Croatia's Tourism Suffering, How Are Things For Our Competition?

We've talked a lot about how the tourism situation in Croatia this tourist season has been a little off. Very much off, actually. While some report no particular changes, highly popular restaurants in Dubrovnik are being pictured just half full, Jadrolinija ferries are being pictured half empty, bookings are down significantly, and Croatia has quite strangely restricted access to tourism figures. Weird, right?

There are a multitude of reasons why Croatia's 2019 tourist season is a drag, but one of the reasons Croatia needs to get its act together in regard to bringing tourists in and stop relying on old (and accidental) glory is the fact that some of its competition countries in the Mediterranean are recovering, and their prices are usually far, far more attractive than Croatian ones.

As Marija Crnjak/Poslovni Dnevnik writes on the 17th of July, 2019, the European Commission for Travel (ETC) expects that the demand for tourism in Europe will remain with an upward trend in 2019, with growth of 3.6 percent.

It isn't only Croatia that has recorded minuses or stagnation this summer, owing to competition countries who returned to the ''tourism game'' in 2019, primarily Turkey, which, with its very low prices, has pulled many tourists away from the likes of Montenegro, Greece, and even from Europe's tourism king - Spain.

Although the European Commission for Travel does continue to provide optimistic forecasts for destinations in Europe in its report for the second quarter, the current situation is causing many to fear the decline in tourist traffic and tourism revenues this year.

The European Commission for Travel's report (ETC) for the second quarter cites expectations that tourism in Europe will remain upward in 2019. A growth rate of 3.6 percent is projected, which is more in line with the annual average from 2008 up until 2018, but is in fact less than last year's growth.

The report states that in the first two quarters of 2019, the Balkan region was the most successful in terms of growth in arrivals, with Montenegro as the record holder with a massive fifty percent increase in the period from January to the end of April, while Turkey experienced such growth at a mere twelve percent. Both Slovenia and Greece recorded significant growth in the first quarter of 2019, both with eight percent growth, and the EC has given a positive forecast for Greece, despite the return of Mediterranean rivals like Turkey.

As is well known, Croatia had six percent more arrivals and three percent more overnight stays in the first six months of this year than it did during the first half of 2018, but for the first time in a few years, there was a significant slump in July.

Namely, in the first twelve days of July 2019, the number of Croatian overnight stays fell by almost five percent, while tourist arrivals dropped by 6.2 percent, according to eVisitor data. The year, however, is still in the surplus, but for the time being, the encouraging percentage figures are drawn entirely from Croatia's successful pre-season, which of course also yields significantly lower tourism revenues than the summer months do.

Optimism hasn't managed to touch on the announcements of Croatia's hoteliers either, a segment in which reservations have dropped during summer so far, and were in the range of three to seven percent in mid-June. On certain portals which have group deals, there are several offers for leading Adriatic hotels and destinations for the end of July, which have been overcrowded over the past three years. Worrying indeed.

Although official figures suggest that the tourist season in neighbouring Montenegro remains at last year's level, those ''from the field'' in Montenegro have warned that the situation is much worse than last year, and that there is a fear that, if this trend continues along with possible unfavourable weather conditions, the season in the popular coastal town of Budva could experience collapse.

The Montenegrin Tourism Association's Petar Ivković, has stated that online sales figures in Montenegro indicate almost forty percent less individual reservations, and that reservations have been booked on the markets of Turkey, Greece, and Egypt.

Ivković agrees that Croatian and Montenegrin tourism are facing a very similar problem - the overgrowth of private accommodation facilities, and has added that only through water consumption and garbage collection calculations in Budva can they mathematically come to the conclusion that Mongenegro's private accommodation is half empty.

Even Greece is experiencing a growing problem of unfair competition in private accommodation, and more and more Greek hoteliers are now expecting a fall in revenue, occupancy, and so prices will have to be lowered in order to fill hotel capacities this summer.

The new Greek government will continue with the tourism policy created by the previous government, and thus facilitate the sector through tax breaks. The new Greek Minister of Tourism of Harry Theocharis has his priorities in order, the first of which is the reduction of the VAT rate from the current 24 percent down to 13 percent for accommodation (with the goal of reaching 11 percent). In addition to the tax breaks, the ministry's agenda is to review resident tax and introduce incentives for the energy renewal of Greek tourist facilities.

The aforementioned Greek ministry will also address the revision of the structure and activities of the Greek National Tourism Organisation (GNTO). They are also planning to partner with the private sector to promote and improve the country's brand, and organise the promotion of alternative tourism.

Even the Spanish Tourism Excellence Association (EXCELTUR) confirmed that this summer there has been a slowdown in Spanish tourist traffic, which is currently at 2018's level, with a moderate increase in revenue.

