Marko Rakar: About Legitimate Interest and the Biggest Banking Secret

April 30, 2023 - The King of Data is back, as Marko Rakar spearheads an initiative to help thousands affected by the Swiss Franc bank loan affair, offering hope of compensation.

Several thousand debtors with loans taken out in Swiss francs received an offer from the company Druga Foundation to their home addresses in recent days, an offer to take over their claims against the banks. The media announced that consultant Marko Rakar and economist Vuk Vuković are behind the initiative, as well as a dozen other lawyers, experts, mathematicians and bankers.

Here is Marko in his own words on the subject.

My general thinking is that you shouldn't spend too much time on sponsored articles, but a few days ago (and again today) I was called out in one such sponsored content, so it's time to look back on it. The first few paragraphs are an introduction to the story, and only then do the details about GDPR and banking secrets begin.

In creative ways, with the frequent use of quotation marks and a lot of question marks, the article stretches out the superficial understanding of law and elementary logic, and problematizes the action carried out by the Second Foundation, of which I am the director. That trading company was founded with a very simple and clear goal, which is to help an extremely large and, in my opinion, tormented social group to use their legal right to compensation for the damage caused to them by the banks when contracting and then collecting loans and leasing that were denominated in Swiss francs. A lot has been written about this entire issue in the last fifteen years, laws were passed to at least partially solve the problem, the state sued the banks (and probably lied in its answers before international bodies), and speculated in secret settlements.

However, when everything is added up and subtracted, according to the numbers known today, we know that there are around 120,000 citizens who were damaged in the process and who are entitled to compensation from the banks. Banks at the same time (totally wrongly but very persistently) repeat the untrue mantra that the conversion of CHF loans into EUR is at the same time compensation. What is true is that the Supreme Court in December 2022 made a legal understanding that injured consumers who have converted their loans are entitled to compensation on the basis of default interest; more precisely, "the consumer/user of the loan has the right to the payment of the corresponding default interest on the overpaid amounts that the bank charged to the consumer when calculating the conversion of the loan.". Ultimately, this legal understanding did not pass the court record and a new decision is expected literally days before the statute of limitations begins, so there is a real possibility that the Supreme Court's decision will be different (hopefully more comprehensive and favorable to the injured citizens).

Croatia is not the only country where a problem with loans in Swiss francs has appeared. In other countries, the courts ultimately made decisions about the total nullity of the contract (therefore it is considered that the deal did not happen at all, the effects of such a solution can be written in even bigger and longer texts), the latest example of this is Slovenia, where the nullity was recently declared. Our position here is somewhat specific, because at the time when loans were issued in CHF, we were not part of the European Union, and it seems that our Government played a not necessarily clean game on this topic by siding with the banks at a time when a dispute was raised before the EU bodies.

Land registers, GDPR and legitimate interest

Banks (through the association of banks) and a native journalist from Večernji, as expected, question our use of data, but what we have done is based on laws and regulations.

(Article 7 of the Law on Land Registry.)

To begin with, attention should be drawn to the Law on Land Registers, namely in Article 7. It clearly states that land registers are public in their entirety. This means that any person can, without stating a reason (legal interest), have unlimited access to land registers. Public availability of data from land registers, among other things, ensures legal security in real estate transactions and protects the transfer of rights to real estate from possible risks. Protection of the public availability of land registers is one of the fundamental principles of land register law. The principle of public in the material sense implies that land registers, extracts and transcripts from them enjoy public faith that their content is complete and true, while the principle of public in the formal sense means that land registers are public because their content is available to everyone. Anyone can request an inspection of the land register and all auxiliary lists and obtain extracts and transcripts from it. The right to inspect the land register is completely unlimited, neither for obtaining an inspection of the land register nor for viewing them, as well as for requesting printouts, transcripts and extracts from the land register, it is not necessary to prove or make probable the existence of a legal or any other interest (details on you can read about it in the scientific-professional paper here). Public availability of land registers is not a Croatian specificity, it is simply a European asset and in a similar way you can access land registers (almost) anywhere in the world.

