July 12, 2019 - Not enough hotels, way too many apartments - one of the stories of Croatian tourism. But have you heard the one of too much tax, almost no tax at all? One reason so many people are turning to private renting.

We are delighted to welcome Kresimir Macan to the TCN team. As the founder of Croatia's oldest PR agency and a former Communications Director to Prime Minister Plenkovic, Kreso understands the undercurrents of Croatian society better than most. His opening piece ventures into the Kingdom of Accidental Tourism, and a quite breathtaking look at who is paying tax - and who is hardly at all - in the tourist accommodation sector. You really couldn't make it up. Welcome, Kreso.

Since so many seem to be surprised with current developments in Croatian tourism, I feel motivated to explain that there is no accidental event that has lead us to the current situation. This strategy is not written in any official tourism strategy of Croatia, but it is the only strategy that actually works. It is showing great results, although not for tourism or the economy in general.

It is the tax incentive strategy which makes the private accommodation rental business in Croatia almost entirely tax-free.

I am not sure if this was an intentional plan, but as with most things in the Kingdom of Accidental Tourism, it just happened. The tax incentive strategy stimulated the development of private accommodation and put it in direct competition with the hotel industry. As previously reported on TCN, Croatia has a chronic shortage of quality hotels and international brands - compare luxury hotel brands in Croatia (with 1777km of coast) and Montenegro (less than 300km) below.

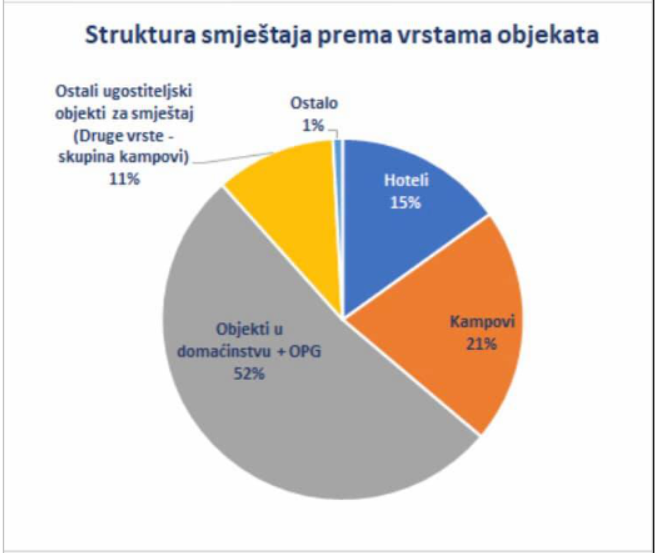

Hotel (15%) and camps (21%) make only 36% of Croatia’s accommodation, while private accommodations (52%) and other camps (11%) make 63%.

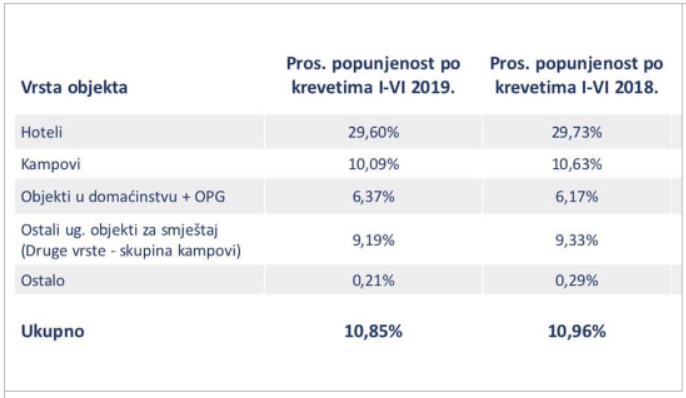

Looking at average capacity usage in the first half of 2018/2019, it is obvious that hotels are used at nearly 30% of capacities (quite a long season), while very profitable camps are around 10%. Private accommodation is used a little above 6%.

