything that is supposed to be creative turns into corruption in Croatia."

If the process of selecting the best designs for the national sides of euro coins had been conducted by professionals, if the profession had been consulted, this whole affair would not have happened, Grbin said, adding that not only the central bank but the government, too, was responsible, as it was quite late with the process of euro introduction.

Grbin believes the call for applications for the design of the national sides of euro coins should be repeated despite the lack of time.

Minister: Those Fishing in Troubled Waters During Euro Changeover to be Exposed

ZAGREB, 5 Feb 2022 - Economy and Sustainable Development Minister Tomislav Ćorić said on Saturday that anyone trying to fish in troubled waters by unjustifiably increasing prices during the euro changeover would be exposed.

"There will be continual monitoring by the state, and, I'm confident, by consumer associations as well. Those who fish in troubled waters and possibly increase prices without justification must be exposed," the minister told reporters during a visit to Split.

Speaking of inflation, he said that global markets had unfortunately started raising gas, electricity and oil prices and that the state could not influence it more significantly except by cutting taxes to alleviate the impact as much as possible after electricity and gas prices go up on 1 April.

"As of 1 April we will do our best so that the electricity and gas price increase is as small as possible," he said.

The minister also noted that this year's inflation would be slightly higher than last year's rate of 2.8%.

Ćorić said that he believed that if the situation on the energy market calmed down, Croatia would not experience the impact of price hikes as experienced by some other EU members.

Asked if inflation would have an impact on this year's tourist season, Ćorić said that if commodity prices increased by a few percentage points in the first half of the year, a likely rise in energy prices could lead to a rise in prices of services.

"I think it will have an effect (on this year's booking prices) but I hope that it will be reasonable and that we will not fish in troubled waters because that makes us less competitive," the minister said.

Asked if the government would cap fuel prices, Ćorić said the government would respond if the prices escalated.

Student Financial Club Informs President of its Educational Euro Changeover Programme

ZAGREB, 27 Jan 2022 - President Zoran Milanović on Thursday received representatives of the Financial Club, a specialised university student association, who presented their "Simply about the euro" project, the president's office said.

The project was carried out between October 2019 and April 2021 and is the first project dedicated to the introduction of the euro in Croatia, launched by university students to educate their colleagues and the public.

The aim of the project was to explain in a simple and comprehensible way all the doubts concerning the euro, the club's representatives told the president.

The project, which received the Rector's Award, included the publication of expert articles on the effects of joining the euro area, the organisation of panels and other activities.

They told the president the Financial Club was established in 2005 at the Zagreb Faculty of Economics and Business.

Besides the "Simply about the euro" project, the club has launched many other programmes aimed at increasing financial literacy in Croatia, notably among youth, including a seminar on the financial literacy of students in many Zagreb schools.

The president supported their idea and activities, his office said.

The Financial Club has received more than 30 Dean's and Rector's awards for various projects and conferences. In 2013, the Zagreb Stock Exchange awarded them for outstanding contribution to market capital education.

Adopting the Euro and Everyday Prices: What Can Consumers Expect?

January 25, 2022 - This year will mark the introduction of the Euro (€) in Croatia, two years after participating in the exchange rate mechanism since 10 July 2020. This set the exchange rate at 1 euro = 7.543450 kuna, with a band of fluctuation of 15%.

From September 5 onwards, retailers throughout the country should display dual prices with both kuna and euros. This measure will extend until the end of 2023.

According to the Croatian media, reactions from the general public surrounding the adoption of the Euro is one of hesitancy. Many fearing the adoption of the Euro may bring on additional inflationary prices.

This sentiment is understandable considering the country is also facing one of the highest year-on-year inflation of 5.5% (DZS).

The same fears were also expressed when 12 countries adopted the Euro in 1999. As many as 80-90% of consumers in Austria, Finland, Portugal, Netherlands, Greece, Germany, and Spain believed that prices were higher after the adoption.

But what could have led to these beliefs in euro-related inflation?

One reason is that consumers use approximated exchange rates for ease of conversions. For example, it can be more intuitive to use a rate of 8 kuna to 1 euro compared to the real rate, distorting inflation by about 6%.

Another, perhaps more calculable concern, is due to something called the rounding effect. This occurs when prices are replaced with more attractive, higher price points that frequently end with numbers 0, 5, or 9.

But are these fears justified, especially for the consumption of everyday goods? Responses from experts have so far has been encouraging.

