March 12th, 2022 - TCN intern Toni Petričić takes a look at the Croatian beer industry in 2020.

In this industry overview, I will try to analyze the Croatian beer industry and show its structure, the most prominent players, trends, and position compared to other beer markets.

From the latest statistical report from the European Brewers association, we can see that there are 98 breweries registered in Croatia, which had a total of 1690 direct employees.

In 2020, the Croatian beer industry shrunk by 12% compared to 2019, according to Heineken Hrvatska financial reports. The pandemic year was marked by lockdowns and lower-performing tourism season, which are the main reasons behind this drop. When looking at the distribution channels, the HORECA channel (hotels, restaurants, and catering) was hit the most with a staggering drop of -38,8%. However, the decrease mentioned above was partially reimbursed by the rise of 1.9% in the retail channel and “on the go” channel (gas stations and kiosks), with an astonishing increase of 61.9%.

Production

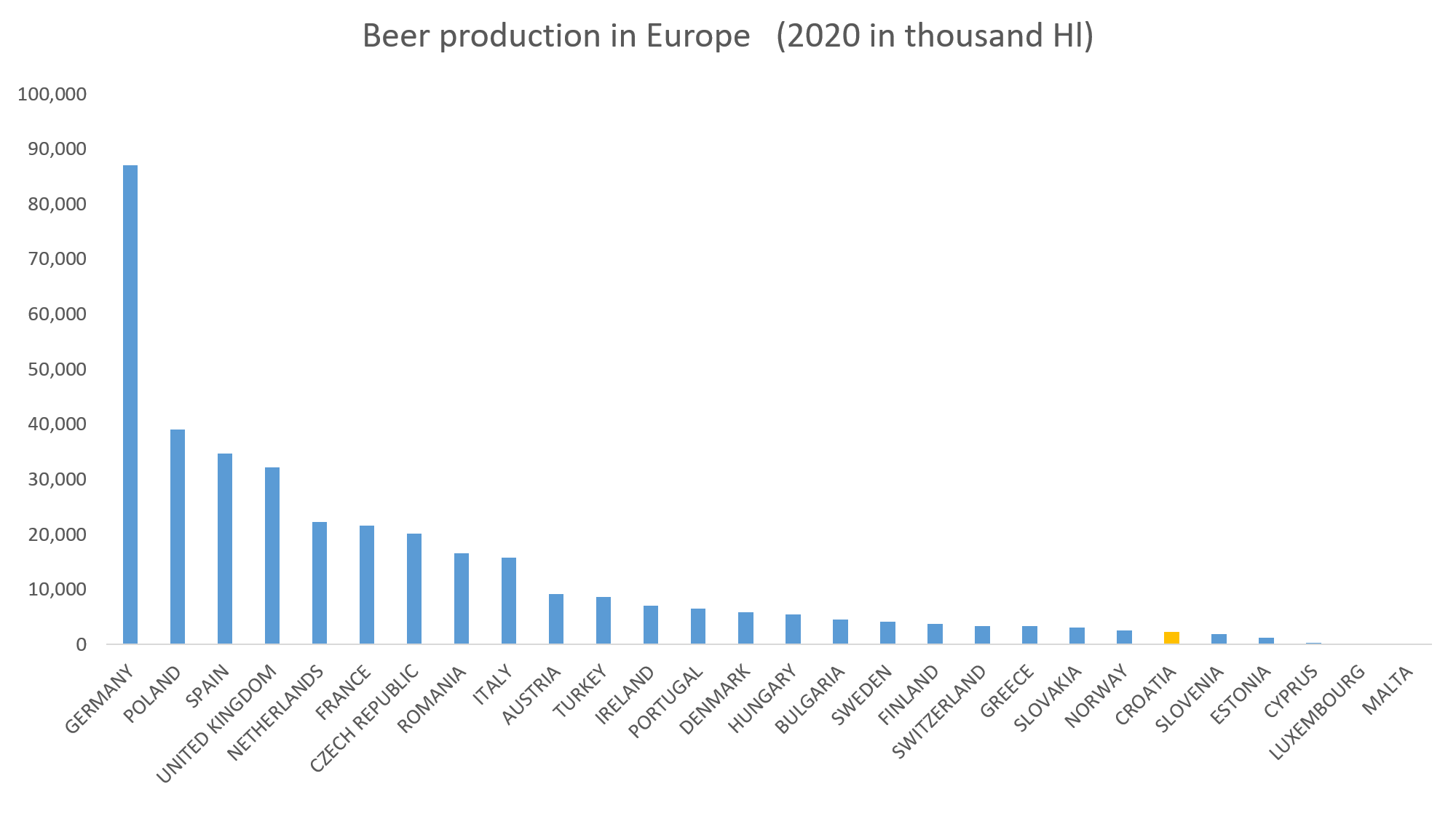

According to the European Brewers Association, beer production in Croatia has amounted to 2344 thousand Hl, which was a drop of 28% compared to 2019. For comparison, in the EU 27 member states, there was a drop of 6%. Furthermore, in the period before the pandemic from 2014 to 2019, Croatian beer production dropped by 5%, while in the same period, the beer production in the 27 EU member states rose by 5%.