(Source Ministry of Tourism)

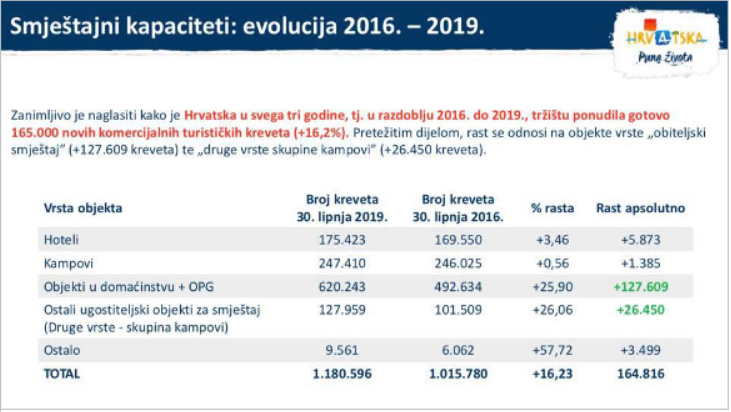

Looking at the numbers of beds and their growth in the last three years results are stunning – while hotel beds grew only 3,46% or 5.873 beds, private accommodation beds grew by a staggering 25,90% +127.609 beds.

A TWENTY-FIVE PER CENT rise in private accommodation beds in just THREE years.

Why? It is simple – whatever income you make from them – it is practically tax-free. In such a heavily taxed country like Croatia, this is quite incredible. It is a tax incentive strategy that happened by chance and nobody dares to control it. It is not the kind of tax incentive that brings investment and EU pensioners to Portugal in recent times. Because those things are thought out very carefully. Of this Croatian tax incentive strategy, nobody thought anything at all. Now they do not dare to change anything.

How come? If you are a business with turnover bigger than 400.000€ in Croatia you pay and charge 25% VAT on every transaction, profit tax of 18% and additional 12% + surcharge tax depending on your local city regulations (Zagreb has 18, while most coastal cities 12%) if you want your profit out as cash, roughly 30% of your profit goes to the State in that scenario.

How it is with hotels and camps? They pay 13% VAT on every room they book and meal they serve in their all-inclusive offer, while their restaurants pay 25% VAT if someone walks in off the street, the same as restaurants elsewhere in Croatia. So at least every 8th euro goes straight to the State budget.