Leading Croatian economists and even the European Commission have repeatedly assured the introduction of the Euro will not have significant effects on aggregate price levels. Researchers have also supported these claims, showing Euro-related inflation has a larger perceived (as opposed to actual) inflation on consumer prices, particularly for cheap, frequently purchased goods.

Two common sectors that can be used as examples to determine if, and how, the rounding effect may lead to an increase in average spending for consumers are: the restaurants and cafes sector, and the food and produce sector.

Food and Produce

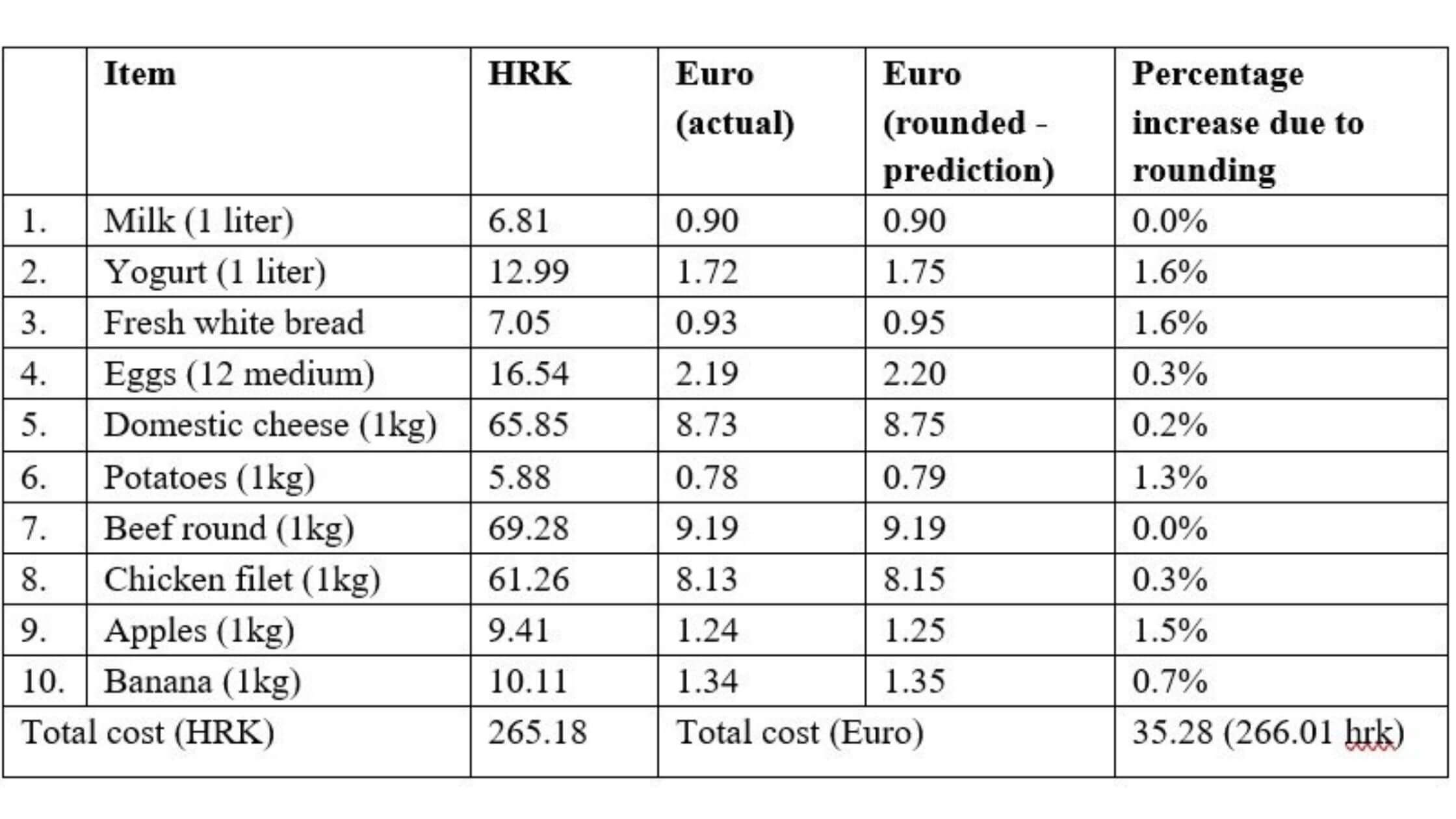

Table 1 outlines the average price of 10 common everyday household items bought on a weekly basis. Conservative estimates are made based on prices averaged from figures at Numbeo and Prices World.