Consumption

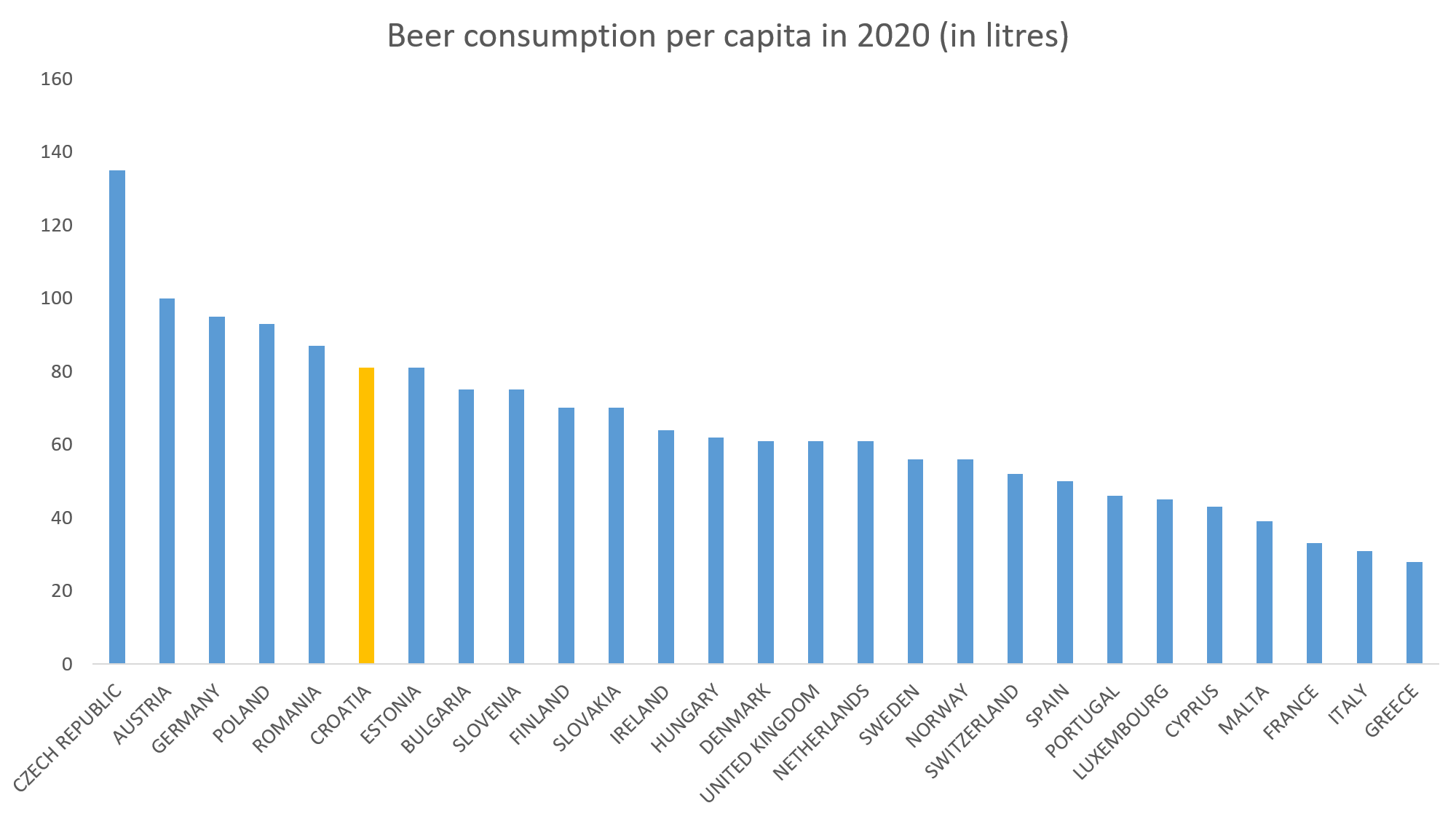

In 2020, beer consumption in Croatia was 2808 thousand Hl, which is a drop of 22% compared to 2019. European countries that were surveyed had in total 8% lower beer consumption. From 2014 to 2019, beer consumption in Croatia increased by 11%, while in surveyed European countries, it increased by 5%.

It is more interesting to look at the consumption per capita, where Croatia holds a strong sixth place among the surveyed European countries with 81 liters of beer consumed yearly. In 2019 it was fifth with 88 liters of beer consumed yearly,

Distribution channels

In 2020, 69% of beer sales came through off-trade, including wholesale and retail, while 31% came from on-trade, which has pubs restaurants, i.e., the hospitality sector. The same ratio was 40%-60% in 2018, which clearly shows the impact of the pandemic.