Therefore, there is no doubt that our data source is not only legitimate, but also completely legal, but also in full compliance with the spirit and intent of the law.

The General Data Protection Regulation (GDPR) regulates how it is possible to collect and process personal data of citizens. The fundamental principle we are interested in here is the legal basis we use, which is called legitimate interest. We believe that the information on the right to compensation is 1001% in line with the protection of the rights of the injured party and the legitimate interest of CHF loan users, whose rights are not limited or jeopardized by this type of processing, but part of their rights are fulfilled, which, given their interest, have priority over others and possibly "other people's" rights. There is simply a legitimate interest of the Second Foundation, as a data processing manager, to try to establish or establish on the basis of public data sources contact with respondents in order to exercise their rights, protect them by providing them with information, advice - without the obligation to enter into a business relationship. On the fact that the legal basis of legitimate interest is applicable in this case, read the opinion of AZOP from December 2022.

Furthermore, Article 6 of the General Data Protection Regulation (GDPR Directive) prescribes and states which legal bases may be applied for data processing. Thus, we can also say that processing through the register of land registers is legal because:

- is necessary in order to protect the interests of natural persons, specifically, citizens damaged by banks through disputed loans in CHF,

- because it protects the public interests of the Republic of Croatia and all citizens to exercise their right to compensation, and at the same time the Republic of Croatia does not suffer damage nor will it inflict damage on its own citizens by violating their fundamental rights,

- provides information and advice to citizens in order to further inform them about their rights, given that they are not given to them by other institutions, and which does not endanger other rights of citizens or put them in a disadvantageous position, on the contrary, it enables them that if they wish to exercise rights they did not know about,

- is not prohibited by any law of the Republic of Croatia,

- processing is also enabled by the PSI directive.

Banning the processing of such data would create a disproportionate benefit for banks (at least EUR 330 million), to the detriment of citizens. Moreover, it would be a disproportionate benefit of the banks in a case that has been proven in numerous court proceedings as a violation of the banks to the detriment of a large number of citizens. And finally, the use of data is in accordance with the European PSI (Public Sector Information) directive, which encourages the reuse and creative use of data from public sources.

However, let's imagine for a moment that this processing is not allowed, then several unsustainable situations would arise:

- citizens harmed by banks through disputed loans in CHF would be denied the possibility to be offered information, advice, or a business relationship for the transfer of compensation by any natural or legal person who

observe this information through the register of land registers, - any natural or legal person who in their activity

searches the register of land registers for the needs of his business would not

may no longer use that data. This includes banks and agencies for

collection of services that use that register in their regular work business without asking the permission of each person whose data is - searched,

- citizens would be deprived of a whole range of services based on

the use of data collected through the public land registry

books, and are also based on the provision of information, services, and

business relations based on data from the register of land registers

(such as real estate companies), - insight into the potential corruption of politicians, public

of employees and banks would be difficult or completely impossible if the protection of CHF data from the register of land registers is not allowed,

there would be a conflict with the legislator's intention to provide public - data through the register of land registers, provide citizens with protection their rights (in this case, the rights of citizens injured in the Frank case to be helped in obtaining compensation in situations where they are not sufficiently informed about their rights or do not have the knowledge or skills or financial prerequisites to exercise the right to compensation).

To simplify, the Association of Banks and the native journalist of Večernji List claim that it is not allowed to inform citizens that they have the right to compensation. Imagine you drop your wallet in a mall parking lot, I noticed it, picked up the wallet and the moment I tried to open the wallet to try to find your address or phone number to notify you and return your money and wallet, the parking attendant (aka employee of a shopping center, probably at heart a PR person or a marketer) shouts over the loudspeaker that GDPR forbids me to open my wallet!

The biggest banking secret

The reason why we started the Second Foundation in the first place is the conclusion that many injured citizens do not even know that they have been injured and that they have the right to compensation from the banks that have given them credit. Although a lot was written about the issue of CHF loans (as well as leasing), due to the obvious asymmetry between the banks' PR departments and the few injured citizens who spoke about it (where the Frank Association undoubtedly played the biggest role). In the public discourse, it is common opinion that citizens are also compensated by the banks by the act of conversion and have no other right. If you read the statement of the bank association, they repeat that claim like a parrot, even though they know very, very well that it is absolutely incorrect and in conflict with judicial practice, and especially with the legal position of the Supreme Court of the Republic of Croatia from December last year. In the past few days, we have received hundreds of messages from people who realized for the first time that they are entitled to compensation.