These figures are based on the assumption that Euro prices are rounded to the nearest attractive price ending with 0, 5, or 9.

Table 1

When 12 countries adopted the Euro in 1999, consumer prices saw an increase of 0.12% to 0.29%. Although the increase in the rounding effect in Croatia may be slightly higher in the hypothetical scenario above, in real terms, this is almost negligible. Based on these estimates, the total cost of these weekly goods is currently 265.18 kuna. After the adoption of the Euro, the conservative estimate for the same goods is €35.29 or 266.01 kuna. A difference of 0.83 kuna or a 0.31% increase. While the euro-related inflation for everyday groceries may not burn a hole in consumers’ pockets, what about a common leisure activity, enjoying a drink or meal at a restaurant or cafe bar?

This is likely where consumers would feel more of a pinch.

Restaurants and cafes

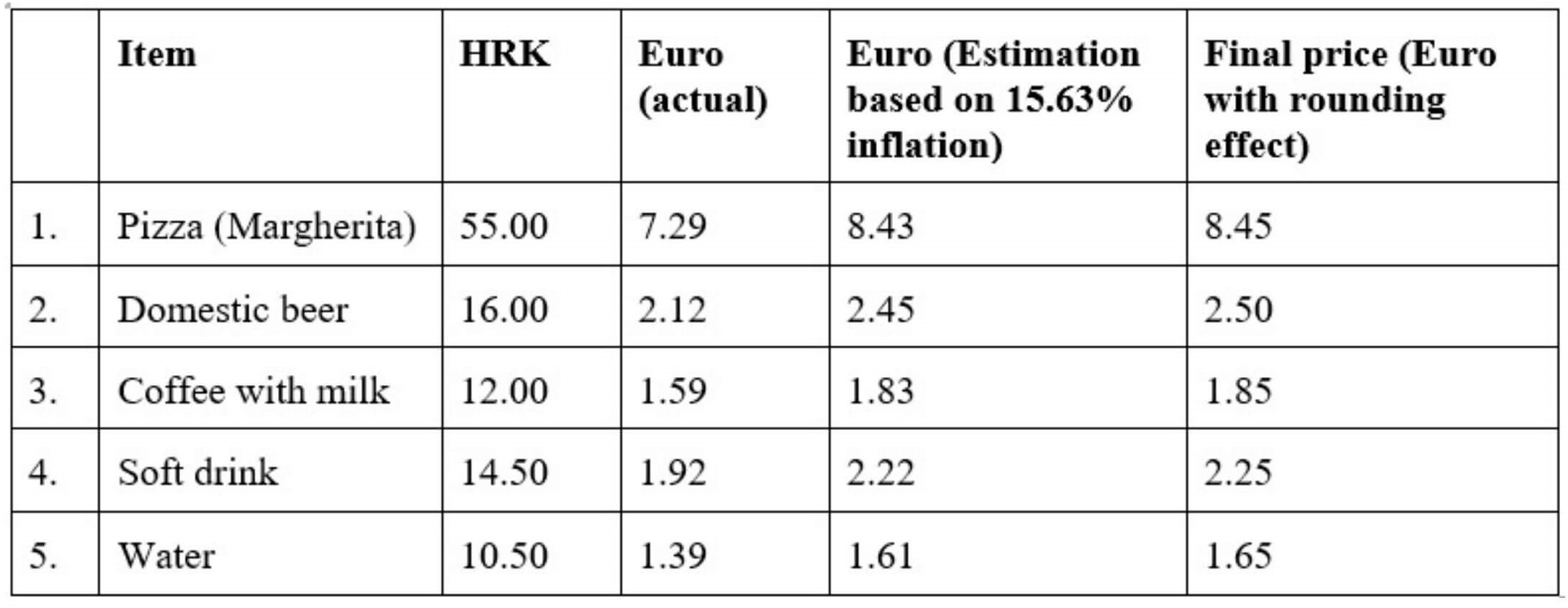

Back in January 2002, inflation for the restaurant and cafe industry in countries that adopted the Euro averaged a jump of 15.63%. In the following 3 months, these prices continued to increase at a rate of 5%. This was in contrast to countries that chose not to adopt the Euro, namely Denmark, Sweden, and the U.K. that only saw price increases of 1.01-2.18%.