Trade

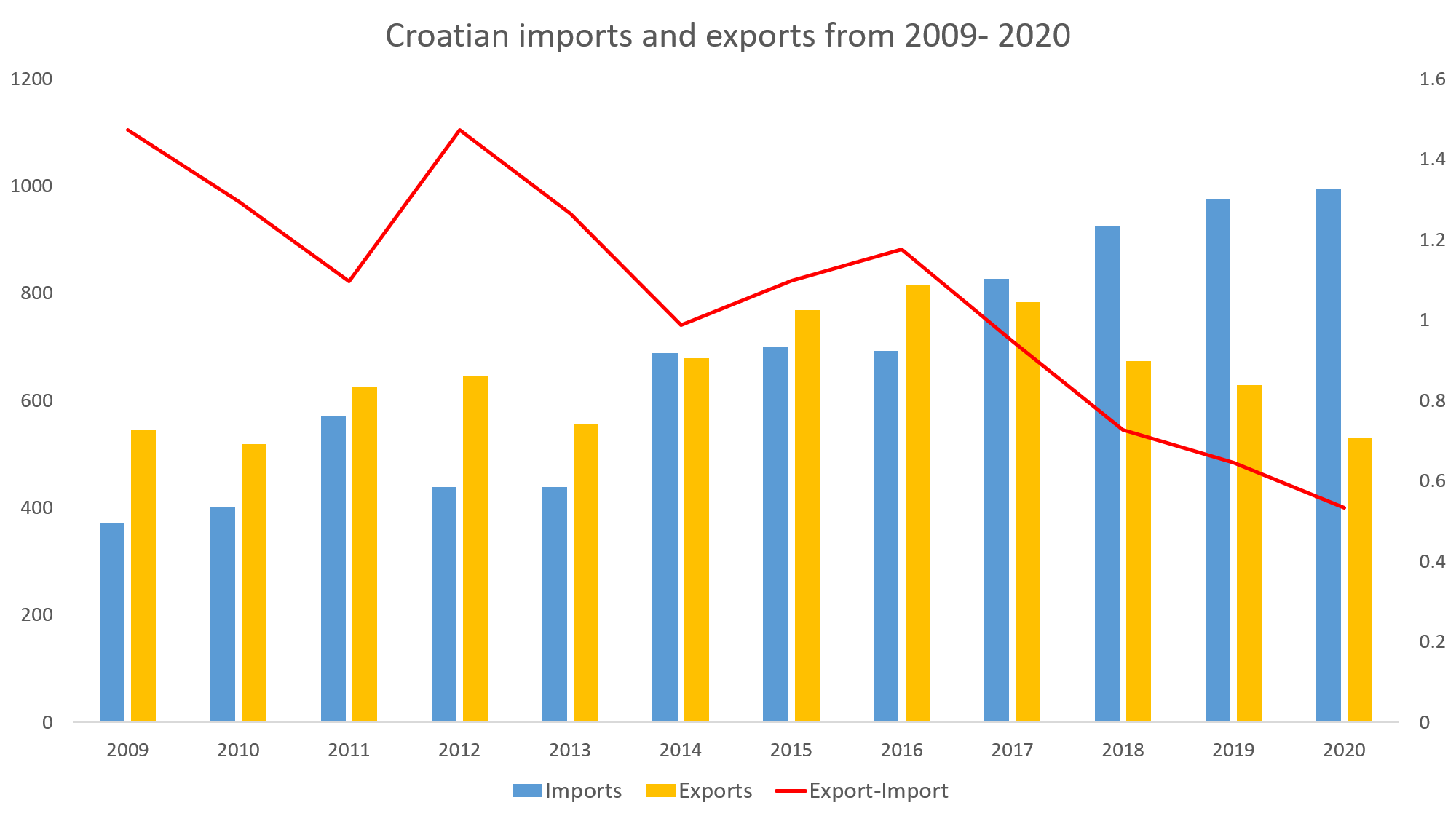

In 2020 Croatia imported 995 thousand Hl, of which 83% came from EU member states. Imports made 35% of all beer consumed in Croatia in 2020, a significant increase compared to 2019 when imports made 27%. The graph below can observe beer imports and exports from 2009 to 2020. We can notice that Croatia went from a beer net exporter to a beer net importer in that period. In the same period imports and exports from and to EU countries have increased by 189% and 143% each respectively. On the other hand, imports from non-EU countries have increased by 102%, while exports have decreased by 18%. From 2013 onwards, when Croatia became an EU member state, the trade relations with the EU intensified more rapidly.