EXCELTUR expects growth of 1.6 percent this summer, down slightly from 2 percent last year. However, in the second quarter of 2019, Spain recorded a decline in tourist traffic in destinations selling just sunshine and sea, unlike Spanish city destinations.

The largest minus have been seen in the traditional beach destinations in Spain, which are more dependent on the demand of foreign tour operators, especially on the Canary islands and in the Balearic islands. Barcelona, Madrid and Valencia have the best forecasts for the rest of the summer. In addition, as vice president of the association José Luis Zoreda explained, the results vary considerably between those destinations and hotels that invested in reconstruction and renovation of their facilities, and those who didn't invest.

Spanish entrepreneurs in tourism are still optimistic according to surveys, and as many as 40.7 percent believe they will increase their sales when compared to last summer. Obviously, Turkey is an absolute hit this year, and in the first five months of the year, it had 11 percent higher turnover than it did last year, with growth expectations of 10 percent year-on-year.

Can Croatia adjust itself accordingly to repair its tourism situation? Only time (and an actual strategy outside of obsessing over eVisitor's figures) will tell.

Make sure to follow our dedicated travel page for much more.

Slow Season 2019: Crunch Time for Croatian Tourism?

As Novac writes on the 12th of July, 2019, at the Croatian Chamber of Commerce (HGK), a session of the Tourist business council was held, discussing the current season's situation with tourism and what the expectations for the end of 2019 are.

After several years of growth at unrealistically high rates caused by external factors, the Croatian tourist season of 2019 has so far seen a slight stagnation and a decline that will be felt the most in private accommodation, although the Croatian National Tourist Board's data for the first six months oddly shows the opposite.

''We have to prepare ourselves well for these new circumstances and be prepared to have to fight for each and every guest,'' said Franco Palma at the Croatian Chamber of Commerce.

Igor Borojević, head of the Croatian National Tourist Board's market strategy department, attempted to defend the situation and claimed that these rather unimpressive figures for summer 2019 represent only a third of the arrivals, or a quarter of the realised overnight stays, and when it comes to the full season's evaluation, July and August will be crucial, the two months during which Croatia typically realises half of its annual indicators.

Croatian bed capacity increased by four percent, primarily in private accommodation, but when it comes to occupancy, the rates appear to be relatively low. In the last three years, Croatia has got 165,000 new beds, of which 154,000 are in private accommodation facilities, while there has only been very modest growth in the country's hotel accommodation.

''Despite this, hotels have remained the carriers of Croatian tourist traffic during the first half of the year, accounting for 50 percent of arrivals and 39 percent of overnight stays,'' Borojević claimed, adding that 2/3 of the major emission markets grew.

High growth rates have also been achieved with some long-haul markets from outside of Europe, such as from the United States of America, with a 13.7 percent increase, a 41 percent increase has been experienced from China, and a significant 53 percent increase has been seen from Taiwan. The market share in the first half of the year has a 20 percent share in total arrivals and a 10 percent share in overnight stays, with over 80 new airline lines contributing to it.

The Croatian National Tourist Board's figures show that during the first six months of this year, Croatia recorded growth of 6 percent, saw 6.8 million arrivals and 26.2 million overnight stays, marking an increase of 3 percent. This is, apparently, a great achievement with regard to what is frequently being referred to as a very challenging tourist year, accompanied by the recovery of Croatia's traditional competitive markets such as Turkey.

''This points to the strengthening of the Croatian tourist offer during the pre-season,'' noted Dragan Kovačević.

Istria, Kvarner and Split-Dalmatia County are the top destinations, while Dubrovnik, Rovinj and the Croatian capital of Zagreb remain the most visited cities in the country.

Croatian hotels, especially those of a higher category, are expected continue to grow slightly, although prices are 10 to 30 percent more expensive than in Europe's long-time tourism experts, such as Spain and Greece, which could easily push Croatia down in the future.

Make sure to follow our dedicated lifestyle and travel pages for much more.

Croatian Camping Sector Has Potential, Yet Season Remains Uncertain

The Croatian camping sector has a lot of potential, but much like with many other things in Croatia, is it really being taken advantage of properly? The short answer is of course, no.

As Marija Crnjak/Poslovni Dnevnik writes on the 11th of July, 2019, a new law should provide for the high-quality planning and preparation of a long-term development strategy in Croatian camps, which should result in the growth of not only quality, but also in the opening up of new, high-quality employment opportunities.

The adoption of the new Law on Tourism Land is of crucial importance for Croatian tourism as it abandons the old model and foresees fifty-year leasing, which offers the ability to release all of the investment potential of the Croatian tourism sector, which is estimated to stand somewhere between three and five billion euros.