Although the Euro was adopted by these countries in 1999 as outlined earlier, Euro notes and coins were only introduced 1 January 2002 which explains this trend. Until then, the old notes and coins of each country were still legal tender.

In neighboring Slovenia when the Euro was adopted in 2007, then governor of the central bank, Mitja Gaspari also shared a similar anecdote regarding the increase in coffee prices.

What might consumers expect from restaurants and cafes in Croatia? The following table uses similar predictions based on countries that previously adopted the Euro and includes a rounding effect.

Table 2

Using numbers from Numbeo and Price World, a meal at an affordable restaurant would average 59 kuna/person. With euro-related inflation, this could go up to 68.22 kuna/person.

The biggest jump is in mid-priced restaurants where an average meal increases from 220 kuna/person to 253.51 kuna/person.

There are a couple of explanations for this large increase in prices for restaurants and cafes, compared to food and produce.

The first scenario may be due to the switch acting as a motivator and coordination device for most, if not all, restaurant and cafe owners to switch to higher prices. This is also made possible through the widespread availability of menu prices online, leading to the rapid diffusion and adoption of a new Euro price point.

A secondary explanation for high inflationary prices can simply be attributed to the increase in anticipated menu costs due to the increase in marginal costs from raw ingredients. Since restaurants and cafes purchase these in bulk, costs accumulate relatively quickly and are passed down to the consumer.

Will these effects last?

The good news is for most euro-adopters in the long run, these spikes were largely temporary as people adjust to the new currency. The Croatian central bank is also giving inhabitants a longer time horizon of over a year to make this adjustment with dual prices lasting through 2023.

For more, check out our dedicated lifestyle section.

Switching to Euro Will Help Croatia Enjoy Better Credit Rating

ZAGREB, 13 Sept 2021 - Finance Minister Zdravko Marić said on Monday that the introduction of the euro as the sole legal tender would impact Croatia's credit rating, and quoted the Fitch agency's presumption that the country's admission to the euro area would raise its credit rating by two notches.

Addressing a meeting of the National Council for the introduction of the Euro as Official Currency in Croatia, which was also attended by the EC Vice President Valdis Dombrovskis, Minister Marić recalled that the 2020 COVID-19 pandemic triggered off a rise in the budget gap, and last year the general government deficit amounted to 7.4% of the country's GDP.

This year, it is estimated at 3.8%.

According to the latest estimates, the budget deficit in 2022 will fall to 2.6% of GDP and to 1.9% in 2023, while in 2024 it is projected to be 1.5% of GDP.

Marić recalled that as a consequence of the higher budget deficit, the public debt also rose in 2020 when it reached 88% of GDP.

This year, the public debt is likely to fall by two percentage points to 86.6%, and in 2022, it is expected to be reduced by a further three percentage points.

Marić expects the public debt to be 76.8% of GDP at the end of 2024.

He announced a shift of the focus to inflation, noting that inflation trends were now present worldwide.

Croatian National Bank (HNB) Governor, Boris Vujčić, said that Croatia's admission to the European Exchange Rate Mechanism (ERM) II had brought the country under the Single Supervisory Mechanism (SSM) and it also joined the Single Resolution Mechanism (SRM).

Concerning the HNB, we are already in the bank union to a large extent. Our experience from participation in the SSM and SRM is good, we have adjusted ourselves to that, Vujčić said.

Commenting on fears of higher prices being triggered off by the euro changeover, the governor pledged the protection of consumers and good communication.

"We are preparing the code of ethics which will be offered to businesses and services to sign, whereby they undertake fair performance during the euro changeover, he explained.

We will introduce monitoring and we will use the best practices of countries that have already converted their national currencies to the euro, he said.

For more, follow our business section.

Prime Minister Confident Croatia Will Be Ready to Join Euro Area on January 1st, 2023

ZAGREB, 13 Sept 2021 - Prime Minister Andrej Plenković said on Monday he was confident Croatia would be ready to enter the euro area on 1 January 2023.

Speaking at the 11th meeting of the national council for the introduction of the euro as Croatia's official currency, Plenković said Croatia had the full support of the European Commission and the European Central Bank to join the euro area.

"We approached this process in a very structured way, carefully. We believe we will fulfill in time all the commitments we undertook by entering the Exchange Rate Mechanism."