The information campaign that we are carrying out is an action that the banks had to carry out independently and offer their clients compensation in accordance with court practice, or an action that the state should have carried out in such a way that, for example, FINA transfers money to the accounts of citizens at the expense of the banks, this is all that stands between the injured citizens and banks are the Franak Association and the Second Foundation (each with its own approach to the problem).

Data on how many citizens are entitled to compensation is very difficult to find (in the annual reports of banks, this data, as well as data on initiated disputes, settlements and completed disputes, are not published because "their public publication could have material effects on the banks' operations", but it is public information that about 120,000 loans were issued that were denominated in Swiss francs. About seventy thousand of them related to non-purpose loans (adaptations, cash, car loans), while the remaining fifty thousand loans related to the purchase of real estate. The other foundation contacted only these about fifty thousand who had registered CHF mortgages, and that's because they are the only loan beneficiaries that can be identified from public sources, but if you are in this second group, we also want to hear from you.

According to current judicial practice, these fifty thousand families are entitled to compensation, which, according to our estimates, is at least 330 million euros. Unfortunately, even with this compensation, our fellow citizens will not be in any profit because for many of them, the unilateral behavior of the banks in the past years caused permanent and irreparable damage and destroyed human lives. The banks are protesting because we made public the secret they have been carefully hiding these years and informed fifty thousand people that they are entitled to compensation, and that a few weeks before the statute of limitations (June 16, 2023).