If this new law becomes operational and developed, then the Croatian camping sector will finally be able to secure the solid place that it deserves with its remarkable potential - which is to become a leader in the Mediterranean and to position Croatia as a country for camping, as was stated by Adriano Palman, (CCU).

Otherwise, Croatian camping makes up about 25 percent of the total tourist accommodation capacity in Croatia, and in terms of overall quality, it's one of the strongest segments of Croatian tourism according to German ADAC ratings, which results in competitive prices compared to other countries in the Mediterranean.

Poslovni Dnevnik talked to Palman after an unfavourable pre-season in which the heavy amount of rain drove would-be camping tourists away, and at the beginning of a challenging season, which will require a lot of luck and skill to see results anything like those of last year reached again.

What are the results of camps for the first half of this year like, what are the reservations for the rest of the season like? What sort of year do Croatian camps expect?

From the opening until the end of June, campsites cumulatively generated 4.55 million overnight stays, or 1.7 percent less than in the same period last year. It's unfortunate, but it's expected.

Due to the scheduling of school holidays, the first two weeks of July will be worse than those same two weeks were last year, too, from the 1st of July to the 7th of July, for example, cumulative overnight stays were down by 8 percent. The rest of the season will be marked by uncertainty and nobody can really predict the final results of that right now. On the other hand, it should be said that this is the same picture that's coming from all of our Mediterranean competitors, as it reflects certain market events, the return to the market of certain eastern Mediterranean countries, as well as favourable weather opportunities in Northern Europe, the Netherlands, and Germany.

A good weather forecast in the north can contribute to last year's trend when campers in those countries decided to spend their holidays there at home and therefore their camps achieved historical record numbers.

Can you expect to have to cut prices due to the bookings being down?

The average cost of family camping in Croatia (two adults and one child, one night on a plot) is around 38.66 euros, and the European average is 37.56 euros. Compared to other countries, we're ranked sixth in terms of prices, the Netherlands, Spain, Denmark, and Switzerland are all more expensive than Croatia, and the most expensive is Italy.

We don't think this price is all that high given the level of quality we offer. The same trend is present in the camping sector across the entire Mediterranean, which is also visible in other forms of accommodation in Croatia. Quality facilities, in which there has been investment and an expansion of an offer, as well as increased the quality, are accepted by the market and are well filled, while unfortunately more and more problems occur in the business of facilities where the raising of the prices didn't result in the raising of the quality. Those issues also exist for those who didn't invest enough.

That's why more and more, they are constantly implementing complete reconstructions and renovations that are aimed towards raising the quality of the camps by two or three stars, up to five stars. There were three such complete renovations in the last couple of years, one in Dalmatia, Kvarner, and Istria, and more are planned in the future.

What is the current picture of Croatian campsites like when compared to its competitors?

Croatia has a total of 785 camps, of which 66 are in the category of 4 or 5 stars, and their capacity covers up to 40.5 percent of the total capacity of Croatian camps.

According to the German ADAC, which is the guide to the camps of Europe and still considered the most relevant and complete camp rating system, in 2019, Croatia is ranked second in the European Union behind the Netherlands. In terms of Croatia's direct competition in the Mediterranean, France is the third, Italy is the fifth, and Spain is the seventh.

The average rating of camps in Croatia is 6.31, the Netherlands ranked first with 6.74, and the average rating of camps in Europe is 5.46.

In all the elements of this rating, Croatian camps are better than the European average, and we're the best in terms of commercial and hospitality offers in the camps; we're third in elements of quality, in the number and size of sanitary facilities and pitches within the camp, and the worst position we're in, with fourth place, are the free time, entertainment and swimming offer, ie, the quality and the equipment of beaches, swimming pools and water centres within the camps.

How was the current law a barrier to investment? Because, we can see that there have been investments...

Although the capacity in 4 and 5 star camps has increased by as much as 2.8 times since 2010, when that law was passed, the realizstion of investments was significantly hampered.

A particular problem was highlighted in Croatian camps that had significant areas of so-called ''tourist land''. In those areas, because of the inadequate legal conclusions and the various limitations that were prescribed, investments were planned within a limited range in the areas of the camps where they could be realised, and not at locations where such investments (water centres, etc) from the point of view of the guests and the product concept, would have been ideal.

The new law should provide for the quality planning and preparation of a long-term development strategy in Croatian campsites, which will result in the enrichment of supply and quality growth, as well as the opening of new, high-quality job opportunities.

How does a modern camp look on the global market today? Do Croatian camps use modern technology, and what is their importance in this segment of tourism?

With the coming of the new generation of millennials, our camps are becoming more and more popular, and along with the advancement of technology, their diversity is growing as well. Croatian camps base their quality on the number and quality of the sanitary facilities, their equipment and the size of their plots, the commercial and hospitality offer in the camps, the leisure offer and entertainment, as well as the quality and amenities of the beach and other swimming related offers. Everything further depends on the positioning of the camp itself and the type of guests it wants to attract.