He said the government regularly discussed reform implementation in money laundering prevention, the business environment, public administration management, and the justice system, adding that he was confident all the ministries involved would fulfill what had been agreed.

Highly euroized economy

Plenković reiterated that over 60% of Croatia's export was to EU member states, over 60% of tourists in Croatia came from the euro area, over two-thirds of savings and half the loans in Croatia were in euros and that Croatia was already a highly euroized economy.

The experience of the countries which joined the euro area shows that it benefitted both their citizens and economies. Entering the euro area will eliminate the currency risk and exchange costs, reduce interest rates, boost foreign investment, and increase the possibility of financing on the capital market, which we are sure will have an additional effect on our credit rating, Plenković said.

That will also facilitate exports and tourist arrivals, he added.

By comparing pay and price trends in new member states, one can conclude that gross wages increased considerably in relation to price growth, he said. "Living standards increased considerably after the introduction of the euro."

Plenković reiterated that Croatia would have €25 billion in EU funds at its disposal in the years ahead.

"We expect an advance of €818 million could arrive in Croatia in the weeks ahead and, with the GDP growth we saw in the second quarter and which, after such a successful tourism season, will certainly be such in the third quarter as well, to embark on strong economic recovery, strengthening the resilience of the Croatian economy, quality of life, and raising the standard of our fellow citizens."

Dombrovskis: EC strongly supports Croatia's work and ambition to join the euro area

The European Commission Executive Vice President of for an Economy that Works for People Valdis Dombrovskis said at the meeting the Croatian government had shown a strong political will and set ambitious goals.

The Commission strongly supports the work and ambitions of the government and other Croatian institutions to join the euro area, which requires meeting all Maastricht criteria, he added.

Your economy is recovering well and will receive support via the recovery and resilience plan. Croatia is the biggest recipient of EU funds. 11.6% of GDP has been allocated to Croatia in grants, he said.

Dombrovskis said taking the euro path was worth it as it would lead to a more prosperous economy.

Asked by the press about the current inflationary pressures and if prices would go up once Croatia joined the euro area, the Commissioner said one should carefully monitor the impact of introducing the euro on prices also while preparing to introduce it in order to prevent significant price growth.

He said that when the euro was being introduced, product prices were being monitored in two currencies, among other things so that citizens could get used to prices in euros.

The relevant authorities will also have to monitor prices. Latvia, for example, where Dombrovskis was prime minister, conducted a campaign for a fair and equitable introduction of the euro.

Everything that was necessary was done to prevent the introduction of the euro from being used to raise prices, and even retail chains took part in the campaign, he said.

He added that no significant price increase was registered in the Baltic countries that entered the euro area last.

Plenković told the press there was no need for a referendum on euro adoption, explaining that during its referendum on its European Union's admission, Croatia also assumed the obligation to enter the euro area.

For more on politics, follow TCN's dedicated page.

Bridge MP Says Croatia Turning into an EU Retirement Home

ZAGREB, 30 Aug 2021 - Zvornimir Troskot, a member of parliament from the opposition Bridge party, said on Monday that the economic situation in the country was not good despite the government's boasting about it being excellent, and he also criticised insufficient production and the country's heavy reliance on tourism.

"It is good that GDP has grown by 16.1% in the last quarter considering our open tourism strategy but we have also been lucky because Spain has been on lockdown due to the pandemic and Greece due to wildfires," Troskot said at a news conference.

He noted that experts did not comment on the impact of inflation and price growth on GDP growth.

"If there are no more external shocks like the pandemic and lockdown, we will return to Croatia's economic reality, namely a 91% share of debt in GDP. That is why we should talk about real structural reforms in the economic sector because during the lockdown, too, the hospital system spent enormous amounts of money despite the fact that hospital care was less available than normally," he said, calling also for a reform of the judiciary.

Economy based on tourism, instead of on production

Troskot believes that public sector investments are yet another problem and recalls that the government has said that EU funds intended for recovery from the coronavirus crisis will eventually end up with private enterprises.

That money will possibly reach entrepreneurs through public procurement and we know how those allocations are made and that they do not reach entrepreneurs, he said, noting that his party had proposed transferring EU funds directly to entrepreneurs who had 68 prepared projects instead of financing public infrastructure projects that should not be a priority at the moment.