Market structure

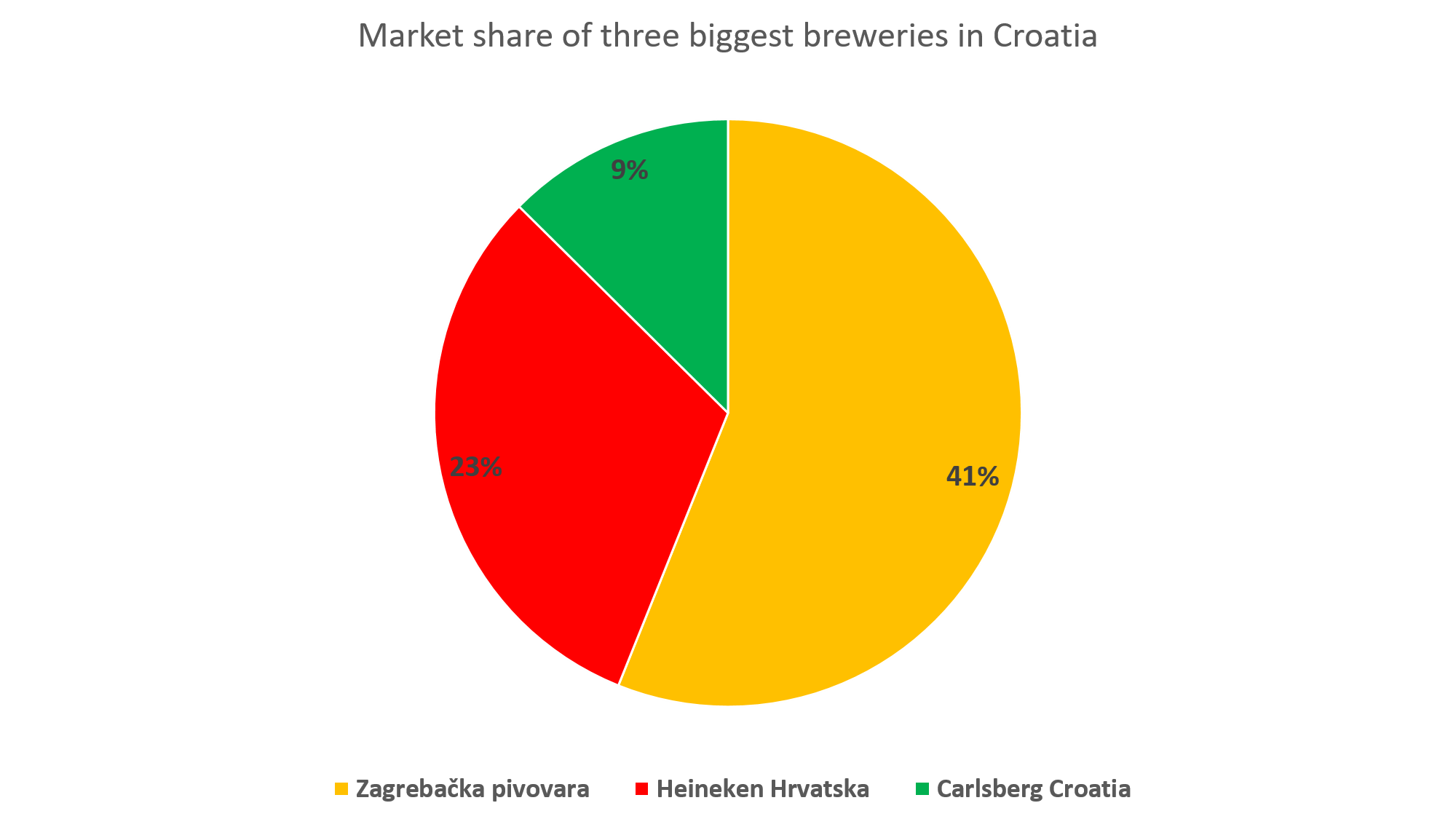

According to my analysis, the Croatian beer market valued at approximately 2,25 billion HRK in 2020. 72,6% of that market is held by the 3 most prominent companies, which leads us to conclude that the Croatian Beer Industry is a concentrated market. HHI index, which is a measure of market concentration, was approximately 2280, making this market moderately concentrated. Still, it is very close to the upper boundary of 2500, where highly concentrated markets start.

Biggest players

The three most prominent players are, in order of their market share, Zagrebačka Pivovara, Heineken Hrvatska, and Carlsberg Croatia.

Zagrebačka Pivovara is the market leader in the Croatian beer industry, with a 40,7% market share in 2020. It was established in1892 in the city of Zagreb. In 2012, they were acquired by Molson Coors Brewing Company, one of the world's largest beer producers. Today they have 577 employees and total revenue of 1.01 billion HRK. Their flagship beer brand is Ožujsko, but they also control brands such as Beck's, Corona, Leffe, Nikšićko, Staropramen, Stella Artois, Hoegaarden, and Lowenbrau.

Karlovačka Pivovara was established in 1854 in the city of Karlovac. In 2003, Heineken International acquired it and was later renamed Heineken Hrvatska. Today it holds the position of the second-largest beer company in Croatia, with a market share of 23%. Heineken Hrvatska employs 326 people and has a total revenue of 542 million HRK. Their brand include: Karlovačko, Heineken, Laško, Union, Krušovice, Desperados, Stari Lisac, StrongBow, Affligem and Edelweiss.

Panonska Pivovara was founded in 1971 as part of Podravka. Carlsberg Breweries has been a shareholder since 1994 and was steadily increasing its share. In 2004 Panonska Pivovara became Carlsberg Croatia. Today Carlsberg Croatia has 295 employees and total revenue of 319 million HRK. Their beer brands are : Pan, Carlsberg, Tuborg, Somersby, Holsten, Grimbergen, Budweiser, Zanatsko and 1664 Blanc.