Accordingly, there are two main developmental routes for camps, the first are large camps which have all of the facilities and are positioned as real holiday resorts where a variety of accommodation options are available, from mobile homes to glamping. Other smaller or small family camps, which are, as opposed to the variety of content offered, more oriented to the very hospitable and close relationship with the host and their highlight is the intimate atmosphere inside the camp.

Apart from these two major developmental routines, there are many other features of special positioning and finding the right traveller and market, from the simple form of an adventure camp, camps on islands, near towns, camps for lovers of special interests (horse riding, bird watching, cycling, kayaking...), up to the most glamorous modern glamping camps.

Which is currently the largest investment in Croatian camps, are mobile homes still the biggest hit?

When talking about investments, in recent years, the trend of investment, the majority of which is in mobile home bidding, has changed considerably, and has become more balanced.

In the last two to three years, Croatian camps have been invested in with the aim to equalise and raise the overall offer and content of the facilities to a higher level, thus obtaining a balanced product that corresponds to the camp quality standards in all elements and doesn't have large jumps between the overall quality of the offer and the product. This includes investments in new water centres and swimming pools and beaches (the swimming offer), investments in the context of the wealth and quality of the shopping offer within the camp, entertainment, investments in equipping and increasing the plot areas as basic accommodation units within the camp, and sanitation facilities.

In addition, a new type of accommodation offer has appeared on campsites, which is the luxurious glamping tent, and currently glamping has the highest growth rate in relation to other capacities, and it is predicted that this trend will continue for the next few years.

How do we stand with the range of Croatian campsites that are open all year round?

Contrary to the general belief, compared with just one decade ago, the trend and the possibility of year-round camps in Croatia has been done well, and today we can boast of fourteen camps all over the country, two on the continent, six in Dalmatia, three in Kvarner and three in Istria.

Nowadays, Croatia has a high quality network of camps that provide winter campers with quality round trips between different destinations and parts of the country, and according to the information from these camps, more and more visitors from all over the world recognise this product and position the Croatian camps not only as a seasonal option, but as a year-long option.

Make sure to follow our dedicated travel page for more information on Croatian tourism, Croatian campsites and much more.

Is The End of Croatia's Current Tourism Concept Near?

Croatia is a country which likes to measure its ''tourism success'' with the numbers of overnight stays realised, not giving a second glance to any real economic factors that the tourist season has had on the country's economy, and playing a very surface level type song to the masses, the composer of which is the beloved eVisitor system.

As Plava Kamenica writes on the 6th of July, 2019, as we reported recently, the current tourist information presented by the Croatian Tourism Association (Hrvatska Udruga Turizma), isn't all that positive. The Croatian Tourism Association surveyed fifteen leading hotel and tourist companies which operate within the Republic of Croatia, and according to them, everything is less this year than it was last year, and the range we're talking about here is large, from one percent to as much as twenty percent less. On average, about three to seven percent less hotels have been booked in Croatia compared to last year.

Most of the respondents in the aforementioned association's survey said the tempo of bookings and reservations in hotels is significantly slower than it was last year. The worst hit are apartment areas, and even camps aren't doing too well, despite the good weather we're experiencing after a very rainy May, it appears that there have been less reservations recorded this year than there were last year, which wasn't all that great either when it comes to July and August.

Novi list has placed this information, which may come as a bit of a surprise to some and the birth of an omen for others, as the main topic on its first page. Other Croatian media outlets, including TCN, have been publishing equally bad news about Croatia's tourism, and Index has questioned some of the representatives of Croatia's various island-based tourist boards to find out more. The survey showed that most of Croatia's islands have recorded a decline in tourist traffic, and among the worse of all lies the central Dalmatian island of Brač, which is being considered the island with the worst imaginable tourist policy and practice.

By analysing all these pieces of bad news, we have to be honest with ourselves and say that it is nothing to do with any sort of ''natural'' July dip, but about the beginning of the end of the current tourism concept here in Croatia. It's had its day, it seems.

Croatia's tourism concept has three critical weak points. Firstly, most of the country's hotel companies are made for mass, third-rate quality tourism, which simply can't attract more demanding (and higher paying) guests, while at the same time, Croatia's hotels can't compete with massive Turkish and North African tourism, because Turkey, Egypt and Tunisia will always, always be cheaper.

Secondly, largely uncontrolled apartment renting has damaged at least Dalmatian tourism potential in the long run. Thirdly, the state has wiped out the restaurant industry with its draconian taxation policies, and without this industry, there can be no tourism, especially while Croatia's hotel industry seems to remain uncompetitive.