The MP also said that the national economy was not based on production, as evidenced by projects like the Pelješac Bridge, which, he said, was good, however, the EU funds approved for it had ended up in the accounts of Chinese, Greek and Austrian companies working on it.

We have based our economy on tourism instead of on production which creates jobs and which is the best instrument to fight inflation, he said.

"When we look at the whole picture, we get the impression that Croatia is becoming exclusively a tourist destination and is turning into a retirement home for the EU," he said, noting that 310,000 Croatians, born between 1984 and 1999, had emigrated to Germany.

He warned that in Slovakia wages in the past 15 years had grown by one thousand euros, while in Croatia they had increased by 327 euros, or a mere 20 euros annually.

Referendum on euro introduction

Asked if Bridge would support the campaign of the Croatian Sovereignists calling for a referendum on the introduction of the euro, Troskot said that his party was in favour of introducing the euro, but that Croatia was still not ready for it because it lacked own production and was not ready for the strong competition in the EU.

"Yes to the euro because we assumed that obligation under the Lisbon Treaty, but not for the time being because we are still not ready for it," he said.

For more on politics, CLICK HERE.

PM: Serbian Bank Can Have Opinion but Has no Say Concerning Tesla and Euro Coins

ZAGREB, 23 July 2021 - Prime Minister Andrej Plenković said on Friday that the Serbian National Bank (NBS), which contests Croatia's intention to put the image of Nikola Tesla on euro coins, could express its opinion on the matter and could take a stand, but that that had no influence in the decision making.

"Nikola Tesla was born in Smiljan on the territory of Croatia. And he lived most of his life in the USA. It is citizens who have recommended that one of the future euro coins should include the image of Nikola Tesla, we do not appropriate anybody," Plenković said after the NBS said on Thursday that putting Tesla's image on the national side of euro coins if Croatia joined the euro area "would represent appropriation of the cultural and scientific legacy of the Serb people."

Plenković elaborated that the suggestion made by Croatians amounted to a great gesture, having in mind the fact that Tesla was of Serb descent and his own merits globally were unquestionable.

We can be proud of that. I cannot see why somebody may deem it as a problem. If I were on the helm of the National Bank of Serbia, I would send congratulations (for such a decision), the Croatian PM said.

The NBS responded with its objections after Plenković announced that Tesla's image would appear on 50, 20 and 10 cent euro coins when Croatia joined the euro area.

The Croatian National Bank Currency Committee on Wednesday defined a final proposal of motifs for the national side of Croatia's future euro coins. This will now be considered by the National Council for the introduction of the euro as Croatia's official currency, after which the government will adopt a conclusion.

The Croatian coat-of-arms, a geographical map of Croatia, the marten (after which the Croatian currency is named), the Glagolitic script and Tesla are motifs that have been proposed.

For more on politics, CLICK HERE.

Croatian National Bank (HNB) Currency Committee Proposes Five Motifs For Euro Coins

ZAGREB, 21 July, 2021 - The Croatian coat-of-arms, a geographical map of Croatia, the marten (Croatian: kuna), the Glagolitic script and Nikola Tesla are motifs proposed for the Croatian side of euro coins, the Croatian National Bank (HNB) said on Wednesday.

The HNB Currency Committee today defined the final proposal for motifs for the national sides of future Croatian euro coins, which will now be considered by the National Council for the Introduction of the Euro as Official Currency in the Republic of Croatia, and then the government will adopt a conclusion.

The Croatian coat-of-arms will be used as a background on all coins, and other motifs will be used on coins of different denominations so that the 2 euro coin will feature a geographical map of Croatia, the 1 euro coin the marten, the 50, 20 and 10 cents coins Nikola Tesla, and 1, 2 and 5 cents coins the Glagolitic script.

The HNB said the main criteria for the selection was that the motif is acceptable to the general public and that it is a national symbol.

The rating given by citizens via an online survey at euro.hr, in which nearly 50,000 citizens took part, and a structured national survey on a sample of 1,000 citizens also influenced the Committee's final decision.

Based on the selected motifs, the HNB will announce a tender for the design of the national side of the euro coin. In mid October, the HNB will send the design of the motifs to the European Commission and the Council of the European Union, the press release said.

The production of euro coins with the Croatian national side should start at least six months before the introduction of the euro, that is the decision of the Council of the EU that Croatia is introducing the euro.

For more about politics in Croatia, follow TCN's dedicated page.