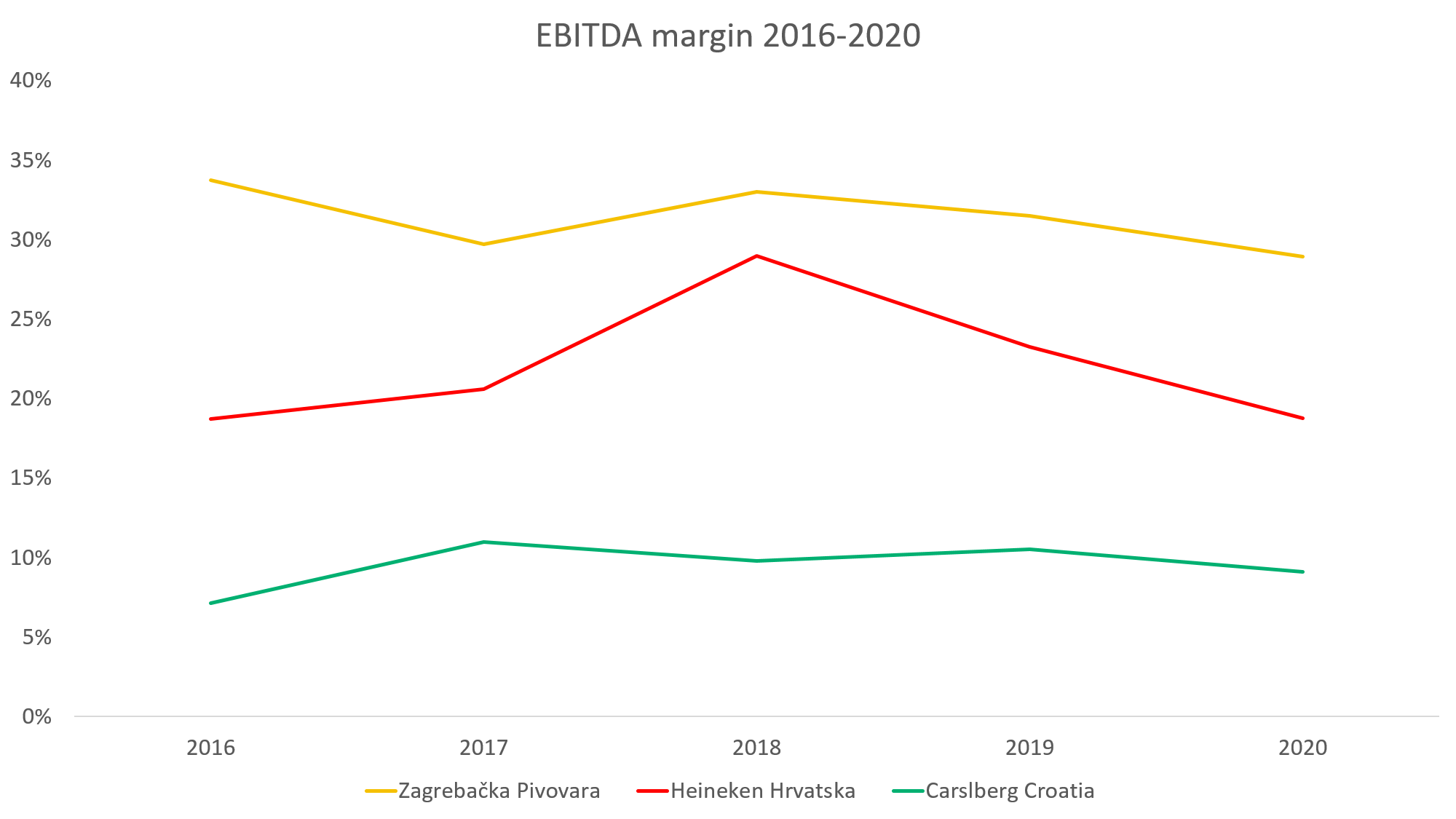

This graph shows the profitability of these three most prominent market players measured by the EBITDA margin, and the difference is pretty obvious. There are numerous possible reasons behind this, including utilization of economy of scale, bargaining power with suppliers and buyers, the extent of automatization, among many others. However, one thing is certain Zagrebačka Pivovara currently has the best position in the market with the highest market share and highest EBITDA margin.

The Croatian beer industry can be characterized as a mature industry with not much growth potential; for example, from 2016 to 2019, Zagrebačka Pivovara is the only one of the three companies above that had a positive CAGR of around 3%. The biggest trend that is fueling the growth of this industry is the craft beer revolution which I already covered in my other article. Even these big mainstream beer producers are beginning to realize the potential of this new niche segment, with Zagrebačka Pivovara rolling out their craft beer brand Grif.

Other beer producers worth mentioning, in order of their total revenue, are Osječka Pivovara, Pivovara Daruvar, Istarska Pivovara, Pivovara Medvedgrad, Garden Brewery and Pivovara Ličanka. These were among the top 10 Croatian beer producers in 2020; they accounted for another 10% of the market.

It will be interesting to observe how will Croatian beer industry develop in the coming years, will the three significant forces hold their positions while adapting to the changing consumer preferences, and how will the craft beer scene affect the whole market.

For more, check out our business section.