The negative results of this odd policy of Russian roulette with tourism, in which Tourism Minister Gari Cappelli participated for three years now, are finally rearing their ugly heads, and while it's difficult to predict just where this will lead - it's unlikely to be anywhere good.

Follow our dedicated lifestyle page for much more.

Less Hotel Reservations for Tourist Season Than 2018 in Croatia

It might seem that Croatian tourism is continuing to boom, but is it? While the country recorded an excellent pre-season which is in line with Croatia's desire for year-round tourism, it seems that Croatia's hotels are experiencing a worse booking rate than they did last year.

As Marija Crnjak/Poslovni Dnevnik writes on the 5th of July, 2019, numerous additional efforts are being made to make sure last minute reservations in Croatia's hotels manage to close in on, or reach last year's figures, the Croatian Tourism Association (Hrvatska Udruga Turizma) revealed yesterday.

By the end of June this year, the number of booking reservations for the height of the summer season in Croatia's hotels fell by three to seven percent in comparison to the same period last year, and as previously mentioned, additional efforts are being made to try to get last-minute reservations up to last year's rate. This was revealed yesterday by the Croatian Tourism Association upon presenting the results of the hotel sector in the second quarter.

"The first half of the current year shows that the announcements of market challenges and turbulence from the beginning of this year were accurate. In the conditions caused by economic uncertainties from emerging markets and growing competition in the Mediterranean, the struggle for each guest is intensifying, especially during the main tourist season. All the information we have is that this tourist season will be the most challenging one over the last few years,'' said the director of the Croatian Tourism Association, Veljko Ostojić.

He added that in the adjustment of policies to adapt to the new market realities, the real ''borders'' of the competitiveness of Croatian tourism can be clearly seen. Most deem Croatia's tourist industry to be continually violated by a much talked about high VAT rate, and that VAT rate is higher than in other countries across the Mediterranean who also rely heavily on tourism as a strong if not main economic branch, as well as in neighbouring Hungary and Austria.

Make sure to follow our dedicated travel and lifestyle pages for much more on Croatia's tourism.

Foreign Tourists Spend 475 Million Euros in Croatia

When not discussing daytrippers and cruise ship passengers, foreign tourists generally spend huge amounts in Croatia, particularly during the summer months. It seems however that Croatia's desire for all-year tourism and a stronger pre and post-season are coming to fruition as the numbers look promising.

As Poslovni Dnevnik/Marija Crnjak writes on the 4th of July, 2019, revenues from foreign tourists in Croatia increased by 5.4 percent in the first quarter of this year compared to the same period last year, according to data from the Croatian National Bank (CNB/HNB).

During January, February and March 2019, tourism revenues from foreign guests amounted to a massive 475 million euros, which is 25 million euros more than was recorded during the same period of 2018. This is more than twice the growth compared to the first quarter of last year, when tourism made 54.3 million euros more than it did back in 2017, which was mainly thanks to last year's earlier Easter.

The increase in revenue in this first quarter of this year matches the increase of foreign tourists' arrivals in Croatia, by almost five percent, while in March and and Easter weekend in the first quarter of last year brought 27 percent more tourists to Croatia.

Tourism Minister Gari Cappelli is pleased with the results of 2019's first quarter.

''The government places great emphasis on the growth and development of the quality of tourism, and significant advances are most noticeable through continuous revenue growth. In the mandate of this government, revenues for the first quarter increased by 23 percent. It's also proof that our policy of strengthening the pre-season yields positive results, not only in terms of tourist traffic, which grew by 36 percent in the same period, but also in tourist spending,'' stated Minister Cappelli.

Throughout 2018, foreign tourists realised slightly more than 10 billion euro in revenue in Croatia, and in the first quarter of the same year, 450.2 million euros in revenue was realised. Shortly before the beginning of the current government's mandate, back in 2016, the first quarter brought Croatia tourism revenue in the amount of 390 million euros, which was 4.5 percent of the total annual tourist income realised by foreign tourists, amounting to 8.6 billion euros.

In that same year, foreign tourists made up 448,000 arrivals during the first quarter, compared to 626,000 in the first three months of this year. Thus, during the mandate of the current Government of Croatia, the first quarter was strengthened by 178 thousand arrivals of foreign tourists and 85 million euros in foreigner tourist income in three years.

What exactly the physical results of the second quarter, which will give a more accurate image of this year's pre-season, are still unknown.

Make sure to follow our dedicated lifestyle page for much more on tourism in Croatia.

Big Capital - Blessing or Curse for the Glamorous Croatian Coast?

As Nenad Bakic/eclectica.hr writes on the 23rd of June, 2019, for a long time now, it's been well known in Croatia that big capital and the Adriatic coast go hand in hand.