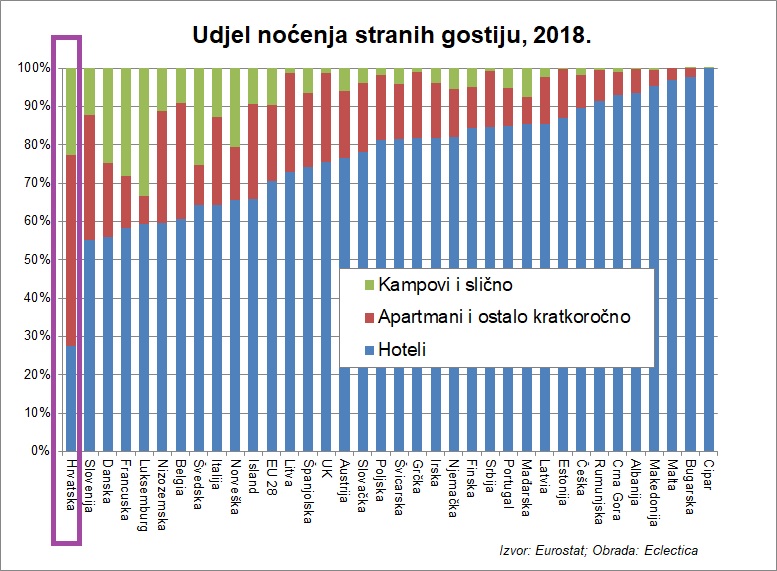

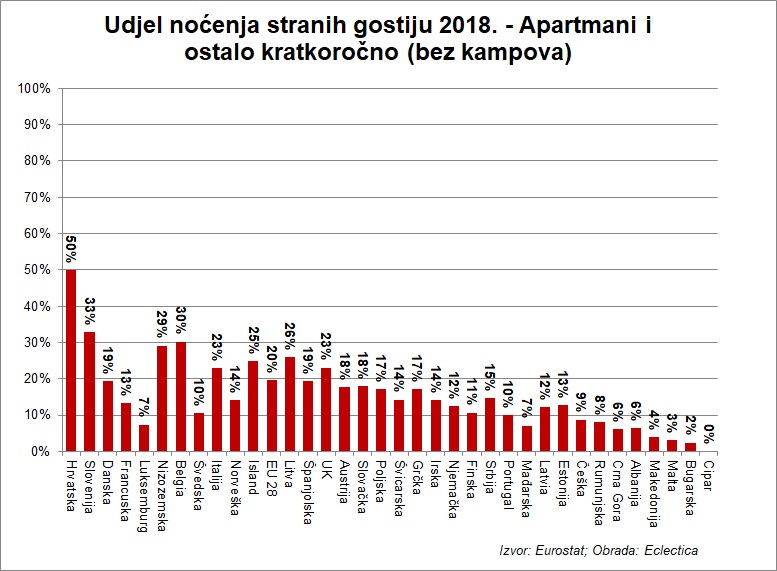

(Nenad Bakic wrote an interesting article on the imbalance - the ratio of hotel overnights is the lowest in Europe, a third of the EU average)

Additionally, hotels and camps pay above average salaries and all dues income taxes and health and pension insurances. According to Lider hotel salaries are significantly higher than those in restaurants (including management salaries) 9.717 kuna gross (1300€) or 6700 net (900€), while the average salaries in restaurants are very low 5,585 gross (750€) – net from 4300 kn (580€) just little bit above the minimum salary of 3750 gross (500€) indicating that part of the salaries in this business are paid in cash tax free. So we add more euros going to the State budget from hotels and camps.

(Bakic again - According to Eurostat, 50% of Croatian tourism overnights last year were in private accommodation. Slovenia - at 33% - was the only other country with more than 30%)

Additionally every hotel guest pays 10kn (1,3€) a day stay tax going to local tourist board supposed to run destination management (boravišna pristojba). The hotel industry claims that they give 31% of their prices to the State via different taxes and other concessions they have to pay.

But, as mentioned above, they make up only 1/3 of Croatian beds. So what Croatia does with other 2/3?

Nothing.

No VAT – they pay a fixed tax per bed on an annual basis, as well as a fixed day stay fee per bed (350kn – 50€ a year). It is calculated that it is roughly 1.5-2% of their yearly income or some 100€ per bed you rent yearly. And this is all folks – you have to report number and details of guests via eVisitor. So if you rent a quality two-bed apartment for 100€ a day – after only a two day of rent you will have paid all your dues to the State.

It is a tax-free paradise and who dares to change it now?

The State did not want to change the fixed price per bed, as it would be unpopular. So they passed the responsibility to local government, most of whom have done nothing about it. It would be political suicide in a tourism town which lives mostly from rental income. How to lose votes and the next election, so better stay with the status quo.

Hotels rent apartments too – do you know how many times more they pay to state compare to private rental apartments? 15 times – FIFTEEN times.

And then we have two-thirds of Croatia's tourism beds in a sector with growth of over 25% in 3 years – there are not enough tourists to satisfy such an offer.

And the State gets peanuts from them. So let’s tax others that we can – hotels and camps – they have a longer season and better occupancy.

In the meantime, private bank saving accounts in Croatia from year to year grow a steady 10 billion kuna (1.350 bn €) a year. Where from? Mostly from the tax-free paradise called private accommodation.

The tax-free strategy is very efficient for everybody, apart from Croatian tourism and the State. So do not ask what is happening, it is clear to everybody who invested heavily in private accommodation in the last three years. Unfortunately, the growth in the number of beds has outpaced the growth of overnight stays, and this leaves more and more beds empty.

The Kings are asking what is happening? The answer is clear - accidental tourism.