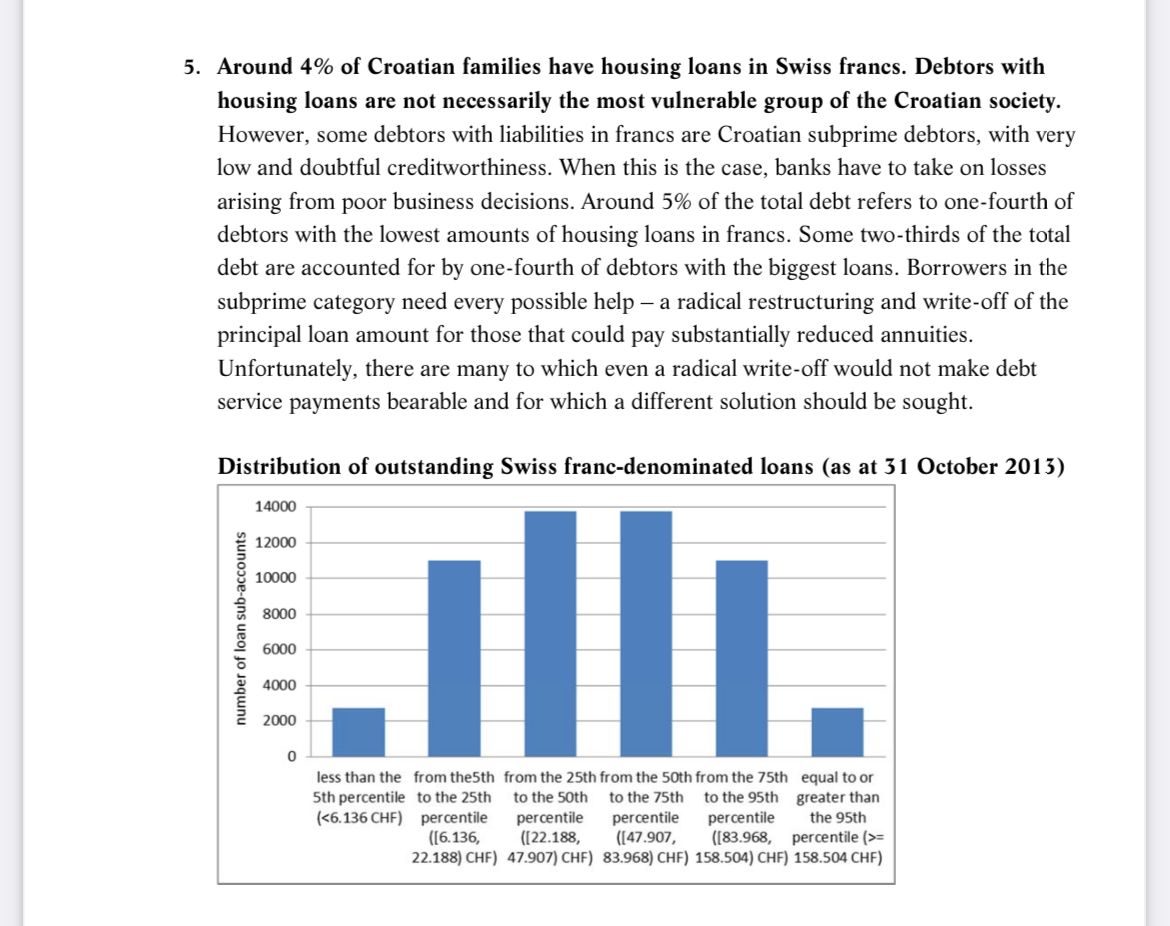

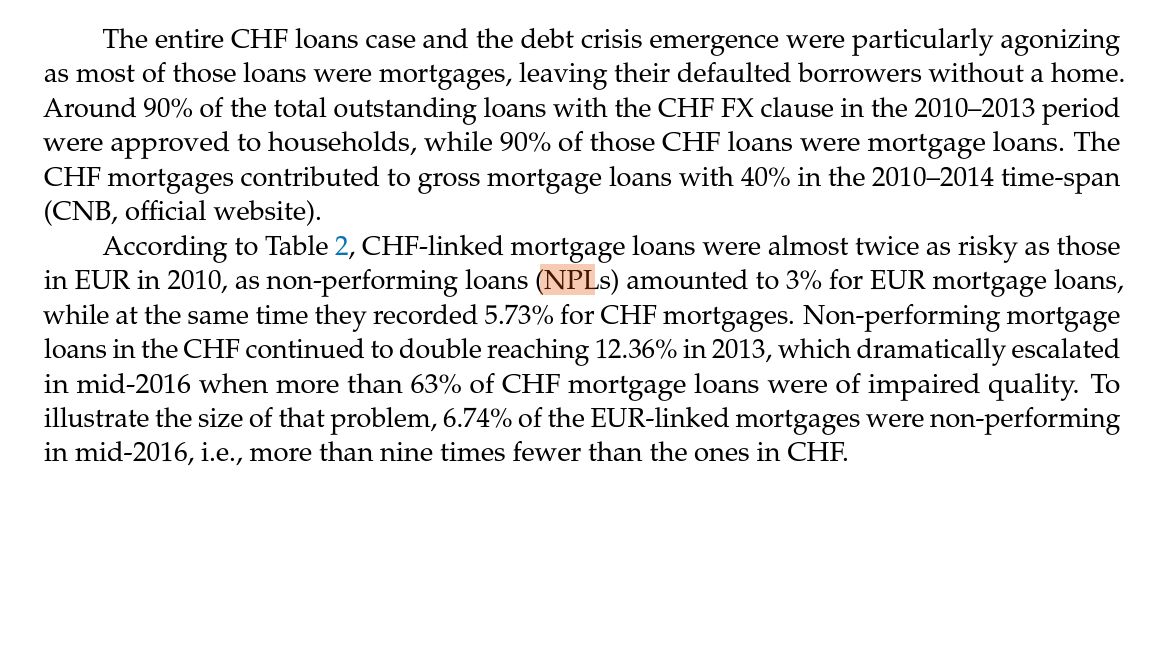

(CNB report in which users of CHF loans are called "subprime".)