In general, Croatia has long been ''heroically fighting against neoliberal capitalism'', and rather successfully at that. The only issue with that is the fact that the premise was wrong because it was just as "well known" that such a type of capitalism had already stepped ''into bed'' with us and for some, it was quite a comfortable situation, although the real truth in itself was completely different.

Not to take away from the many entrepreneurs and invention this country has given to the world, Croatia continues to take many an unimpressive title when it comes to anything outside of natural beauty, which is something we can't influence (thank God). When speaking economically, Croatia is the least free country in the European Union behind Greece, and of course, Croatia is rather tragically lagging behind in almost every single significant aspect, and people are leaving in their droves, and that demographic leaking tap isn't going to stop dripping.

Croatia's struggle against "big" capital in the tourism industry was a wrong move, though perhaps of a somewhat visionary nature.

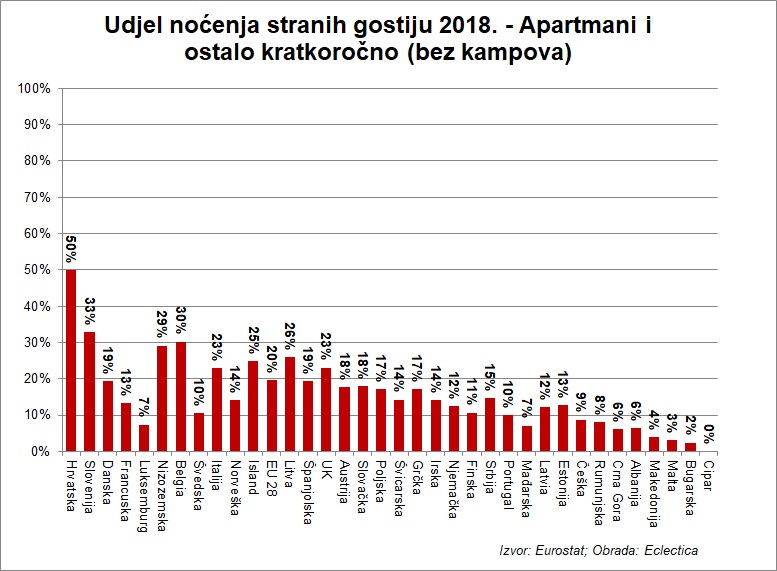

The result of the situation with big capital on the Croatian coast is the following: The coast is concreted over by apartments, and the share of Croatian hotel accommodation is half the size of the of that of the next EU country.

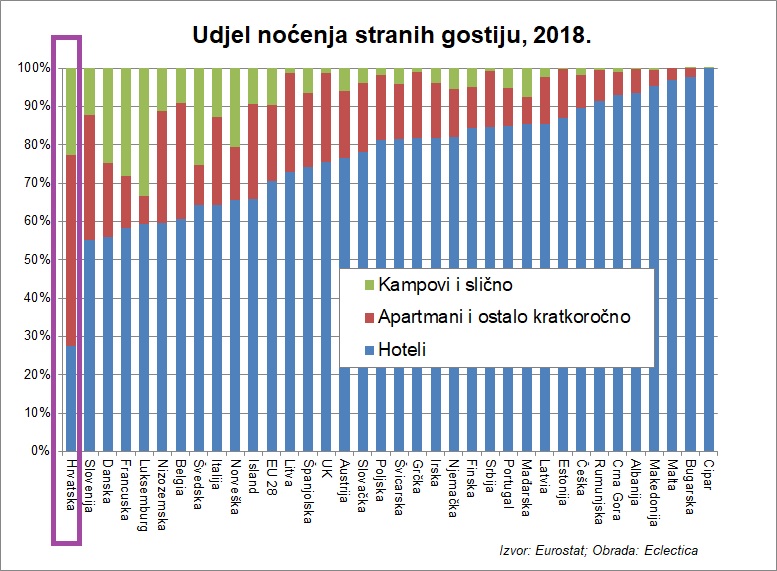

This chart shows the share of accommodation for foreign tourists, according to overnight stays spent:

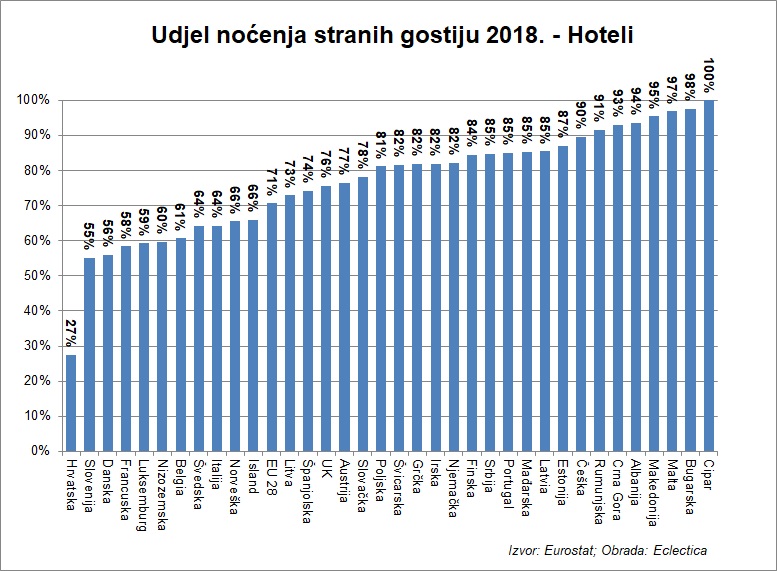

Specifically, for hotels it looks like this:

As you can see, the share of accommodation in Croatian hotels is exactly 1/3 of the European Union average.

For apartments, things look like this:

Bakić adds the fact that it is regularly forgotten that Croatia has an incredibly unique advantage, and it's reachable by some 100 million people by car (the captive market). In addition, real tourism is a capital and a work-intensive activity, and because of the Croatian shortage of labour which is a result of the demographic crisis and issues with the payment of living wages, hotels are up on their feet. For apartments, this is much less important.

You can follow more from Nenad Bakić on his Eclectica website.

Make sure to follow our dedicated lifestyle page for more information on Croatian tourism and much more.

Holidays in Croatia: 10% More Tourists Expected than Last Year

Croatia's summer tourism is not the only season breaking records this year.

Is Split-Dalmatia County on Verge of Tourism Collapse? An Expert Opinion

Split is bursting at the seems of tourism due to the lack of infrastructure which does not meet the increasing demands of the sector. This was demonstrated by the “Study on the Capacity of Tourism in Split-Dalmatia County," developed by the Institute of Tourism, reports Slobodna DalmacijaSlobodna Dalmacija on December 16, 2018.

With the existing traffic and public infrastructure, Split should not increase the number of tourists in July and August, experts warn.

Given the state of the infrastructure, the study recommends that the entire coastline from Trogir to Makarska should not increase the number of tourists in the peak season. If the problems are not eliminated, there will be "unwanted consequences on the upcoming arrivals, quality of tourism products, and thus on tourism spending and tourism revenues."

“Without the significant involvement of the local self-government in tackling traffic problems and solving workforce problems on the islands, further growth in the number of tourists could mean a collapse of the tourism system in certain places, which would have long-term consequences for the County's economy, and thus the satisfaction of its citizens,” warns the study.

Local authorities in the County are aware that tourism has reached capacities beyond which it should not be exaggerated with further growth in the peak season.

Almost all cities and islands, including Split, complained that they did not want to increase tourists in July and August. Trogir and Baška Voda would even reduce the number of arrivals. Only in Inland Dalmatia would the local self-government wish to double the number of tourists, as tourism is merely beginning there.

The Tourist Board of Split-Dalmatia County commissioned the study. At the beginning of July, the Croatian Chamber of Commerce and the County presented the project to media representatives: ”We are the first to have something like this."

The summer heat was accompanied by unforgettable traffic jams around Split and its surroundings - and this season ended with a rise in tourist overnights.

Dr. Zoran Klarić from the Zagreb Institute of Tourism commented on whether there is the possibility that Split sees a tourism collapse.

“We were obliged to warn of critical points where problems might arise, but there is little chance that the system will break down.

People are afraid that the system will collapse. But we shouldn’t panic. There will be no collapse, but traffic jams will become so unbearable that people will be dissatisfied and in the coming years, there might be fewer tourists. This is what is happening in cities like Prague or Paris, where you can’t practically pass through city centers,” Klarić believes.

The Institute considers there could be a problem with the water supply throughout the County, with the four largest cities supplied from the Jadro experiencing water losses. On Vis and in Makarska there is a “supply of potable water to the level of sufficiency in the season, and existing water supply capacities are at the margins of full utilization."

“Split is too dependent on the Jadro river source. If something happens with that source, the city would be in big trouble. Like what happened in Slavonski Brod, they might be without water. The tourists won’t escape in masses because of this, but they will be dissatisfied,” says Klarić.

There are also problems with the sewage, with numerous septic tanks unloading into the sea without prior treatment.

"The city has to invest something, and the state automatically responds poorly if someone seeks money. Especially in an environment that makes a lot of money from tourism,” warns the head of the Study.

One of the problems is the electrical power system which is on the edge of wear in certain areas, so for example, the load of the power line in Split is almost over the thermal transmission limits. Additionally, the whole County system is not ready to receive electricity from renewable sources, and that resource is virtually unused.

“While there will be no collapse regarding electricity, there will be a reduction, as was the case on some islands, for example, Vis,” notes Dr. Klarić.