In a CNB document from 2015, loan users in the Swiss are called "subprime" (remember the American movie "Big Short"), subprime loan holders are those who can reasonably be assumed to have difficulties in repaying the loan. At the moment when the Swiss central bank decided to remove the indexation with the EUR (our Kuna was indexed in the same way from the first to its last day), loan installments often doubled and became unrepayable overnight. The motivation for loans in the Swiss was the interest rates, but the devil is in the details, mortgage loans are taken out over many years and the repayment plans are arranged in such a way that at first the monthly repayment is largely due to the interest, a smaller part to the principal, and that balance would change over time. If you wanted to buy a property worth EUR 100,000, due to the accumulation of interest costs over a long period of time, with a higher interest rate on EUR loans, you could, for example, borrow for only EUR 70,000, while the same loan repayment plan, but in CHF, could provide money for the full value of the property. The bank looks at the value of the collateral (the property you are buying) and your repayment options. CHF loans were an option for you to buy the property you wanted within your repayment capacity (or you bought a bigger property for what you thought was the same money).

Until the middle of 2016, as many as 63% of loans in Swiss francs were of "impaired quality", which translated means that as many as 63% of all loan holders had problems in repayment (which the banks ingeniously tried to solve by unilaterally raising interest rates to reflect the increased risks). Delinquency was nine times higher than with EUR loans, if you need a definition of "subprime", that's it.

However, the biggest banking secret that we were all convinced of is that the Conversion Act is a big victory for the "little man", while in nature it was a maneuver by the banks to save themselves in the situation surrounding the dramatic growth of risky placements denominated in CHF.

The violent reaction of the banks is understandable and expected, they were barely saved by the law on conversion, with incredible PR efforts they managed to preserve the myth that "conversion is compensation" all these years and only a few weeks before the statute of limitations, the Second Foundation messed up their accounts, and if the bankers do something what they don't like is that someone touches their bonuses and management contract extensions that are suddenly questionable. All the warning signs were there all along, hidden in the footnotes of the banks' annual reports or the reports of the credit rating companies (read, there are interesting details in the footnotes, especially of the Austrian banks, maybe I should write about that too).

And lastly, to address two recurring details. A series of headlines incorrectly states that we "buy out claims", the Second Foundation is a company whose function is to provide injured citizens with the right to compensation - we are literally the opposite/antithesis of any "claims collection agency".

Some ask why we don't sue for the complete nullity of the contract instead of compensation on the basis of default interest? My life practice has taught me that one should be honest and take care not to promise anything to anyone that I am not reasonably sure I can deliver, and therefore the offer of the Second Foundation is limited to what we believe we can deliver on this day. Of course, we have developed and prepared legal tactics for every foreseeable situation, including a possible nullity decision. Of course, we want to collect and maximize any compensation as quickly as possible, but that does not mean that we want to collect a large number of contracts at any cost with an unobjective or naive approach to the problem and excessive promises. Our offer is non-binding, everyone must make their own decision by consulting with people and experts they trust. If you are one of the recipients of our letter and have decided to exercise your right independently, that is absolutely OK and every euro you collect from the banks is our small victory.

Thought of the day:

An election is coming. Universal peace is declared, and the foxes have a sincere interest in prolonging the lives of the poultry.

This article originally appeared on Marko Rakar's blog, Mrak.org.

Supreme Court Makes Two Important Decisions for Consumers and Banks

ZAGREB, 9 Feb 2022 - The Supreme Court said on Wednesday that it had made two decisions "relevant for a large number of ongoing cases against banks launched by bank clients", which the Franak association welcomed, saying it expected the highest court to rule by Easter on the nullity of contracts on CHF-pegged loans as well.

The Franak association brings together former holders of loans pegged to the Swiss franc.

The Supreme Court said that in one of its two decisions, it allowed a review motion against a second-instance court ruling related to the following legal issue, whether "in an appeal against an enforcement ruling and the subsequent proceedings, to have the enforcement declared impermissible, one can insist on the circumstance that points to the nullity of the notarial act (consumer contract), which constitutes the enforcement order in the enforcement proceedings."

"This is a legal matter that requires the Croatian Supreme Court to adopt a legal position in line with the Court of the EU in the application of the Unfair Contract Terms Directive, which should result in the evolution of law through legal practice," the court said.

Franak believes this means that the Supreme Court will decide whether enforcement may be carried out if implemented on the basis of an invalid contract, but also on the basis of a contract containing invalid contractual provisions, i.e. on the basis of a partially invalid contract.

"That decision will apply to all loans with the CHF currency clause, but also to euro and kuna-denominated loans with contractual provisions on invalid interest rates," the association said.

In the other decision, the Supreme Court refused a review motion by a bank, upholding decisions by lower courts and taking the position that as the plaintiff, the bank must compensate the consumer for litigation costs regardless of the fact that the client had withdrawn the lawsuit.

Franak said this decision is not related to a decision on consumers' right to compensation after the conversion of CHF-pegged loans to euro loans, which it expects the Court of the EU will make by May.

"If, however, the Court of the EU decides that our case is not within its jurisdiction, the decision on conversion and compensation will be made by the Croatian Supreme Court, but this specific review motion has nothing to do with that either," the association said.

It expressed satisfaction that the Supreme Court president "is doing what he promised to do" and that it expected "the issue of nullity of contracts on CHF-pegged loans to be resolved by Easter."

The position of Supreme Court president is held by Radovan Dobronić, who on 4 July 2013, as a Zagreb Commercial Court judge, delivered a ruling in favour of the Consumer Protection Association which had sued eight banks with regard to the Swiss franc foreign currency clause and their unilateral decision to increase interest rates.

Dobronić said at the time that the banks had violated consumers' rights by failing to fully inform them about all the parameters necessary to decide on taking loans.

The ruling on the legal nullity of the currency clause in contracts on loans pegged to the Swiss franc, was later upheld by the High Commercial Court and its ruling was upheld by the Constitutional Court.

For more, check out our politics section.

20,000 Civil Suits Brought Against Banks over Swiss Franc Loans

ZAGREB, June 14, 2019 - MP Goran Aleksić of the opposition SNAGA party said on Friday that at least 20,000 civil suits had been brought against banks whereby clients who took Swiss franc loans seek reimbursement of overpaid amounts.

The exact number will be known in the weeks ahead, he said at a press conference.

Aleksić recalled that the Supreme Court ruled that holders of CHF loans who converted their loans into euro were entitled to sue banks and seek a refund of overpaid interest. He said the Supreme Court was expected to decide on reviews filed by banks to that ruling by the end of July.

That will be followed by a new wave of civil suits brought over the exchange rate difference, which makes up 66-75% of the total overpaid amount, Aleksić said, adding that he expected 100,000 suits against banks to be brought by June 2023, when the statute of limitations expires for the exchange rate difference.

Attorney Nenad Horvat said that if the Supreme Court ruling on reviews filed by banks was in favour of clients, the number of new suits would surge. He said parliament should adopt a law for the compensation of all damaged clients, otherwise the courts would be swamped with CHF loan cases.

More news about Swiss franc loans can be found in the Business section.

NGO Praises Supreme Court Ruling on Loans in Swiss Francs

ZAGREB, April 2, 2019 - The Franak association of holders of loans previously denominated in Swiss francs said on Tuesday that the Supreme Court had ruled that people who had converted their CHF-denominated loans into euro loans under the Consumer Credit Act were entitled to sue banks and seek a refund of money that banks had taken from them illegally.

The Supreme Court has found that the fact that consumers signed an annex to their loan agreements and converted their CHF loans into euro-denominated loans does not mean that they automatically lost interest in determining that some of the provisions of the loan agreement were null and void, Franak said.

Opposition MP Goran Aleksić told Hina that claimants would certainly seek the difference between the exchange rate and interest, adding that banks would have to pay back all overpaid amounts plus default interest. He said that the Supreme Court ruling applied to all converted loans.

About 125,000 people concluded CHF-denominated loan agreements, of whom 70,000 had previously become entitled to sue, while the remaining 55,000 have now received legal security that they can sue for a refund of overpaid interest. If they all go to court, banks will eventually have to pay more than 10 billion kuna (1.35 billion euro) in overpaid amounts, Aleksić said.

Franak said that the statute of limitations on overpaid interest runs out on 13 June 2019.