The garbage problem in the County is so severe that the authors of the Study warn that "not only should the number of tourists in the County not be increased, but that number should be reduced until the problem of waste disposal is resolved."

“A lot of these things do not work - but they do not have to do with tourism. We accuse tourism of being guilty of everything, but for example, crowds only increase the existing problems. Here I am thinking primarily of the garbage problem, which is great in Split-Dalmatia County.”

A particular problem is the traffic infrastructure, for example, the roads, the massive lack of parking lots and the many crowds of traffic, which negatively affects tourists and even more so the residents of the County.

"As for parking and traffic, there is one trivial thing to talk about, and it is essential. Split has no 'smart traffic lights.' Zagreb is also not glamorous as far as traffic is concerned, and very little has been done, but a lot has been done by introducing 'green waves' and automatic traffic measurements. In Split, that is not the case at all, the traffic lights are uncoordinated,” Klarić added.

“You have a tunnel leading from Kopilica to the port, and the parking problem can be easily solved at Kopilica. There is plenty of parking space there, and the railroad can serve as a metro.

When I go to a big tourist city, I never park in the city center. You cannot find a place, and it's terribly expensive. In principle, people park in the outskirts and take public transport to the center,” explains Klarić.

The Institute of Tourism advises, however, that "long-term consideration should be given to the relocation of crucial traffic facilities in the area of the City Port, primarily the ferry port and the bus station.

“In Zadar, there was tremendous resistance to moving the ferry port to Gaženica, but now everyone is happy. We propose, according to the old urban idea, that we run the line going to Supetar to Stobreč. I know this idea is sensitive, but that's the story. Half of the tourism traffic in the city harbor is on the Split-Supetar-Split line because it is by far the most frequent connection.

The bus station could easily be moved to Kopilica. This is not an integral part of the study, but detecting problems and pointing out what will happen and what should be done,” he adds.

The study recommends that Žnjan, Marjan and Salona should be exploited more for tourism.

“Žnjan can be an area where tourists could spread out and moved away from the center. Everyone will go to Diocletian's Palace, you cannot avoid it, but it is important that those who come to Split for two days are not in the palace all the time and can go elsewhere. This is the essence of it - to regulate pressure, disperse it and move it where it causes less damage.”

One thousand five hundred respondents were surveyed for the Study. It turns out that tourists have only 1.3 square meters of space on the beaches in Split, but there are fewer crowds on the beaches than tourists on the Makarska Riviera, who have a little more space - three square meters per bather.

Also, tourists are much more satisfied with Split, which is the opposite on the Makarska Riviera, where only 58 percent of tourists are satisfied, giving it the worst result in the County.

“When you come to Split, you do not expect a big city to have large beach spaces. Barcelona or Venice practically have no beaches, and if you go there, you will not go swimming. For tourists, it is enough to have Bačvice. And if Split people are not satisfied with Bačvice, they will probably swim somewhere else, on Šolta or the Marjan beaches.

It is also clear that Split has shown less tolerance towards tourism, as the percentage of people who do not live from tourism is much higher than in Makarska,” Klarić says.

The positive attitude toward tourism is highest on the Makarska Riviera and the Split Riviera (the area from Trogir to Omiš), as most people there benefit from tourism.

On the Split Riviera, 62 percent of residents have direct or indirect benefits, and on the Makarska Riviera, as much as 89 percent of them have some benefit from tourism. On the other hand, in Split, 52 percent of respondents said they did not have any benefits from tourism.

Despite some differences, local authorities in the County estimated that the capacity of tourism in July and August has reached its limit.

In Split, the "local self-government is of the opinion that the number of tourists in the peak season should be kept at the existing level and the number of one-day visitors should be reduced", according to the study. On the Split Riviera, there are divided opinions, as some would increase the number of tourists, and some would keep it the same, while Trogir would reduce the number of tourists in the peak season.

On the Makarska Riviera, the local self-government is mostly against increasing the number of tourists, except for Gradac (10%). Baška Voda would cut them by as much as 30 percent.

Although the Institute for Tourism sees opportunities to increase tourism on the Central Dalmatian islands, the local self-government on Hvar is not for increasing the number of tourists in the season. Only Postira and Pučišća on Brač are for it, while Selca would reduce tourists in the peak season by 10 percent.

The local government would retain the existing number on Vis, while Komiža is for a minimum increase. Inland Dalmatia wants to double the number of tourists in the peak season. All local authorities in the County are hoping for a more significant amount of tourists in the pre and postseason, except for Trogir, which would keep their numbers in June and September at the current level.

To read more about Split, follow TCN's dedicated page.

Is Croatia's Tourism Industry Threatened by Stagnation and Collapse?

A concerning warning from Brussels...