More news on Swiss franc loans can be found in the Business section.

Swiss Franc Loans Ruling Step in Right Direction

ZAGREB, March 29, 2019 - SNAGA party member of parliament Goran Aleksić said on Thursday that the Supreme Court's decision whereby decisions by banks on the variable interest rate on loans pegged to the Swiss franc in the period from 1 January 2013 to 1 January 2014 were declared unlawful, was good but that loan holders were still waiting for a crucial decision, the one on their right to claim back overpaid interest.

"We are waiting for the Supreme Court to deliver a ruling on whether, after conversion, we have the right to claim back overpaid interest. The current decision does not speak about that because the bank that was sued called only when it appealed for the lawsuit to be dropped due to conversion, however, under the litigation law, it was too late for that," Aleksić told Hina.

The Supreme Court has decided on what it could decide on. It could not decide on loan conversion because that could not be discussed and that is why a decision on converted loans is still being awaited, said Aleksić.

"What is good about this decision is the fact that the Supreme Court has confirmed what we have been saying all along, and that is that banks did not have the right to unilaterally set the parameters to change interest rates but rather that they had to agree on that with their clients," said Aleksić.

The Supreme Court said earlier in the day that decisions by banks on the variable interest rate on loans pegged to the Swiss franc in the period from 1 January 2013 to 1 January 2014 were unlawful because banks had not adjusted their operations concerning variable interest rates to the amended Consumer Credit Act.

Two decisions that are important for loan conversion have been submitted for a review and only the second decision by the Supreme Court is expected to bring a solution to the issue of converted loans, said Aleksić.

"Both decisions refer to converted loans and the second one that we are still waiting for refers to a review of a ruling that was unfavourable for the consumer and only when the Supreme Court rules on that, will we know our status," said Aleksić.

The Franak association, which brings together holders of loans previously pegged to the Swiss franc and converted to euro loans, and the SNAGA party in January called on the Supreme Court to deliver a ruling as soon as possible on reviews related to loan holders' right to compensation following loan conversion, considering the fact that the statute of limitations on their claims for overpaid interest expires in June this year.

More news about Swiss franc loans can be found in the Business section.

Court Rules Variable Interest Rates on Swiss Franc Loans Was Unlawful

ZAGREB, March 28, 2019 - The Supreme Court said on Thursday that decisions by banks on the variable interest rate on loans pegged to the Swiss franc in the period from 1 January 2013 to 1 January 2014 were unlawful because banks had not adjusted their operations concerning variable interest rates to the amended Consumer Credit Act.

"Even though in order to correct the invalid provision, banks had specified in their offer to clients, in line with the law, the way the variable interest rate would be set, they unilaterally and contrary to the law, set an interest rate that was higher than the initially agreed interest rate," the Supreme Court said.

It said that because banks charged an interest rate that was higher than the one initially agreed to clients' demands to be refunded for the overpaid amount were justified.

The court said that its latest decision did not change its conclusion of 20 March 2018 that a class action discontinued the statute of limitations on claims by individual clients.

The Franak association, which brings together holders of loans previously pegged to the Swiss franc and converted to euro loans, and the SNAGA party in January called on the Supreme Court to deliver a ruling as soon as possible on bank audits in relation to loan holders' right to compensation following loan conversion, considering the fact that the statute of limitations on their claims for overpaid interest expires in June this year.

More news on Swiss franc loans can be found in the Business section.

Constitutional Court Confirms Law on Swiss Franc Loan Conversion

The Court rejected a request to declare as unconstitutional the law which forced banks to convert loans in Swiss francs into euros.

Croatian National Bank Forced to Reveal Bank Secrets

Court accepted a request by the Franak Association.

Banks Warn Government It Does Not Have Much Time for Agreement

Banks want the government to urgently come to an agreement about the issue of conversion of Swiss franc loans into euros.

MOST and HDZ Differ in Their Approach to Conversion of Swiss Franc Loans

The issue of possible lawsuits by banks against Croatia due to forced conversion of Swiss franc loans into euros could become an obstacle in political negotiations between HDZ and MOST.